Please help me to fill out this.

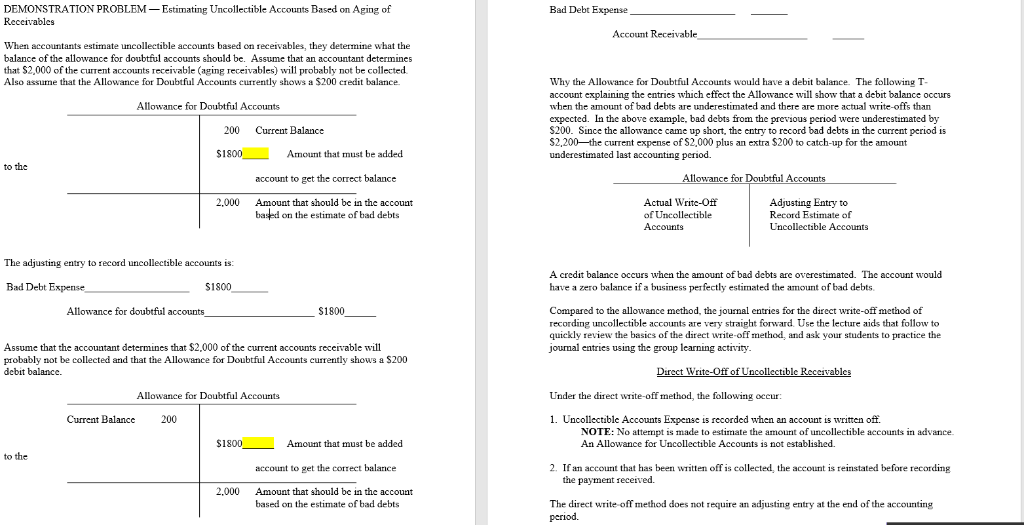

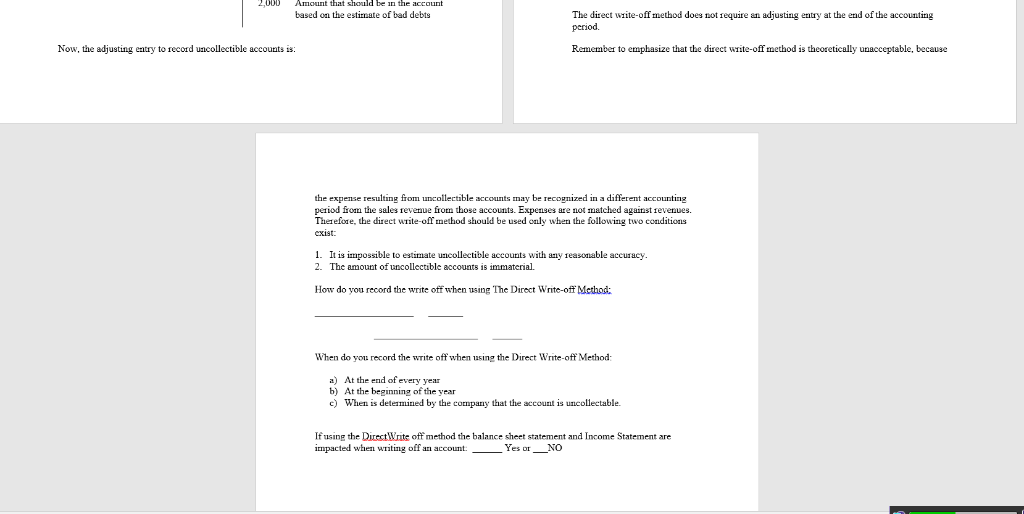

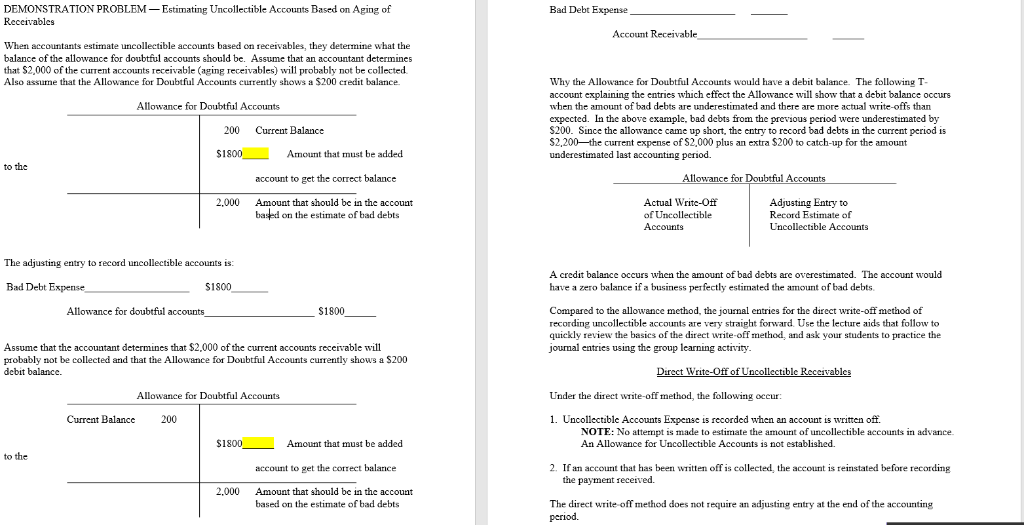

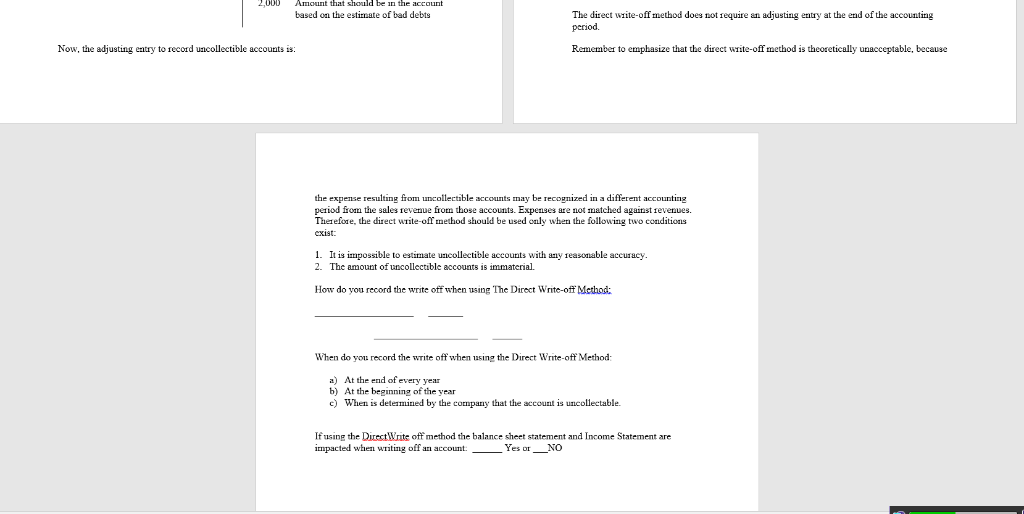

DEMONSTRATION PROBLEM-Estimating Uncoectible Accounts Based on Aging of Receivables Bad Debt Expense Account Receivable When accountants estimate uncollectible accounts based on receivables, they determine what the balance of the allowance for doubtful accounts should be. Assume that an accountant determines that $2,000 of the current accounts receivable (aging receivables) will probably not be collected Also assume that the Allowance for Doubtful Accounts currently shows a $200 credit balance Why the Allowance for Doubtful Accounts would have a debit balance. The following T account explaining the entries which effect the Allowac ll show that a debit balance occurs when the amount of bad debts are underestimated and there are more actual write-offs than expected. In the above example, bad debts from the previous period were underestimated by S200. Since the allowance came up short, the entry to record bad debts in the current period is S2,200-the current expense of S2,000 plus an extra $200 to catch-up for the amount underestimated last accounting period. Allowance for Doubtful Accounts 200 Current Balance 1800Amount that must be added to the account to get the correct balance e for Doubtful Accounts 2,000 Amount that should be in the accouat based on the estimate of bad debts Actual Write-Of Adusting Entry to Record Estimate of Uncollectible Accounts Accounts The adjusting entry to record uncollectible accounts is: A credit balance occurs when the amount of bad debts are overestimated. The account would have a zero balance if a business perfectly estimated the amount of bad debts. Bad Debt Expense $1800 S1800- Allowance for doubtful accounts Compared to the allowance method, the jounal entries for the direct write-offmethod of recording uncollectble accounts are very straight forward. Use the lecture aids that follow to quickly review the basies of the direct write-off method, and ask