Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me solve for a and b. It's very tricky. I attached the inputs. I haven't made any adjustments to units price or costs.

Please help me solve for a and b. It's very tricky. I attached the inputs.

Please help me solve for a and b. It's very tricky. I attached the inputs.

I haven't made any adjustments to units price or costs. The correct NPV is suppose to be $98,762. I'm just not sure how to get there. I will make sure to thumbs up, thank you.

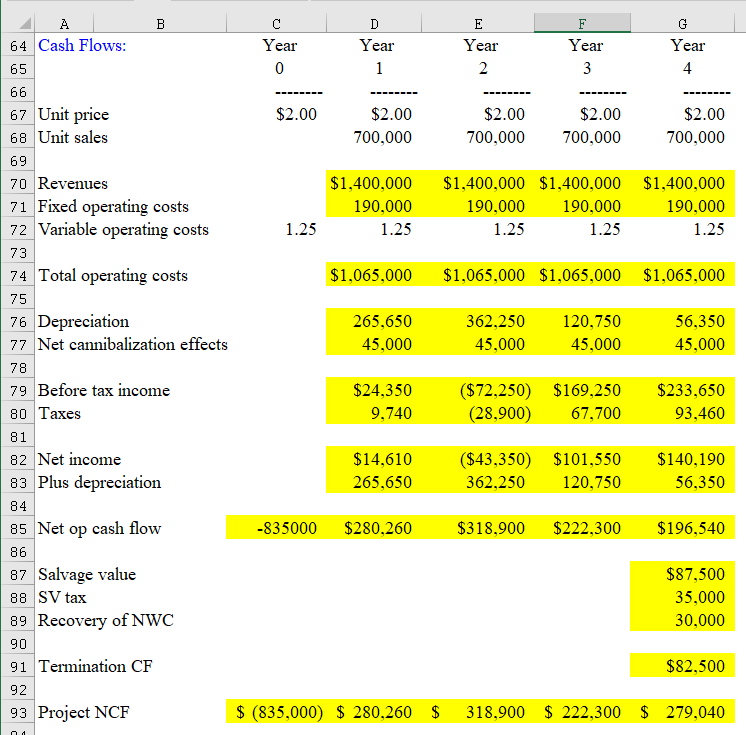

If you are using the spreadsheet model, also determine the impact on the company's IRR, MIRR, ARR, and payback. 9. If you are using the model, return to the initial inflation assumptions (4 percent for price and 2 percent for cash operating costs). a. Assume that the estimate of unit sales remains at 700,000 units per year. To the closest penny, what Year 0 unit price would the company have to set to cause the project to just break even, that is, to force NPV = $0? b. Now assume that the sales price starts at $2, and that prices increase by 4 percent per year thereafter while cash costs increase by 2 percent per year. To the closest 1,000, how low could annual unit sales be and still have the project break even? Year 0 Year 1 Year 2 Year Year 64 Cash Flows: 65 66 67 Unit price 68 Unit sales -------- -------- $2.00 $2.00 700,000 -------- $2.00 700,000 -------- $2.00 700,000 -------- $2.00 700,000 69 $1,400,000 190.000 $1,400,000 $1,400,000 190.000 190.000 1.25 1.25 $1,400,000 190.000 1.25 1.25 1.25 1.25 1.25 $1,065,000 $1,065,000 $1,065,000 $1,065,000 265,650 45,000 362,250 45,000 120,750 45,000 56,350 45,000 70 Revenues 71 Fixed operating costs 72 Variable operating costs 73 74 Total operating costs 75 76 Depreciation 77 Net cannibalization effects 78 79 Before tax income 80 Taxes 81 82 Net income 83 Plus depreciation 84 85 Net op cash flow $24,350 ($72,250) $169,250 $233,650 9,740 (28,900) 67,700 93,460 $14,610 265,650 ($43,350) 362,250 $101,550 120,750 $140,190 56,350 -835000 $280,260 $318,900 $222,300 $196,540 86 87 Salvage value 88 SV tax 89 Recovery of NWC 90 91 Termination CF $87,500 35,000 30,000 $82,500 93 Project NCF $ (835,000) $ 280,260 $ 318.900 $ 222,300 $ 279,040Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started