Please help me solve this problem set for all parts of requirements 6,7,8. Thank you.

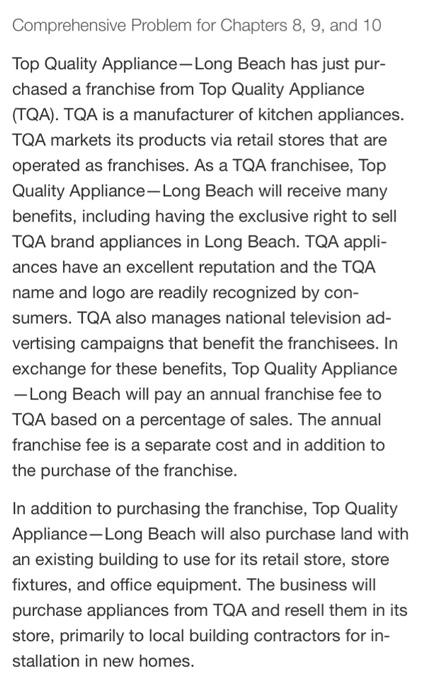

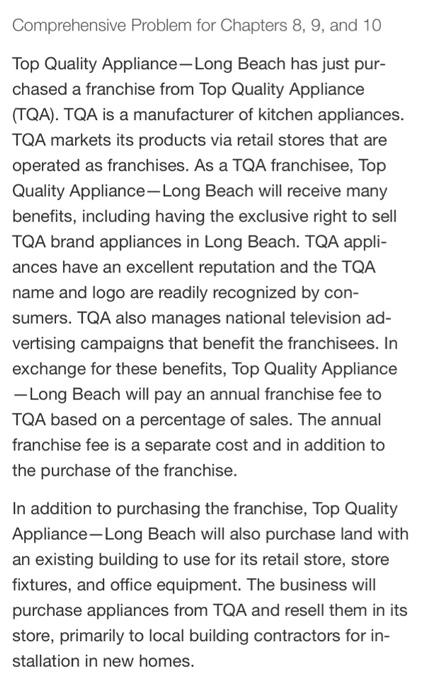

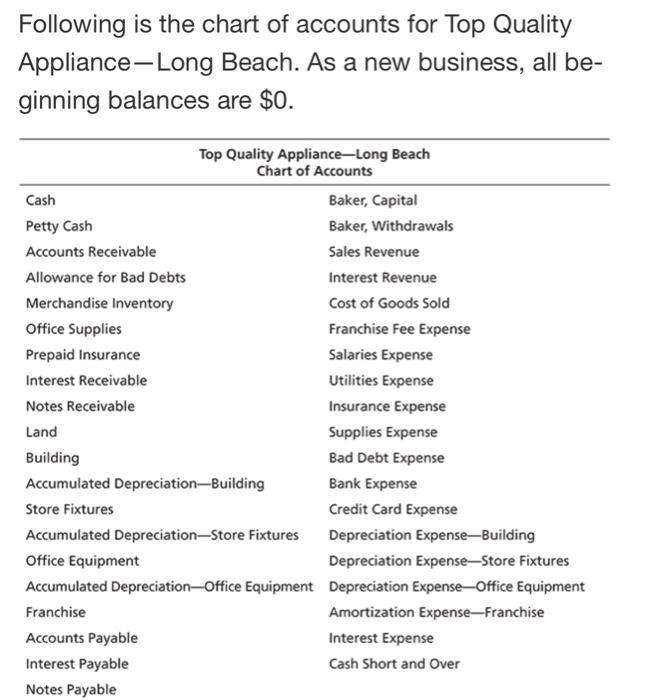

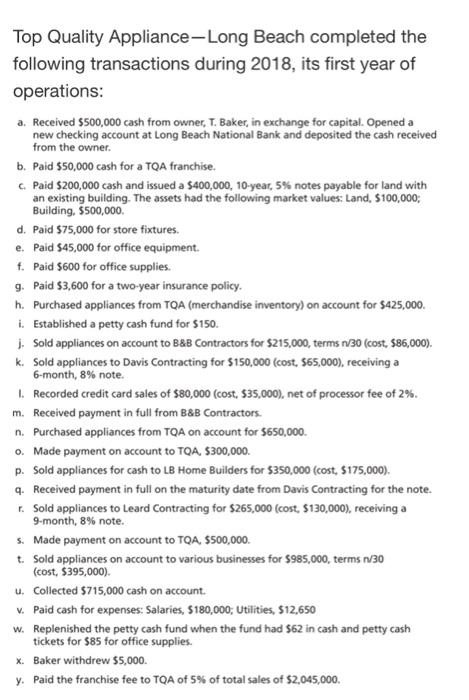

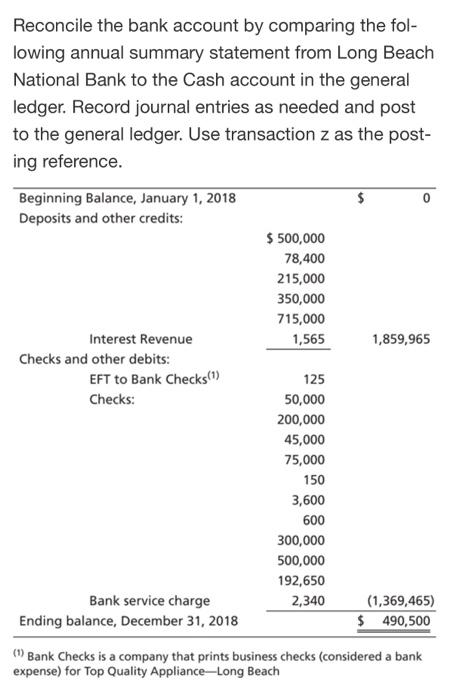

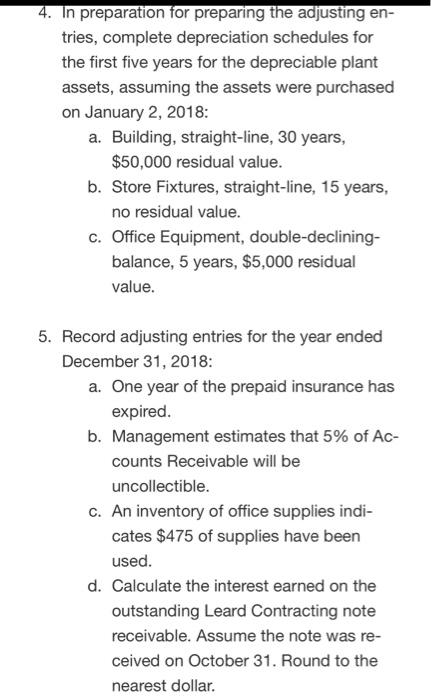

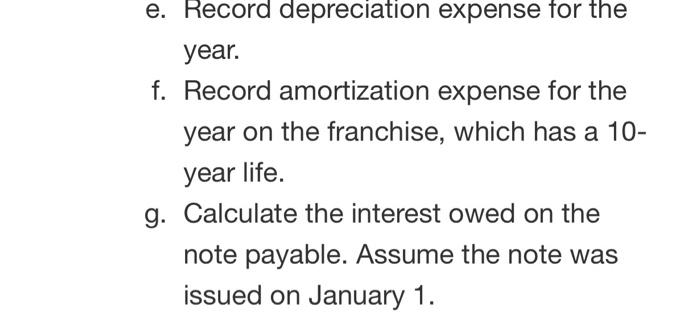

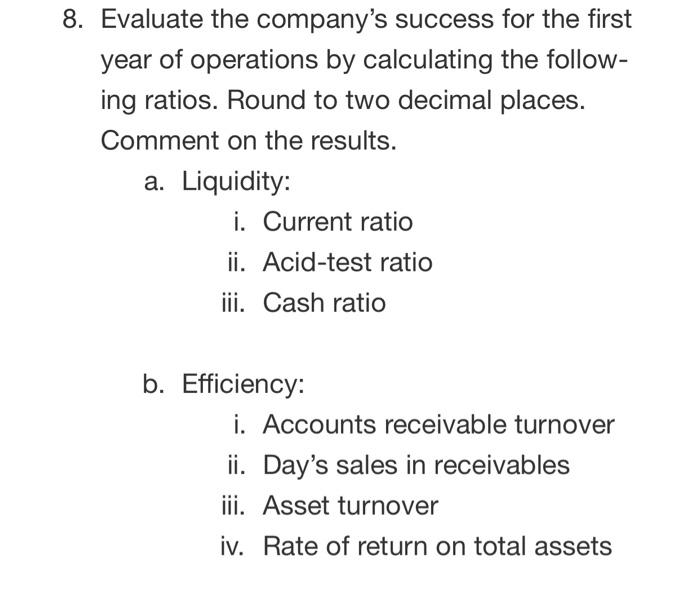

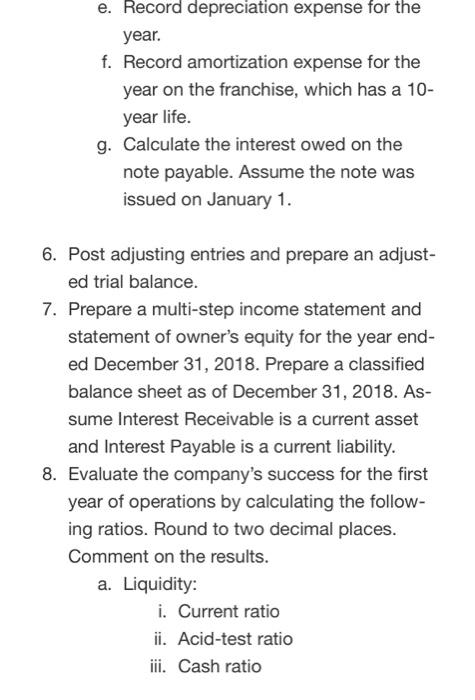

Comprehensive Problem for Chapters 8, 9, and 10 Top Quality Appliance-Long Beach has just pur- chased a franchise from Top Quality Appliance (TQA). TQA is a manufacturer of kitchen appliances. TQA markets its products via retail stores that are operated as franchises. As a TQA franchisee, Top Quality Appliance-Long Beach will receive many benefits, including having the exclusive right to sell TQA brand appliances in Long Beach. TQA appli- ances have an excellent reputation and the TQA name and logo are readily recognized by con- sumers. TQA also manages national television ad- vertising campaigns that benefit the franchisees. In exchange for these benefits, Top Quality Appliance - Long Beach will pay an annual franchise fee to TQA based on a percentage of sales. The annual franchise fee is a separate cost and in addition to the purchase of the franchise. In addition to purchasing the franchise, Top Quality Appliance-Long Beach will also purchase land with an existing building to use for its retail store, store fixtures, and office equipment. The business will purchase appliances from TQA and resell them in its store, primarily to local building contractors for in- stallation in new homes. Following is the chart of accounts for Top Quality Appliance-Long Beach. As a new business, all be- ginning balances are $0. Top Quality Appliance-Long Beach Chart of Accounts Cash Baker, Capital Petty Cash Baker, Withdrawals Accounts Receivable Sales Revenue Allowance for Bad Debts Interest Revenue Merchandise Inventory Cost of Goods Sold Office Supplies Franchise Fee Expense Prepaid Insurance Salaries Expense Interest Receivable Utilities Expense Notes Receivable Insurance Expense Land Supplies Expense Building Bad Debt Expense Accumulated Depreciation-Building Bank Expense Store Fixtures Credit Card Expense Accumulated Depreciation-Store Fixtures Depreciation ExpenseBuilding Office Equipment Depreciation Expense-Store Fixtures Accumulated Depreciation Office Equipment Depreciation Expense-Office Equipment Franchise Amortization Expense-Franchise Accounts Payable Interest Expense Interest Payable Cash Short and Over Notes Payable Top Quality Appliance-Long Beach completed the following transactions during 2018, its first year of operations: a. Received $500,000 cash from owner, T. Baker, in exchange for capital. Opened a new checking account at Long Beach National Bank and deposited the cash received from the owner b. Paid $50,000 cash for a TOA franchise. Paid $200,000 cash and issued a $400,000, 10-year, 5% notes payable for land with an existing building. The assets had the following market values: Land, $100,000; Building, $500,000 d. Paid $75,000 for store fixtures. e. Paid $45,000 for office equipment. f. Paid $600 for office supplies. g. Paid $3,600 for a two-year insurance policy. h. Purchased appliances from TOA (merchandise inventory) on account for $425,000 1. Established a petty cash fund for $150. 1. Sold appliances on account to B&B Contractors for $215,000, terms 1/30 (cost, $86,000). k. Sold appliances to Davis Contracting for $150,000 (cost, $65,000), receiving a 6-month, 8% note. 1. Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2%. m. Received payment in full from B&B Contractors. n. Purchased appliances from TQA on account for $650,000. o. Made payment on account to TOA, $300,000 p. Sold appliances for cash to LB Home Builders for $350,000 (cost, $175,000). 