Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me The next 5 questions use the same below information Company C had the following investment. Help them determine the financial statement implications

please help me

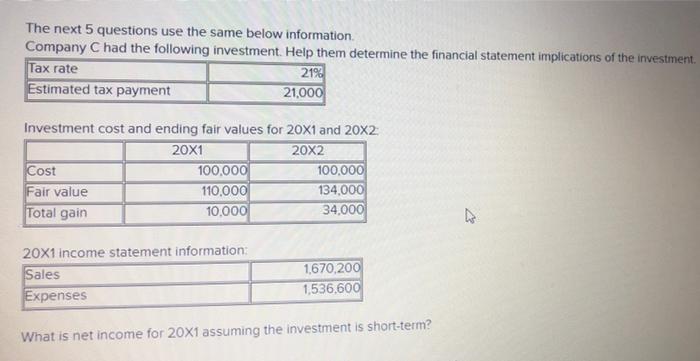

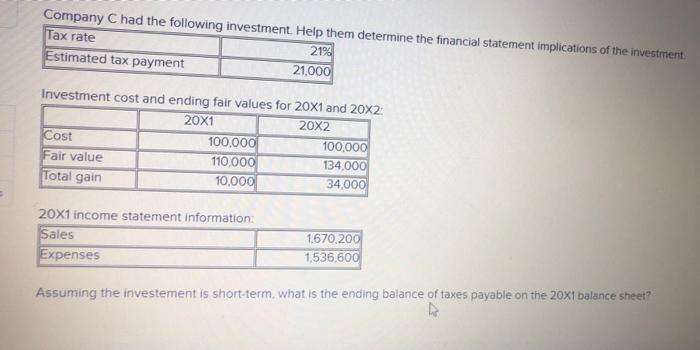

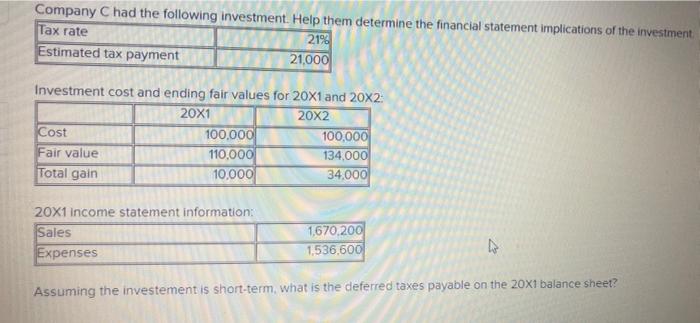

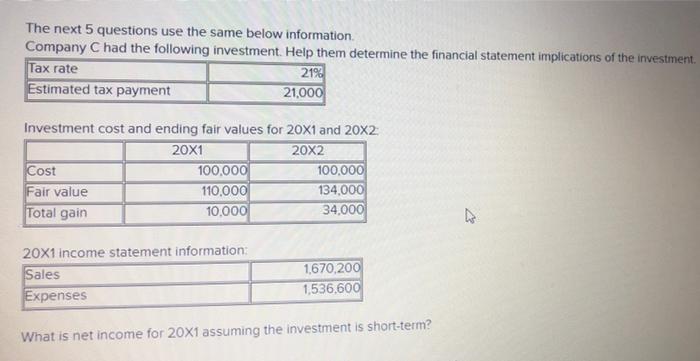

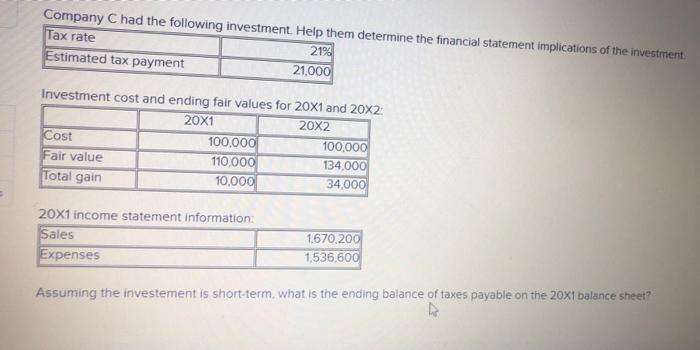

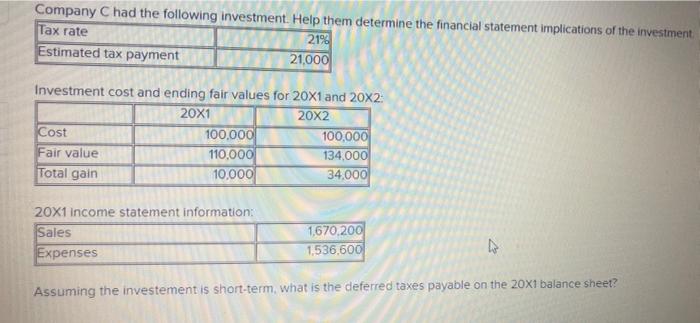

The next 5 questions use the same below information Company C had the following investment. Help them determine the financial statement implications of the investment Tax rate 21% Estimated tax payment 21.000 Investment cost and ending fair values for 20x1 and 20X2: 20X1 20x2 Cost 100,000 100,000 Fair value 110,000 134,000 Total gain 10.000 34,000 20X1 income statement information: Sales Expenses 1.670,200 1,536,600 What is net income for 20X1 assuming the investment is short-term? Company C had the following investment. Help them determine the financial statement implications of the investment. Tax rate 21% Estimated tax payment 21.000 Investment cost and ending fair values for 20X1 and 20X2: 20X1 20X2 Cost 100,000 100,000 Fair value 110,000 134,000 Total gain 10,000 34.000 20X1 income statement information: Sales Expenses 1.670,200 1.536,600 Assuming the investement is short-term what is the ending balance of taxes payable on the 20x1 balance sheet? Company C had the following investment. Help them determine the financial statement implications of the investment Tax rate 219 Estimated tax payment 21.000 Investment cost and ending fair values for 20X1 and 20x2: 20X1 20X2 Cost 100,000 100,000 Fair value 110,000 134,000 Total gain 10,000 34.000 20X1Income statement information: Sales Expenses 1,670.200 1.536,600 Do Assuming the investement is short-term what is the deferred taxes payable on the 20x1 balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started