Answered step by step

Verified Expert Solution

Question

1 Approved Answer

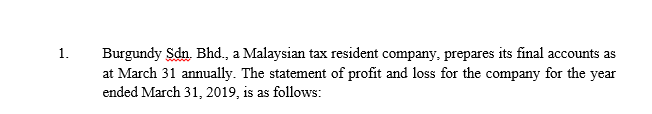

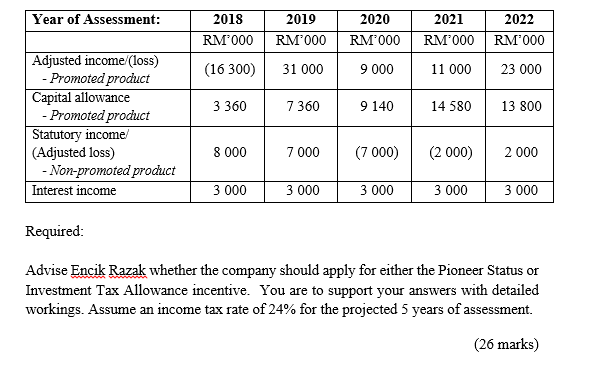

Please help me to solve these 2 questions. 1. Burgundy Sdn. Bhd., a Malaysian tax resident company, prepares its final accounts as at March 31

Please help me to solve these 2 questions.

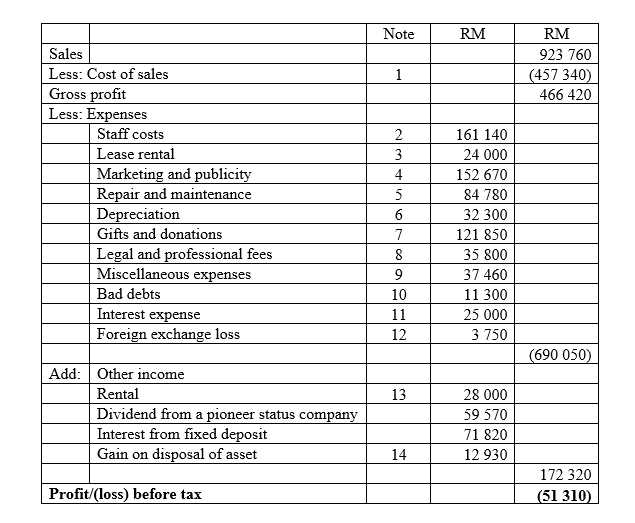

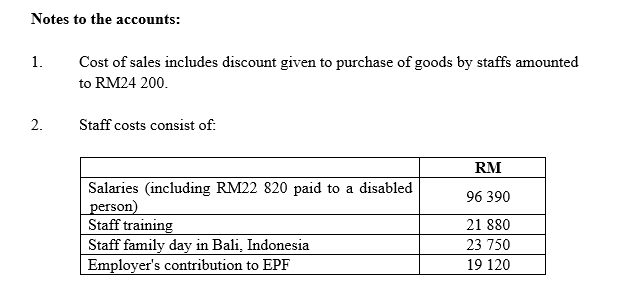

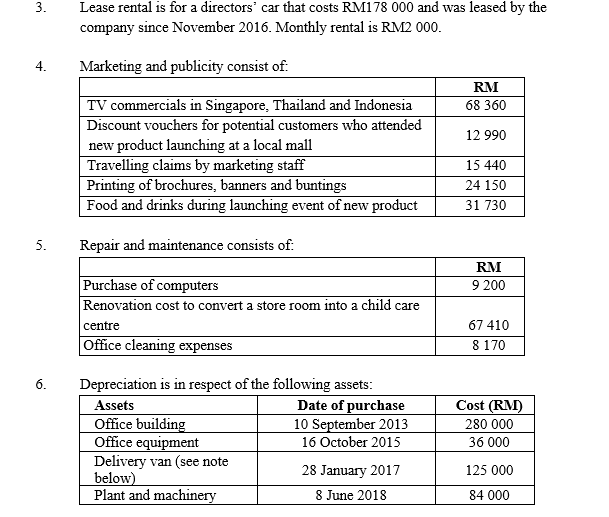

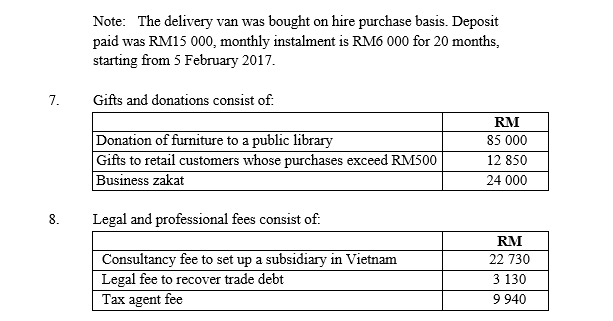

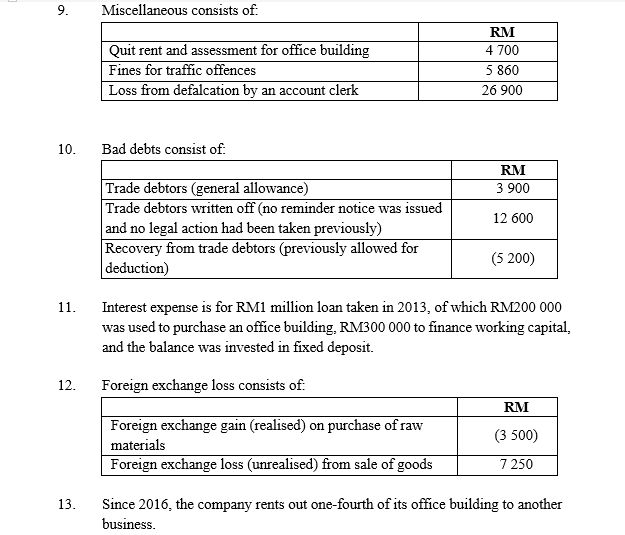

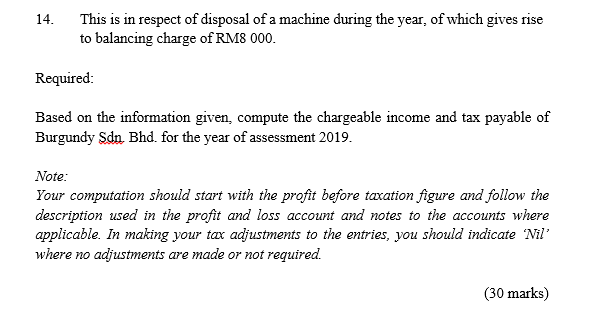

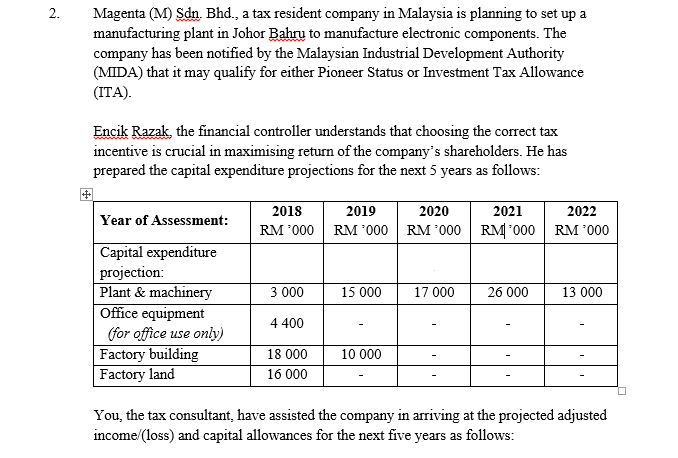

1. Burgundy Sdn. Bhd., a Malaysian tax resident company, prepares its final accounts as at March 31 annually. The statement of profit and loss for the company for the year ended March 31, 2019, is as follows: Note RM RM 923 760 (457 340) 466 420 1 Sales Less: Cost of sales Gross profit Less: Expenses Staff costs Lease rental Marketing and publicity Repair and maintenance Depreciation Gifts and donations Legal and professional fees Miscellaneous expenses Bad debts Interest expense Foreign exchange loss 2 3 4 5 6 7 161 140 24 000 152 670 84 780 32 300 121 850 35 800 37 460 11 300 25 000 3 750 8 9 10 11 12 (690 050) 13 Add: Other income Rental Dividend from a pioneer status company Interest from fixed deposit Gain on disposal of asset 28 000 59 570 71 820 12 930 14 Profit/(loss) before tax 172 320 (51 310) Notes to the accounts: 1. Cost of sales includes discount given to purchase of goods by staffs amounted to RM24 200. 2. Staff costs consist of: RM 96 390 Salaries (including RM22 820 paid to a disabled person) Staff training Staff family day in Bali, Indonesia Employer's contribution to EPF 21 880 23 750 19 120 3. Lease rental is for a directors' car that costs RM178 000 and was leased by the company since November 2016. Monthly rental is RM2 000. 4. Marketing and publicity consist of: RM 68 360 12 990 TV commercials in Singapore, Thailand and Indonesia Discount vouchers for potential customers who attended new product launching at a local mall Travelling claims by marketing staff Printing of brochures, banners and buntings Food and drinks during launching event of new product 15 440 24 150 31 730 5. Repair and maintenance consists of: RM 9 200 Purchase of computers Renovation cost to convert a store room into a child care centre Office cleaning expenses 67 410 8 170 6. Depreciation is in respect of the following assets: Assets Date of purchase Office building 10 September 2013 Office equipment 16 October 2015 Delivery van (see note 28 January 2017 below) Plant and machinery 8 June 2018 Cost (RM) 280 000 36 000 125 000 84 000 Note: The delivery van was bought on hire purchase basis. Deposit paid was RM15 000, monthly instalment is RM6 000 for 20 months, starting from 5 February 2017. 7. Gifts and donations consist of Donation of furniture to a public library Gifts to retail customers whose purchases exceed RM500 Business zakat RM 85 000 12 850 24 000 8. Legal and professional fees consist of: Consultancy fee to set up a subsidiary in Vietnam Legal fee to recover trade debt Tax agent fee RM 22 730 3 130 9 940 9. Miscellaneous consists of: Quit rent and assessment for office building Fines for traffic offences Loss from defalcation by an account clerk RM 4 700 5 860 26 900 10. Bad debts consist of RM 3 900 12 600 Trade debtors (general allowance) Trade debtors written off (no reminder notice was issued and no legal action had been taken previously) Recovery from trade debtors (previously allowed for deduction) (5 200) 11. Interest expense is for RM1 million loan taken in 2013, of which RM200 000 was used to purchase an office building, RM300 000 to finance working capital, and the balance was invested in fixed deposit. 12. Foreign exchange loss consists of: RM (3 500) Foreign exchange gain (realised) on purchase of raw materials Foreign exchange loss (unrealised) from sale of goods 7250 13. Since 2016, the company rents out one-fourth of its office building to another business. 14. This is in respect of disposal of a machine during the year, of which gives rise to balancing charge of RM8 000. Required: Based on the information given, compute the chargeable income and tax payable of Burgundy Sdn. Bhd. for the year of assessment 2019. Note: Your computation should start with the profit before taxation figure and follow the description used in the profit and loss account and notes to the accounts where applicable. In making your tax adjustments to the entries, you should indicate 'Nil' where no adjustments are made or not required. (30 marks) 2. Magenta (M) Sdn. Bhd., a tax resident company in Malaysia is planning to set up a manufacturing plant in Johor Bahru to manufacture electronic components. The company has been notified by the Malaysian Industrial Development Authority (MIDA) that it may qualify for either Pioneer Status or Investment Tax Allowance (ITA). Encik Razak, the financial controller understands that choosing the correct tax incentive is crucial in maximising return of the company's shareholders. He has prepared the capital expenditure projections for the next 5 years as follows: 2018 2019 2020 2021 2022 RM 000 RM 000 RM '000 RM2000 RM '000 Year of Assessment: Capital expenditure projection: Plant & machinery Office equipment (for office use only) Factory building Factory land 3 000 15 000 17 000 26 000 13 000 4 400 10 000 18 000 16 000 You, the tax consultant, have assisted the company in arriving at the projected adjusted income (loss) and capital allowances for the next five years as follows: Year of Assessment: 2018 RM 000 2019 RM'000 2020 RM'000 2021 RM'000 2022 RM'000 (16 300) 31 000 9 000 11 000 23 000 3 360 7360 9 140 14 580 13 800 Adjusted income (loss) - Promoted product Capital allowance - Promoted product Statutory income (Adjusted loss) - Non-promoted product Interest income 8 000 7 000 (7 000) (2 000) 2 000 3 000 3 000 3 000 3 000 3 000 Required: Advise Encik Razak whether the company should apply for either the Pioneer Status or Investment Tax Allowance incentive. You are to support your answers with detailed workings. Assume an income tax rate of 24% for the projected 5 years of assessment. (26 marks) 1. Burgundy Sdn. Bhd., a Malaysian tax resident company, prepares its final accounts as at March 31 annually. The statement of profit and loss for the company for the year ended March 31, 2019, is as follows: Note RM RM 923 760 (457 340) 466 420 1 Sales Less: Cost of sales Gross profit Less: Expenses Staff costs Lease rental Marketing and publicity Repair and maintenance Depreciation Gifts and donations Legal and professional fees Miscellaneous expenses Bad debts Interest expense Foreign exchange loss 2 3 4 5 6 7 161 140 24 000 152 670 84 780 32 300 121 850 35 800 37 460 11 300 25 000 3 750 8 9 10 11 12 (690 050) 13 Add: Other income Rental Dividend from a pioneer status company Interest from fixed deposit Gain on disposal of asset 28 000 59 570 71 820 12 930 14 Profit/(loss) before tax 172 320 (51 310) Notes to the accounts: 1. Cost of sales includes discount given to purchase of goods by staffs amounted to RM24 200. 2. Staff costs consist of: RM 96 390 Salaries (including RM22 820 paid to a disabled person) Staff training Staff family day in Bali, Indonesia Employer's contribution to EPF 21 880 23 750 19 120 3. Lease rental is for a directors' car that costs RM178 000 and was leased by the company since November 2016. Monthly rental is RM2 000. 4. Marketing and publicity consist of: RM 68 360 12 990 TV commercials in Singapore, Thailand and Indonesia Discount vouchers for potential customers who attended new product launching at a local mall Travelling claims by marketing staff Printing of brochures, banners and buntings Food and drinks during launching event of new product 15 440 24 150 31 730 5. Repair and maintenance consists of: RM 9 200 Purchase of computers Renovation cost to convert a store room into a child care centre Office cleaning expenses 67 410 8 170 6. Depreciation is in respect of the following assets: Assets Date of purchase Office building 10 September 2013 Office equipment 16 October 2015 Delivery van (see note 28 January 2017 below) Plant and machinery 8 June 2018 Cost (RM) 280 000 36 000 125 000 84 000 Note: The delivery van was bought on hire purchase basis. Deposit paid was RM15 000, monthly instalment is RM6 000 for 20 months, starting from 5 February 2017. 