Please help me to solve these parts. I know the answer but I want only solution

Brad and Becky are both 31, and expecting their first baby, which has led them to consider their financial situation, such as the financial implications if one of them died or became sick or injured and could no longer work.

They are both in careers they enjoy and each earn $60,000 gross salary.

Brads monthly take home pay is $4,000

Beckys monthly take home pay is $3,200

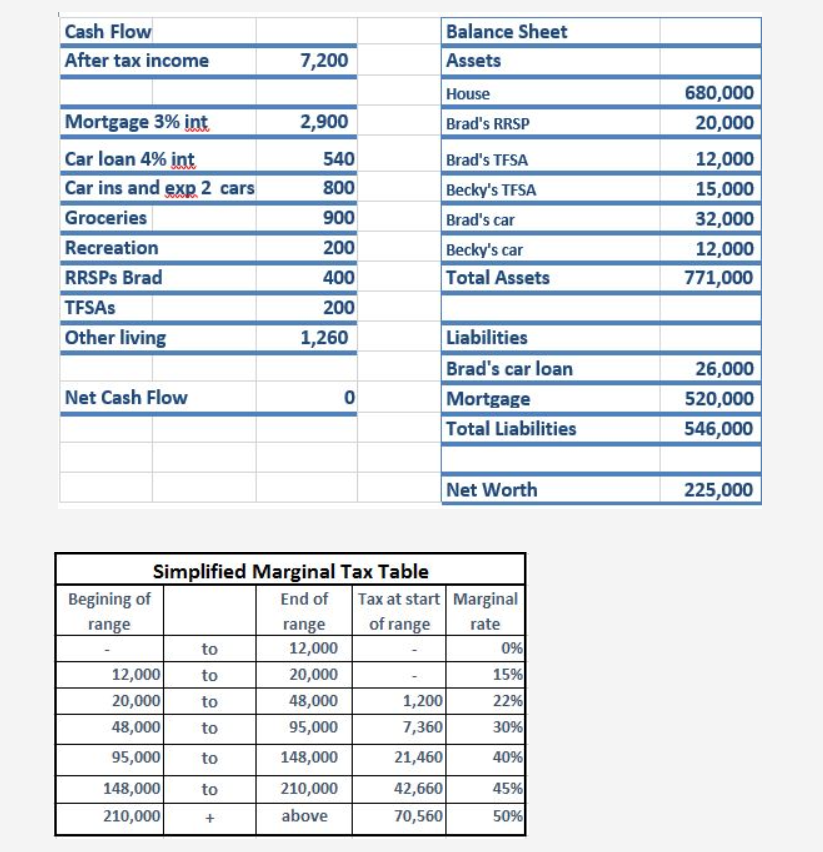

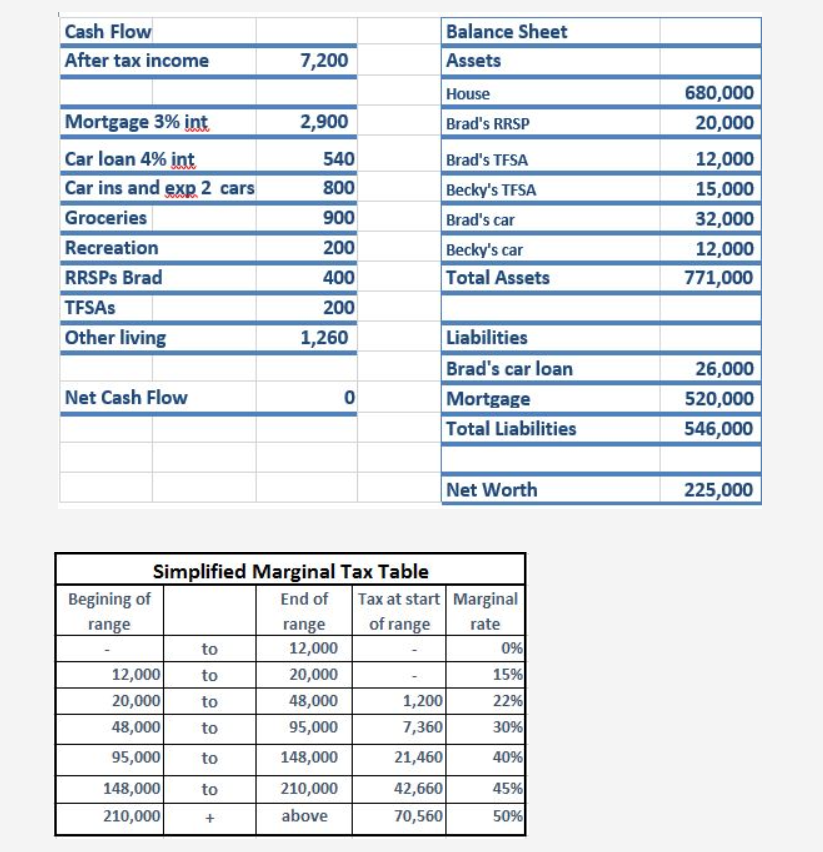

Their financial statements are as follows.

| Match the correct answer to the following questions. |

-

| Question | Correct Match | Selected Match | | Based on their cash flow statement, what is the minimum disposable income they need to make ends meet, without changing their lifestyle? | J. 6600 | J. 6600 | | Becky's LTD plan pays 60% of her gross income. What LTD insurance benefit can she expect on a tax free basis? | B. 3000 | B. 3000 | | If Becky's LTD paid her a $4,000 a month taxable benefit, how much monthly income would this provide her on an after tax basis? | C. 3390 | C. 3390 | | Brad has no disability insurance coverage from his work. If Brad can qualify for personal DI coverage of 90% of his after tax income, what amount would this be? | D. 3680 | D. 3680 | | If Brad and Becky wanted to each have enough life insurance on themselves to provide a $60,000 income to the family indefinitely, and assuming a long term annual real rate of return of 2.2% on the capital, how much life insurance would they each need? (nearest thousand) | P. 2,727,000 | P. 2,727,000 | | How much life insurance would they need if they assumed that providing 25 years of $60,000 income was enough, and that they could be sure of a 2.2% annual real rate of return after tax, on the capital? (nearest thousand) | L. 1,144,000 | L. 1,144,000 | | |

