Question: Please help me to solve this problem, and give me the correct answer, thank you so much g) Overhead for 2019 is budgeted to be

Please help me to solve this problem, and give me the correct answer, thank you so much

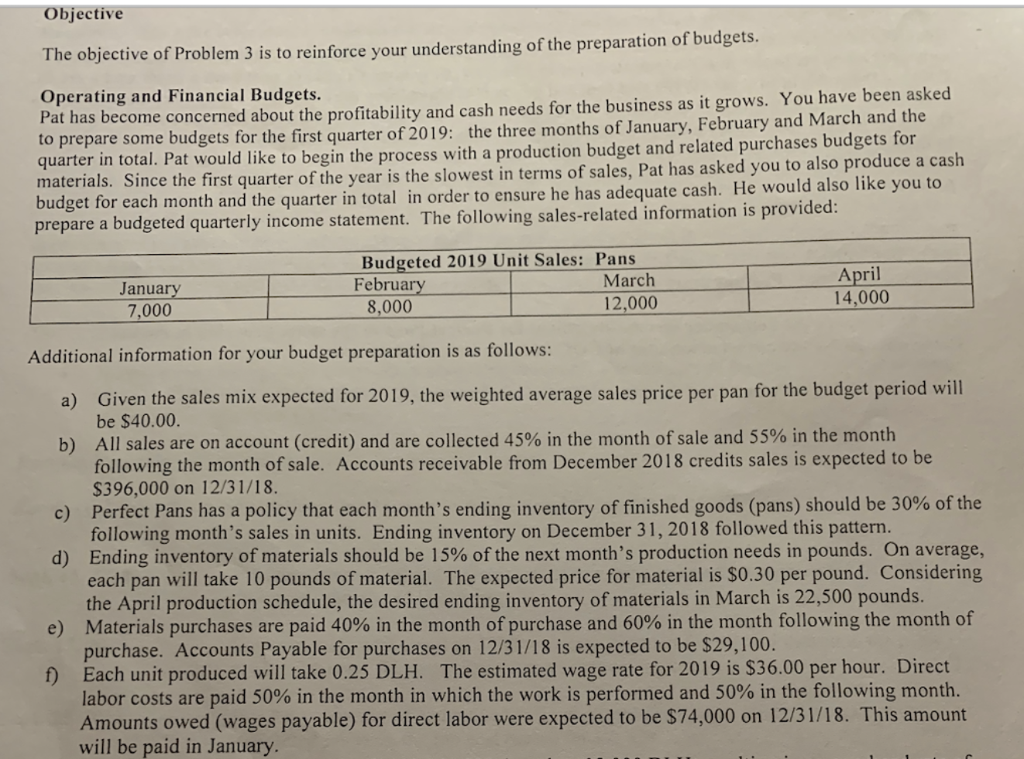

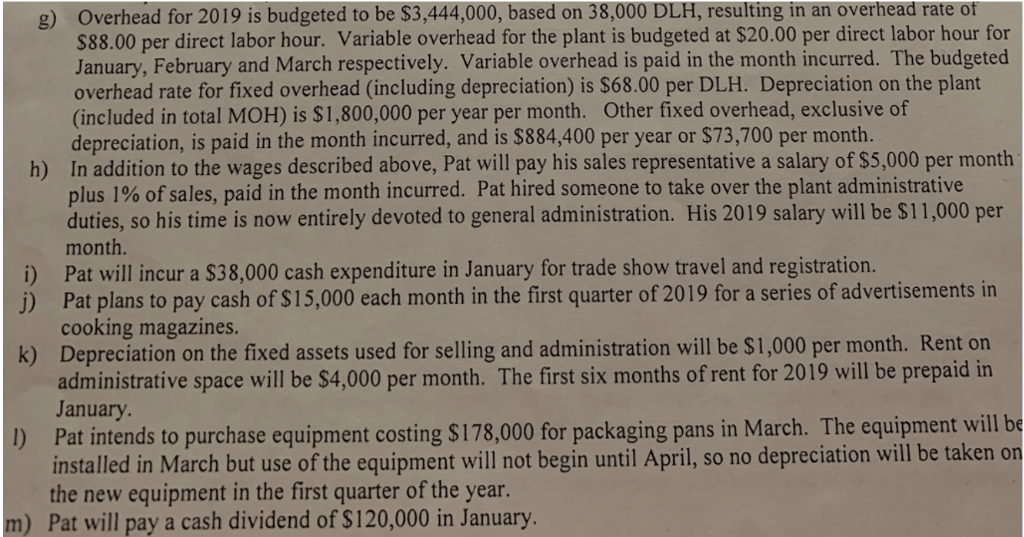

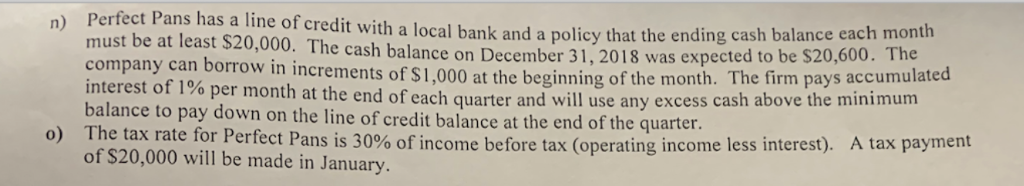

g) Overhead for 2019 is budgeted to be $3,444,000, based on 38,000 DLH, resulting in an overhead rate ot $88.00 per direct labor hour. Variable overhead for the plant is budgeted at $20.00 per direct labor hour for January, February and March respectively. Variable overhead is paid in the month incurred. The budgeted overhead rate for fixed overhead (including depreciation) is $68.00 per DLH. Depreciation on the plart (included in total MOH) is $1,800,000 per year per month. Other fixed overhead, exclusive of depreciation, is paid in the month incurred, and is $884,400 per year or $73,700 per month In addition to the wages described above, Pat will pay his sales representative a salary of $5,000 per month plus 1% of sales, paid in the month incurred. Pat hired someone to take over the plant administrative duties, so his time is now entirely devoted to general administration. His 2019 salary will be $11,000 per month. Pat will incur a $38,000 cash expenditure in January for trade show travel and registration. Pat plans to pay cash of S15,000 each month in the first quarter of 2019 for a series of advertisements in cooking magazines. Depreciation on the fixed assets used for selling and administration will be $1,000 per month. Rent on administrative space will be $4,000 per month. The first six months of rent for 2019 will be prepaid in January Pat intends to purchase equipment costing $178,000 for packaging pans in March. The equipment will be installed in March but use of the equipment will not begin until April, so no depreciation will be taken on h) i) j) k) l) the new equipment in the first quarter of the year. m) Pat will pay a cash dividend of $120,000 in January. Perfect Pans h must be at least $20,000. The cash bal company can borrow in increments of $1,000 at the beginning of the month interest of 1% balance to pay down on the line of credit balance at the end of the quarter The tax rate for Perfect of $20,000 will be made in January as a line of credit with a local bank and a policy that the ending cash balance each month o per month at the end of each quarter and will use any excess cash above the minimum ans is 30% of income before tax (operating income less interest ance on December 31,2018 was expected to be S20,600. The . The firm pays accumulated o) Atax payment 5. February, and March and for the quarter in total Prepare a labor budget in hours and dollars and a cash payments for labor budget for the montns or sanuary 5. Perfect Pans Direct Labor Budget For the Quarter Ended March 31, 2019 January February March Quarter Perfect Pans Cash Payments for Direct Labor Budget For the Quarter Ended March 31,2019 January February March Quarter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts