Answered step by step

Verified Expert Solution

Question

1 Approved Answer

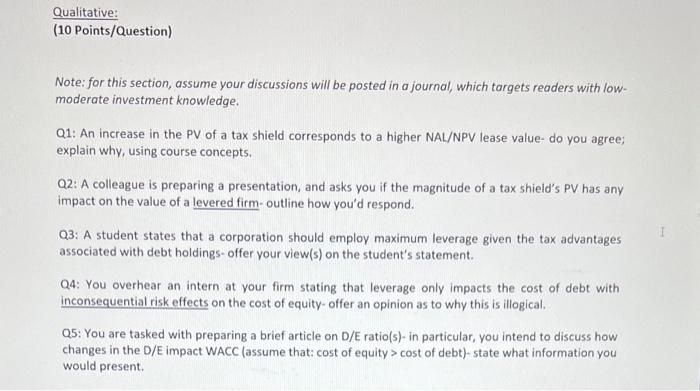

please help me solve this Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge.

please help me solve this

Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge. Q1: An increase in the PV of a tax shield corresponds to a higher NAL/NPV lease value-do you agree; explain why, using course concepts. Q2: A colleague is preparing a presentation, and asks you if the magnitude of a tax shield's PV has any impact on the value of a levered firm-outline how you'd respond. Q3: A student states that a corporation should employ maximum leverage given the tax advantages associated with debt holdings- offer your view(s) on the student's statement. Q4: You overhear an intern at your firm stating that leverage only impacts the cost of debt with inconsequential risk effects on the cost of equity-offer an opinion as to why this is illogical. Q5: You are tasked with preparing a brief article on D/E ratio(s)- in particular, you intend to discuss how changes in the D/E impact WACC (assume that: cost of equity > cost of debt)-state what information you would present

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started