Answered step by step

Verified Expert Solution

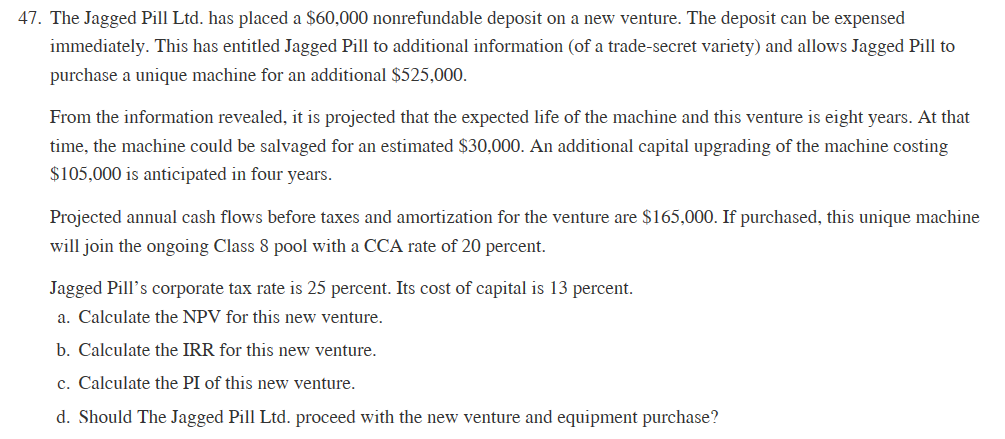

Question

1 Approved Answer

Please help me to explain where is the 1 9 % in the answer for question bThe Jagged Pill Ltd . has placed a $

Please help me to explain where is the in the answer for question bThe Jagged Pill Ltd has placed a $ nonrefundable deposit on a new venture. The deposit can be expensed

immediately. This has entitled Jagged Pill to additional information of a tradesecret variety and allows Jagged Pill to

purchase a unique machine for an additional $

From the information revealed, it is projected that the expected life of the machine and this venture is eight years. At that

time, the machine could be salvaged for an estimated $ An additional capital upgrading of the machine costing

$ is anticipated in four years.

Projected annual cash flows before taxes and amortization for the venture are $ If purchased, this unique machine

will join the ongoing Class pool with a CCA rate of percent.

Jagged Pill's corporate tax rate is percent. Its cost of capital is percent.

a Calculate the NPV for this new venture.

b Calculate the IRR for this new venture.

c Calculate the PI of this new venture.

d Should The Jagged Pill Ltd proceed with the new venture and equipment purchase?a n T rIY d

Expected Aftertax Present Value

Year Event Cash Flow Cash Flow @

Purchase machine $ $

Cash flow

PV

Capital upgrade

PV

Salvage

PV

CCA pool PV of tax savings

NPV $

Note: The $ deposit is a sunk cost and is irrelevant for this decision.

b Expected Aftertax Present Value

Year Event Cash Flow Cash Flow @

Purchase machine $ $

Cash flow

Capital upgrade

Salvage

CCA pool PV of tax savings

NPV $

$ PV @ $ PV @

PV @ Cost

$ $

This is an approximation.

This is calculated @

Jagged Pill should purchase the new machine. Value will increase by $the NPV the IRR exceeds the cost of capital and the PI exceeds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started