4. Received payment in full on the maturity date from Davis Contracting for the note. r. Sold appliances to Leard Contracting for $265,000 (cost, $130,000), receiving a 9-month, 8% note. S. Made payment on account to TQA, $500,000. t. Sold appliances on account to various businesses for $985,000, terms 1/30 (cost, $395,000) u. Collected $715,000 cash on account. v. Paid cash for expenses: Salaries, $180,000; Utilities, $12,650 W. Replenished the petty cash fund when the fund had $62 in cash and petty cash tickets for $85 for office supplies. X. Baker withdrew $5,000. y. Paid the franchise fee to TOA of 5% of total sales of $2,045,000. Requirements 1. Record the transactions in the general jour- nal. Omit explanations. 2. Post to the general ledger. 3. It is a common business practice to reconcile the bank accounts on a monthly basis. How- ever, in this problem, the reconciliation of the company's checking account will be done at the end of the year, based on an annual summary. Reconcile the bank account by comparing the fol- lowing annual summary statement from Long Beach National Bank to the Cash account in the general ledger. Record journal entries as needed and post to the general ledger. Use transaction z as the post- ing reference. Reconcile the bank account by comparing the fol- lowing annual summary statement from Long Beach National Bank to the Cash account in the general ledger. Record journal entries as needed and post to the general ledger. Use transaction z as the post- ing reference. Beginning Balance, January 1, 2018 0 Deposits and other credits: $ 500,000 78,400 215,000 350,000 715,000 Interest Revenue 1,565 1,859,965 Checks and other debits: EFT to Bank Checks(1) 125 Checks: 50,000 200,000 45,000 75,000 150 3,600 600 300,000 500,000 192,650 Bank service charge 2,340 (1,369,465) Ending balance, December 31, 2018 $ 490,500 (1) Bank Checks is a company that prints business checks (considered a bank expense) for Top Quality Appliance-Long Beach 4. In preparation for preparing the adjusting en- tries, complete depreciation schedules for the first five years for the depreciable plant assets, assuming the assets were purchased on January 2, 2018: a. Building, straight-line, 30 years, $50,000 residual value. b. Store Fixtures, straight-line, 15 years, no residual value. c. Office Equipment, double-declining- balance, 5 years, $5,000 residual value. 