Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me to calculate question E12-4a. I have attached all the information that I found on the book. Conditional Formatting Format as Table Calibri

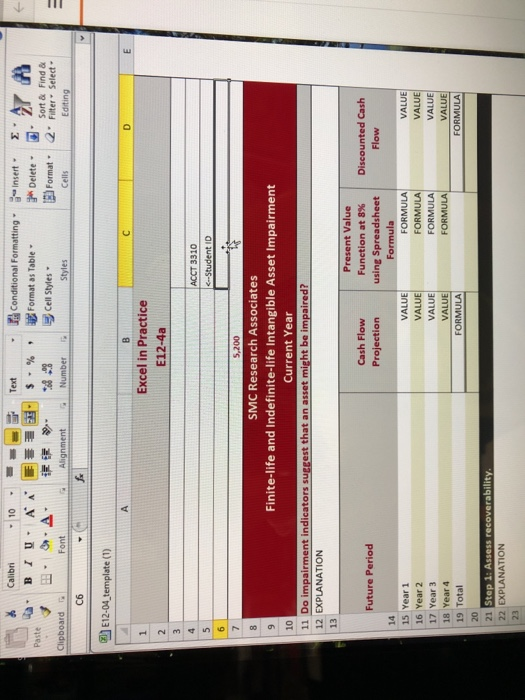

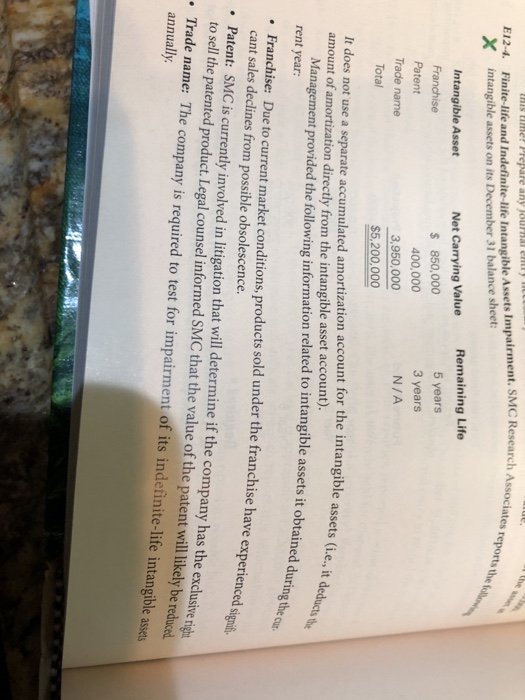

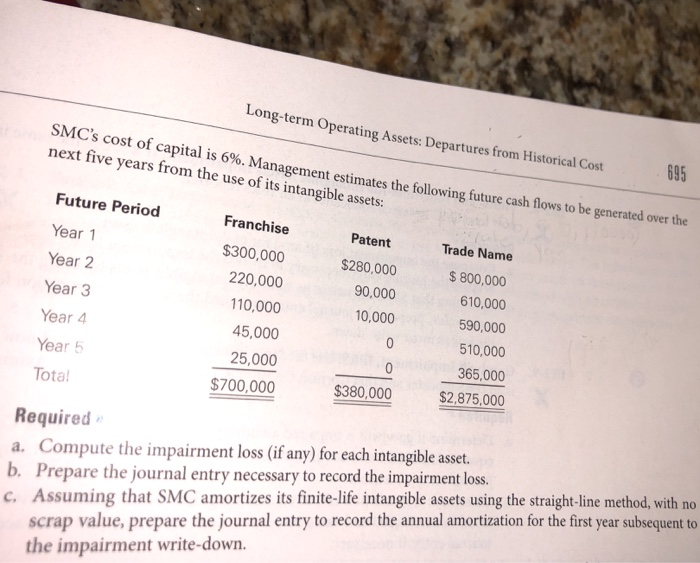

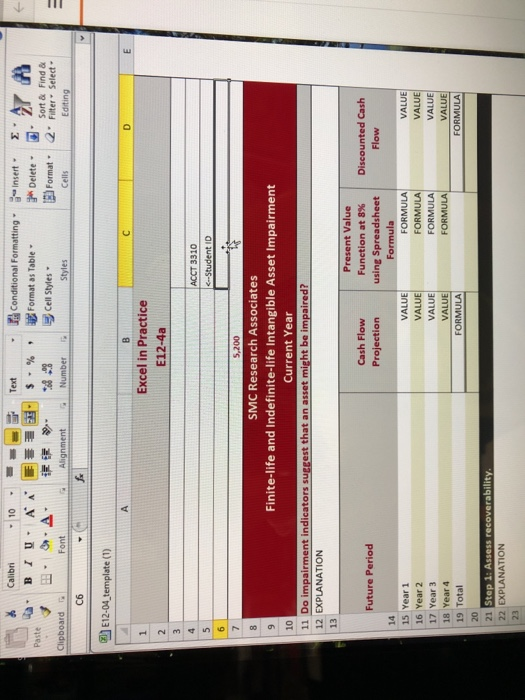

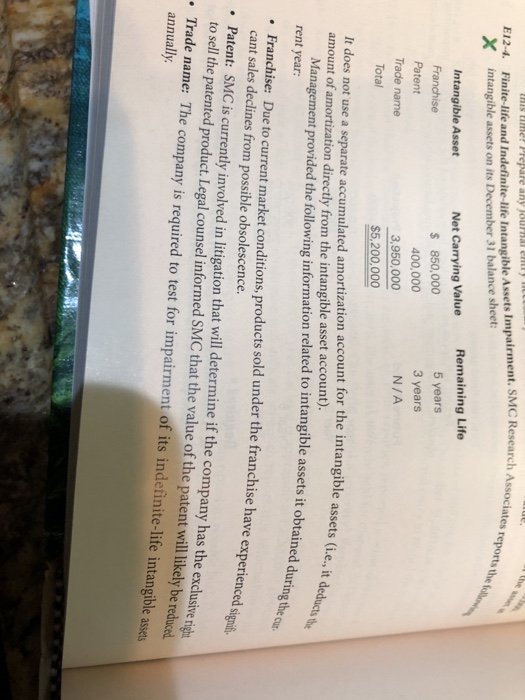

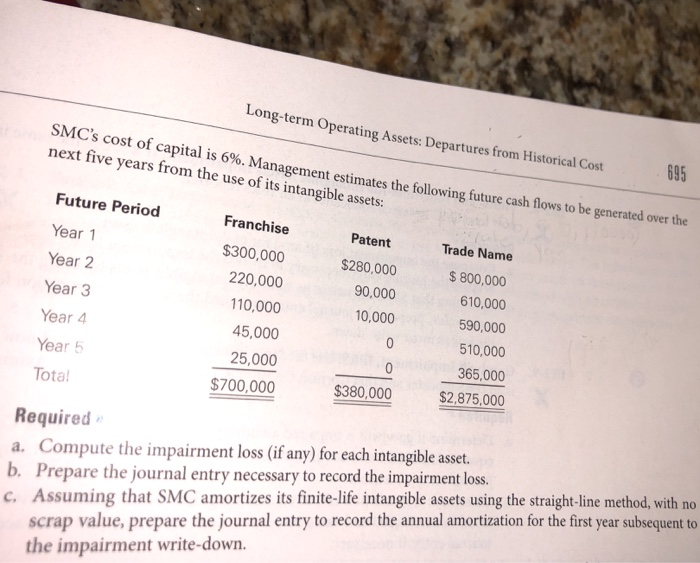

please help me to calculate question E12-4a. I have attached all the information that I found on the book. Conditional Formatting Format as Table Calibri - 10 insert Delete Format BI U AA Sort & Find & 2" Filter Select Editing Cells Styles Clipboard Font E12-04_template (1) Excel in Practice E12-4a ACCT 3310 -Student ID 5.200 SMC Research Associates Finite-life and Indefinite-life Intangible Asset Impairment Current Year 11 Do Impairment indicators suerest that an asset might be impaired? 12 EXPLANATION 13 Discounted Cash Flow Cash Flow Projection Future Period Present Value Function at 8% using Spreadsheet Formula FORMULA FORMULA FORMULA FORMULA 15 Year 1 16 Year 2 17 Year 3 18 Year 4 19 Total VALUE VALUE VALUE VALUE FORMULA VALUE VALUE VALUE VALUE FORMULA 21 Step 1: Assess recoverability. 22 EXPLANATION ssociates reports the folle 512-4. X this timer Prepare any journal em Finite-life and Indefinite-life Intangible Assets Impairment. SMC Research Associa intangible assets on its December 31 balance sheet: Intangible Asset Franchise Net Carrying Value $ 850,000 400,000 3,950,000 $5,200,000 Remaining Life 5 years 3 years N/A Patent Trade name Total gible assets (i.e., it deducts the It does not use a separate accumulated amortization account for the intangible assets amount of amortization directly from the intangible asset account). Management provided the following information related to intangible assets it obtained duri rent year: obtained during the on nchise have experienced signifi Franchise: Due to current market conditions, products sold under the