Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me solve this Jack, a geologist, had been debating for years whether or not to venture out on his own and operate his

please help me solve this

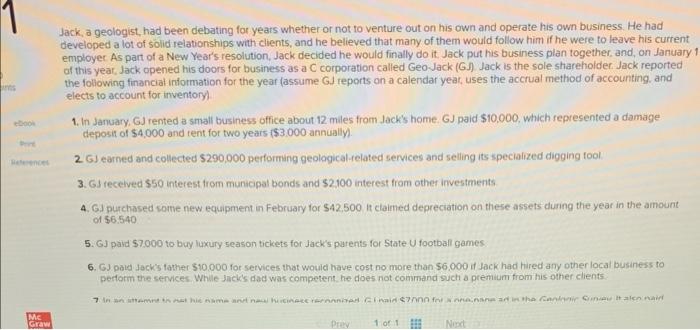

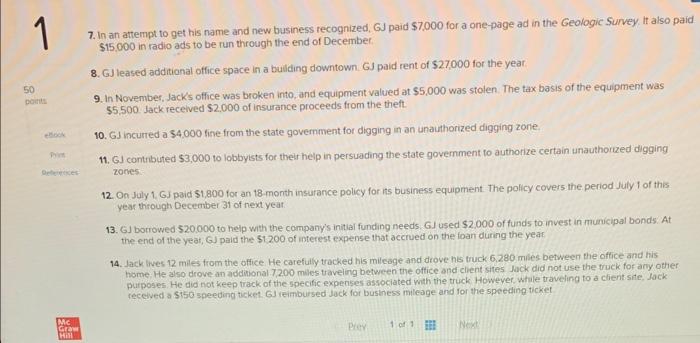

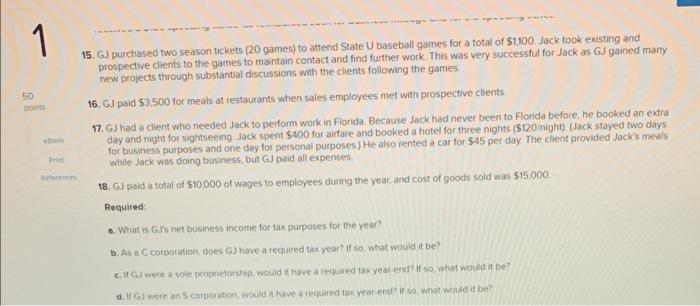

Jack, a geologist, had been debating for years whether or not to venture out on his own and operate his own business. He had developed a lot of solid relationships with clients, and he believed that many of them would follow him if he were to leave his current employer As part of a New Year's resolution, Jack decided he would finally do it. Jack put his business plan together, and, on January of this year, Jack opened his doors for business as a C corporation called Geo Jack (G). Jack is the sole shareholder Jack reported the following financiat information for the year (assume GJ reports on a calendar year, uses the accrual method of accounting. and elects to account for inventory) 1. In January, GJ rented a small business office about 12 miles from Jack's home. GJ paid $10,000, which represented a damage deposit of $4,000 and tent for two years $3,000 annually). 2. G) earned and collected $290,000 performing geological-felated services and selling its specialized digging fool 3. G) recelved $50 interest from municipal bonds and $2,100 interest from other inventments 4. 6. purchased vome new equipment in February for $42.500 it claimed depreciation on these assets during the year in the amount of $6.540 5. GJ paid $7.000 to buy luxury season tickets for Jack's purents for State U football games 6. GJ pakd Jeck's father $10,000 for services that wouid have cost no more than $6,000 if lack had hired any other local business to pertorm the services. While Jacks dad was competent, he does not command such a premium from his olher clients 7. In an attempt to get his name and new business recognized, GJ paid $7,000 for a one-page ad in the Geologic Survey. it also paid $15,000 in radio ads to be run through the end of December. 8. GJ leased additional office space in a buliding downtown. GJ paid rent of $27,000 for the year: 9. In November, Jacks office was broken into, and equipment valued at $5,000 was stolen. The tax basis of the equipment was $5,500 Jack received $2,000 of insurance proceeds from the theft. 10. 6 J incurred a $4,000 fine from the state govemment for digging in an unauthorized digging zone. 11. GJ contributed $3,000 to lobbyists for their help in persuading the state government to authonize certain unauthorized digging zones 12. On July 1,GJ paid $1,800 for an 18 month insurance policy for its business equipment. The policy covers the period July 1 of this year through December 31 of next year 13. GJ borrowed $20.000 to help with the company's initlai funding needs. GJ used $2.000 of funds to invest in municipal bonds. At the end of the yeat, GJ paid the 51200 of interest expense that accrued on the foan during the year 14. Jack lives 12 miles from the office He carefully tracked his milesge and drove his truck 6,280 miles between the office and his home. He also drove an additional 7,200 miles traveling between the office and client sites Jack did not use the truck for any other purposes. He did not keep track of the specific expenses associated with the truck However, while traveling to a client site, Jack recelved a \$iso speeding ticket. GJ ieimbursed Jack for busthess mileage and ror the speeding ticket 15. GJ purchased two season tickets (20 games) to attend State U baseball games for a total of $1,100. Jack took existing and prospective clients to the games to maintain contact and find further work. This was very successful for Jack as GJ gained many new projects through substantul discussions with the clients following the games 16. GJ paid $3,500 for mieals at restaurants when sales employees met with prospective clients 17. GJ had a client who needed Jack to perform work in Flonida. Because Jack had never been to Florida before, he booked an extra day and night for sightseeing Jack spent $400 for airtare and booked a hotel for three nights (\$120inight) (Jack stayed two days for business purposes and one day for personal purposes) He also rented a car for 545 per day The client provided Jack's meals while Jack was doing business, but GJ paid all expenses. 18. GJ paid a total of $10,000 of wages to employees during the year. and cost of goods sold was $15,000, Required: 0. What is Gis net business income for tax purposes for the year? b. As a C cotpotation, does GJ have a requred tax year? if so, what would it be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started