Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me, Thx! 2. The NNV Company is a new venture, which is evaluating its first business project. The proposed project's expected (unle vered)

please help me, Thx!

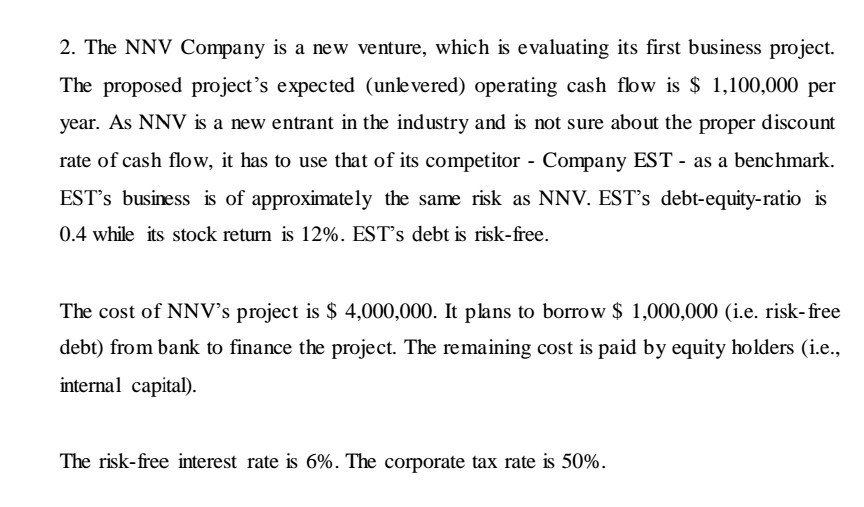

2. The NNV Company is a new venture, which is evaluating its first business project. The proposed project's expected (unle vered) operating cash flow is S 1,100,000 per year. As NNV is a new entrant in the industry and is not sure about the proper discount rate of cash flow, it has to use that of its competitor - Company EST- as a benchmark. EST's business is of approximately the same risk as NNV. EST's debt-equity-ratio is 0.4 while its stock return is 12%. EST's debt is risk-free. The cost of NNV's project is $ 4,000,000. It plans to borrow S 1,000,000 (i.e. risk-free debt) from bank to finance the project. The remaining cost is paid by equity holders (i.e., internal capital) The risk-free interest rate is 6%. The corporate tax rate is 50%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started