Answered step by step

Verified Expert Solution

Question

1 Approved Answer

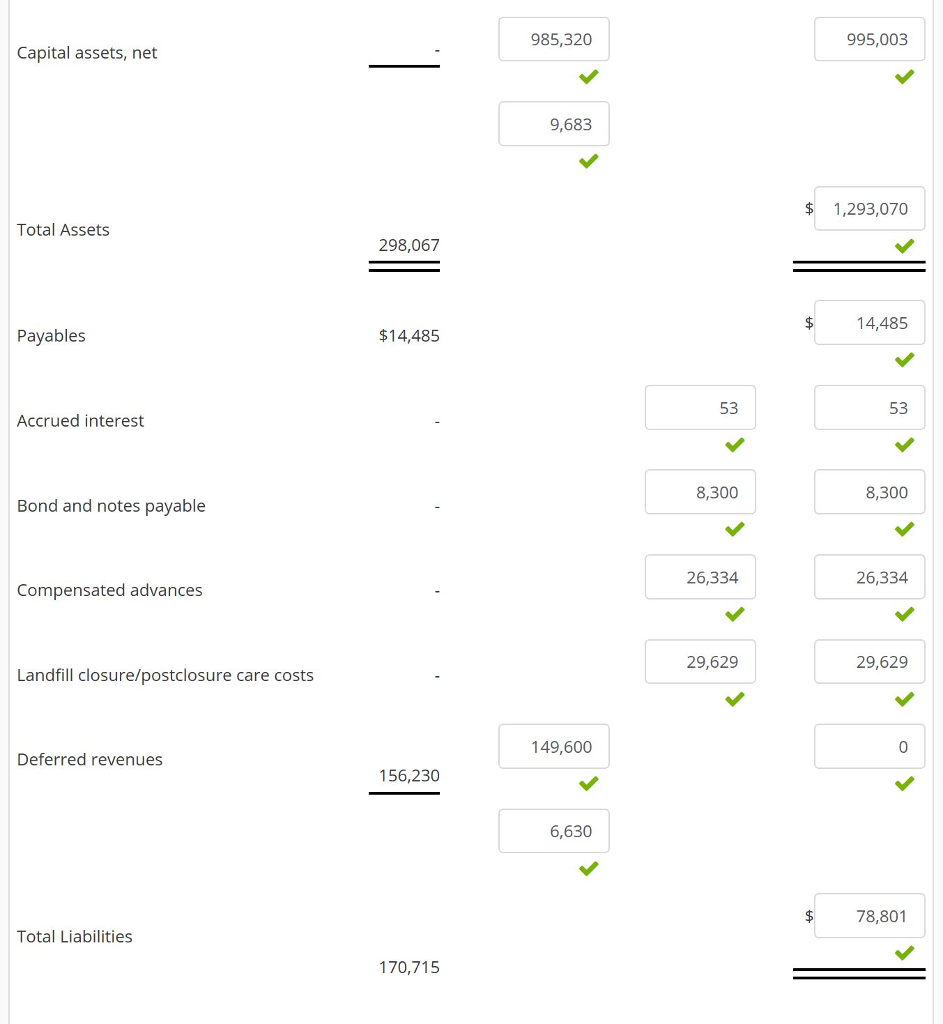

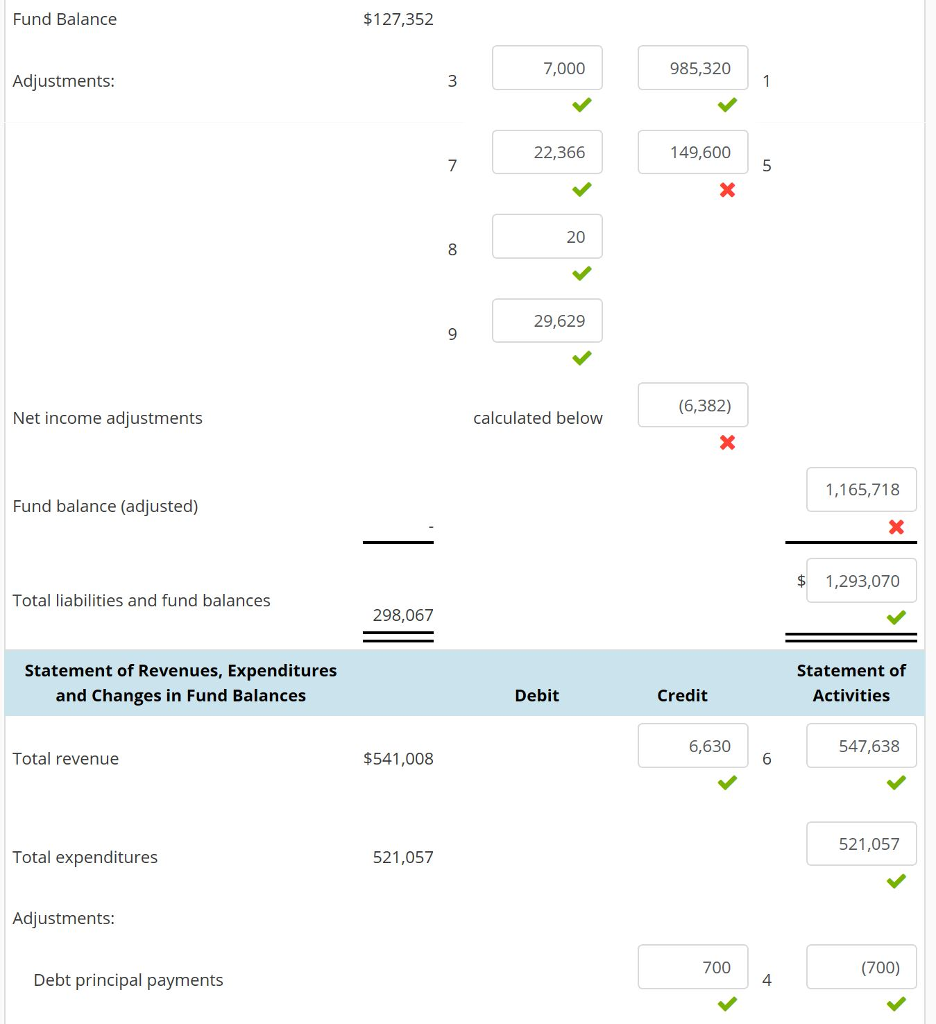

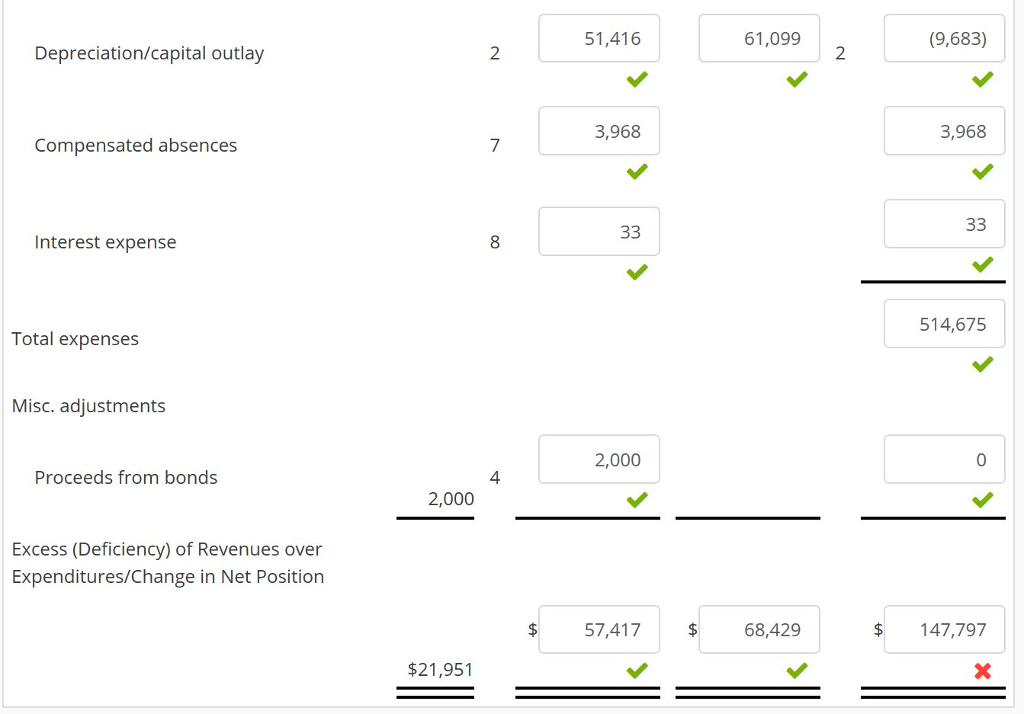

Please help me to understand the last few values I couldn't get correct and why--thank you! Reconciliations required to yield government-wide financial statements from fund

Please help me to understand the last few values I couldn't get correct and why--thank you!