5. Record adjusting entries for the year ended December 31, 2018: a. One year of the prepaid insurance has expired. b. Management estimates that 5% of Ac- counts Receivable will be uncollectible. C. An inventory of office supplies indi- cates $475 of supplies have been used. d. Calculate the interest earned on the outstanding Leard Contracting note receivable. Assume the note was re- ceived on October 31. Round to the nearest dollar. e. Record depreciation expense for the year. f. Record amortization expense for the year on the franchise, which has a 10- year life. g. Calculate the interest owed on the note payable. Assume the note was issued on January 1. 8. Evaluate the company's success for the first year of operations by calculating the follow- ing ratios. Round to two decimal places. Comment on the results. a. Liquidity: i. Current ratio ii. Acid-test ratio iii. Cash ratio b. Efficiency: i. Accounts receivable turnover ii. Day's sales in receivables iii. Asset turnover iv. Rate of return on total assets . e. Record depreciation expense for the year. f. Record amortization expense for the year on the franchise, which has a 10- year life. g. Calculate the interest owed on the note payable. Assume the note was issued on January 1. 6. Post adjusting entries and prepare an adjust- ed trial balance. 7. Prepare a multi-step income statement and statement of owner's equity for the year end- ed December 31, 2018. Prepare a classified balance sheet as of December 31, 2018. As- sume Interest Receivable is a current asset and Interest Payable is a current liability. 8. Evaluate the company's success for the first year of operations by calculating the follow- ing ratios. Round to two decimal places. Comment on the results. a. Liquidity: i. Current ratio ii. Acid-test ratio iii. Cash ratio