franchise have experie cant sales declines from possible obsolescence. Patent: SMC is currently involved in litigation that will determine if the company has the exclusion. to sell the patented product. Legal counsel informed SMC that the value of the patent will likely be red Trade name: The company is required to test for impairment of its indefinite-life intangible assets annually. Long-term Operating Assets: Departures from Historical Cost SMC's cost of capital is 6%. Management estimates the following future cash flows to be generated over t next five years from the use of its intangible assets: 033 Franchise Future Period Year 1 Year 2 Year 3 Patent Trade Name 220,000 $300,000 $280,000 $ 800,000 90,000 610,000 110,000 10,000 Year 4 590,000 45,000 Year 5 510,000 25,000 365,000 Tota! $700,000 $380,000 $2,875,000 Required a. Compute the impairment loss (if any) for each intangible asset. b. Prepare the journal entry necessary to record the impairment loss. c. Assuming that SMC amortizes its finite-life intangible assets using the straight-line method, with no scrap value, prepare the journal entry to record the annual amortization for the first year subsequent to the impairment write-down

please help me to calculate question E12-4a. I have attached all the information that I found on the book. Conditional Formatting Format as Table Calibri - 10 insert Delete Format BI U AA Sort & Find & 2" Filter Select Editing Cells Styles Clipboard Font E12-04_template (1) Excel in Practice E12-4a ACCT 3310 -Student ID 5.200 SMC Research Associates Finite-life and Indefinite-life Intangible Asset Impairment Current Year 11 Do Impairment indicators suerest that an asset might be impaired? 12 EXPLANATION 13 Discounted Cash Flow Cash Flow Projection Future Period Present Value Function at 8% using Spreadsheet Formula FORMULA FORMULA FORMULA FORMULA 15 Year 1 16 Year 2 17 Year 3 18 Year 4 19 Total VALUE VALUE VALUE VALUE FORMULA VALUE VALUE VALUE VALUE FORMULA 21 Step 1: Assess recoverability. 