Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me solve the following 5!! please only attempt if you can solve all 5! thank you so much for your time, will rate!

please help me solve the following 5!! please only attempt if you can solve all 5! thank you so much for your time, will rate!

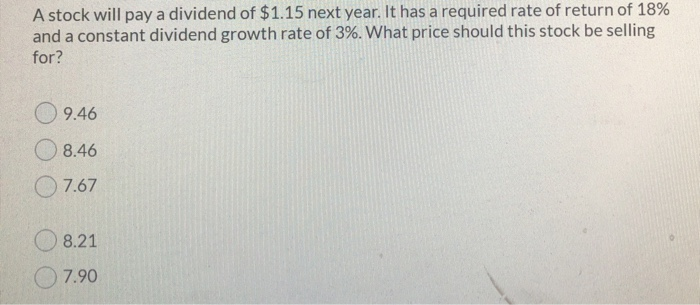

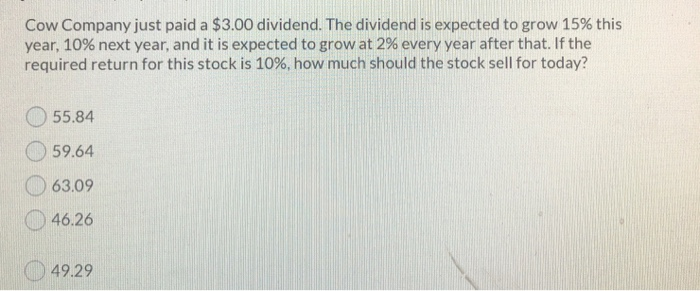

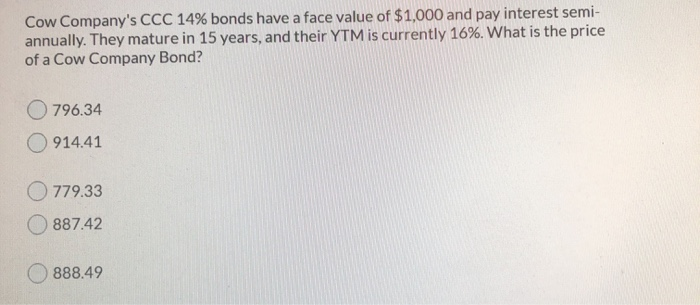

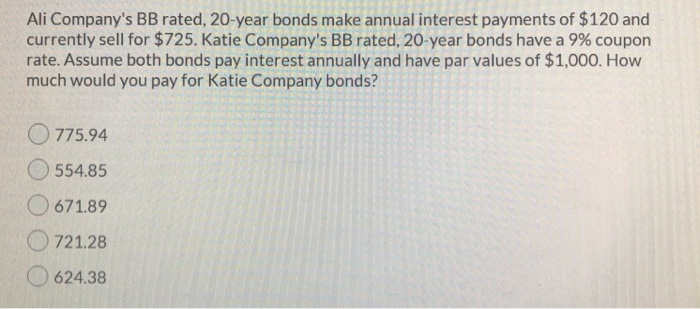

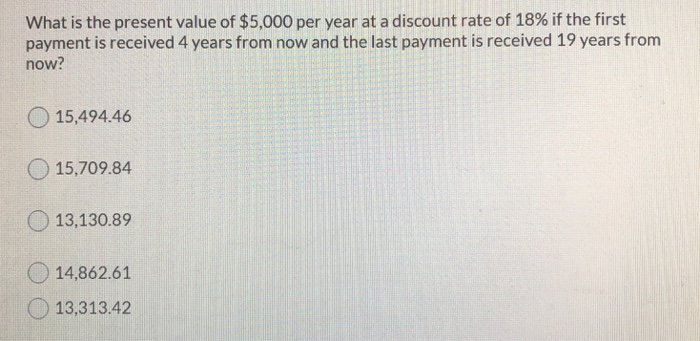

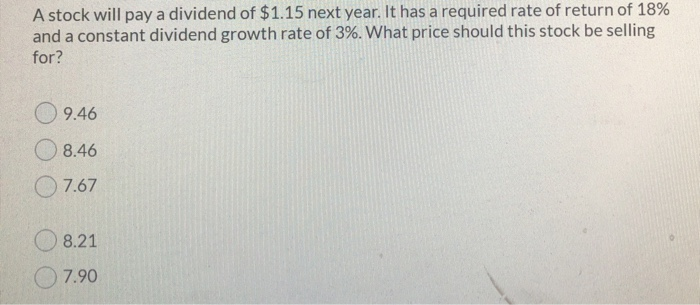

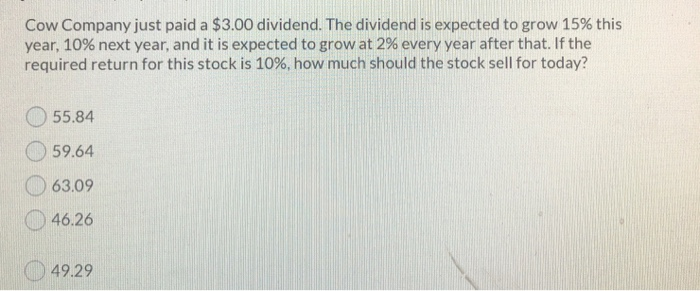

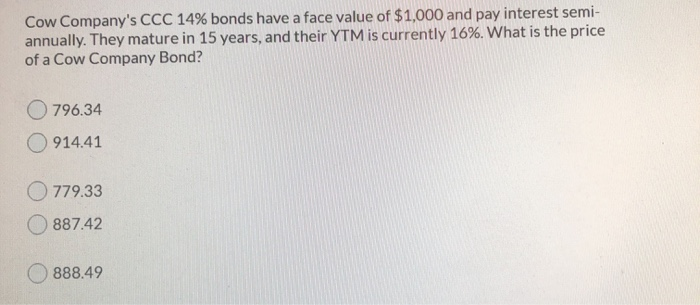

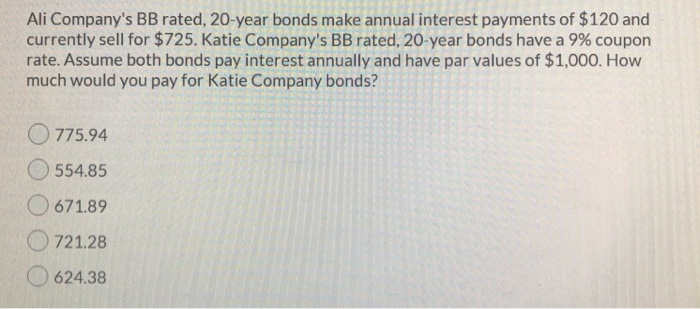

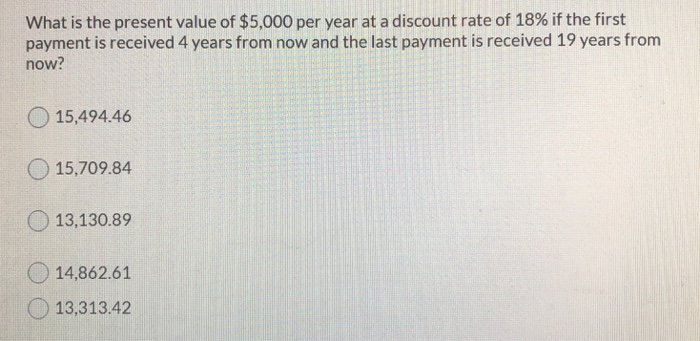

A stock will pay a dividend of $1.15 next year. It has a required rate of return of 18% and a constant dividend growth rate of 3%. What price should this stock be selling for? 09.46 8.46 O 7.67 O 8.21 7.90 Cow Company just paid a $3.00 dividend. The dividend is expected to grow 15% this year, 10% next year, and it is expected to grow at 2% every year after that. If the required return for this stock is 10%, how much should the stock sell for today? O 55.84 59.64 O 63.09 46.26 49.29 Cow Company's CCC 14% bonds have a face value of $1,000 and pay interest semi- annually. They mature in 15 years, and their YTM is currently 16%. What is the price of a Cow Company Bond? O 796.34 O914.41 779.33 887.42 888.49 What is the present value of $5,000 per year at a discount rate of 18% if the first payment is received 4 years from now and the last payment is received 19 years from now? O 15,494.46 15,709.84 13,130.89 14,862.61 13,313.42

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started