Question: Please help me to solve this case study. Please answer all questions. Petrocal determines that 60% of the overall gasoline market consists of service-oriented customers,

Please help me to solve this case study. Please answer all questions.

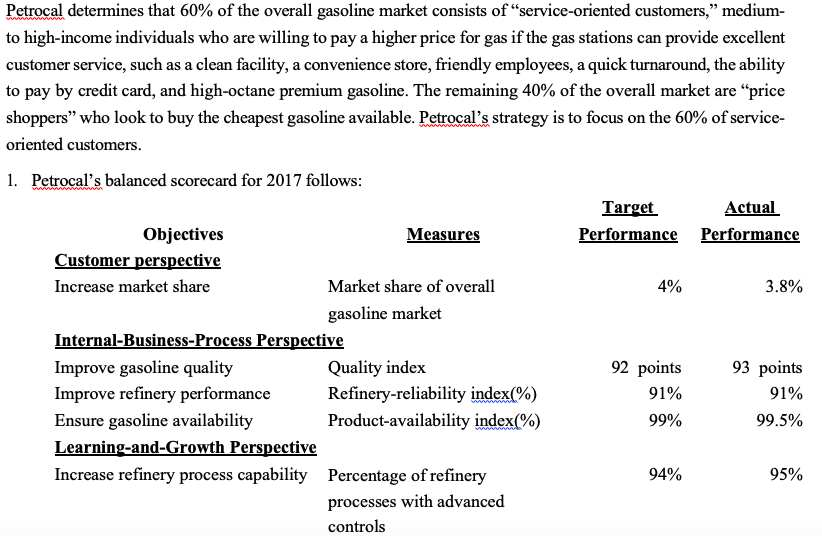

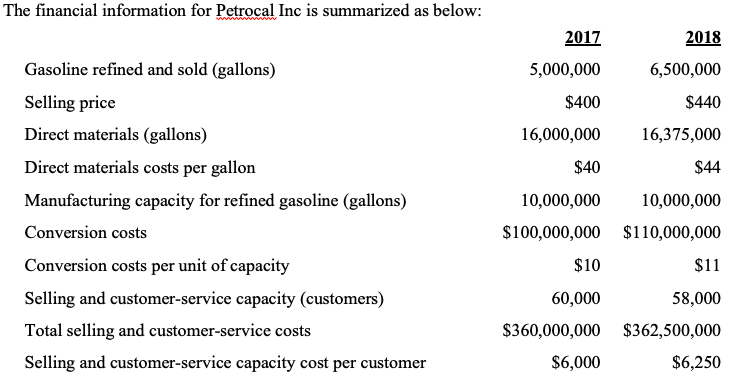

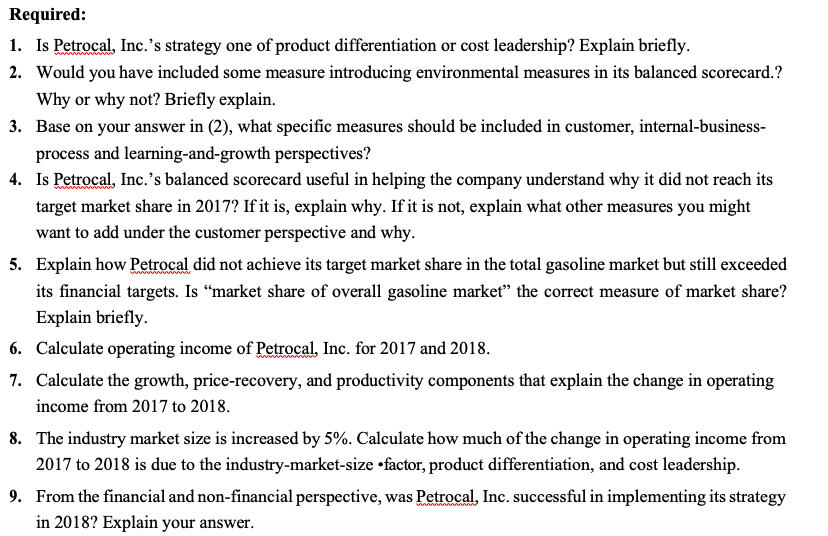

Petrocal determines that 60% of the overall gasoline market consists of "service-oriented customers," medium- to high-income individuals who are willing to pay a higher price for gas if the gas stations can provide excellent customer service, such as a clean facility, a convenience store, friendly employees, a quick turnaround, the ability to pay by credit card, and high-octane premium gasoline. The remaining 40% of the overall market are "price shoppers who look to buy the cheapest gasoline available. Petrocal's strategy is to focus on the 60% of service- oriented customers 1. Petrocal's balanced scorecard for 2017 follows Target Actual Objectives ustomer perspective Measures Performance Performance Increase market share Market share of overall 4% 3.8% gasoline market Internal-Business-Process Perspective Improve gasoline quality Improve refinery performance Ensure gasoline availability Learning-and-Growth Perspective Increase refinery process capability Percentage of refinery Quality index Refinery-reliability index(%) Product-availability index(%) 92 points 91% 99% 93 points 91% 99.5% 94% 95% processes with advanced controls The financial information for Petrocal Inc is summarized as below 2018 6,500,000 $440 16,000,00016,375,000 $44 10,000,000 S100,000,000 $110,000,000 2017 5,000,000 $400 Gasoline refined and sold (gallons) Selling price Direct materials (gallons) Direct materials costs per gallorn Manufacturing capacity for refined gasoline (gallons) Conversion costs Conversion costs per unit of capacity Selling and customer-service capacity (customers) Total selling and customer-service costs Selling and customer-service capacity cost per customer $40 10,000,000 $10 58,000 S360,000,000 $362,500,000 $6,250 60,000 $6,000 Required: 1. Is Petrocal, Inc.'s strategy one of product differentiation or cost leadership? Explain briefly. 2. Would you have included some measure introducing environmental measures in its balanced scorecard.? Why or why not? Briefly explain. Base on your answer in (2), what specific measures should be included in customer, internal-business- process and learning-and-growth perspectives? Is Petrocal, Inc.'s balanced scorecard useful in helping the company understand why it did not reach its target market share in 2017? If it is, explain why. If it is not, explain what other measures you might want to add under the customer perspective and why. Explain how Petrocal did not achieve its target market share in the total gasoline market but still exceeded its financial targets. Is "market share of overall gasoline market" the correct measure of market share? Explain briefly. Calculate operating income of Petrocal, Inc. for 2017 and 2018. Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2017 to 2018. The industry market size is increased by 5%. Calculate how much ofthe change in operating income from 2017 to 2018 is due to the industry-market-size factor, product differentiation, and cost leadership. From the financial and non-financial perspective, was Petrocal, Inc. successful in implementing its strategy in 2018? Explain your answer. 