Please help me to highlight the answers. Thanks.

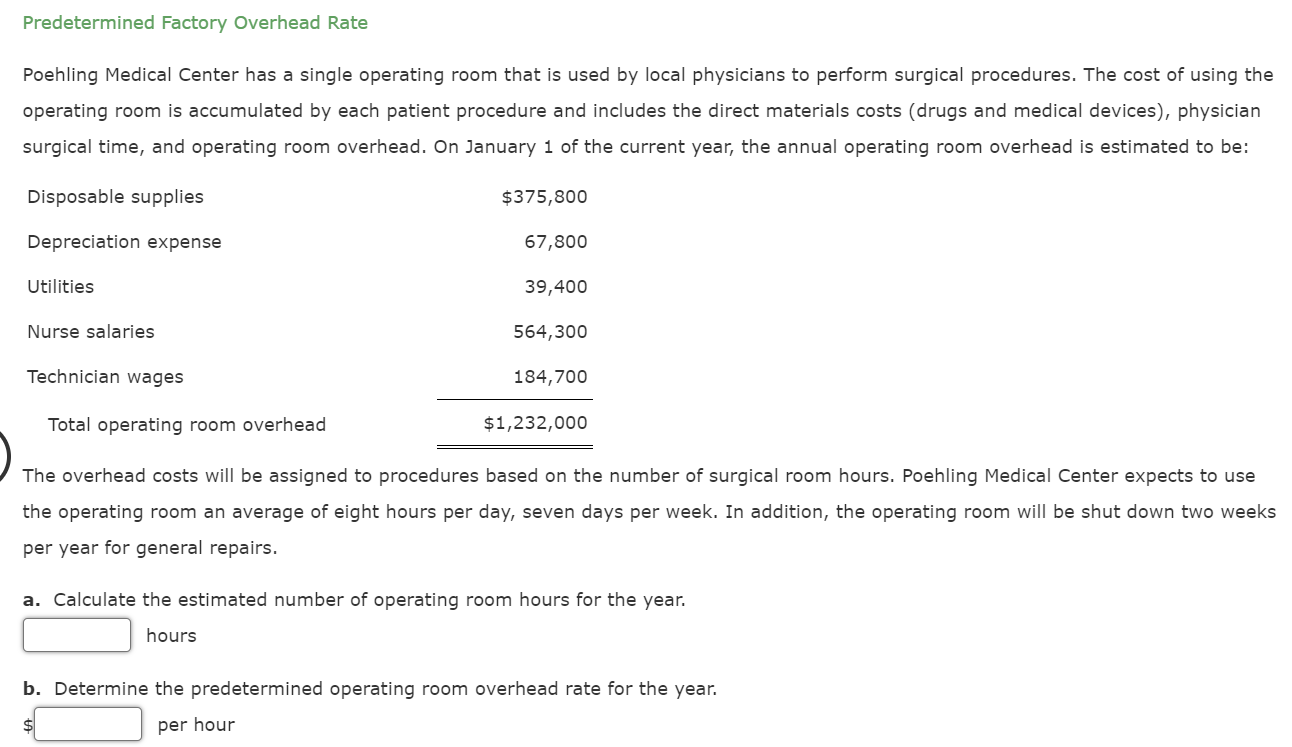

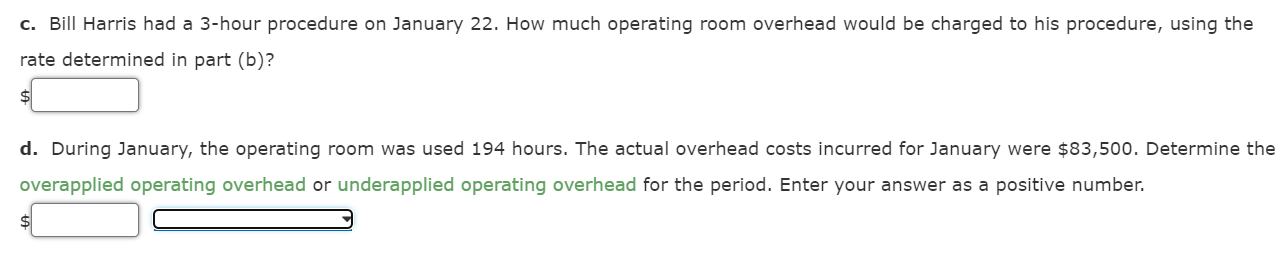

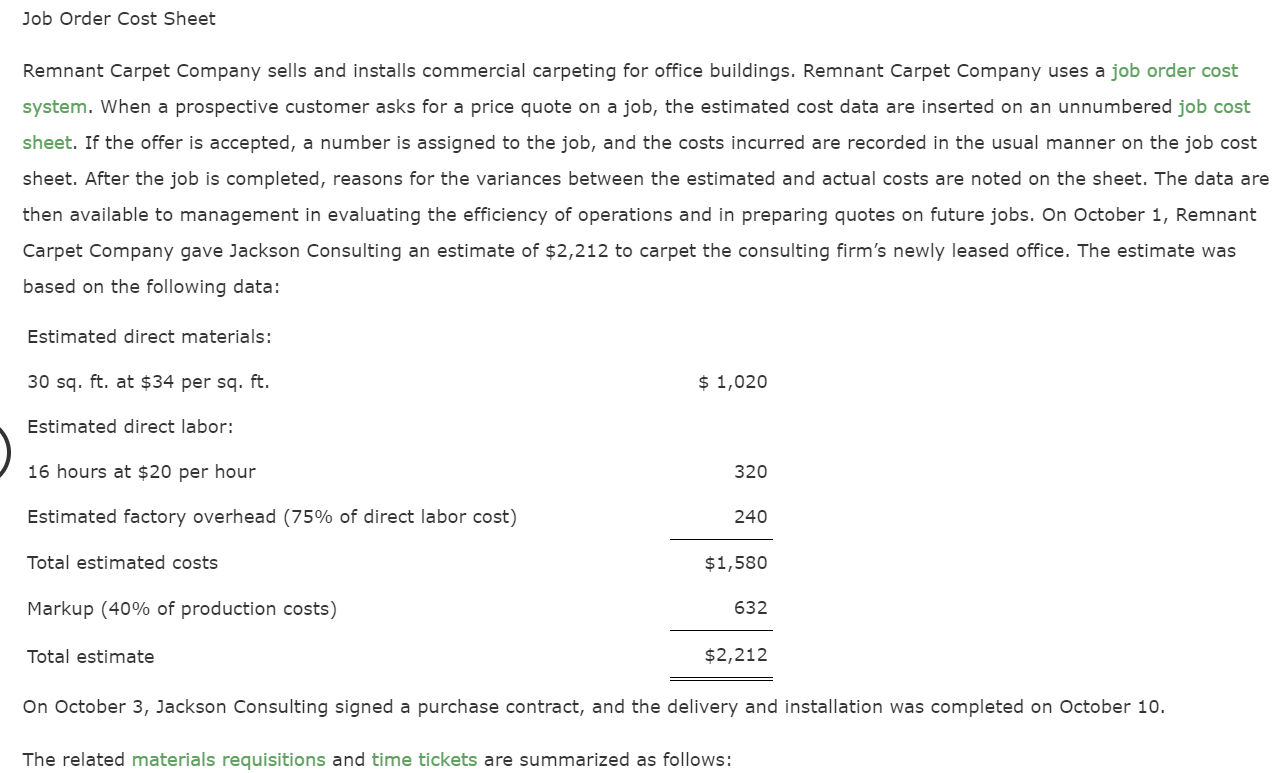

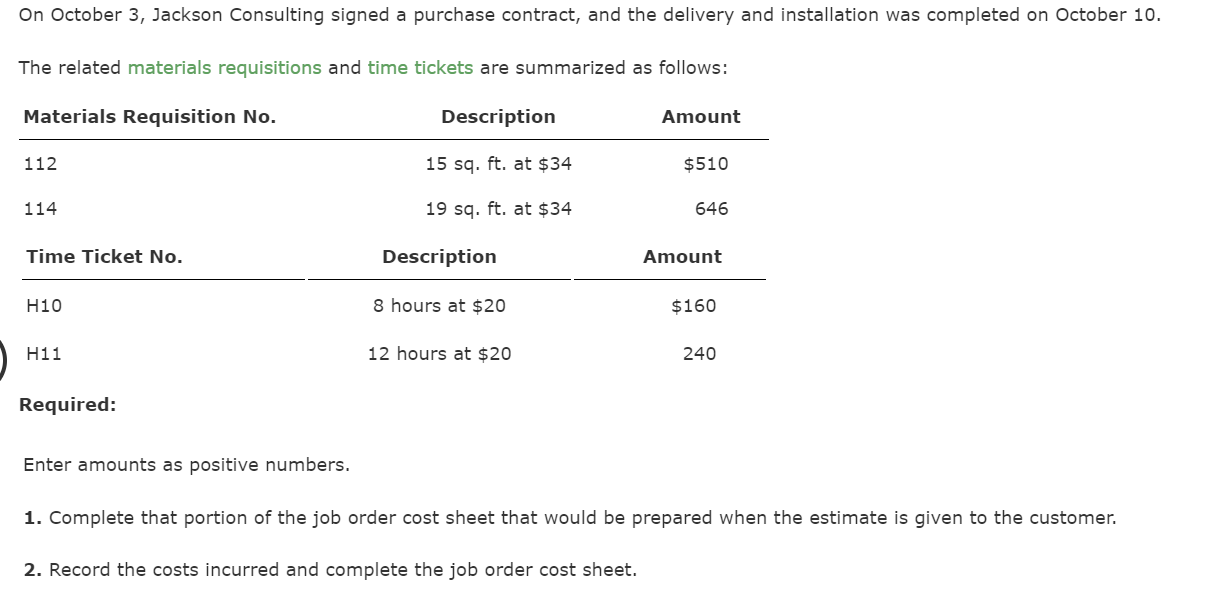

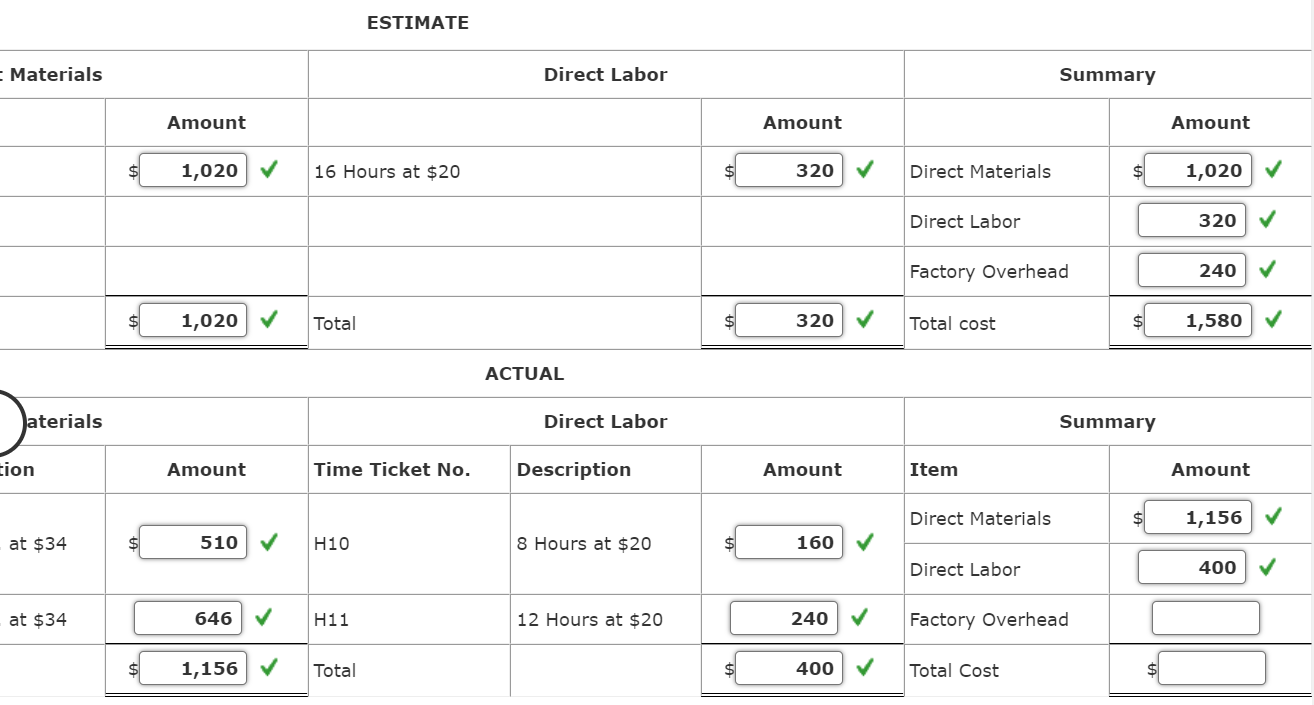

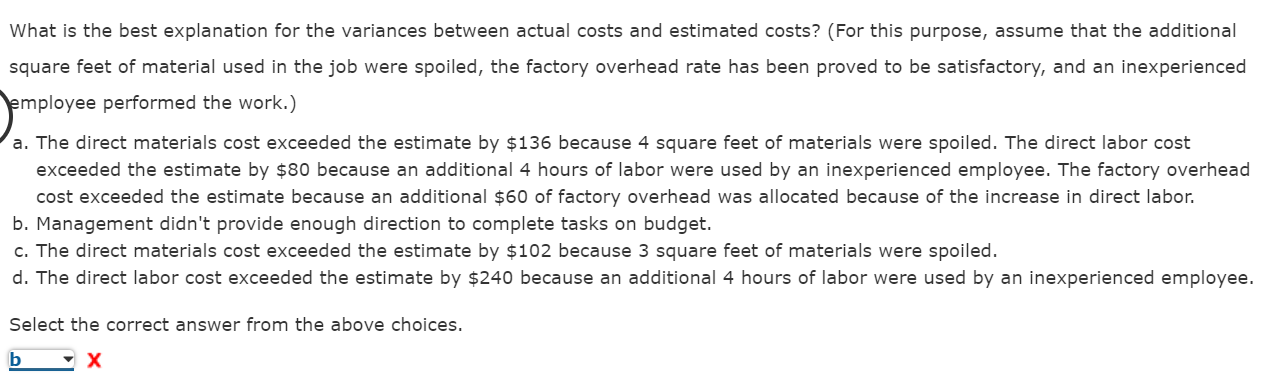

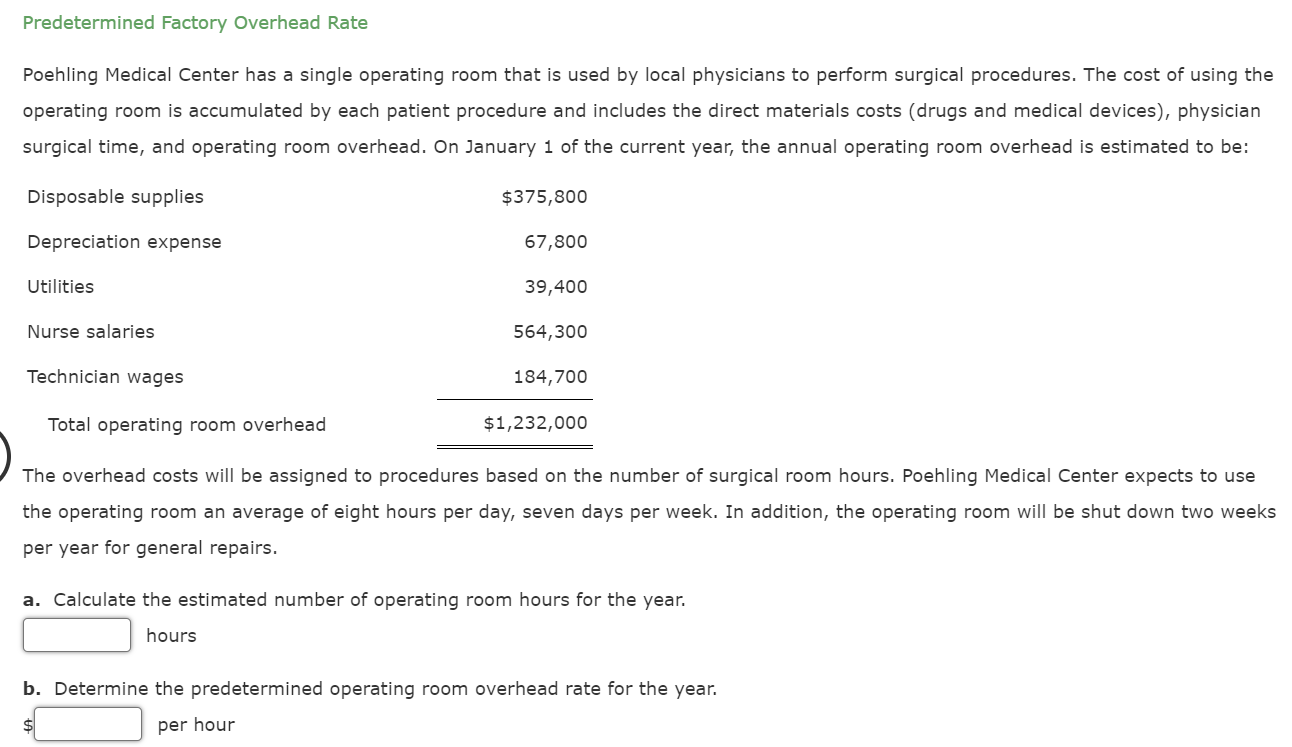

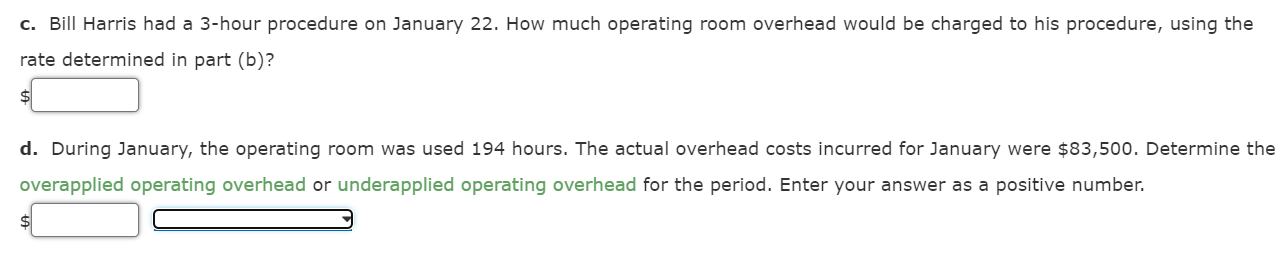

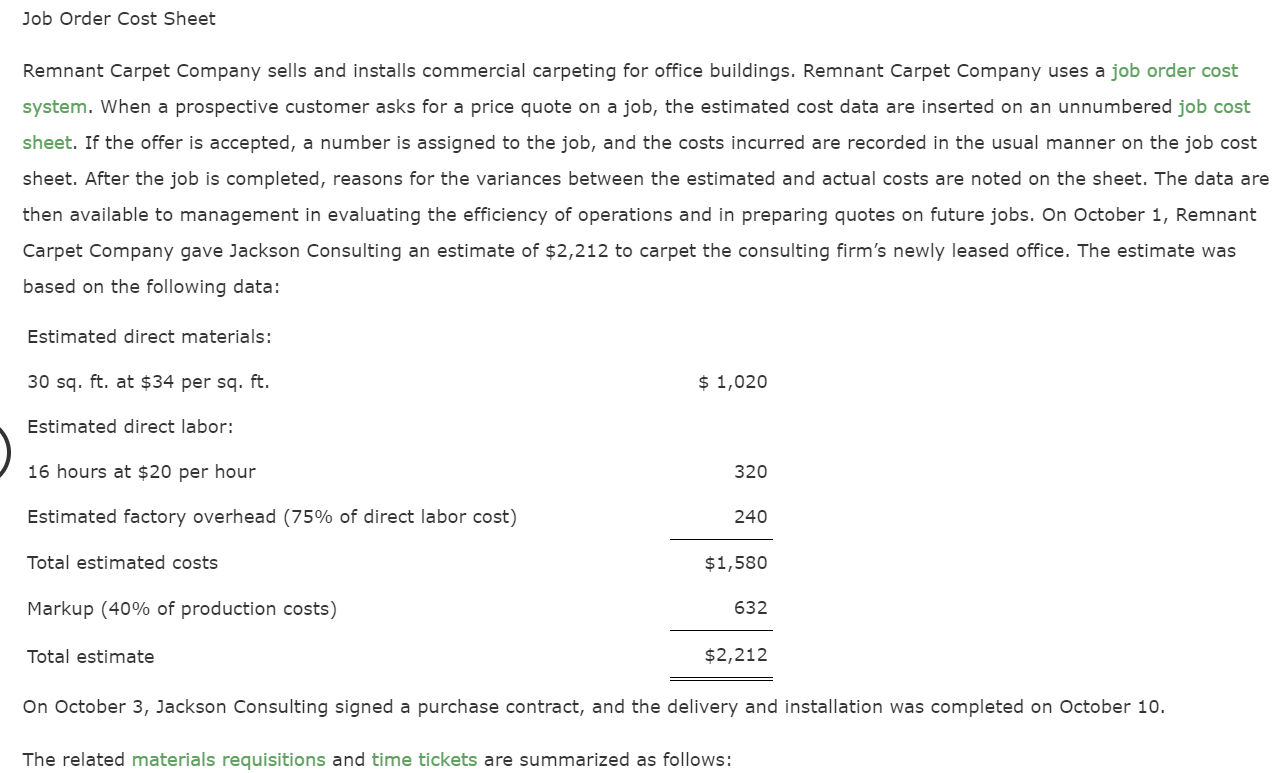

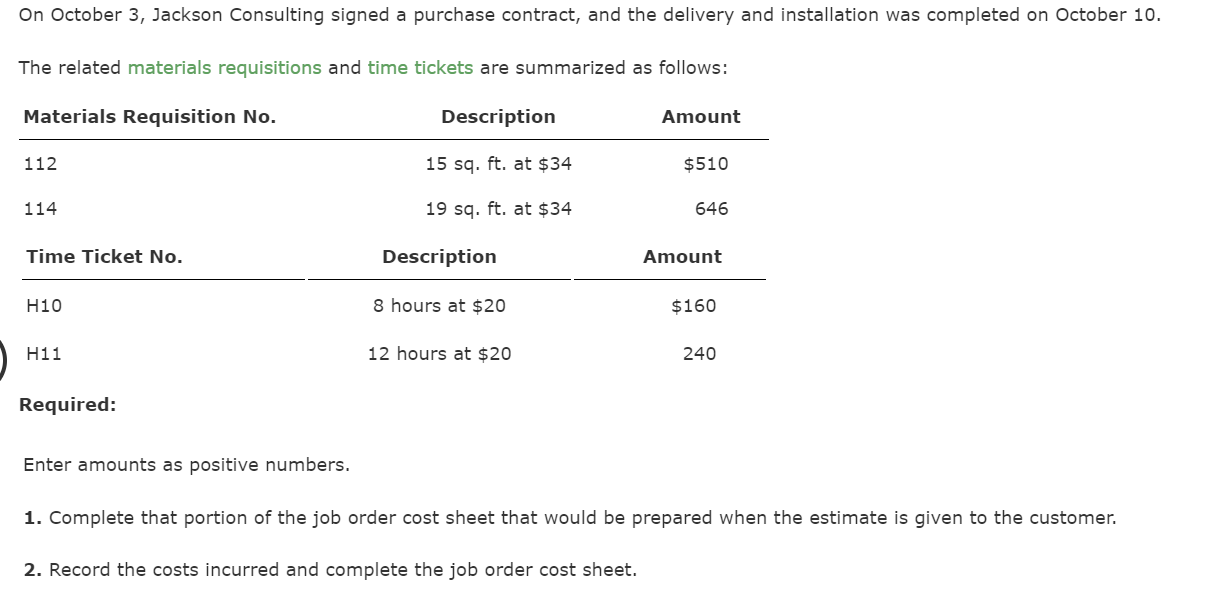

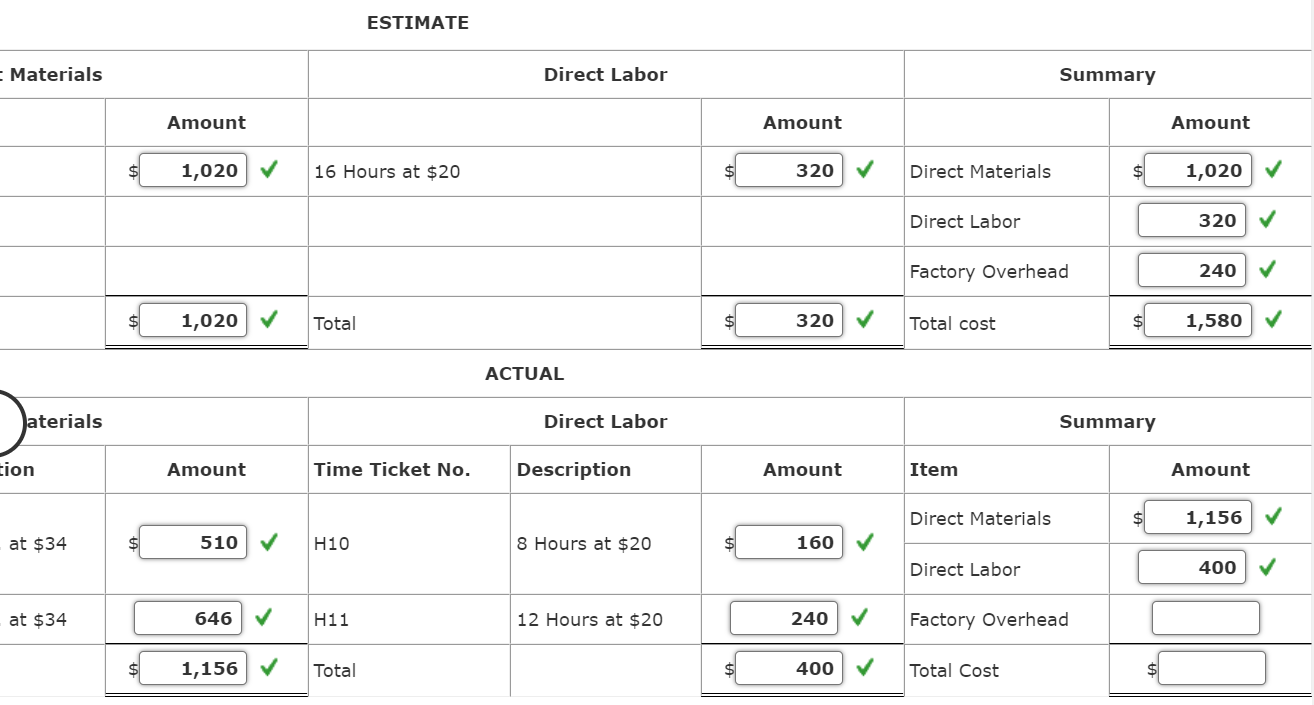

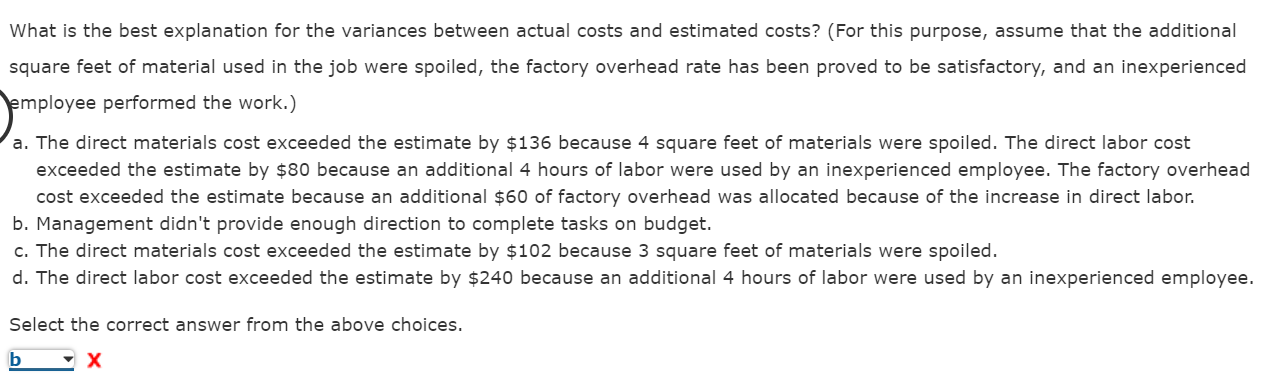

