Answered step by step

Verified Expert Solution

Question

1 Approved Answer

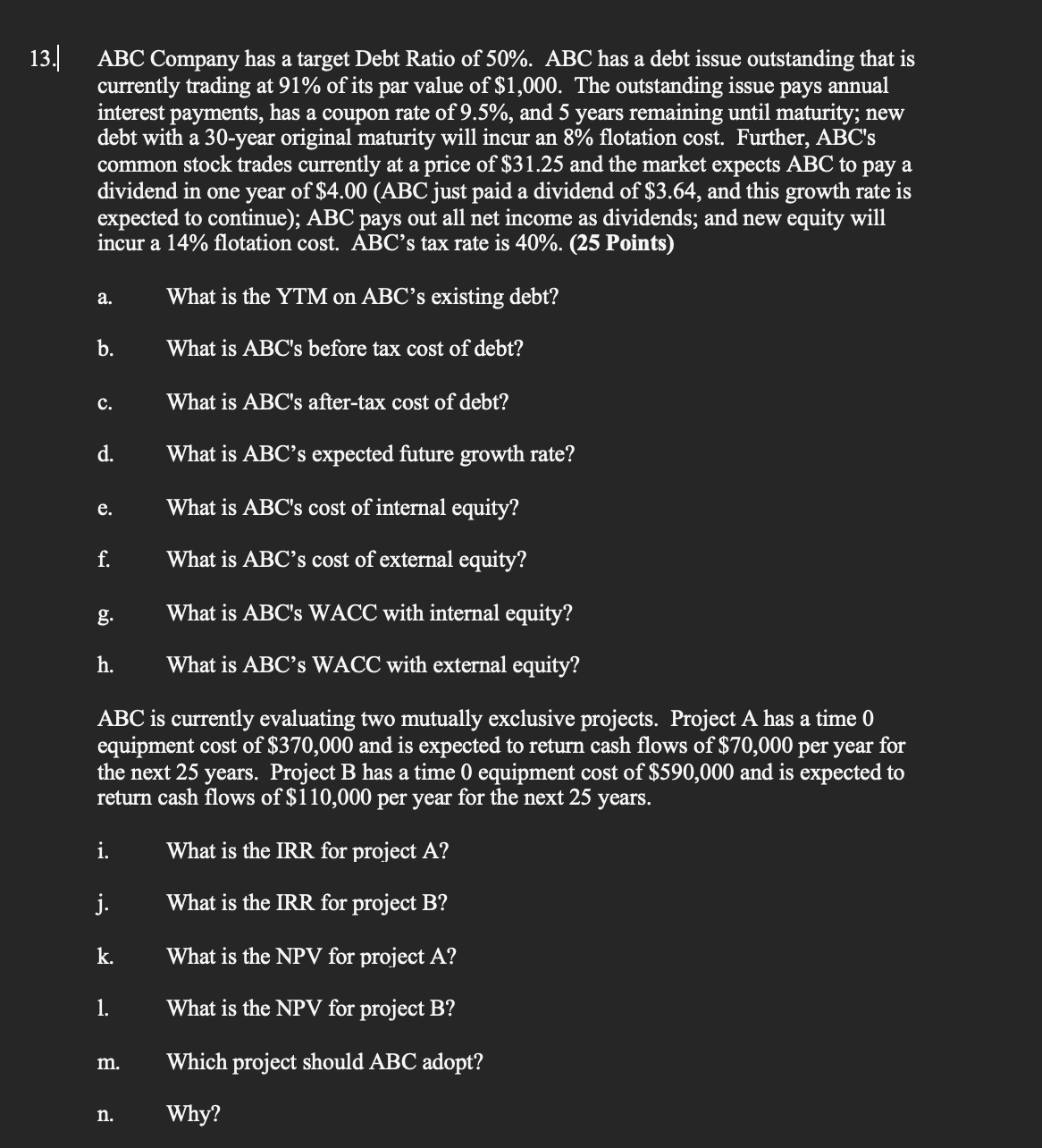

Please help me solve in excel using excel funtions whenevr possible ABC Company has a target Debt Ratio of 5 0 % . ABC has

Please help me solve in excel using excel funtions whenevr possible

ABC Company has a target Debt Ratio of ABC has a debt issue outstanding that is

currently trading at of its par value of $ The outstanding issue pays annual

interest payments, has a coupon rate of and years remaining until maturity; new

debt with a year original maturity will incur an flotation cost. Further, ABC's

common stock trades currently at a price of $ and the market expects ABC to pay a

dividend in one year of $ABC just paid a dividend of $ and this growth rate is

expected to continue; ABC pays out all net income as dividends; and new equity will

incur a flotation cost. ABC's tax rate is Points

a What is the YTM on ABC's existing debt?

b What is ABC s before tax cost of debt?

c What is ABC s aftertax cost of debt?

d What is ABC s expected future growth rate?

e What is ABC s cost of internal equity?

f What is ABC s cost of external equity?

g What is ABC s WACC with internal equity?

h What is ABC's WACC with external equity?

ABC is currently evaluating two mutually exclusive projects. Project A has a time

equipment cost of $ and is expected to return cash flows of $ per year for

the next years. Project B has a time equipment cost of $ and is expected to

return cash flows of $ per year for the next years.

i What is the IRR for project

j What is the IRR for project B

k What is the NPV for project A

What is the NPV for project B

m Which project should ABC adopt?

n Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started