Please help me solve all of them!!

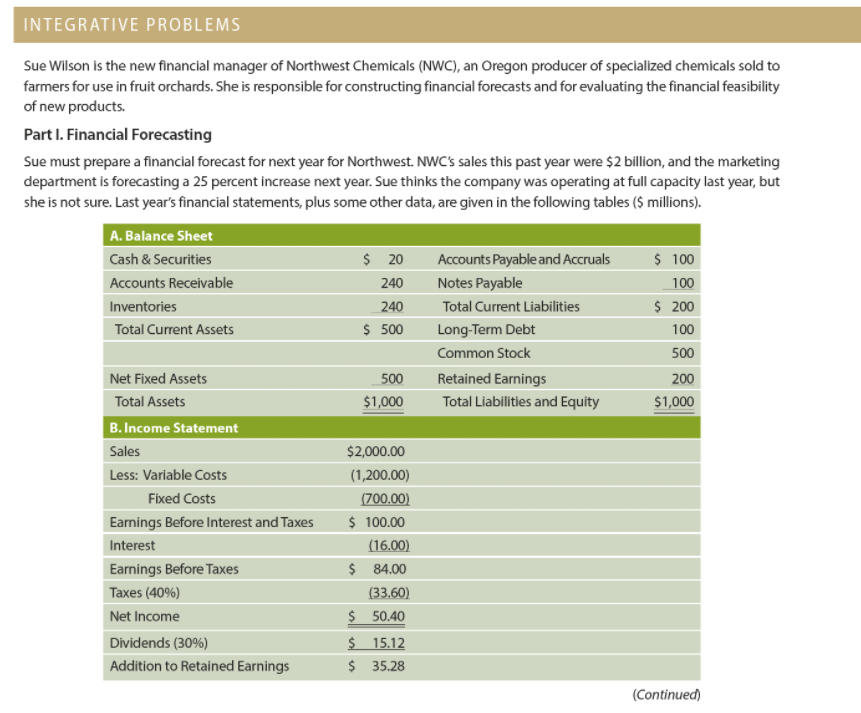

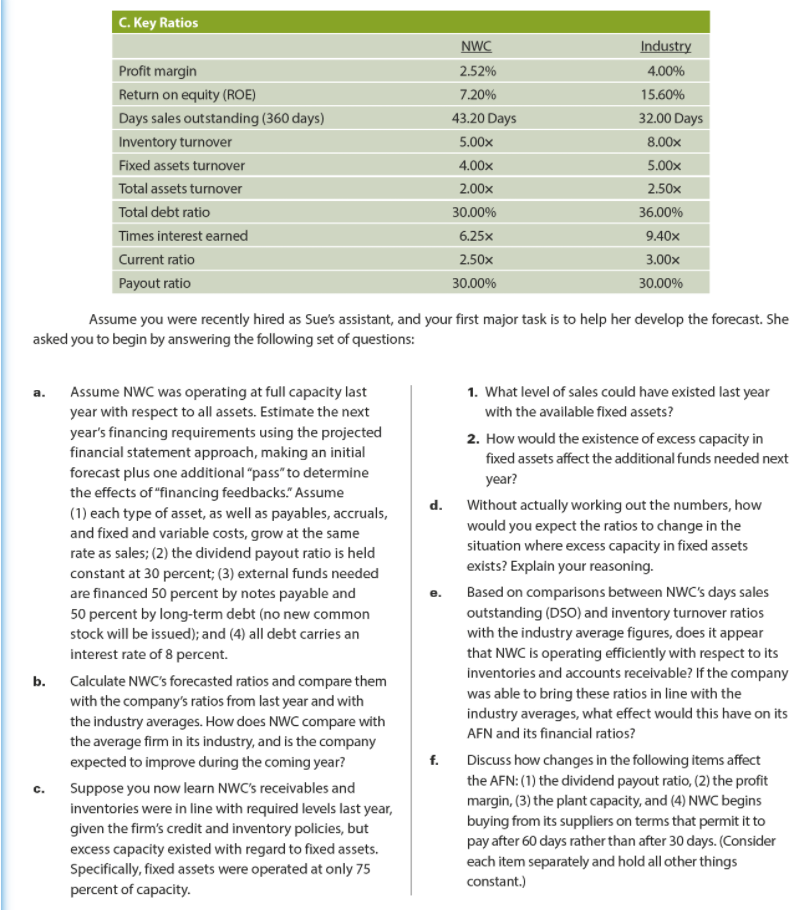

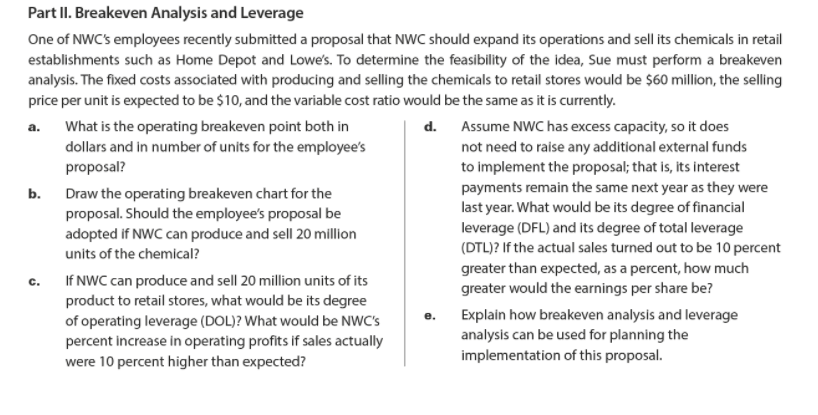

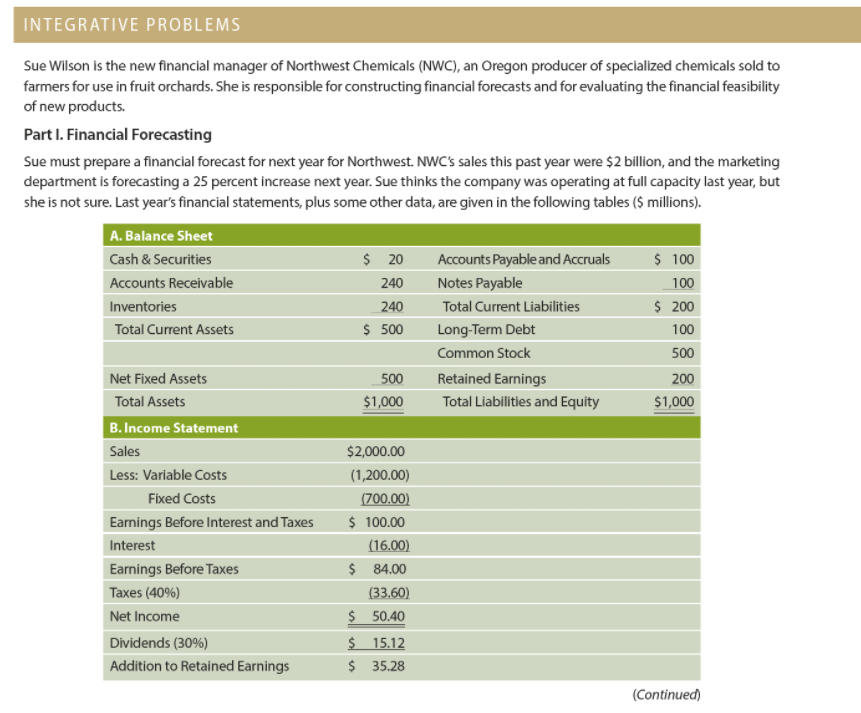

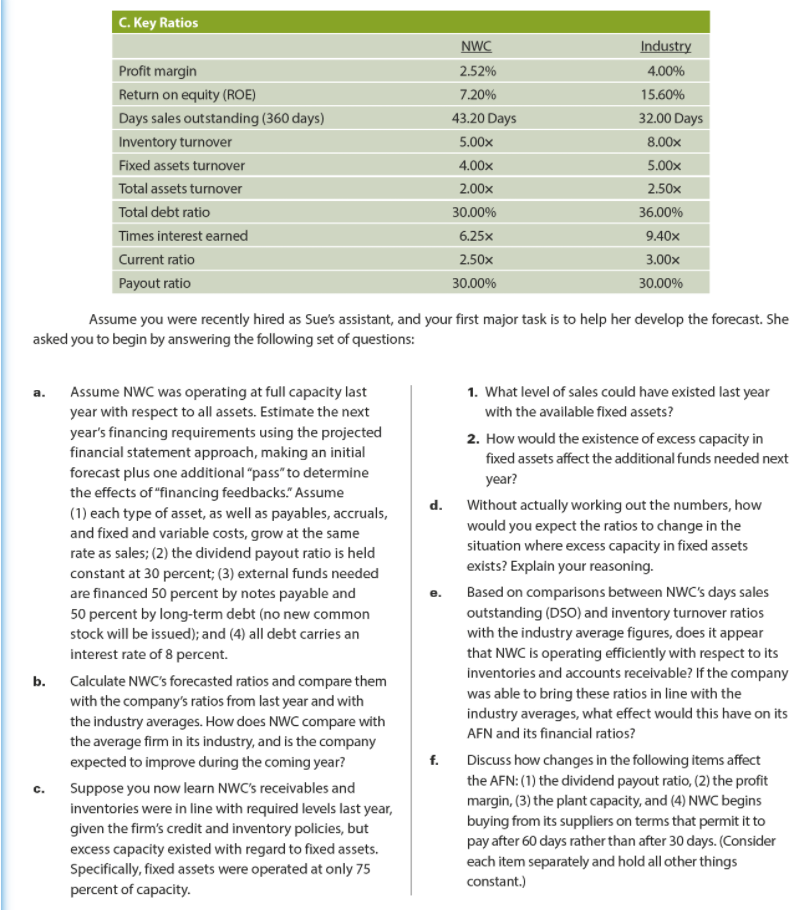

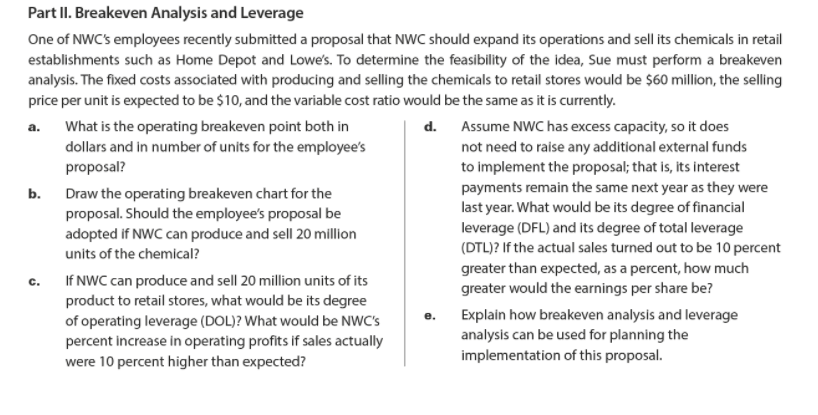

INTEGRATIVE PROBLEMS 100 Sue Wilson is the new financial manager of Northwest Chemicals (NWC), an Oregon producer of specialized chemicals sold to farmers for use in fruit orchards. She is responsible for constructing financial forecasts and for evaluating the financial feasibility of new products. Part I. Financial Forecasting Sue must prepare a financial forecast for next year for Northwest. NWC's sales this past year were $2 billion, and the marketing department is forecasting a 25 percent increase next year. Sue thinks the company was operating at full capacity last year, but she is not sure. Last year's financial statements, plus some other data, are given in the following tables ($ millions). A. Balance Sheet Cash & Securities $ 20 Accounts Payable and Accruals $ 100 Accounts Receivable 240 Notes Payable 100 Inventories 240 Total Current Liabilities $ 200 Total Current Assets $ 500 Long-Term Debt Common Stock 500 Net Fixed Assets 500 Retained Earnings 200 Total Assets $1,000 Total Liabilities and Equity $1,000 B. Income Statement Sales $2,000.00 Less: Variable Costs (1,200.00) Fixed Costs (700.00) Earnings Before Interest and Taxes $ 100.00 Interest (16.00) Earnings Before Taxes $ 84.00 Taxes (40%) (33.60) Net Income $ 50.40 Dividends (30%) $ 15.12 Addition to Retained Earnings $ 35.28 (Continued) C. Key Ratios NWC Industry Profit margin 2.52% 4.00% Return on equity (ROE) 7.20% 15.60% Days sales outstanding (360 days) 43.20 Days 32.00 Days Inventory turnover 5.00x 8.00x Fixed assets turnover 4.00x 5.00x Total assets turnover 2.00% 2.50x Total debt ratio 30.00% 36.00% Times interest earned 6.25% 9.40x Current ratio 2.50x 3.00x Payout ratio 30.00% 30.00% Assume you were recently hired as Sue's assistant, and your first major task is to help her develop the forecast. She asked you to begin by answering the following set of questions: a. Assume NWC was operating at full capacity last year with respect to all assets. Estimate the next year's financing requirements using the projected financial statement approach, making