Answered step by step

Verified Expert Solution

Question

1 Approved Answer

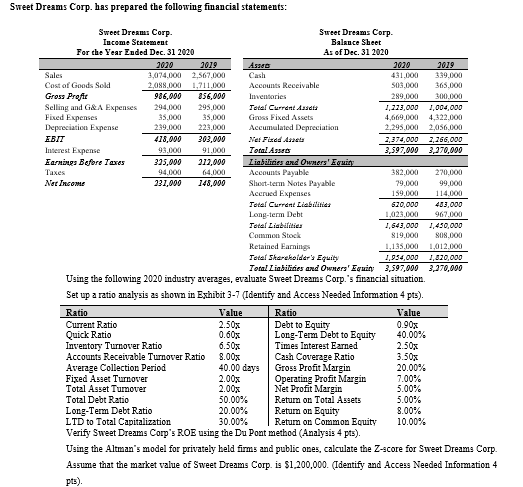

Please help me solve this. Thank you! Sweet Dreams Corp. has prepared the following financial statements: SweetDresmaCorp.IncomeStatementFortheYearEndedDec.312020SureetDreamsCorp.BalauceSheetAsofDec.312020 Using the following 2020 industry averages, evaluate Sweet

Please help me solve this. Thank you!

Sweet Dreams Corp. has prepared the following financial statements: SweetDresmaCorp.IncomeStatementFortheYearEndedDec.312020SureetDreamsCorp.BalauceSheetAsofDec.312020 Using the following 2020 industry averages, evaluate Sweet Dreams Corp.'5 financial situation. Set up a ratio analysis as shown in Exhibit 3-7 (Identify and Access Needed Information 4 pt5). Using the Altman" 5 model for privately held firms and public ones, calculate the Z-9core for Sweet Dreams Corp. Assume that the market value of Sweet Dreams Corp. is $1,200,000. (Identify and Access Needed Information 4 pts). d) Calculate Sweet Dreams Corp.'s economic profit for these years and compare it to net income. Assume that the weighted average cost of capital is 12% (Identify and Access Needed Information 4 pts). e) Interpretation: please describe where you obtained information to develop analyses and interpret the results. Please include your written description in the "interpretation" tab. If you do not complete this section with your words or leave the interpretation tab as a blank, you receive 0 point in this HW. 1. Complete individual interpretation for each ratio. 2. Describe your analysis, and elaborate your results in relation to ratios, Do Pont ROE, Z-score and Sweet Dreams Corp. has prepared the following financial statements: SweetDresmaCorp.IncomeStatementFortheYearEndedDec.312020SureetDreamsCorp.BalauceSheetAsofDec.312020 Using the following 2020 industry averages, evaluate Sweet Dreams Corp.'5 financial situation. Set up a ratio analysis as shown in Exhibit 3-7 (Identify and Access Needed Information 4 pt5). Using the Altman" 5 model for privately held firms and public ones, calculate the Z-9core for Sweet Dreams Corp. Assume that the market value of Sweet Dreams Corp. is $1,200,000. (Identify and Access Needed Information 4 pts). d) Calculate Sweet Dreams Corp.'s economic profit for these years and compare it to net income. Assume that the weighted average cost of capital is 12% (Identify and Access Needed Information 4 pts). e) Interpretation: please describe where you obtained information to develop analyses and interpret the results. Please include your written description in the "interpretation" tab. If you do not complete this section with your words or leave the interpretation tab as a blank, you receive 0 point in this HW. 1. Complete individual interpretation for each ratio. 2. Describe your analysis, and elaborate your results in relation to ratios, Do Pont ROE, Z-score andStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started