Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me solving problem5.5 and please if you can explain to me all the step to get the answer For Equipment (10 year life)

Please help me solving problem5.5 and please if you can explain to me all the step to get the answer

For Equipment (10 year life) 5,400 600 6,000, I don't understand how you get 6000 is it from the accumulated deprecation difference of 30,000 /5 = 6,000 each year? why 5 year? can you please help me

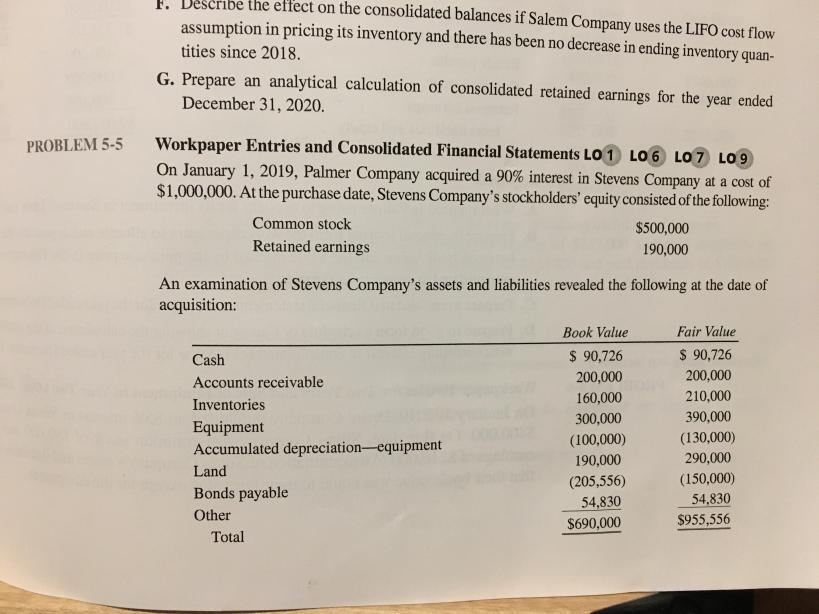

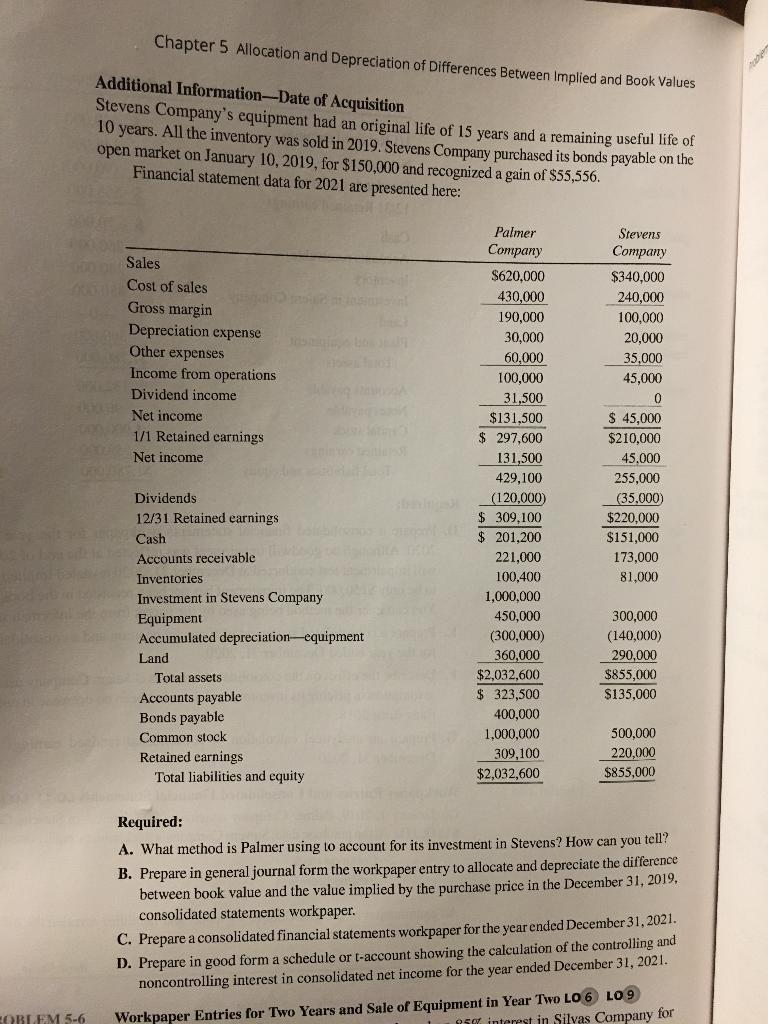

F. Describe the effect on the consolidated balances if Salem Company uses the LIFO cost flow assumption in pricing its inventory and there has been no decrease in ending inventory quantities since 2018. G. Prepare an analytical calculation of consolidated retained earnings for the year ended December 31,2020. Workpaper Entries and Consolidated Financial Statements LO 1 Lo 6 LO 7 Lo 9 On January 1, 2019, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Company's stockholders' equity consisted of the following: An examination of Stevens Company's assets and liabilities revealed the following at the date of acquisition: Chapter 5 Allocation and Depreciation of Differences Between Implied and Book Values Additional Information-Date of Acquisition Stevens Company's equipment had an original life of 15 years and a remaining useful life of 10 years. All the inventory was sold in 2019. Stevens Company purchased its bonds payable on the open market on January 10,2019, for $150,000 and recognized a gain of $55,556. Financial statement data for 2021 are presented here: Required: A. What method is Palmer using to account for its investment in Stevens? How can you tell? B. Prepare in general journal form the workpaper entry to allocate and depreciate the difference between book value and the value implied by the purchase price in the December 31, 2019 , consolidated statements workpaper. C. Prepare a consolidated financial statements workpaper for the year ended December 31,2021. D. Prepare in good form a schedule or t-account showing the calculation of the controlling and noncontrolling interest in consolidated net income for the year ended December 31,2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started