an initial forecast plus one additional "pass" to determine the effects of "financing feedbacks." Assume (1) each type of asset, as well as payables, accruals, and fixed and variable costs, grow at the same rate as sales; (2) the dividend payout ratio is held constant at 30 percent; (3) external funds needed are financed 50 percent by notes payable and 50 percent by long-term debt (no new common stock will be issued); and (4) all debt carries an interest rate of 8 percent. b. Calculate NWC's forecasted ratios and compare them with the company's ratios from last year and with the industry averages. How does NWC compare with the average firm in its industry, and is the company expected to improve during the coming year? c. Suppose you now learn NWC's receivables and inventories were in line with required levels last year, given the firm's credit and inventory policies, but excess capacity existed with regard to fixed assets. Specifically, fixed assets were operated at only 75 percent of capacity. 1. What level of sales could have existed last year with the available fixed assets? 2. How would the existence of excess capacity in fixed assets affect the additional funds needed next year? d. Without actually working out the numbers, how would you expect the ratios to change in the situation where excess capacity in fixed assets exists? Explain your reasoning. Based on comparisons between NWC's days sales outstanding (DSO) and inventory turnover ratios with the industry average figures, does it appear that NWC is operating efficiently with respect to its inventories and accounts receivable? If the company was able to bring these ratios in line with the industry averages, what effect would this have on its AFN and its financial ratios? f. Discuss how changes in the following items affect the AFN: (1) the dividend payout ratio, (2) the profit margin, (3) the plant capacity, and (4) NWC begins buying from its suppliers on terms that permit it to pay after 60 days rather than after 30 days. (Consider each item separately and hold all other things constant.) Part II. Breakeven Analysis and Leverage One of NWC's employees recently submitted a proposal that NWC should expand its operations and sell its chemicals in retail establishments such as Home Depot and Lowe's. To determine the feasibility of the idea, Sue must