Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me solve this case. Business Case: LG Company is considering the purchase of a new machine. Its invoice price is $145,000, freight charges

Please help me solve this case.

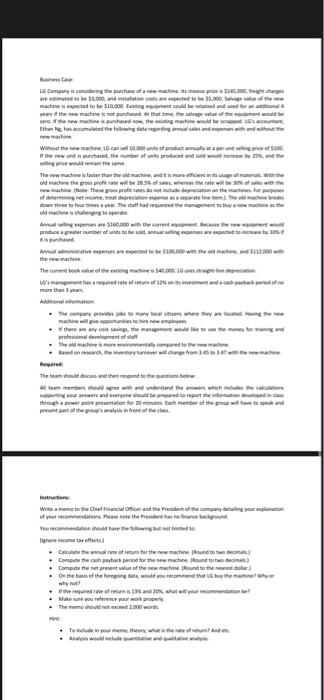

Business Case:

LG Company is considering the purchase of a new machine. Its invoice price is $145,000, freight charges are estimated to be $3,000, and installation costs are expected to be $5,000. Salvage value of the new machine is expected to be $10,000. Existing equipment could be retained and used for an additional 4 years if the new machine is not purchased. At that time, the salvage value of the equipment would be zero. If the new machine is purchased now, the existing machine would be scrapped. LGs accountant, Ethan Ng, has accumulated the following data regarding annual sales and expenses with and without the new machine.

Without the new machine, LG can sell 10,000 units of product annually at a per unit selling price of $100. If the new unit is purchased, the number of units produced and sold would increase by 25%, and the selling price would remain the same.

The new machine is faster than the old machine, and it is more efficient in its usage of materials. With the old machine the gross profit rate will be 28.5% of sales, whereas the rate will be 30% of sales with the new machine. (Note: These gross profit rates do not include depreciation on the machines. For purposes of determining net income, treat depreciation expense as a separate line item.). The old machine breaks down three to four times a year. The staff had requested the management to buy a new machine as the old machine is challenging to operate.

Annual selling expenses are $160,000 with the current equipment. Because the new equipment would produce a greater number of units to be sold, annual selling expenses are expected to increase by 10% if it is purchased.

Annual administrative expenses are expected to be $100,000 with the old machine, and $112,000 with the new machine.

The current book value of the existing machine is $40,000. LG uses straight-line depreciation.

LGs management has a required rate of return of 12% on its investment and a cash payback period of no more than 3 years.

Additional information:

The company provides jobs to many local citizens where they are located. Having the new machine will give opportunities to hire new employees

If there are any cost savings, the management would like to use the money for training and professional development of staff.

The old machine is more environmentally compared to the new machine.

Based on research, the inventory turnover will change from 3.45 to 3.47 with the new machine.

Required:

The team should discuss and then respond to the questions below:

All team members should agree with and understand the answers which includes the calculations supporting your answers and everyone should be prepared to report the information developed in class through a power point presentation for 20 minutes. Each member of the group will have to speak and present part of the groups analysis in front of the class.

Instructions:

Write a memo to the Chief Financial Officer and the President of the company detailing your explanation of your recommendations. Please note the President has no finance background.

You recommendation should have the following but not limited to: (Ignore income tax effects.)

Calculate the annual rate of return for the new machine. (Round to two decimals.)

Compute the cash payback period for the new machine. (Round to two decimals.)

Compute the net present value of the new machine. (Round to the nearest dollar.)

On the basis of the foregoing data, would you recommend that LG buy the machine? Why or

why not?

If the required rate of return is 13% and 20%, what will your recommendation be?

Make sure you reference your work properly.

The memo should not exceed 2,000 words.

Hint:

To include in your memo, theory; what is the rate of return? And etc.

Analysis would include quantitative and qualitative analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started