Answered step by step

Verified Expert Solution

Question

1 Approved Answer

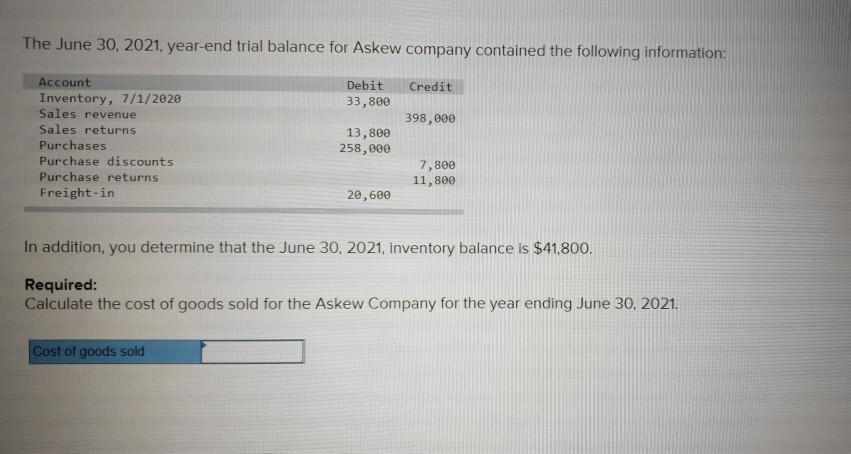

please help me. thank you. The June 30, 2021, year-end trial balance for Askew company contained the following information: Credit Debit 33,800 398,000 Account Inventory,

please help me. thank you.

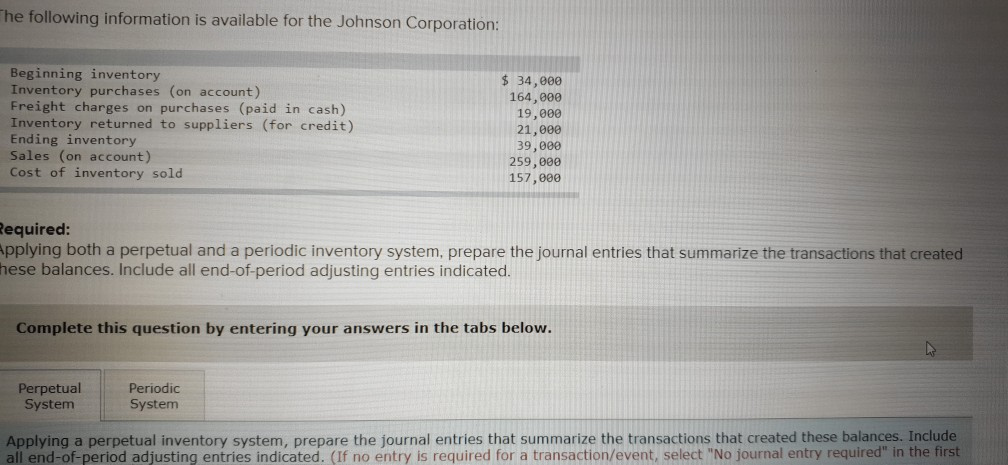

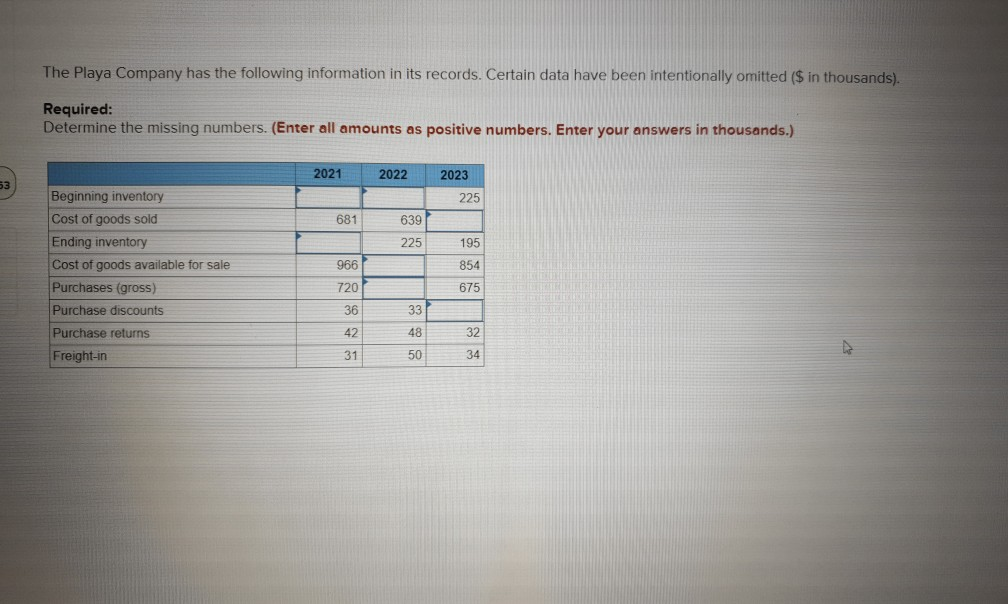

The June 30, 2021, year-end trial balance for Askew company contained the following information: Credit Debit 33,800 398,000 Account Inventory, 7/1/2020 Sales revenue Sales returns Purchases Purchase discounts Purchase returns Freight-in 13,800 258,000 7,800 11,800 20,600 In addition, you determine that the June 30, 2021, inventory balance is $41,800. Required: Calculate the cost of goods sold for the Askew Company for the year ending June 30, 2021. Cost of goods sold The following information is available for the Johnson Corporation: $ 34,000 164,000 19,000 Beginning inventory Inventory purchases (on account) Freight charges on purchases (paid in cash) Inventory returned to suppliers (for credit) Ending inventory Sales (on account) Cost of inventory sold 21,000 39,000 259,000 157,000 Required: Applying both a perpetual and a periodic inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. Complete this question by entering your answers in the tabs below. Perpetual System Periodic System Applying a perpetual inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. (If no entry is required for a transaction/event, select "No journal entry required" in the first The Playa Company has the following information in its records. Certain data have been intentionally omitted ($ in thousands). Required: Determine the missing numbers. (Enter all amounts as positive numbers. Enter your answers in thousands.) 2021 2022 2023 53 225 681 639 225 195 854 966 Beginning inventory Cost of goods sold Ending inventory Cost of goods available for sale Purchases (gross) Purchase discounts Purchase returns Freight-in 720 675 36 33 42 48 32 31 50 34Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started