7. Gifts and donations consist of Donation of furniture to a public library Gifts to retail customers whose purchases exceed RM500 Business zakat RM 85 000 12 850 24 000 8. Legal and professional fees consist of: Consultancy fee to set up a subsidiary in Vietnam Legal fee to recover trade debt Tax agent fee RM 22 730 3 130 9 940 9. Miscellaneous consists of: Quit rent and assessment for office building Fines for traffic offences Loss from defalcation by an account clerk RM 4 700 5 860 26 900 10. Bad debts consist of RM 3 900 12 600 Trade debtors (general allowance) Trade debtors written off (no reminder notice was issued and no legal action had been taken previously) Recovery from trade debtors (previously allowed for deduction) (5 200) 11. Interest expense is for RM1 million loan taken in 2013, of which RM200 000 was used to purchase an office building, RM300 000 to finance working capital, and the balance was invested in fixed deposit. 12. Foreign exchange loss consists of: RM (3 500) Foreign exchange gain (realised) on purchase of raw materials Foreign exchange loss (unrealised) from sale of goods 7250 13. Since 2016, the company rents out one-fourth of its office building to another business. 14. This is in respect of disposal of a machine during the year, of which gives rise to balancing charge of RM8 000. Required: Based on the information given, compute the chargeable income and tax payable of Burgundy Sdn. Bhd. for the year of assessment 2019. Note: Your computation should start with the profit before taxation figure and follow the description used in the profit and loss account and notes to the accounts where applicable. In making your tax adjustments to the entries, you should indicate 'Nil' where no adjustments are made or not required. (30 marks) 2. Magenta (M) Sdn. Bhd., a tax resident company in Malaysia is planning to set up a manufacturing plant in Johor Bahru to manufacture electronic components. The company has been notified by the Malaysian Industrial Development Authority (MIDA) that it may qualify for either Pioneer Status or Investment Tax Allowance (ITA). Encik Razak, the financial controller understands that choosing the correct tax incentive is crucial in maximising return of the company's shareholders. He has prepared the capital expenditure projections for the next 5 years as follows: 2018 2019 2020 2021 2022 RM 000 RM 000 RM '000 RM2000 RM '000 Year of Assessment: Capital expenditure projection: Plant & machinery Office equipment (for office use only) Factory building Factory land 3 000 15 000 17 000 26 000 13 000 4 400 10 000 18 000 16 000 You, the tax consultant, have assisted the company in arriving at the projected adjusted income (loss) and capital allowances for the next five years as follows: Year of Assessment: 2018 RM 000 2019 RM'000 2020 RM'000 2021 RM'000 2022 RM'000 (16 300) 31 000 9 000 11 000 23 000 3 360 7360 9 140 14 580 13 800 Adjusted income (loss) - Promoted product Capital allowance - Promoted product Statutory income (Adjusted loss) - Non-promoted product Interest income 8 000 7 000 (7 000) (2 000) 2 000 3 000 3 000 3 000 3 000 3 000 Required: Advise Encik Razak whether the company should apply for either the Pioneer Status or Investment Tax Allowance incentive. You are to support your answers with detailed workings. Assume an income tax rate of 24% for the projected 5 years of assessment. (26 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started