Please help me to solve the incorrect ones and the blank ones. Please include where the value come from so I can do it in excel. Thank you in advance

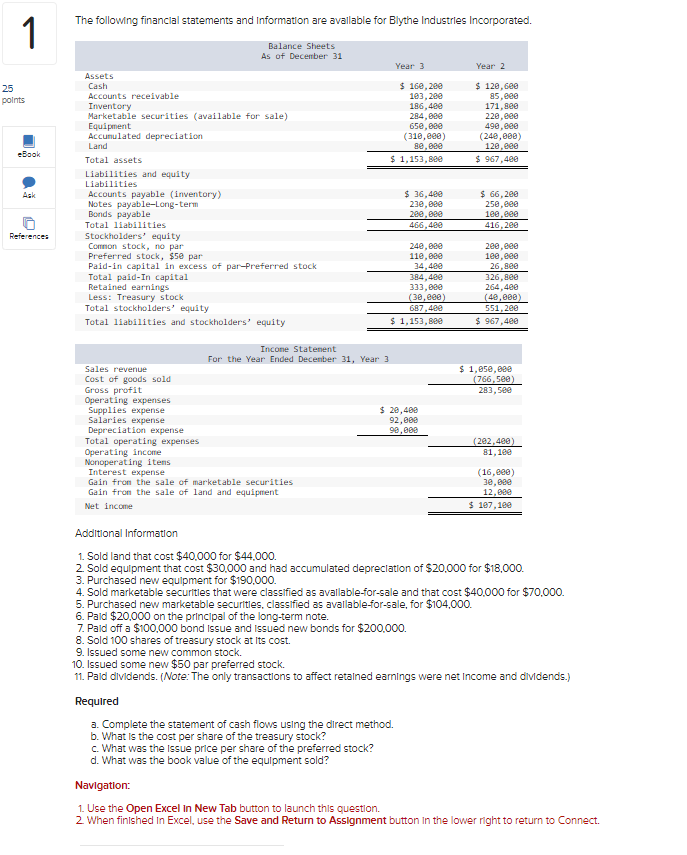

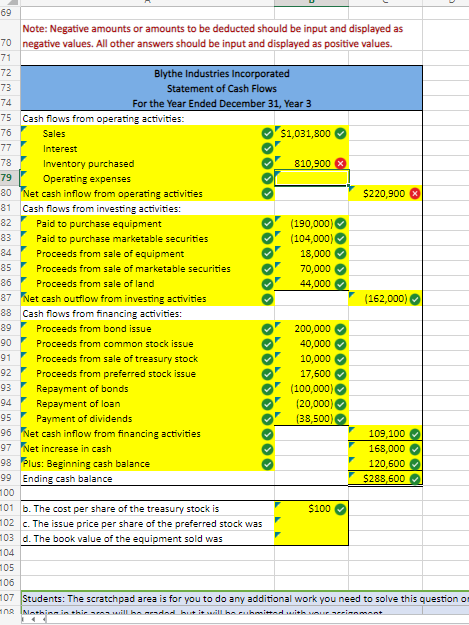

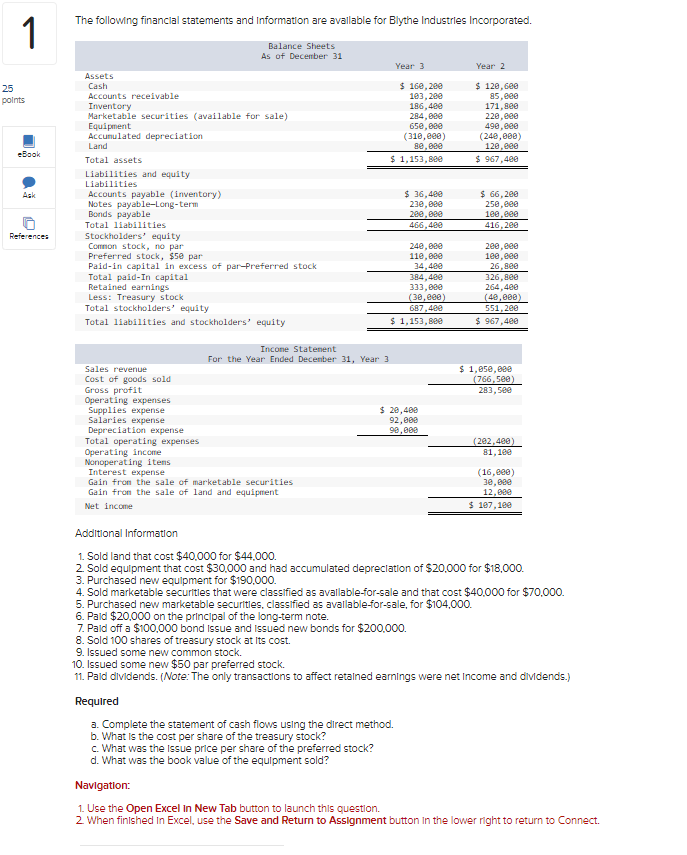

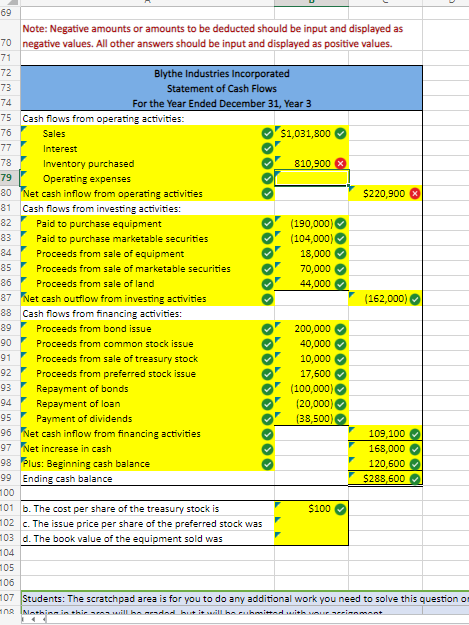

The followng financlal statements and Information are avallable for Blythe Industrles Incorporated. Additional Information 1. Sold land that cost $40,000 for $44,000. 2. Sold equipment that cost $30,000 and had accumulated depreclation of $20,000 for $18,000. 3. Purchased new equipment for $190,000. 4. Sold marketable securitles that were classlfied as avallable-for-sale and that cost $40,000 for $70,000. 5. Purchased new marketable securitles, classlfied as avallable-for-sale, for $104,000. 6. Paid $20,000 on the principal of the long-term note. 7. Pald off a $100,000 bond Issue and Issued new bonds for $200,000. 8. Sold 100 shares of treasury stock at its cost. 9. Issued some new common stock. 10. Issued some new $50 par preferred stock. 11. Paid dividends. (Note: The only transactions to affect retained eamings were net income and divdends.) Required a. Complete the statement of cash flows using the direct method. b. What is the cost per share of the treasury stock? c. What was the issue price per share of the preferred stock? d. What was the book value of the equipment sold? Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished In Excel, use the Save and Return to Assignment button in the lower right to return to Connect. Note: Negative amounts or amounts to be deducted should be input and displayed as negative values. All other answers should be input and displayed as positive values. Blythe Industries Incorporated Statement of Cash Flows For the Year Ended December 31, Year 3 Cash flows from operating activities: Sales Interest Inventory purchased Operating expenses Net cash inflow from operating activities Cash flows from investing activities: Paid to purchase equipment (190,000) Paid to purchase marketable securities Proceeds from sale of equipment (104,000) Proceeds from sale of marketable securities Proceeds from sale of land Net cash outflow from investing activities Cash flows from financing activities: Proceeds from bond issue Proceeds from common stock issue Proceeds from sale of treasury stock Proceeds from preferred stock issue Repayment of bonds Repayment of loan Payment of dividends Net cash inflow from financing activities Net increase in cash Plus: Beginning cash balance Ending cash balance (162,000) 18,000 70,000 44,000 b. The cost per share of the treasury stock is c. The issue price per share of the preferred stock was d. The book value of the equipment sold was Students: The scratchpad area is for you to do any additional work you need to solve this question or The followng financlal statements and Information are avallable for Blythe Industrles Incorporated. Additional Information 1. Sold land that cost $40,000 for $44,000. 2. Sold equipment that cost $30,000 and had accumulated depreclation of $20,000 for $18,000. 3. Purchased new equipment for $190,000. 4. Sold marketable securitles that were classlfied as avallable-for-sale and that cost $40,000 for $70,000. 5. Purchased new marketable securitles, classlfied as avallable-for-sale, for $104,000. 6. Paid $20,000 on the principal of the long-term note. 7. Pald off a $100,000 bond Issue and Issued new bonds for $200,000. 8. Sold 100 shares of treasury stock at its cost. 9. Issued some new common stock. 10. Issued some new $50 par preferred stock. 11. Paid dividends. (Note: The only transactions to affect retained eamings were net income and divdends.) Required a. Complete the statement of cash flows using the direct method. b. What is the cost per share of the treasury stock? c. What was the issue price per share of the preferred stock? d. What was the book value of the equipment sold? Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished In Excel, use the Save and Return to Assignment button in the lower right to return to Connect. Note: Negative amounts or amounts to be deducted should be input and displayed as negative values. All other answers should be input and displayed as positive values. Blythe Industries Incorporated Statement of Cash Flows For the Year Ended December 31, Year 3 Cash flows from operating activities: Sales Interest Inventory purchased Operating expenses Net cash inflow from operating activities Cash flows from investing activities: Paid to purchase equipment (190,000) Paid to purchase marketable securities Proceeds from sale of equipment (104,000) Proceeds from sale of marketable securities Proceeds from sale of land Net cash outflow from investing activities Cash flows from financing activities: Proceeds from bond issue Proceeds from common stock issue Proceeds from sale of treasury stock Proceeds from preferred stock issue Repayment of bonds Repayment of loan Payment of dividends Net cash inflow from financing activities Net increase in cash Plus: Beginning cash balance Ending cash balance (162,000) 18,000 70,000 44,000 b. The cost per share of the treasury stock is c. The issue price per share of the preferred stock was d. The book value of the equipment sold was Students: The scratchpad area is for you to do any additional work you need to solve this question or