Please help me to complete this excel with the information given above.

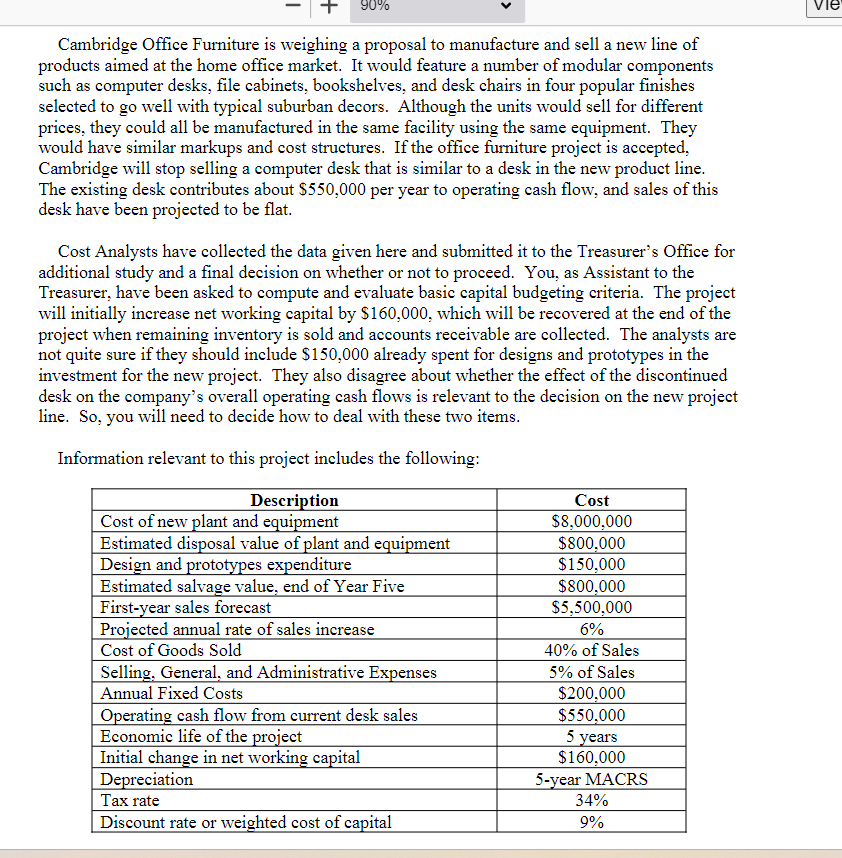

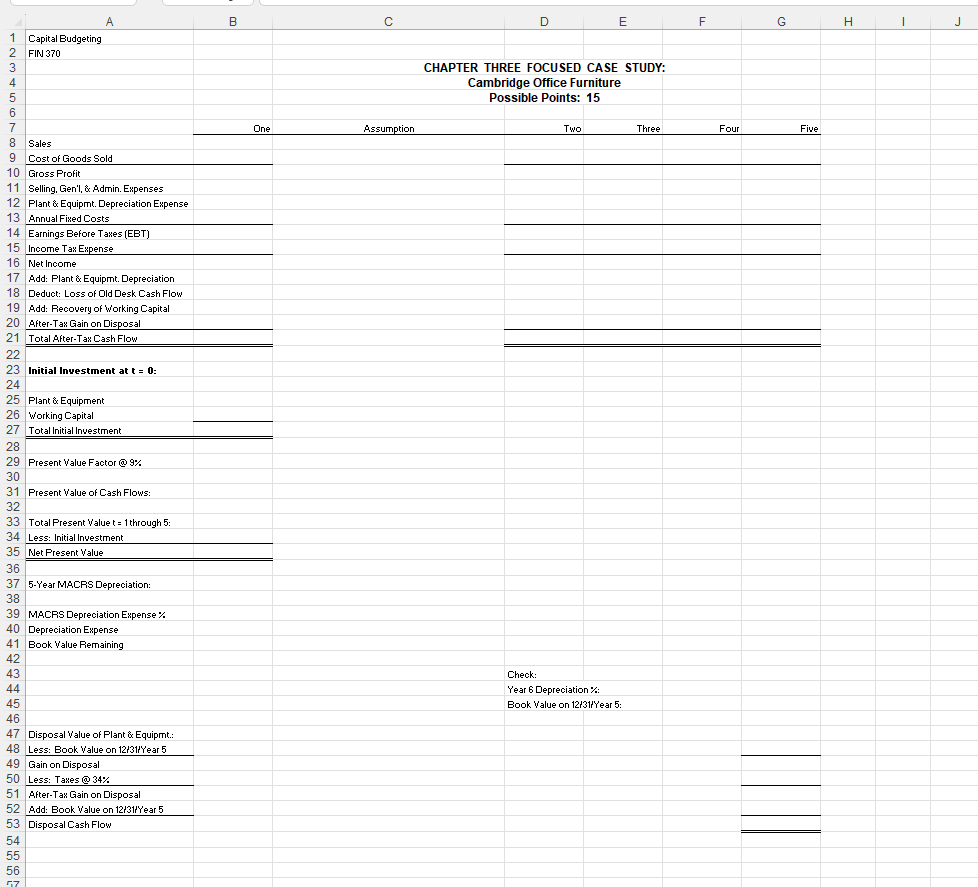

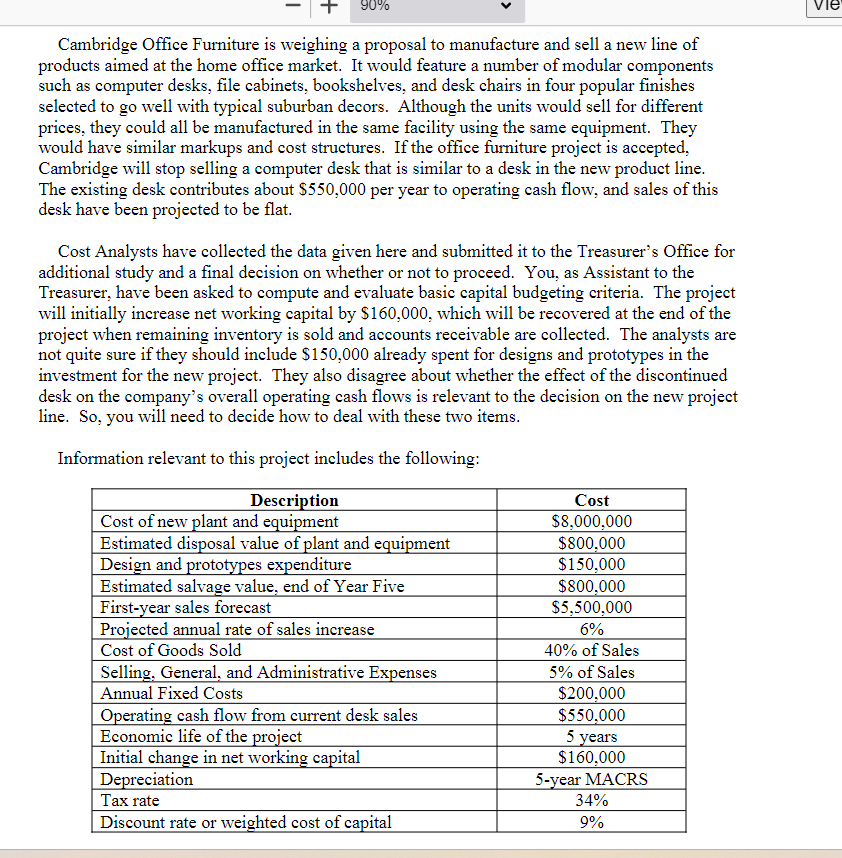

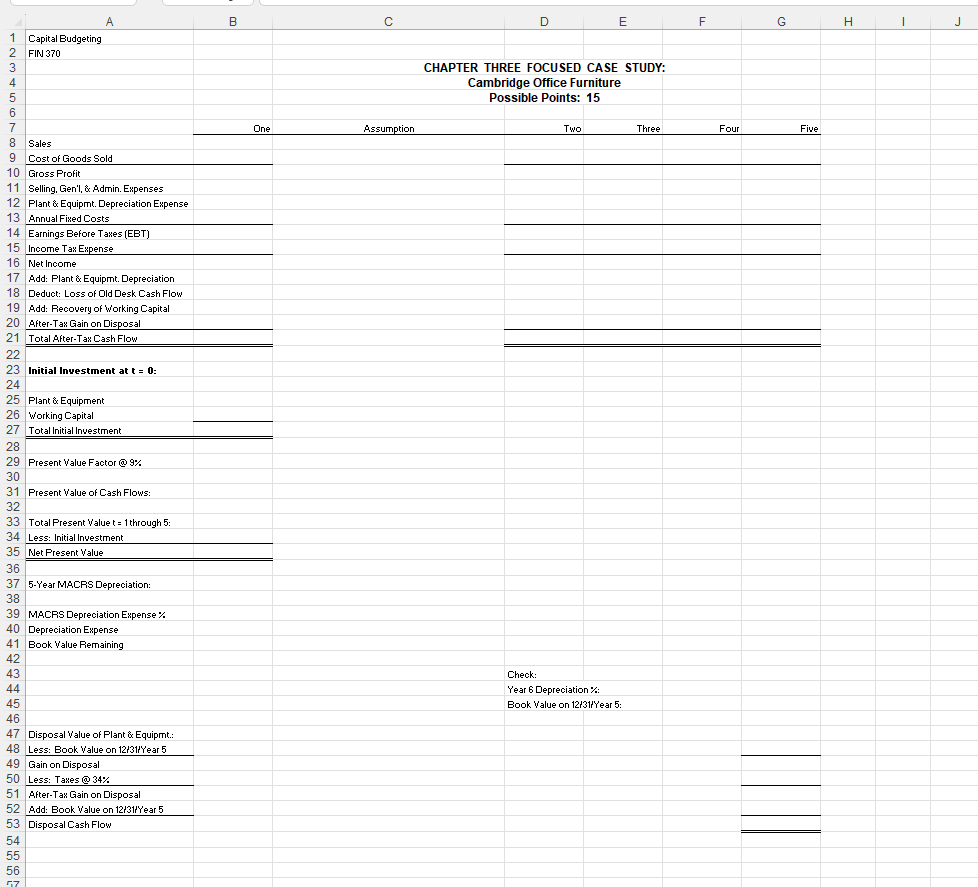

Cambridge Office Furniture is weighing a proposal to manufacture and sell a new line of products aimed at the home office market. It would feature a number of modular components such as computer desks, file cabinets, bookshelves, and desk chairs in four popular finishes selected to go well with typical suburban decors. Although the units would sell for different prices, they could all be manufactured in the same facility using the same equipment. They would have similar markups and cost structures. If the office furniture project is accepted, Cambridge will stop selling a computer desk that is similar to a desk in the new product line. The existing desk contributes about $550,000 per year to operating cash flow, and sales of this desk have been projected to be flat. Cost Analysts have collected the data given here and submitted it to the Treasurer's Office for additional study and a final decision on whether or not to proceed. You, as Assistant to the Treasurer, have been asked to compute and evaluate basic capital budgeting criteria. The project will initially increase net working capital by $160,000, which will be recovered at the end of the project when remaining inventory is sold and accounts receivable are collected. The analysts are not quite sure if they should include $150,000 already spent for designs and prototypes in the investment for the new project. They also disagree about whether the effect of the discontinued desk on the company's overall operating cash flows is relevant to the decision on the new project line. So, you will need to decide how to deal with these two items. Cambridge Office Furniture is weighing a proposal to manufacture and sell a new line of products aimed at the home office market. It would feature a number of modular components such as computer desks, file cabinets, bookshelves, and desk chairs in four popular finishes selected to go well with typical suburban decors. Although the units would sell for different prices, they could all be manufactured in the same facility using the same equipment. They would have similar markups and cost structures. If the office furniture project is accepted, Cambridge will stop selling a computer desk that is similar to a desk in the new product line. The existing desk contributes about $550,000 per year to operating cash flow, and sales of this desk have been projected to be flat. Cost Analysts have collected the data given here and submitted it to the Treasurer's Office for additional study and a final decision on whether or not to proceed. You, as Assistant to the Treasurer, have been asked to compute and evaluate basic capital budgeting criteria. The project will initially increase net working capital by $160,000, which will be recovered at the end of the project when remaining inventory is sold and accounts receivable are collected. The analysts are not quite sure if they should include $150,000 already spent for designs and prototypes in the investment for the new project. They also disagree about whether the effect of the discontinued desk on the company's overall operating cash flows is relevant to the decision on the new project line. So, you will need to decide how to deal with these two items