Predetermined Factory Overhead Rate Poehling Medical Center has a single operating room that is used by local physicians to perform surgical procedures. The cost of using the operating room is accumulated by each patient procedure and includes the direct materials costs (drugs and medical devices), physician surgical time, and operating room overhead. On January 1 of the current year, the annual operating room overhead is estimated to be: Disposable supplies $375,800 Depreciation expense 67,800 Utilities 39,400 Nurse salaries 564,300 Technician wages 184,700 Total operating room overhead $1,232,000 The overhead costs will be assigned to procedures based on the number of surgical room hours. Poehling Medical Center expects to use the operating room an average of eight hours per day, seven days per week. In addition, the operating room will be shut down two weeks per year for general repairs. a. Calculate the estimated number of operating room hours for the year. hours b. Determine the predetermined operating room overhead rate for the year. $ per hour c. Bill Harris had a 3-hour procedure on January 22. How much operating room overhead would be charged to his procedure, using the rate determined in part (b)? d. During January, the operating room was used 194 hours. The actual overhead costs incurred for January were $83,500. Determine the overapplied operating overhead or underapplied operating overhead for the period. Enter your answer as a positive number. $ Job Order Cost Sheet Remnant Carpet Company sells and installs commercial carpeting for office buildings. Remnant Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On October 1, Remnant Carpet Company gave Jackson Consulting an estimate of $2,212 to carpet the consulting firm's newly leased office. The estimate was based on the following data: Estimated direct materials: 30 sq. ft. at $34 per sq. ft. $ 1,020 Estimated direct labor: 16 hours at $20 per hour 320 Estimated factory overhead (75% of direct labor cost) 240 Total estimated costs $1,580 Markup (40% of production costs) 632 Total estimate $2,212 On October 3, Jackson Consulting signed a purchase contract, and the delivery and installation was completed on October 10. The related materials requisitions and time tickets are summarized as follows: On October 3, Jackson Consulting signed a purchase contract, and the delivery and installation was completed on October 10. The related materials requisitions and time tickets are summarized as follows: Materials Requisition No. Description Amount 112 15 sq. ft. at $34 $510 114 19 sq. ft. at $34 646 Time Ticket No. Description Amount H10 8 hours at $20 $160 H11 12 hours at $20 240 Required: Enter amounts as positive numbers. 1. Complete that portion of the job order cost sheet that would be prepared when the estimate is given to the customer. 2. Record the costs incurred and complete the job order cost sheet. ESTIMATE - Materials Direct Labor Summary Amount Amount Amount 1,020 16 Hours at $20 $ 320 Direct Materials $ 1,020 Direct Labor 320 Factory Overhead 240 1,020 Total 320 Total cost 1,580 ACTUAL Jaterials Direct Labor Summary Eion Amount Time Ticket No. Description Amount Item Amount Direct Materials $ 1,156 at $34 510 H10 8 Hours at $20 $ 160 Direct Labor 400 at $34 646 H11 12 Hours at $20 240 Factory Overhead si 1,156 Total 400 Total Cost What is the best explanation for the variances between actual costs and estimated costs? (For this purpose, assume that the additional square feet of material used in the job were spoiled, the factory overhead rate has been proved to be satisfactory, and an inexperienced employee performed the work.) a. The direct materials cost exceeded the estimate by $136 because 4 square feet of materials were spoiled. The direct labor cost exceeded the estimate by $80 because an additional 4 hours of labor were used by an inexperienced employee. The factory overhead cost exceeded the estimate because an additional $60 of factory overhead was allocated because of the increase in direct labor. b. Management didn't provide enough direction to complete tasks on budget. c. The direct materials cost exceeded the estimate by $102 because 3 square feet of materials were spoiled. d. The direct labor cost exceeded the estimate by $240 because an additional 4 hours of labor were used by an inexperienced employee. Select the correct answer from the above choices. b X