Please help me solve my International finance homework

Please help me solve my International finance homework

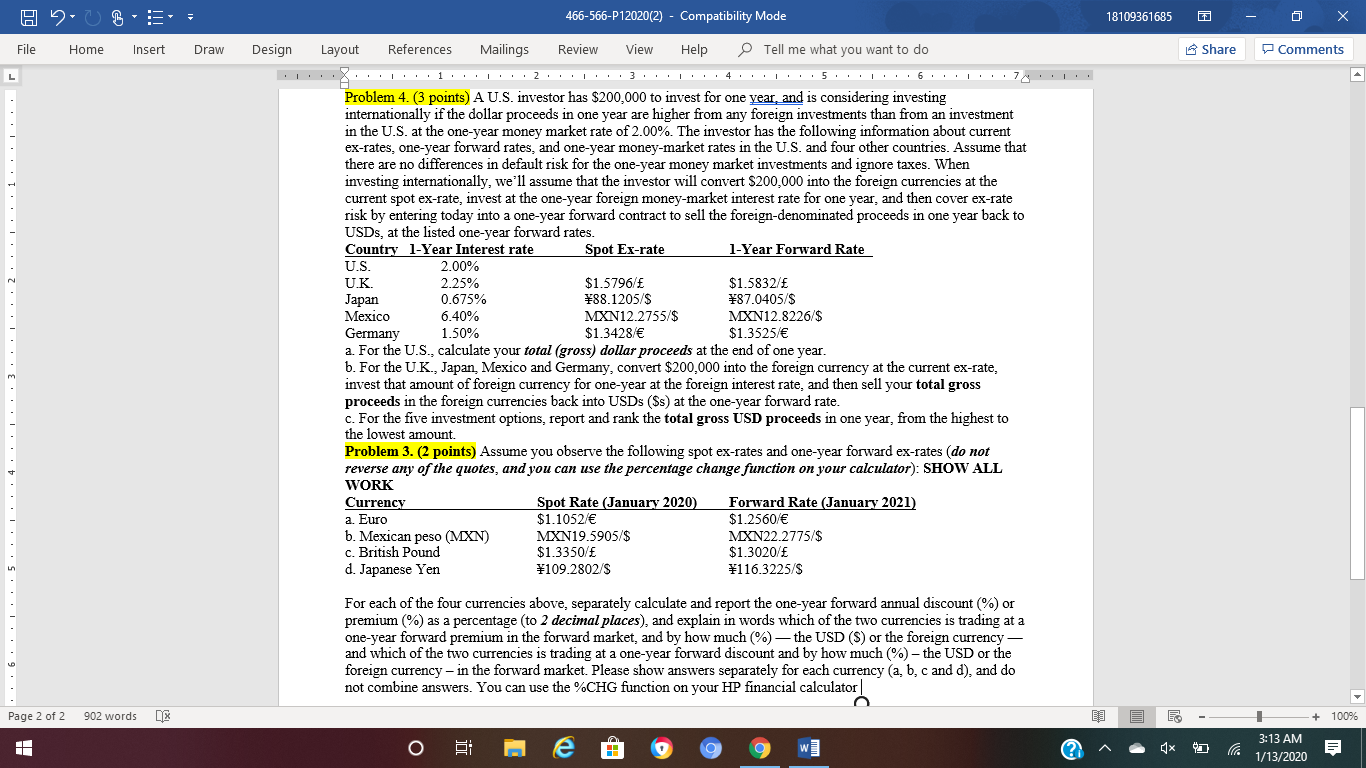

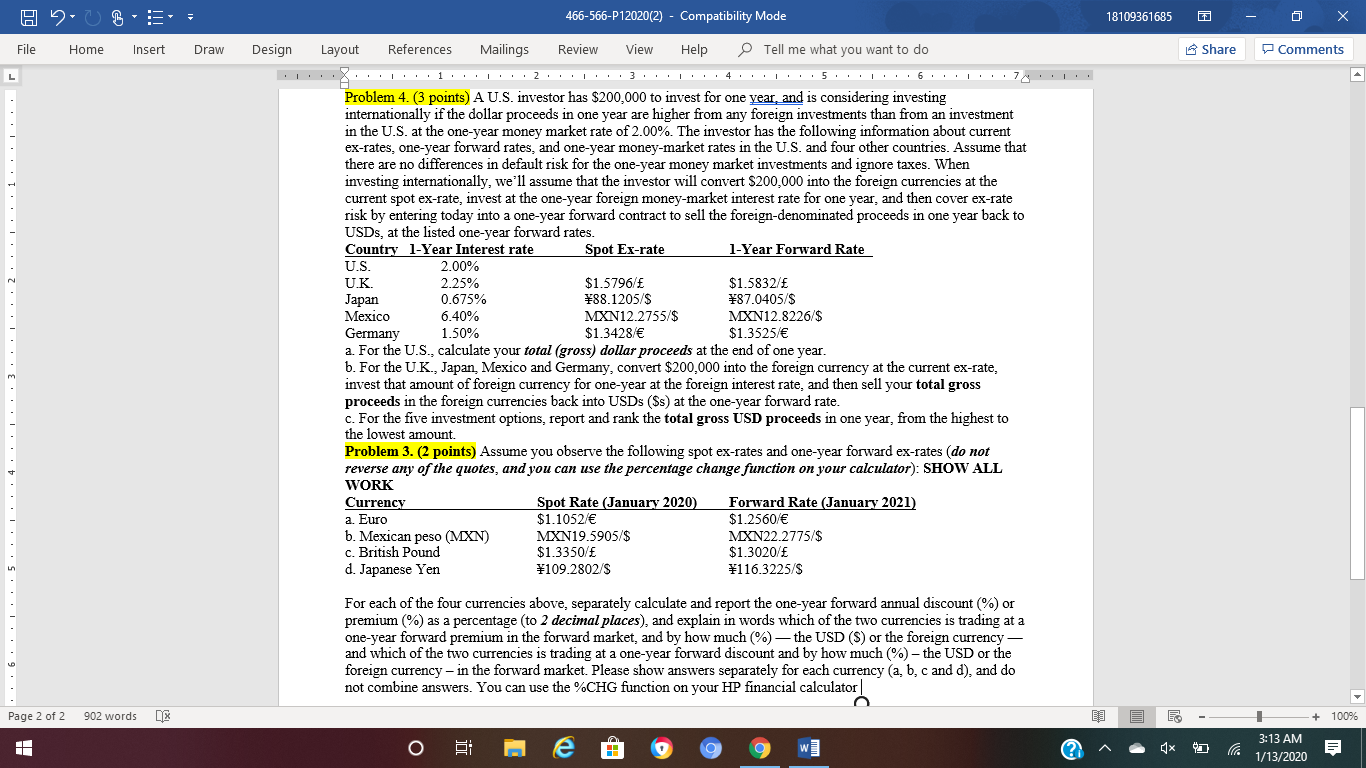

HUBE 466-566-P12020(2) - Compatibility Mode 18109361685 0 - 0 X File Home Insert Draw Design Layout References Mailings Review View Help Tell me what you want to do Share Comments .T .XIIII.1.IIII.2. IIII.3. III.4IIIII.5. III.6''T'.7 Problem 4. (3 points) A U.S. investor has $200,000 to invest for one year, and is considering investing internationally if the dollar proceeds in one year are higher from any foreign investments than from an investment in the U.S. at the one-year money market rate of 2.00%. The investor has the following information about current ex-rates, one-year forward rates, and one-year money-market rates in the U.S. and four other countries. Assume that there are no differences in default risk for the one-year money market investments and ignore taxes. When investing internationally, we'll assume that the investor will convert $200,000 into the foreign currencies at the current spot ex-rate, invest at the one-year foreign money-market interest rate for one year, and then cover ex-rate risk by entering today into a one-year forward contract to sell the foreign-denominated proceeds in one year back to USDs, at the listed one-year forward rates. Country 1-Year Interest rate Spot Ex-rate 1-Year Forward Rate U.S. 2.00% UK 2.25% $1.5796/ $1.5832/ Japan 0.675% 88.1205/$ 87.0405/$ Mexico 6.40% MXN12.2755/$ MXN12.8226/$ Germany 1.50% $1.3428/ $1.3525/ a. For the U.S., calculate your total (gross) dollar proceeds at the end of one year. b. For