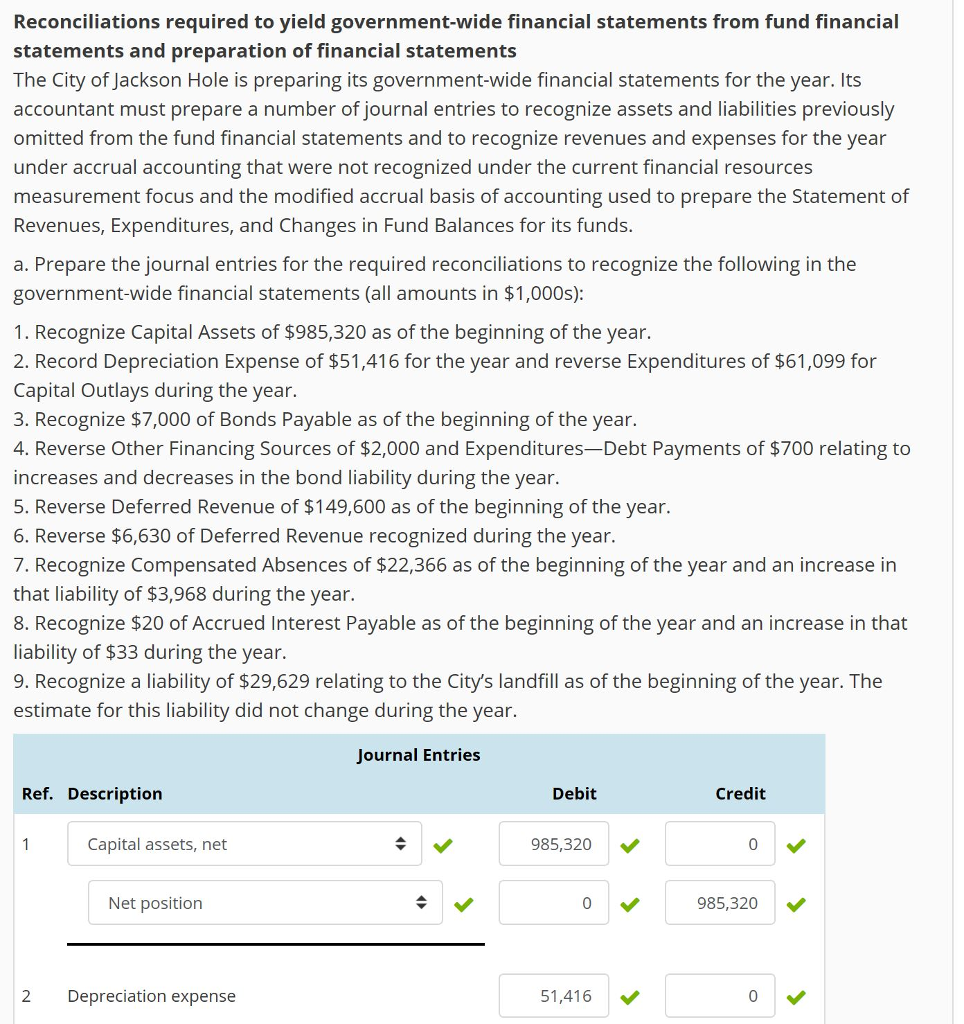

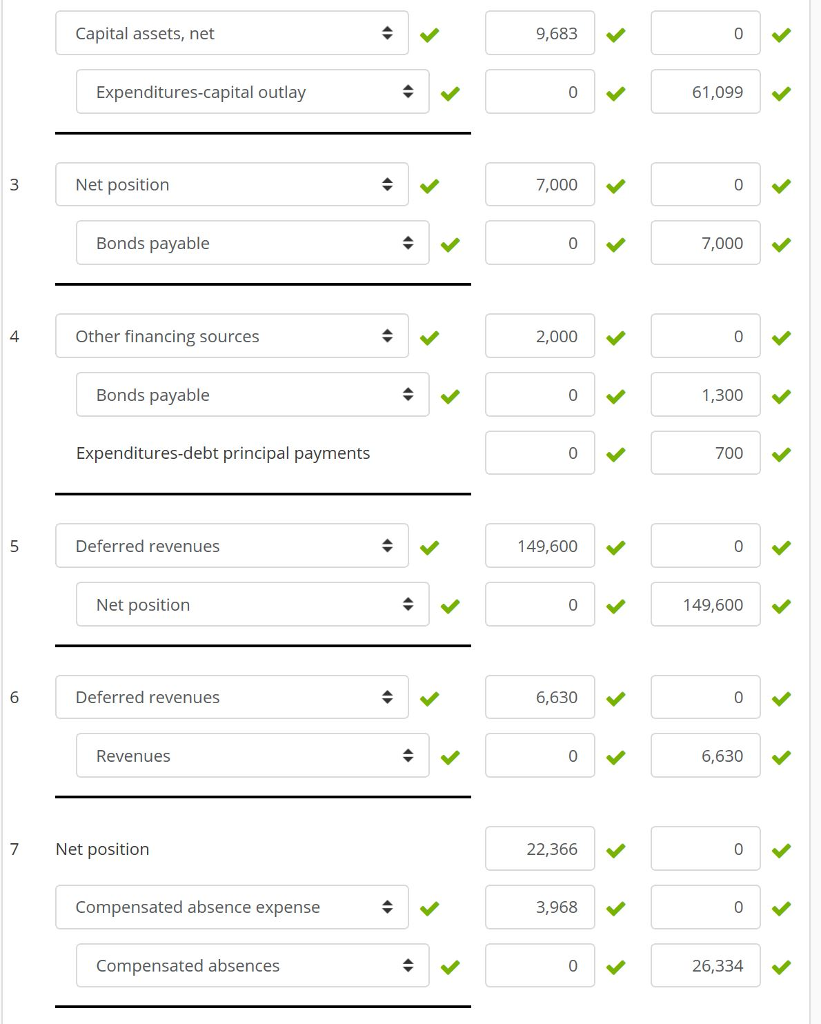

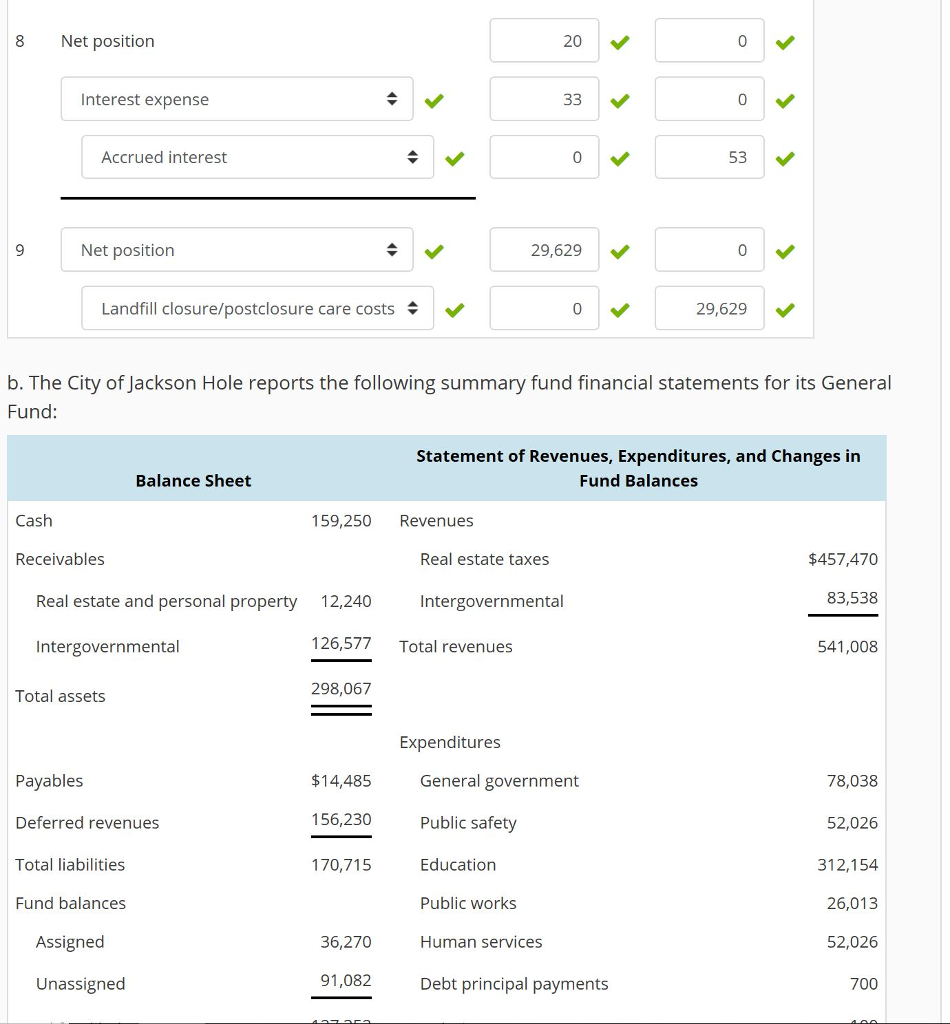

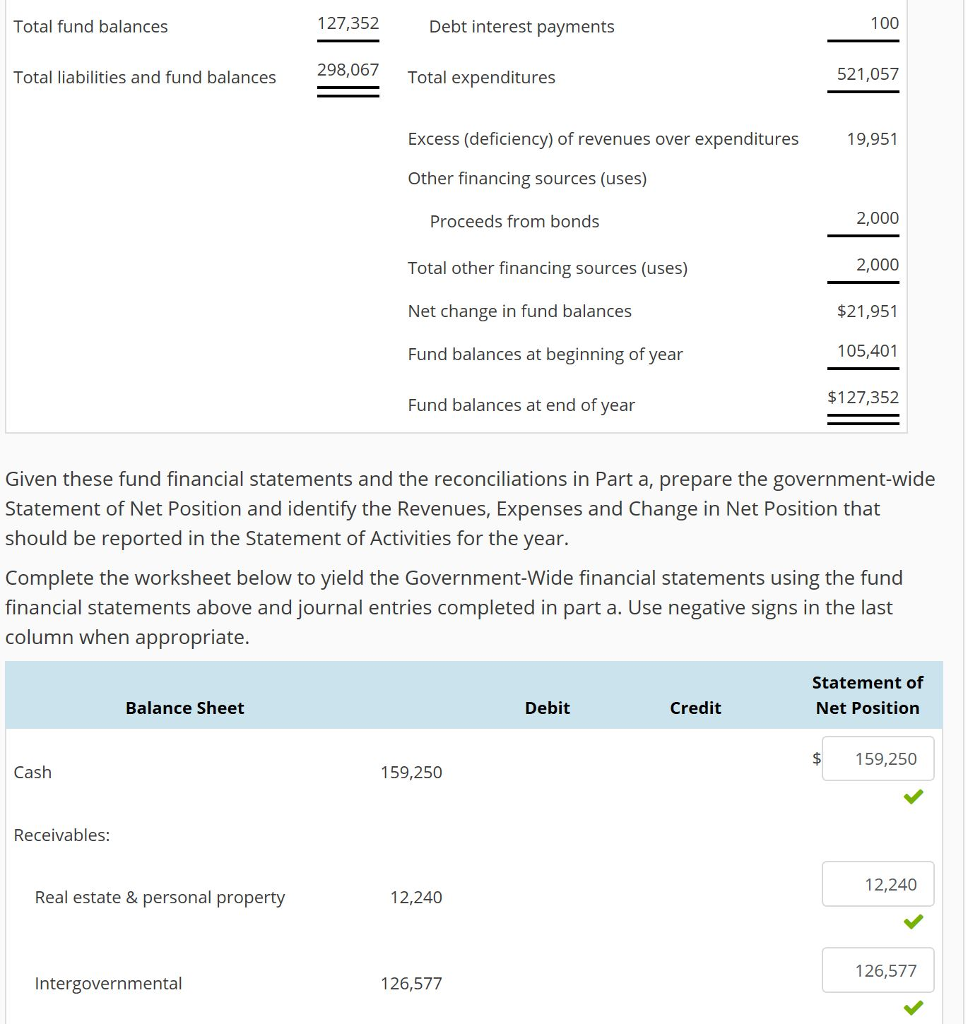

Reconciliations required to yield government-wide financial statements from fund financial statements and preparation of financial statement:s The City of Jackson Hole is preparing its government-wide financial statements for the year. Its accountant must prepare a number of journal entries to recognize assets and liabilities previously omitted from the fund financial statements and to recognize revenues and expenses for the year under accrual accounting that were not recognized under the current financial resources measurement focus and the modified accrual basis of accounting used to prepare the Statement of Revenues, Expenditures, and Changes in Fund Balances for its funds. a. Prepare the journal entries for the required reconciliations to recognize the following in the government-wide financial statements (all amounts in $1,000s) 1. Recognize Capital Assets of $985,320 as of the beginning of the year. 2. Record Depreciation Expense of $51,416 for the year and reverse Expenditures of $61,099 for Capital Outlays during the year. 3. Recognize $7,000 of Bonds Payable as of the beginning of the year. 4. Reverse Other Financing Sources of $2,000 and Expenditures-Debt Payments of $700 relating to increases and decreases in the bond liability during the year. 5. Reverse Deferred Revenue of $149,600 as of the beginning of the year. 6. Reverse $6,630 of Deferred Revenue recognized during the year. 7. Recognize Compensated Absences of $22,366 as of the beginning of the year and an increase in that liability of $3,968 during the year. 8. Recognize $20 of Accrued Interest Payable as of the beginning of the year and an increase in that liability of $33 during the year. 9. Recognize a liability of $29,629 relating to the City's landfill as of the beginning of the year. The estimate for this liability did not change during the year. Journal Entries Ref. Description Debit Credit Capital assets, net 985,320 0 Net position 985,320 2 Depreciation expense 51,416 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started