22 EXPLANATION ssociates reports the folle 512-4. X this timer Prepare any journal em Finite-life and Indefinite-life Intangible Assets Impairment. SMC Research Associa intangible assets on its December 31 balance sheet: Intangible Asset Franchise Net Carrying Value $ 850,000 400,000 3,950,000 $5,200,000 Remaining Life 5 years 3 years N/A Patent Trade name Total gible assets (i.e., it deducts the It does not use a separate accumulated amortization account for the intangible assets amount of amortization directly from the intangible asset account). Management provided the following information related to intangible assets it obtained duri rent year: obtained during the on nchise have experienced signifi Franchise: Due to current market conditions, products sold under the franchise have experie cant sales declines from possible obsolescence. Patent: SMC is currently involved in litigation that will determine if the company has the exclusion. to sell the patented product. Legal counsel informed SMC that the value of the patent will likely be red Trade name: The company is required to test for impairment of its indefinite-life intangible assets annually. Long-term Operating Assets: Departures from Historical Cost SMC's cost of capital is 6%. Management estimates the following future cash flows to be generated over t next five years from the use of its intangible assets: 033 Franchise Future Period Year 1 Year 2 Year 3 Patent Trade Name 220,000 $300,000 $280,000 $ 800,000 90,000 610,000 110,000 10,000 Year 4 590,000 45,000 Year 5 510,000 25,000 365,000 Tota! $700,000 $380,000 $2,875,000 Required a. Compute the impairment loss (if any) for each intangible asset. b. Prepare the journal entry necessary to record the impairment loss. c. Assuming that SMC amortizes its finite-life intangible assets using the straight-line method, with no scrap value, prepare the journal entry to record the annual amortization for the first year subsequent to the impairment write-down

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started