Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me. thank you. You have been pricing an MP3 player in several stores. Three stores have the identical price of $400. Each store

please help me. thank you.

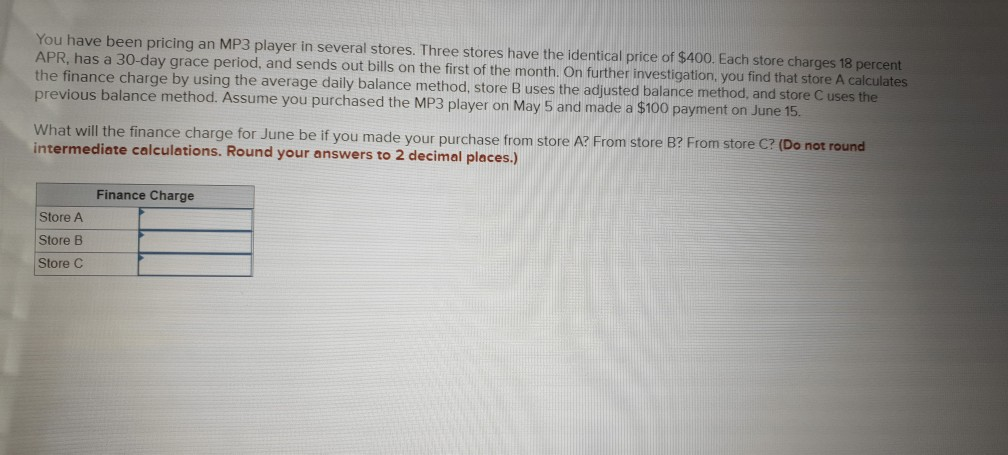

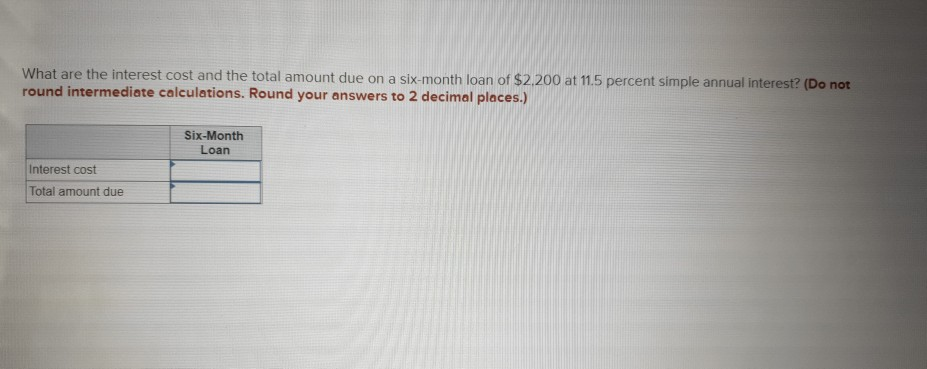

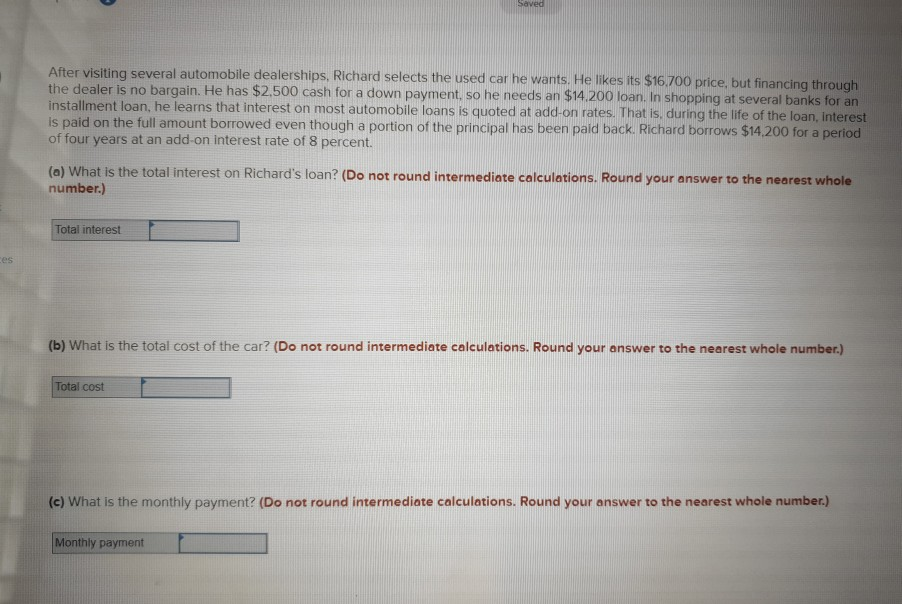

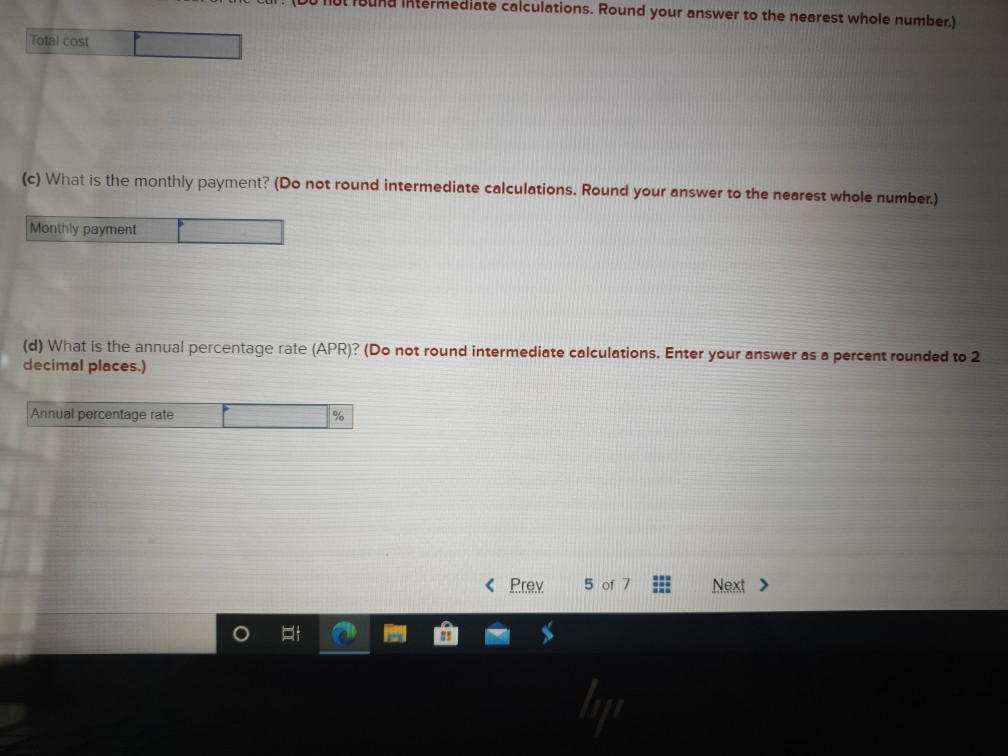

You have been pricing an MP3 player in several stores. Three stores have the identical price of $400. Each store charges 18 percent APR, has a 30-day grace period, and sends out bills on the first of the month. On further investigation, you find that store A calculates the finance charge by using the average daily balance method, store B uses the adjusted balance method, and store C uses the previous balance method. Assume you purchased the MP3 player on May 5 and made a $100 payment on June 15. What will the finance charge for June be if you made your purchase from store A? From store B? From store C? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Finance Charge Store A Store B Store C What are the interest cost and the total amount due on a six-month loan of $2.200 at 11.5 percent simple annual interest? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Six-Month Loan Interest cost Total amount due After visiting several automobile dealerships, Richard selects the used car he wants. He likes its $16.700 price, but financing through the dealer is no bargain. He has $2.500 cash for a down payment, so he needs an $14,200 loan. In shopping at several banks for an installment loan, he learns that interest on most automobile loans is quoted at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed even though a portion of the principal has been paid back. Richard borrows $14,200 for a period of four years at an add-on interest rate of 8 percent. (a) What is the total interest on Richard's loan? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Total interest es (b) What is the total cost of the car? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Total cost (c) What is the monthly payment? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Monthly payment Intermediate calculations. Round your answer to the nearest whole number.) Total cost (c) What is the monthly payment? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Monthly payment (d) What is the annual percentage rate (APR)? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Annual percentage rate B lipStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started