3. 4. 5. 6. 7. 8. 9. Petrocal determines that 60% of the overall gasoline market consists of "service-oriented customers," medium- to high-income individuals who are willing to pay a higher price for gas if the gas stations can provide excellent customer service, such as a clean facility, a convenience store, friendly employees, a quick turnaround, the ability to pay by credit card, and high-octane premium gasoline. The remaining 40% of the overall market are "price shoppers who look to buy the cheapest gasoline available. Petrocal's strategy is to focus on the 60% of service- oriented customers 1. Petrocal's balanced scorecard for 2017 follows Target Actual Objectives ustomer perspective Measures Performance Performance Increase market share Market share of overall 4% 3.8% gasoline market Internal-Business-Process Perspective Improve gasoline quality Improve refinery performance Ensure gasoline availability Learning-and-Growth Perspective Increase refinery process capability Percentage of refinery Quality index Refinery-reliability index(%) Product-availability index(%) 92 points 91% 99% 93 points 91% 99.5% 94% 95% processes with advanced controls The financial information for Petrocal Inc is summarized as below 2018 6,500,000 $440 16,000,00016,375,000 $44 10,000,000 S100,000,000 $110,000,000 2017 5,000,000 $400 Gasoline refined and sold (gallons) Selling price Direct materials (gallons) Direct materials costs per gallorn Manufacturing capacity for refined gasoline (gallons) Conversion costs Conversion costs per unit of capacity Selling and customer-service capacity (customers) Total selling and customer-service costs Selling and customer-service capacity cost per customer $40 10,000,000 $10 58,000 S360,000,000 $362,500,000 $6,250 60,000 $6,000 Required: 1. Is Petrocal, Inc.'s strategy one of product differentiation or cost leadership? Explain briefly. 2. Would you have included some measure introducing environmental measures in its balanced scorecard.? Why or why not? Briefly explain. Base on your answer in (2), what specific measures should be included in customer, internal-business- process and learning-and-growth perspectives? Is Petrocal, Inc.'s balanced scorecard useful in helping the company understand why it did not reach its target market share in 2017? If it is, explain why. If it is not, explain what other measures you might want to add under the customer perspective and why. Explain how Petrocal did not achieve its target market share in the total gasoline market but still exceeded its financial targets. Is "market share of overall gasoline market" the correct measure of market share? Explain briefly. Calculate operating income of Petrocal, Inc. for 2017 and 2018. Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2017 to 2018. The industry market size is increased by 5%. Calculate how much ofthe change in operating income from 2017 to 2018 is due to the industry-market-size factor, product differentiation, and cost leadership. From the financial and non-financial perspective, was Petrocal, Inc. successful in implementing its strategy in 2018? Explain your answer. 3. 4. 5. 6. 7. 8. 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts