Please help me to do the quickbooks question. Thanks so much!

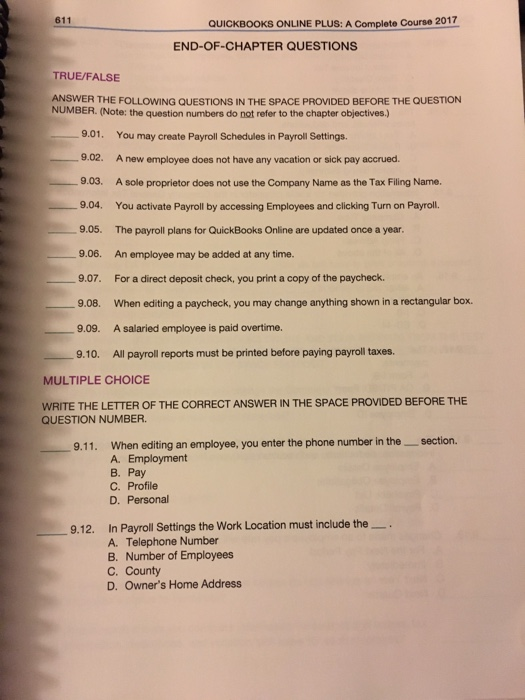

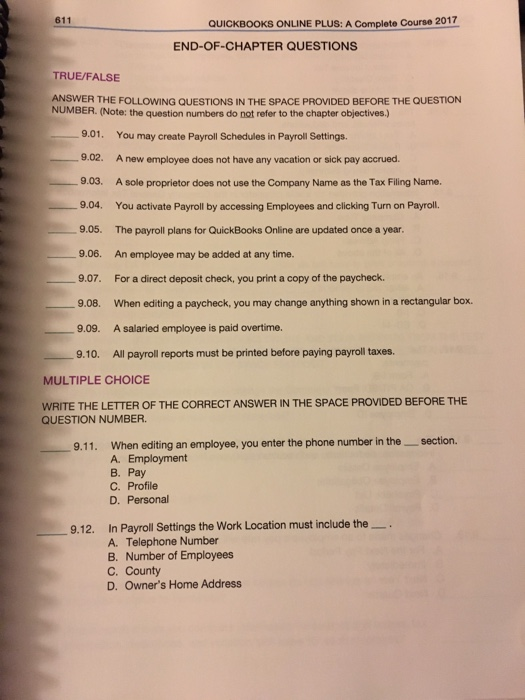

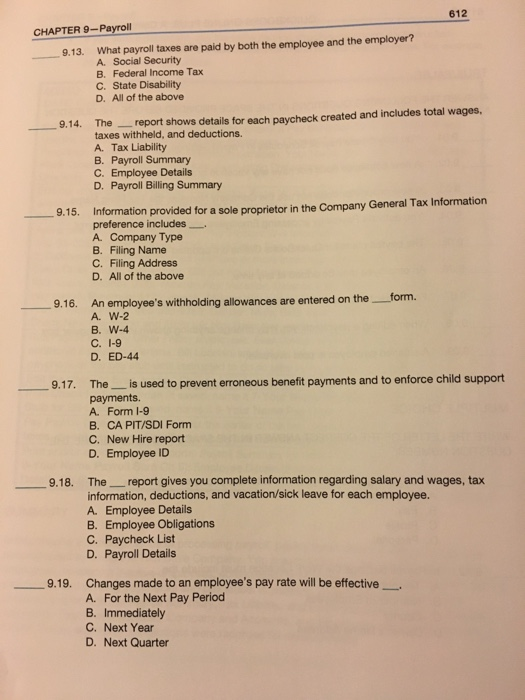

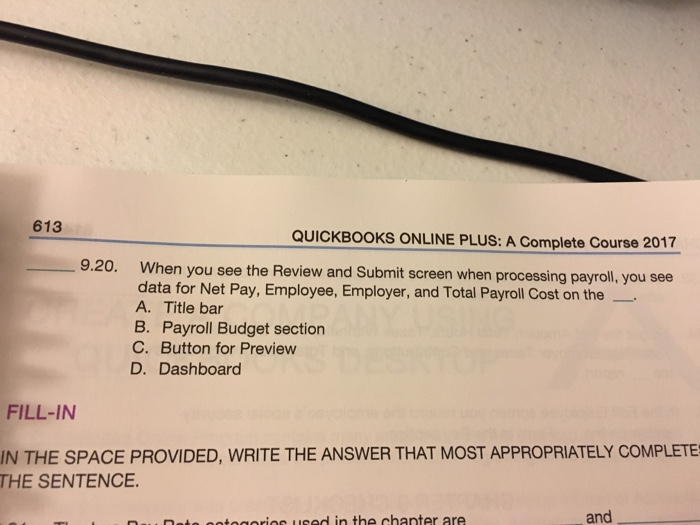

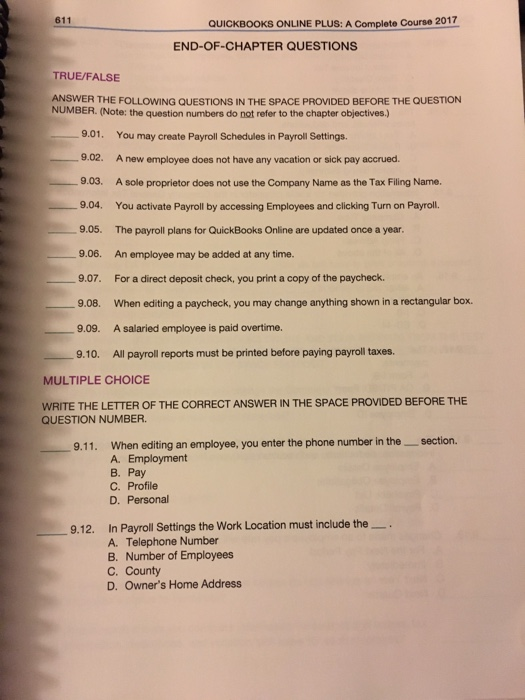

611 QUICKBOOKS ONLINE PLUS: A Complete Course 2017 END-OF-CHAPTER QUESTIONS TRUE/FALSE ANSWER THE FOLLOWING QUESTIONS IN THE SPACE PROVIDED BEFORE THE QUESTION NUMBER. (Note: the question numbers do not refer to the chapter objectives.) 9.01. You may create Payroll Schedules in Payroll Settings. 9.02. A new employee does not have any vacation or sick pay accrued. 9.03. A sole proprietor does not use the Company Name as the Tax Filling Name 9.04. You activate Payroll by accessing Employees and clicking Turn on Payroll. 9.05. The payroll plans for QuickBooks Online are updated once a year 9.06. An employee may be added at any time. 9.07. For a direct deposit check, you print a copy of the paycheck 9.08. When editing a paycheck, you may change anything shown in a rectangular box. 9.09. A salaried employee is paid overtime. 9.10. All payroll reports must be printed before paying payroll taxes. MULTIPLE CHOICE WRITE THE LETTER OF THE CORRECT ANSWER IN THE SPACE PROVIDED BEFORE THE QUESTION NUMBER 9.11. When editing an employee, you enter the phone number in the section. A. Employment B. Pay C. Profile D. Personal In Payroll Settings the Work Location must include the A. Telephone Number B. Number of Employees C. County D. Owner's Home Address 9.12. 612 CHAPTER 9-Payroll What payroll taxes are paid by both the employee and the employer? A. Social Security B. Federal Income Tax C. State Disability D. All of the above 9.13. 9.14. Thereport shows details for each paycheck created and includes total wages, taxes withheld, and deductions. A. Tax Liability B. Payroll Summary C. Employee Details D. Payroll Billing Summary 9. Information provided for a sole proprietor in the Company General Tax Information 15. preference includes- A Company Type B. Filing Name C. Filing Address D. All of the above 9.16. An employee's withholding allowances are entered on the form. A. W-2 B. W-4 C. 1-9 D. ED-44 9.17. The_is used to prevent erroneous benefit payments and to enforce child support payments. A. Form I-9 B. CA PIT/SDI Form C. New Hire report D. Employee ID 9.18. The report gives you complete information regarding salary and wages, tax information, deductions, and vacation/sick leave for each employee. A. Employee Details B. Employee Obligations C. Paycheck List D. Payroll Details Changes made to an employee's pay rte will be effective A. For the Next Pay Period B. Immediately C. Next Year D. Next Quarter 9.19. 613 QUICKBOOKS ONLINE PLUS: A Complete Course 2017 9.20. When you see the Review and Submit screen when processing payroll, you see data for Net Pay, Employee, Employer, and Total Payroll Cost on the A. Title bar B. Payroll Budget section C. Button for Preview D. Dashboard FILL-IN IN THE SPACE PROVIDED, WRITE THE ANSWER THAT MOST APPROPRIATELY COMPLETE THE SENTENCE nata ontogorios used in the chanter are and