perform a breakeven analysis. The fixed costs associated with producing and selling the chemicals to retail stores would be $60 million, the selling price per unit is expected to be $10, and the variable cost ratio would be the same as it is currently. a. What is the operating breakeven point both in d. Assume NWC has excess capacity, so it does dollars and in number of units for the employee's not need to raise any additional external funds proposal? to implement the proposal; that is, its interest b. Draw the operating breakeven chart for the payments remain the same next year as they were proposal. Should the employee's proposal be last year. What would be its degree of financial adopted if NWC can produce and sell 20 million leverage (DFL) and its degree of total leverage units of the chemical? (DTL)? If the actual sales turned out to be 10 percent greater than expected, as a percent how much C. If NWC can produce and sell 20 million units of its greater would the earnings per share be? product to retail stores, what would be its degree of operating leverage (DOL)? What would be NWC's Explain how breakeven analysis and leverage percent increase in operating profits if sales actually analysis can be used for planning the were 10 percent higher than expected? implementation of this proposal. INTEGRATIVE PROBLEMS 100 Sue Wilson is the new financial manager of Northwest Chemicals (NWC), an Oregon producer of specialized chemicals sold to farmers for use in fruit orchards. She is responsible for constructing financial forecasts and for evaluating the financial feasibility of new products. Part I. Financial Forecasting Sue must prepare a financial forecast for next year for Northwest. NWC's sales this past year were $2 billion, and the marketing department is forecasting a 25 percent increase next year. Sue thinks the company was operating at full capacity last year, but she is not sure. Last year's financial statements, plus some other data, are given in the following tables ($ millions). A. Balance Sheet Cash & Securities $ 20 Accounts Payable and Accruals $ 100 Accounts Receivable 240 Notes Payable 100 Inventories 240 Total Current Liabilities $ 200 Total Current Assets $ 500 Long-Term Debt Common Stock 500 Net Fixed Assets 500 Retained Earnings 200 Total Assets $1,000 Total Liabilities and Equity $1,000 B. Income Statement Sales $2,000.00 Less: Variable Costs (1,200.00) Fixed Costs (700.00) Earnings Before Interest and Taxes $ 100.00 Interest (16.00) Earnings Before Taxes $ 84.00 Taxes (40%) (33.60) Net Income $ 50.40 Dividends (30%) $ 15.12 Addition to Retained Earnings $ 35.28 (Continued) C. Key Ratios NWC Industry Profit margin 2.52% 4.00% Return on equity (ROE) 7.20% 15.60% Days sales outstanding (360 days) 43.20 Days 32.00 Days Inventory turnover 5.00x 8.00x Fixed assets turnover 4.00x 5.00x Total assets turnover 2.00% 2.50x Total debt ratio 30.00% 36.00% Times interest earned 6.25% 9.40x Current ratio 2.50x 3.00x Payout ratio 30.00% 30.00% Assume you were recently hired as Sue's assistant, and your first major task is to help her develop the forecast. She asked you to begin by answering the following set of questions: a. Assume NWC was operating at full capacity last year with respect to all assets. Estimate the next year's financing requirements using the projected financial statement approach, making an initial forecast plus one additional "pass" to determine the effects of "financing feedbacks." Assume (1) each type of asset, as well as payables, accruals, and fixed and variable costs, grow at the same rate as sales; (2) the dividend payout ratio is held constant at 30 percent; (3) external funds needed are financed 50 percent by notes payable and 50 percent by long-term debt (no new common stock will be issued); and (4) all debt carries an interest rate of 8 percent. b. Calculate NWC's forecasted ratios and compare them with the company's ratios from last year and with the industry averages. How does NWC compare with the average firm in its industry, and is the company expected to improve during the coming year? c. Suppose you now learn NWC's receivables and inventories were in line with required levels last year, given the firm's credit and inventory policies, but excess capacity existed with regard to fixed assets. Specifically, fixed assets were operated at only 75 percent of capacity. 1. What level of sales could have existed last year with the available fixed assets? 