Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me. thank you. Dhaliwal Digital categorizes its accounts receivable into three age groups for purposes of estimating its allowance for uncollectible accounts. 1.

please help me. thank you.

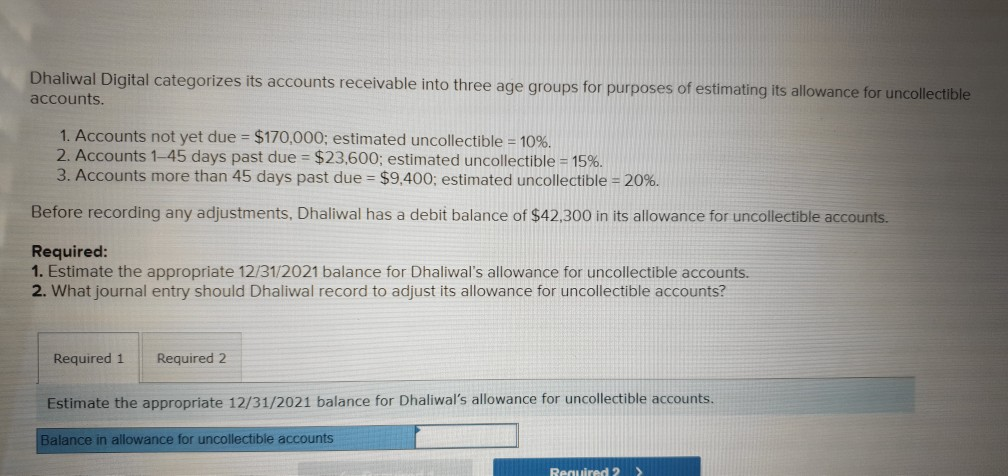

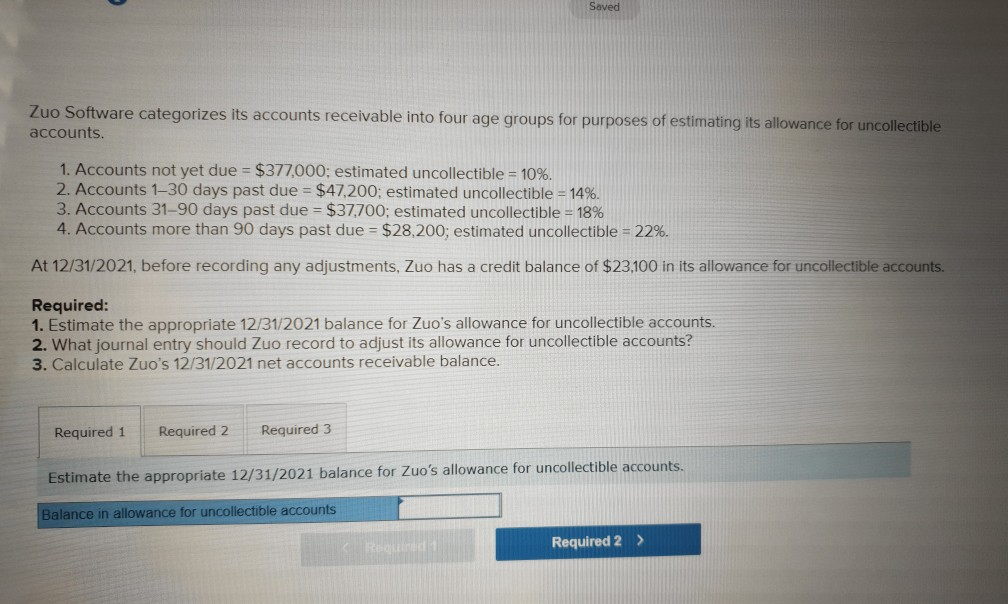

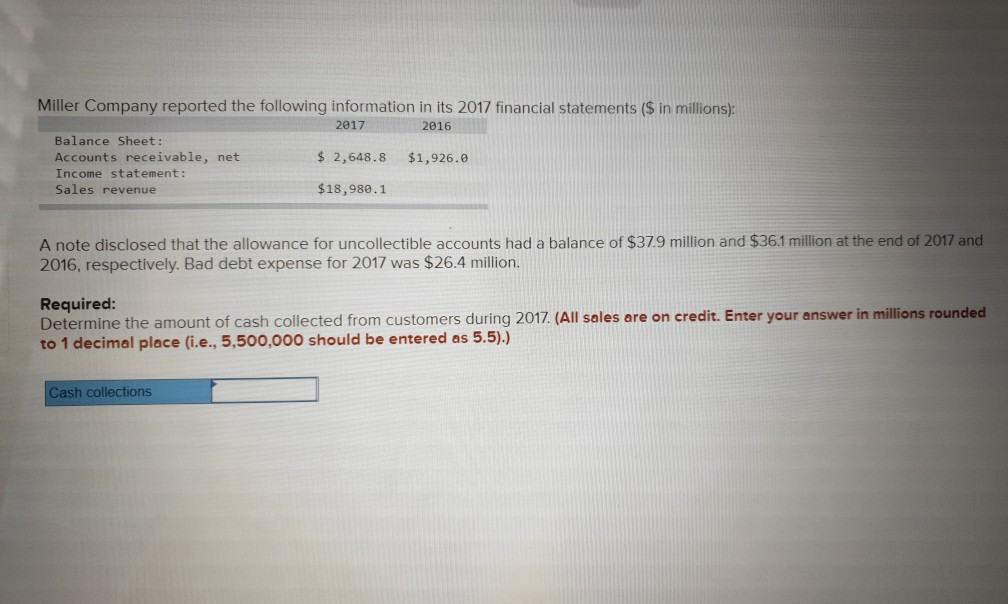

Dhaliwal Digital categorizes its accounts receivable into three age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due = $170,000; estimated uncollectible = 10%. 2. Accounts 1-45 days past due = $23,600; estimated uncollectible = 15%. 3. Accounts more than 45 days past due = $9.400; estimated uncollectible = 20%. Before recording any adjustments, Dhaliwal has a debit balance of $42,300 in its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/31/2021 balance for Dhaliwal's allowance for uncollectible accounts. 2. What journal entry should Dhaliwal record to adjust its allowance for uncollectible accounts? Required 1 Required 2 Estimate the appropriate 12/31/2021 balance for Dhaliwal's allowance for uncollectible accounts. Balance in allowance for uncollectible accounts Required 2 > Saved Zuo Software categorizes its accounts receivable into four age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due = $377,000: estimated uncollectible = 10%. 2. Accounts 130 days past due = $47,200, estimated uncollectible = 14%. 3. Accounts 31-90 days past due = $37,700; estimated uncollectible = 18% 4. Accounts more than 90 days past due = $28,200; estimated uncollectible = 22%. At 12/31/2021, before recording any adjustments, Zuo has a credit balance of $23,100 in its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/31/2021 balance for Zuo's allowance for uncollectible accounts. 2. What journal entry should Zuo record to adjust its allowance for uncollectible accounts? 3. Calculate Zuo's 12/31/2021 net accounts receivable balance. Required 1 Required 2 Required 3 Estimate the appropriate 12/31/2021 balance for Zuo's allowance for uncollectible accounts. Balance in allowance for uncollectible accounts Root Required 2 > Miller Company reported the following information in its 2017 financial statements ($ in millions): 2017 2016 Balance Sheet: Accounts receivable, net $ 2,648.8 $1,926.0 Income statement : Sales revenue $18,980.1 A note disclosed that the allowance for uncollectible accounts had a balance of $37.9 million and $36.1 million at the end of 2017 and 2016, respectively. Bad debt expense for 2017 was $26.4 million. Required: Determine the amount of cash collected from customers during 2017. (All sales are on credit. Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Cash collectionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started