please help me to solve this question

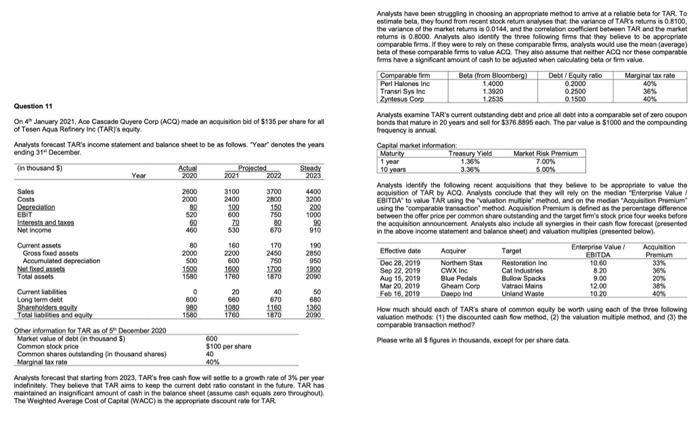

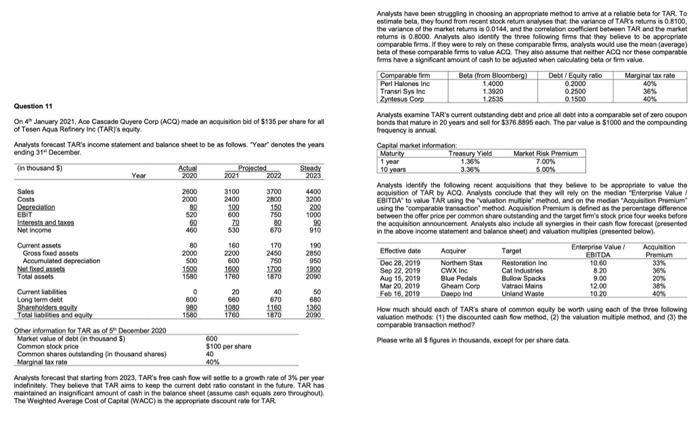

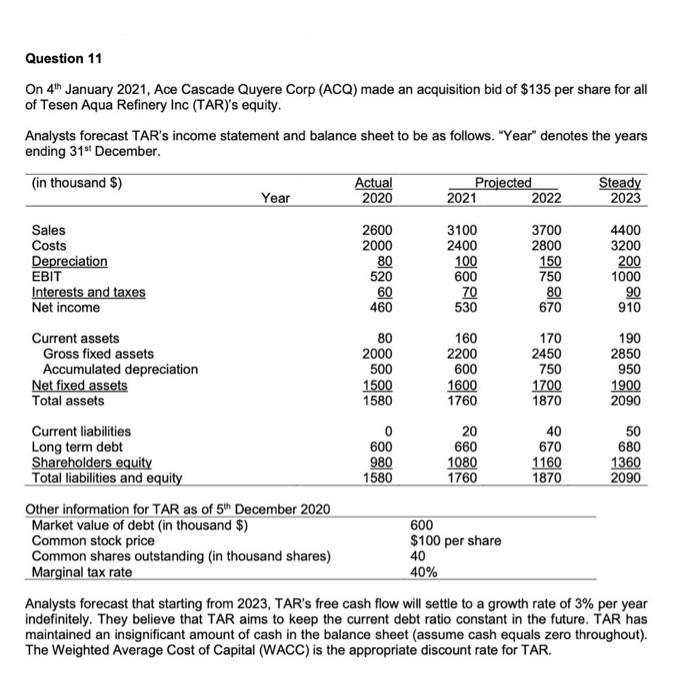

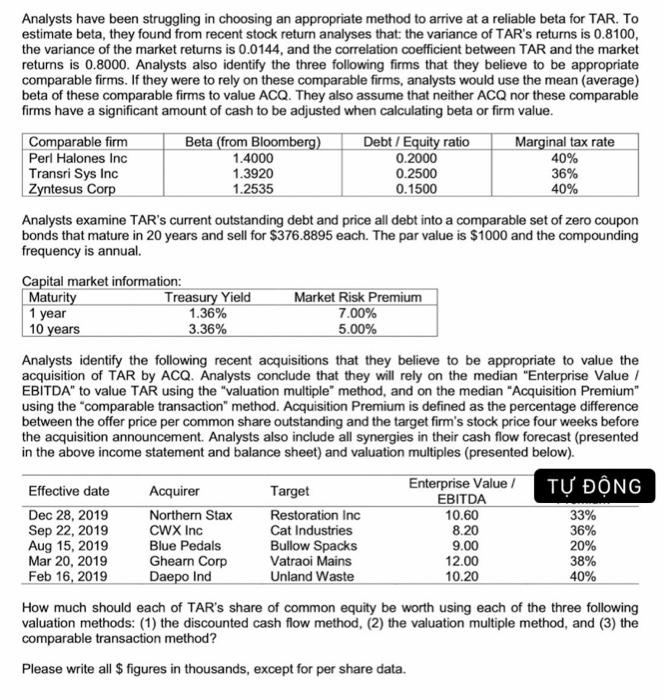

Analysts have been strugging in choosing an appropriate method to arrive at a relable beta for TAR. To estimate beta, they found from tecert stock retum aralyses that the variance of TAY's returns is 0.8100. the variance of the market returns a 0.0144, and the correlation coefficient between TAR and the market neturns is 0.8000. Analysts also idently the three following fins that they beleve to be appropriate comparable frms. If they wore bo rely on these comparabie friss, aralysts wovld use the meen (average) beta of these comparable frms to value ACO. They also atsume that neither ACQ nor these comparatie frems have a signicoant amount of cash to be adiusted when calculating beta or frm value. \begin{tabular}{|l|c|c|c|} \hline Comparable firm & Beta from Bloomberg) & Debf I Equity rabo & Masgial tax rale \\ \hline Pert Halones ine & 1.4000 & 0.2000 & 40% \\ Transri Sys ine & 1.3920 & 0.2500 & 36% \\ \hline Zyntesus Corp & 1.2535 & 0.1500 & 404 \\ \hline \end{tabular} Question 11 Analyats examine TAR's curent eutsianding dabt and price all debt into a comparabio set of zero coupon On 4" January 2021, Ace Cascade Quyere Corp (ACO) made an acquitilion bid of 3135 per shere for all bonds that mature in 20 years and sell for $376.8095 each. The par value is $1000 and the compounding of Tesen Aqua Rptinery ine (TARers equity. frequency is annaal. Analysts forveast TAP's inoome stafement and balance sheet to be as folows. "Year denotes the years ending 312 December. Arabyits identfy the folowing recent acqubibions that they beleve to be appropriate to walue the acquistion of TAG, by ACO. Analysts cocclude that they will sely on the medan "Enterprise Value I. EBITDA" to value TAR using the "valuation multple' metod, and on the medar "Aoquabon Premiun" using the "comparabie transaction" method. Acquistion Premium is defined as the percentage dfference between the offer price per cemmon ahare outatanding and the target firmis stock price four weoks before in the above inoome statement and balance sheet) and valuation mutiples (presented below). Oter iflormalion for TAR as of S December 2020 \begin{tabular}{ll} Market value of debt (in thousand 5) & 600 \\ Common stock price & $100 per share \\ Common shares outatanding (nn thousand ahares) & 40 \\ Maginal tax rath & 40% \\ \hline \end{tabular} How much should esch of TAR's share of oommon equty be worth using oach of the tree following valuation metheds (1) the discounted eash flow method, (2) the valation muliple method. and (3) the comperable transaction method? Please wrte al 5 figures in thcusands, except for per share data. Analyss forecast bat siarting tron 20z3, TAF's free cash fow wit selte to a growth rabe of 3% per yeer insefinitely. They believe that TAR aims to keop the current debt ralio oonesant in the future. TAR has maintained an insignfieart amount of eash in the bolanse sheet (sssume eash equals zerb throughout) The Weighted Average Cost of Capial (WACC) in the aspropriate discount rate for TAR. On 4th January 2021, Ace Cascade Quyere Corp (ACQ) made an acquisition bid of $135 per share for all of Tesen Aqua Refinery Inc (TAR)'s equity. Analysts forecast TAR's income statement and balance sheet to be as follows. "Year" denotes the years ending 31st December. Analysts forecast that starting from 2023, TAR's free cash flow will settle to a growth rate of 3% per year indefinitely. They believe that TAR aims to keep the current debt ratio constant in the future. TAR has maintained an insignificant amount of cash in the balance sheet (assume cash equals zero throughout). The Weighted Average Cost of Capital (WACC) is the appropriate discount rate for TAR. Analysts have been struggling in choosing an appropriate method to arrive at a reliable beta for TAR. To estimate beta, they found from recent stock return analyses that: the variance of TAR's returns is 0.8100, the variance of the market returns is 0.0144, and the correlation coefficient between TAR and the market returns is 0.8000. Analysts also identify the three following firms that they believe to be appropriate comparable firms. If they were to rely on these comparable firms, analysts would use the mean (average) beta of these comparable firms to value ACQ. They also assume that neither ACQ nor these comparable firms have a significant amount of cash to be adjusted when calculating beta or firm value. Analysts examine TAR's current outstanding debt and price all debt into a comparable set of zero coupon bonds that mature in 20 years and sell for $376.8895 each. The par value is $1000 and the compounding frequency is annual. Analysts identify the following recent acquisitions that they believe to be appropriate to value the acquisition of TAR by ACQ. Analysts conclude that they will rely on the median "Enterprise Value / EBITDA" to value TAR using the "valuation multiple" method, and on the median "Acquisition Premium" using the "comparable transaction" method. Acquisition Premium is defined as the percentage difference between the offer price per common share outstanding and the target firm's stock price four weeks before the acquisition announcement. Analysts also include all synergies in their cash flow forecast (presented in the above income statement and balance sheet) and valuation multiples (presented below). How much should each of TAR's share of common equity be worth using each of the three following valuation methods: (1) the discounted cash flow method, (2) the valuation multiple method, and (3) the comparable transaction method? Please write all $ figures in thousands, except for per share data. Analysts have been strugging in choosing an appropriate method to arrive at a relable beta for TAR. To estimate beta, they found from tecert stock retum aralyses that the variance of TAY's returns is 0.8100. the variance of the market returns a 0.0144, and the correlation coefficient between TAR and the market neturns is 0.8000. Analysts also idently the three following fins that they beleve to be appropriate comparable frms. If they wore bo rely on these comparabie friss, aralysts wovld use the meen (average) beta of these comparable frms to value ACO. They also atsume that neither ACQ nor these comparatie frems have a signicoant amount of cash to be adiusted when calculating beta or frm value. \begin{tabular}{|l|c|c|c|} \hline Comparable firm & Beta from Bloomberg) & Debf I Equity rabo & Masgial tax rale \\ \hline Pert Halones ine & 1.4000 & 0.2000 & 40% \\ Transri Sys ine & 1.3920 & 0.2500 & 36% \\ \hline Zyntesus Corp & 1.2535 & 0.1500 & 404 \\ \hline \end{tabular} Question 11 Analyats examine TAR's curent eutsianding dabt and price all debt into a comparabio set of zero coupon On 4" January 2021, Ace Cascade Quyere Corp (ACO) made an acquitilion bid of 3135 per shere for all bonds that mature in 20 years and sell for $376.8095 each. The par value is $1000 and the compounding of Tesen Aqua Rptinery ine (TARers equity. frequency is annaal. Analysts forveast TAP's inoome stafement and balance sheet to be as folows. "Year denotes the years ending 312 December. Arabyits identfy the folowing recent acqubibions that they beleve to be appropriate to walue the acquistion of TAG, by ACO. Analysts cocclude that they will sely on the medan "Enterprise Value I. EBITDA" to value TAR using the "valuation multple' metod, and on the medar "Aoquabon Premiun" using the "comparabie transaction" method. Acquistion Premium is defined as the percentage dfference between the offer price per cemmon ahare outatanding and the target firmis stock price four weoks before in the above inoome statement and balance sheet) and valuation mutiples (presented below). Oter iflormalion for TAR as of S December 2020 \begin{tabular}{ll} Market value of debt (in thousand 5) & 600 \\ Common stock price & $100 per share \\ Common shares outatanding (nn thousand ahares) & 40 \\ Maginal tax rath & 40% \\ \hline \end{tabular} How much should esch of TAR's share of oommon equty be worth using oach of the tree following valuation metheds (1) the discounted eash flow method, (2) the valation muliple method. and (3) the comperable transaction method? Please wrte al 5 figures in thcusands, except for per share data. Analyss forecast bat siarting tron 20z3, TAF's free cash fow wit selte to a growth rabe of 3% per yeer insefinitely. They believe that TAR aims to keop the current debt ralio oonesant in the future. TAR has maintained an insignfieart amount of eash in the bolanse sheet (sssume eash equals zerb throughout) The Weighted Average Cost of Capial (WACC) in the aspropriate discount rate for TAR. On 4th January 2021, Ace Cascade Quyere Corp (ACQ) made an acquisition bid of $135 per share for all of Tesen Aqua Refinery Inc (TAR)'s equity. Analysts forecast TAR's income statement and balance sheet to be as follows. "Year" denotes the years ending 31st December. Analysts forecast that starting from 2023, TAR's free cash flow will settle to a growth rate of 3% per year indefinitely. They believe that TAR aims to keep the current debt ratio constant in the future. TAR has maintained an insignificant amount of cash in the balance sheet (assume cash equals zero throughout). The Weighted Average Cost of Capital (WACC) is the appropriate discount rate for TAR. Analysts have been struggling in choosing an appropriate method to arrive at a reliable beta for TAR. To estimate beta, they found from recent stock return analyses that: the variance of TAR's returns is 0.8100, the variance of the market returns is 0.0144, and the correlation coefficient between TAR and the market returns is 0.8000. Analysts also identify the three following firms that they believe to be appropriate comparable firms. If they were to rely on these comparable firms, analysts would use the mean (average) beta of these comparable firms to value ACQ. They also assume that neither ACQ nor these comparable firms have a significant amount of cash to be adjusted when calculating beta or firm value. Analysts examine TAR's current outstanding debt and price all debt into a comparable set of zero coupon bonds that mature in 20 years and sell for $376.8895 each. The par value is $1000 and the compounding frequency is annual. Analysts identify the following recent acquisitions that they believe to be appropriate to value the acquisition of TAR by ACQ. Analysts conclude that they will rely on the median "Enterprise Value / EBITDA" to value TAR using the "valuation multiple" method, and on the median "Acquisition Premium" using the "comparable transaction" method. Acquisition Premium is defined as the percentage difference between the offer price per common share outstanding and the target firm's stock price four weeks before the acquisition announcement. Analysts also include all synergies in their cash flow forecast (presented in the above income statement and balance sheet) and valuation multiples (presented below). How much should each of TAR's share of common equity be worth using each of the three following valuation methods: (1) the discounted cash flow method, (2) the valuation multiple method, and (3) the comparable transaction method? Please write all $ figures in thousands, except for per share data