the UK, Japan, Mexico and Germany, convert $200,000 into the foreign currency at the current ex-rate, invest that amount of foreign currency for one-year at the foreign interest rate, and then sell your total gross proceeds in the foreign currencies back into USDs (Ss) at the one-year forward rate. c. For the five investment options, report and rank the total gross USD proceeds in one year, from the highest to the lowest amount. Problem 3. (2 points) Assume you observe the following spot ex-rates and one-year forward ex-rates (do not reverse any of the quotes, and you can use the percentage change function on your calculator): SHOW ALL WORK Currency Spot Rate (January 2020) Forward Rate (January 2021) a. Euro $1.1052/ $1.2560/ b. Mexican peso (MXN) MXN19.5905/$ MXN22.2775/$ c. British Pound $1.3350/ $1.3020/ d. Japanese Yen 109.2802/S 116.3225/$ For each of the four currencies above, separately calculate and report the one-year forward annual discount ) or premium (%) as a percentage (to 2 decimal places), and explain in words which of the two currencies is trading at a one-year forward premium in the forward market, and by how much %)the USD ($) or the foreign currency and which of the two currencies is trading at a one-year forward discount and by how much (%)-the USD or the foreign currency - in the forward market. Please show answers separately for each currency (a, b, c and d), and do not combine answers. You can use the CHG function on your HP financial calculator Page 2 of 2 902 words DX E - + 100% o @ @ @ 09 wi _ 3:13 AM 1/13/2020

Please help me solve my International finance homework

Please help me solve my International finance homework