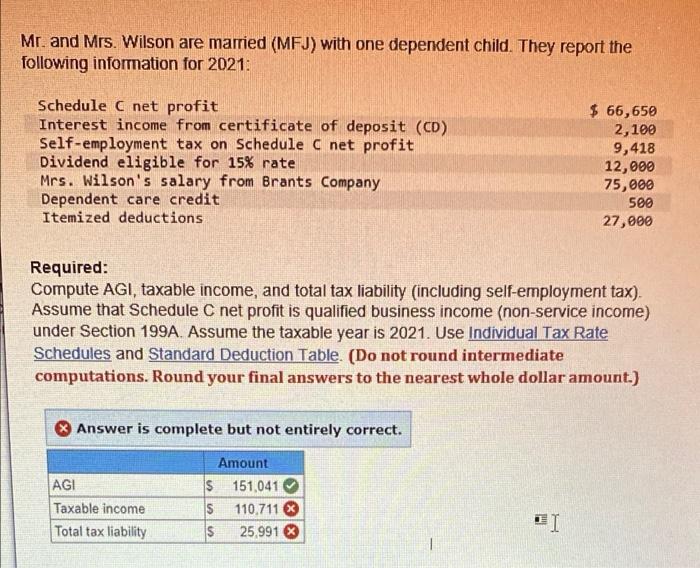

please help me to anwser correctly the ones that are incorrect. thank you.

