Question: please help me to solve the (d) Katec Corporation borrowed $71,000.00 at 3% compounded quarterly for 14 years to buy a warehouse, Equal payments are

please help me to solve the (d)

please help me to solve the (d)

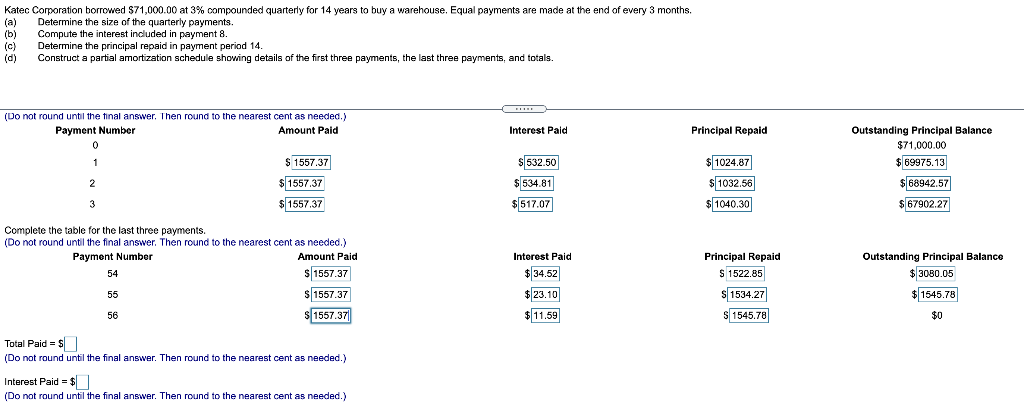

Katec Corporation borrowed $71,000.00 at 3% compounded quarterly for 14 years to buy a warehouse, Equal payments are made at the end of every 3 months. (a) Determine the size of the quarterly payments. (b) () Compute the interest included in payment 8. (c) Determine the principal repaid in payment period 14. (d) Construct a partial amortization schedule showing details of the first three payments, the last three payments, and totals BRIDE (Do not round until the final answer. Then round to the nearest cent as needed.) Payment Number Amount Paid 0 Interest Pald Principal Repaid Outstanding Principal Balance $71,000.00 $69975.13 1 $ 1557.37 2 $ 532.50 $ 534.81 $517.07 $ 1557.37 $ 1557.37 $ 1024.87 $ 1032,56 $ 1040.30 $68942.57 3 3 $ 67902.27 Complete the table for the last three payments. (Do not round until the final answer. Then round to the nearest cent as needed.) Payment Number Amount Paid 54 S 1557.37 55 S 1557.37 56 S 1557.37 Interest Pald $ 34.52 $23.10 $11.59 Principal Repaid S 1522.85 S 1534.27 S 1545.78 Outstanding Principal Balance $ 3030.05 $ 1545.78 $0 Total Paid = $ (Do not round until the final answer. Then round to the nearest cent as needed.) . ) Interest Paid = $ (Do not round until the final answer. Then round to the nearest cent as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts