please help me solve the questions presented

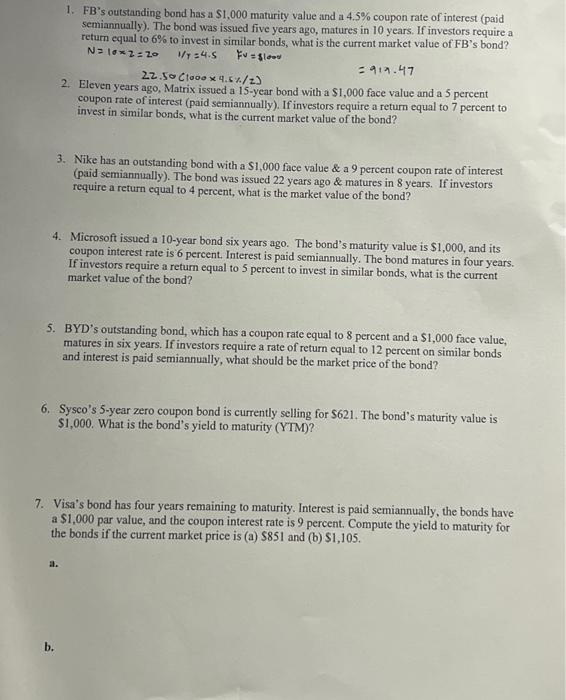

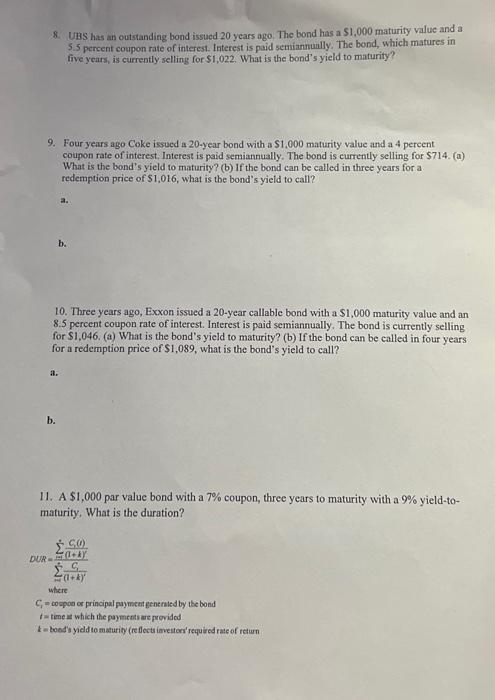

1. FB's outstanding bond has a $1,000 maturity value and a 4.5% coupon rate of interest (paid semiannually). The bond was issued five years ago, matures in 10 years. If investors require a return equal to 6% to invest in similar bonds, what is the current market value of FB's bond? N=102=201/r=4.5Fv=$1000 22.50(10004.5%/2) =919.47 2. Eleven years ago, Matrix issued a 15 -year bond with a $1,000 face value and a 5 percent coupon rate of interest (paid semiannually). If investors require a return equal to 7 percent to invest in similar bonds, what is the current market value of the bond? 3. Nike has an outstanding bond with a $1,000 face value \& a 9 percent coupon rate of interest (paid semiannually). The bond was issued 22 years ago \& matures in 8 years. If investors require a return equal to 4 percent, what is the market value of the bond? 4. Microsoft issued a 10-year bond six years ago. The bond's maturity value is $1,000, and its coupon interest rate is 6 percent. Interest is paid semiannually. The bond matures in four years. If investors require a return equal to 5 percent to invest in similar bonds, what is the current market value of the bond? 5. BYD's outstanding bond, which has a coupon rate equal to 8 percent and a $1,000 face value, matures in six years. If investors require a rate of return equal to 12 percent on similar bonds and interest is paid semiannually, what should be the market price of the bond? 6. Sysco's 5-year zero coupon bond is currently selling for $621. The bond's maturity value is $1,000. What is the bond's yield to maturity (YTM)? 7. Visa's bond has four years remaining to maturity. Interest is paid semiannually, the bonds have a $1,000 par value, and the coupon interest rate is 9 percent. Compute the yield to maturity for the bonds if the current market price is (a) $851 and (b) $1,105. a. b. 8. UBS has an outstanding bond issued 20 years ago. The bond has a $1,000 maturity valuc and a 5.5 percent coupon rate of interest. Interest is paid semiannually. The bond, which matures in five years, is currently selling for $1,022. What is the bond's yield to maturity? 9. Four years ago Coke issued a 20 -year bond with a $1,000 maturity value and a 4 pereent coupon rate of interest. Interest is paid semiannually. The bond is currently selling for \$714. (a) What is the bond's yield to maturity? (b) If the bond can be called in three years for a redemption price of $1,016, what is the bond's yield to call? a. b. 10. Three years ago, Exxon issued a 20 -year callable bond with a $1,000 maturity value and an 8.5 percent coupon rate of interest. Interest is paid semiannually. The bond is currently selling for $1,046. (a) What is the bond's yield to maturity? (b) If the bond can be called in four years for a redemption price of $1,089, what is the bond's yield to call? a. b. 11. A $1,000 par value bond with a 7% coupon, three years to maturity with a 9% yield-tomaturity, What is the duration? DUR=i=15(1+k)C5i=1+(1+k)c1(t) C1= cospos or principal paymed generaled by the bond t= time it which the paymens are providod t = boed hy yid to maturify (re flects investori' required rate of raum