2. How would the existence of excess capacity in fixed assets affect the additional funds needed next year? d. Without actually working out the numbers, how would you expect the ratios to change in the situation where excess capacity in fixed assets exists? Explain your reasoning. Based on comparisons between NWC's days sales outstanding (DSO) and inventory turnover ratios with the industry average figures, does it appear that NWC is operating efficiently with respect to its inventories and accounts receivable? If the company was able to bring these ratios in line with the industry averages, what effect would this have on its AFN and its financial ratios? f. Discuss how changes in the following items affect the AFN: (1) the dividend payout ratio, (2) the profit margin, (3) the plant capacity, and (4) NWC begins buying from its suppliers on terms that permit it to pay after 60 days rather than after 30 days. (Consider each item separately and hold all other things constant.) Part II. Breakeven Analysis and Leverage One of NWC's employees recently submitted a proposal that NWC should expand its operations and sell its chemicals in retail establishments such as Home Depot and Lowe's. To determine the feasibility of the idea, Sue must perform a breakeven analysis. The fixed costs associated with producing and selling the chemicals to retail stores would be $60 million, the selling price per unit is expected to be $10, and the variable cost ratio would be the same as it is currently. a. What is the operating breakeven point both in d. Assume NWC has excess capacity, so it does dollars and in number of units for the employee's not need to raise any additional external funds proposal? to implement the proposal; that is, its interest b. Draw the operating breakeven chart for the payments remain the same next year as they were proposal. Should the employee's proposal be last year. What would be its degree of financial adopted if NWC can produce and sell 20 million leverage (DFL) and its degree of total leverage units of the chemical? (DTL)? If the actual sales turned out to be 10 percent greater than expected, as a percent how much C. If NWC can produce and sell 20 million units of its greater would the earnings per share be? product to retail stores, what would be its degree of operating leverage (DOL)? What would be NWC's Explain how breakeven analysis and leverage percent increase in operating profits if sales actually analysis can be used for planning the were 10 percent higher than expected? implementation of this proposal