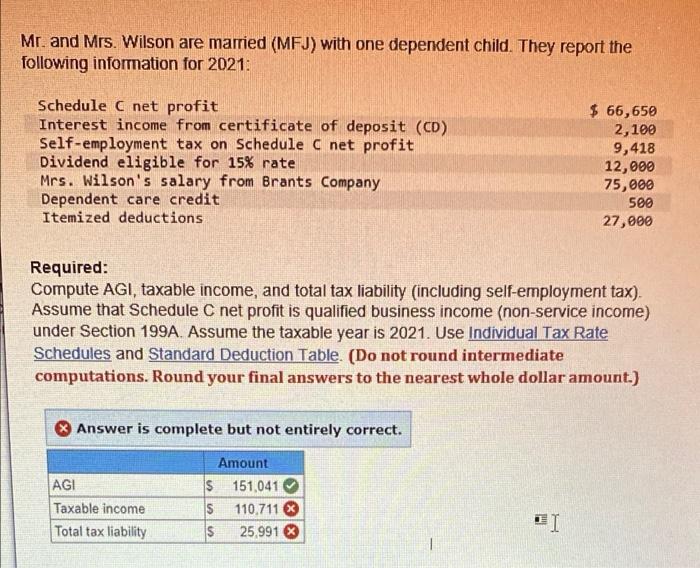

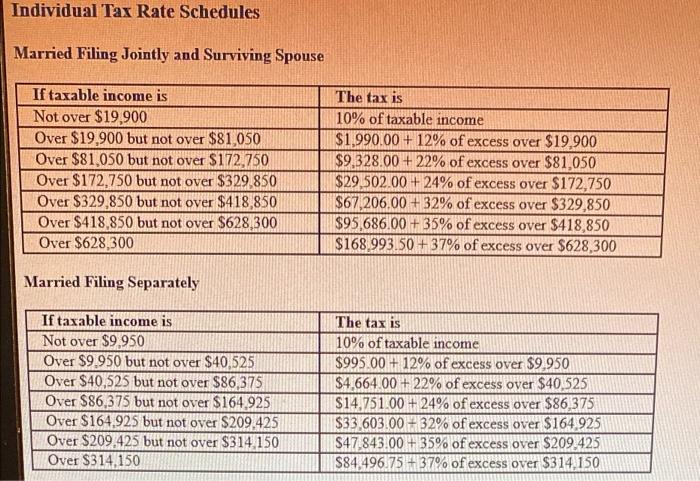

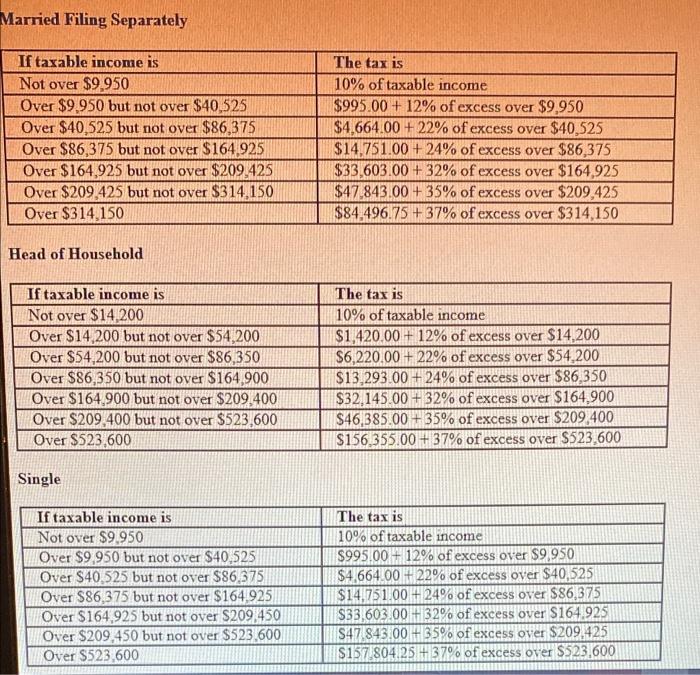

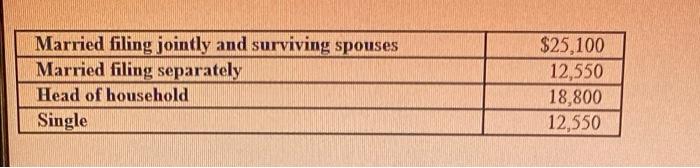

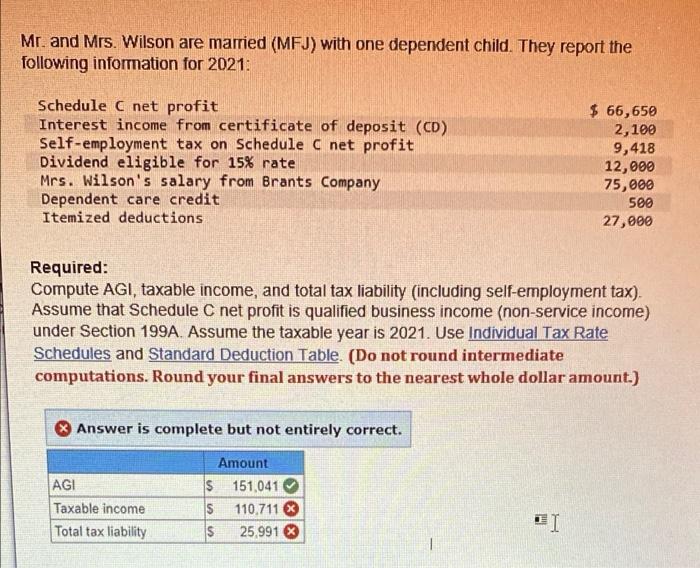

Mr. and Mrs. Wilson are married (MFJ) with one dependent child. They report the following information for 2021: Schedule ( net profit Interest income from certificate of deposit (CD) Self-employment tax on Schedule C net profit Dividend eligible for 15% rate Mrs. Wilson's salary from Brants Company Dependent care credit Itemized deductions $ 66,650 2,100 9,418 12,000 75,000 seo 27,000 Required: Compute AGI, taxable income, and total tax liability (including self-employment tax). Assume that Schedule C net profit is qualified business income (non-service income) under Section 199A. Assume the taxable year is 2021. Use Individual Tax Rate Schedules and Standard Deduction Table. (Do not round intermediate computations. Round your final answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. AGI Taxable income Total tax liability Amount $ 151,041 S 110.711 S 25.991 % Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse If taxable income is Not over $19,900 Over $19,900 but not over $81,050 Over $81,050 but not over $172.750 Over $172,750 but not over $329,850 Over $329,850 but not over $418,850 Over $418,850 but not over $628,300 Over $628,300 The tax is 10% of taxable income $1.990.00 + 12% of excess over $19.900 $9.328.00 + 22% of excess over $81,050 $29,502.00+ 24% of excess over $172,750 $67,206.00 +32% of excess over $329,850 $95,686.00 + 35% of excess over $418,850 $168.993.50 +37% of excess over $628,300 Married Filing Separately If taxable income is Not over $9.950 Over $9.950 but not over $40,525 Over $40,525 but not over $86,375 Over $86,375 but not over $164.925 Over $164.925 but not over $209.425 Over $209,425 but not over $314,150 Over $314,150 The tax is 10% of taxable income $995.00 +12% of excess over $9.950 $4,664.00 +22% of excess over $40,525 $14,751.00 +24% of excess over $86,375 $33,603.00 +32% of excess over $164.925 S47 843.00 + 35% of excess over $209.425 $84.496.75 -37% of excess over $314.150 Married Filing Separately If taxable income is Not over $9.950 Over $9.950 but not over $40.525 Over $40,525 but not over $86,375 Over $86,375 but not over $164.925 Over $164,925 but not over $209,425 Over $209,425 but not over $314,150 Over $314,150 The tax is 10% of taxable income $995.00 +12% of excess over $9.950 $4,664.00 +22% of excess over $40,525 $14,751.00 +24% of excess over $86,375 $33,603.00 +32% of excess over $164,925 $47.843.00 + 35% of excess over $209,425 $84.496.75 +37% of excess over $314,150 Head of Household If taxable income is Not over $14,200 Over $14,200 but not over $54,200 Over $54,200 but not over $86,350 Over $86,350 but not over $164,900 Over $164.900 but not over $209,400 Over $209,400 but not over $523,600 Over $523.600 The tax is 10% of taxable income $1,420.00 + 12% of excess over $14,200 $6,220.00+ 22% of excess over $54,200 $13,293.00 24% of excess over $86,350 $32.145.00 + 32% of excess over $164.900 $46,385.00+ 35% of excess over $209,400 $156,355.00 +37% of excess over S523,600 Single If taxable income is Not over $9.950 Over $9.950 but not over $40.525 Over $40,525 but not over $86,375 Over $86,375 but not over $164.925 Over $164.925 but not over S209,450 Over $209,450 but not over $523.600 Over S523,600 The tax is 10% of taxable income $995.00 + 12% of excess over $9.950 $4,664.00 +22% of excess over $40,525 $14.751.00 +24% of excess over $86,375 $33,603.00 +32% of excess over $164.925 S47.843.00 +35% of excess over $209.425 $157 804.25 +37% of excess over S523,600 0 Married filing jointly and surviving spouses Married filing separately Head of household Single $25,100 12,550 18,800 12,550