your students to practice the journal entries using the group learning activity Assume that the accountant determines that $2,000 of the current accounts reable will probably not be collected and that the Allowance for Doubtful Accounts currently shows a S200 debit balance. tible Allowance for Doubtful Accounts Under the direet write-off method, the following oceur: Current Balance200 1. Uncollectible Accounts Expense is recorded when an account is written of. NOTE: No attempt is made to estimate the amount of uncollectible accounts in advance An Allowance for Uncollectible Accounts is not established. $1800 Amount that must be added to the account to get the correct balance 2. If an account that has been written off is collected, the account is reinstated before recording the payment received. 2.000 Amount that should be in the account based on the estimate of bad debts The direct write offmethod does not require an adjusting entry at the end of the accounting period. 2,000 Amount that should be in the account based on the estinate of bad debts The direct write-offmethod does not require an adjusting entry at the end of the accounting period. Now, the adjusting entry to record uncollectible accounts is: Remember to emphasize that the direct write-off method is theoretically unacceptable, because the expense resulting from uncollectible period fron the sales revenue from those accounts. Expenses are not matched against revenues. Therefore, the direet wte-offmethod should be used oly when the following two conditions cxist: ccounts may be recognized in a different 1. It is impossible to estimate 2. The amount ofuncollectible accounts is immaterial. e accounts with any reasonable accuracy How do you record the write off when using The Direct Write-off Method: When do you record the write off when using the Direct Write-off Method ) At the end of every year b) At the beginning of the year c) When is determined by the company that the account is uncollectable. If using the DirectWrits off method the balance sheet statement and Income Statement are impacted when writing off an account Yes or NO