Cash Flow After tax income Balance Sheet Assets 7,200 House 680,000 20,000 Mortgage 3% int 2,900 Brad's RRSP 540 800 900 Car loan 4% int Car ins and exp 2 cars Groceries Recreation RRSPs Brad TFSAs Other living Brad's TFSA Becky's TFSA Brad's car Becky's car Total Assets 12,000 15,000 32,000 12,000 771,000 200 400 200 1,260 Liabilities Brad's car loan Mortgage Total Liabilities Net Cash Flow 0 26,000 520,000 546,000 Net Worth 225,000 Simplified Marginal Tax Table Begining of End of Tax at start Marginal range range of range rate to 12,000 096 12,000 to 20,000 15% 20,000 to 48,000 1,200 2296 48,000 to 95,000 7,360 30% 95,000 to 148,000 21,460 40% 148,000 to 210,000 42,660 45% 210,000 above 70,560 50% + Cash Flow After tax income Balance Sheet Assets 7,200 House 680,000 20,000 Mortgage 3% int 2,900 Brad's RRSP 540 800 900 Car loan 4% int Car ins and exp 2 cars Groceries Recreation RRSPs Brad TFSAs Other living Brad's TFSA Becky's TFSA Brad's car Becky's car Total Assets 12,000 15,000 32,000 12,000 771,000 200 400 200 1,260 Liabilities Brad's car loan Mortgage Total Liabilities Net Cash Flow 0 26,000 520,000 546,000 Net Worth 225,000 Simplified Marginal Tax Table Begining of End of Tax at start Marginal range range of range rate to 12,000 096 12,000 to 20,000 15% 20,000 to 48,000 1,200 2296 48,000 to 95,000 7,360 30% 95,000 to 148,000 21,460 40% 148,000 to 210,000 42,660 45% 210,000 above 70,560 50% +