Please, help me tocaolvw the wrong answers.

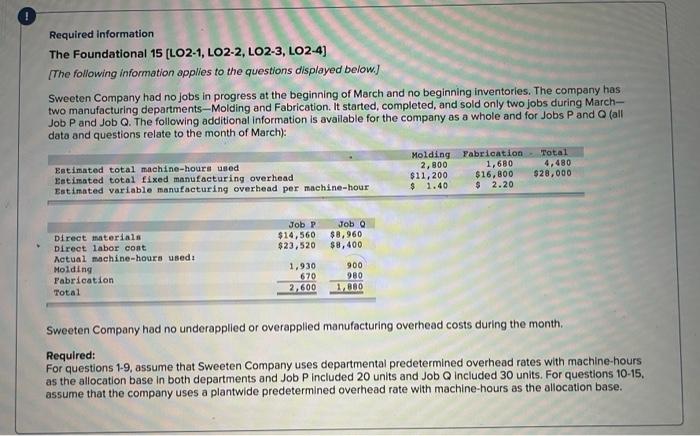

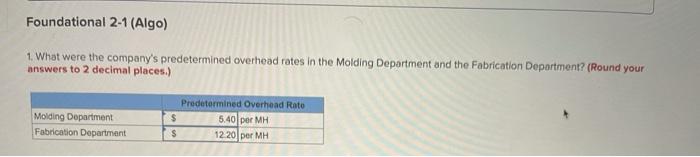

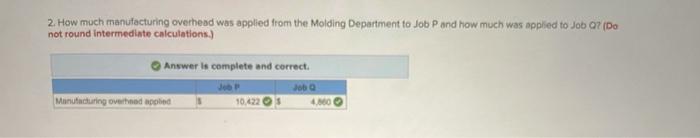

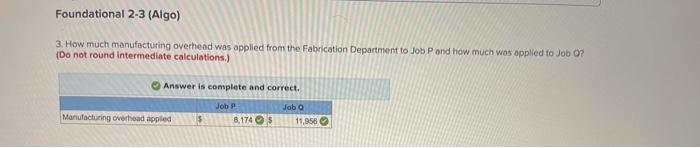

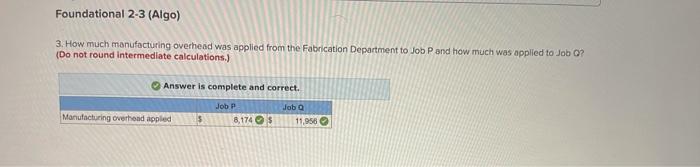

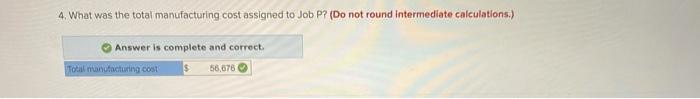

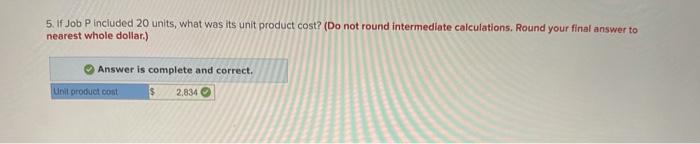

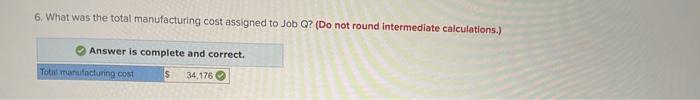

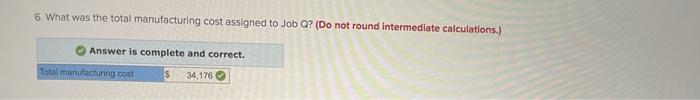

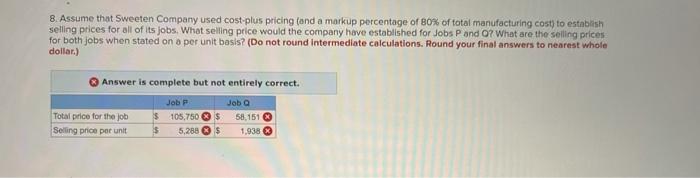

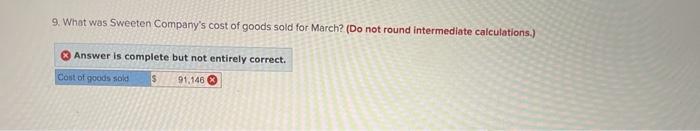

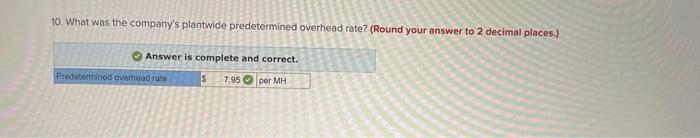

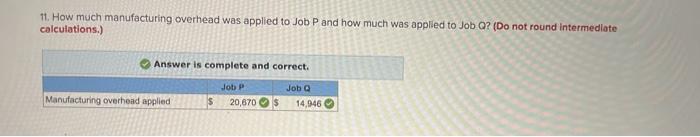

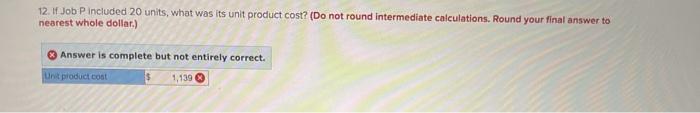

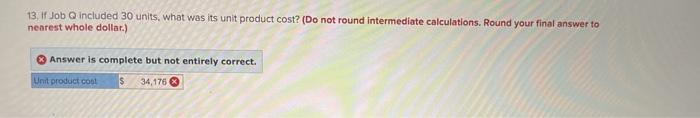

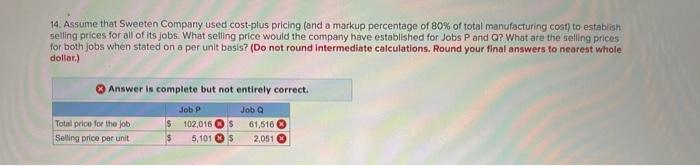

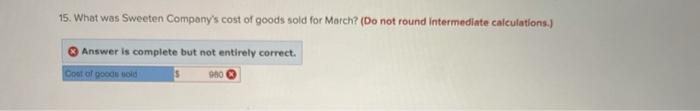

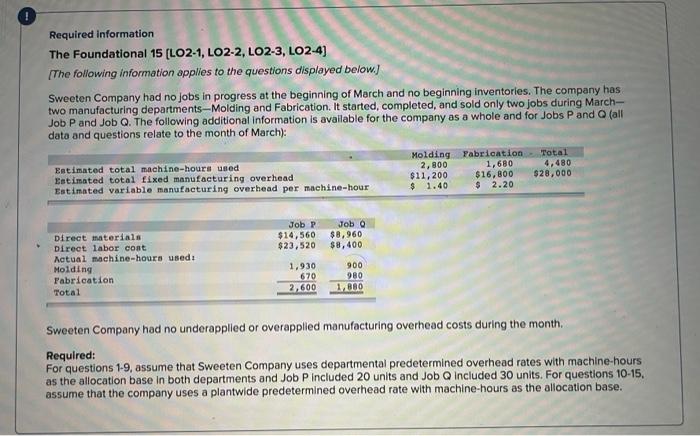

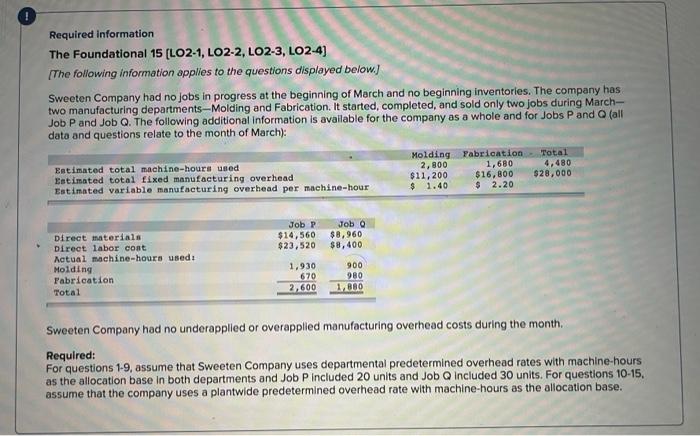

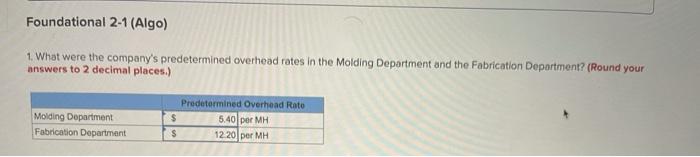

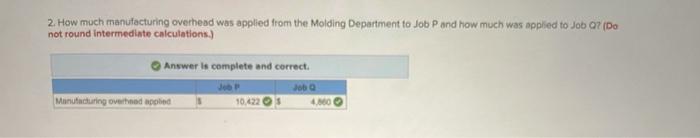

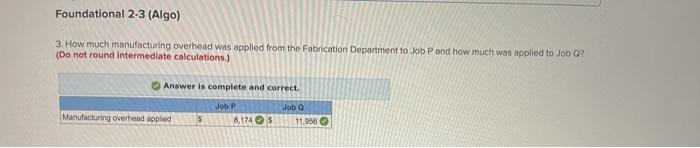

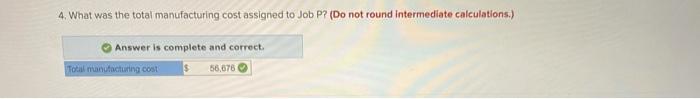

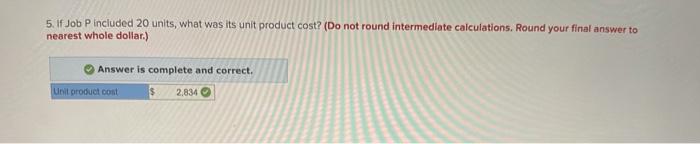

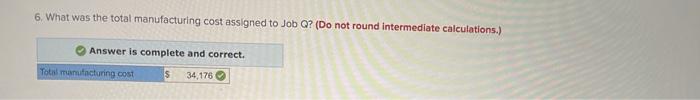

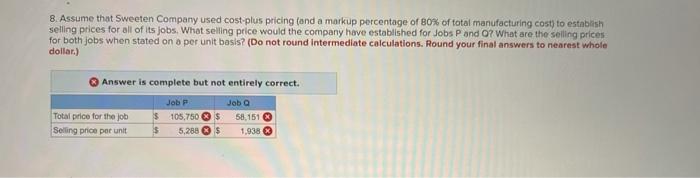

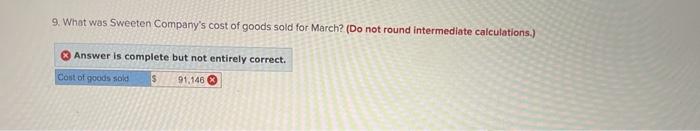

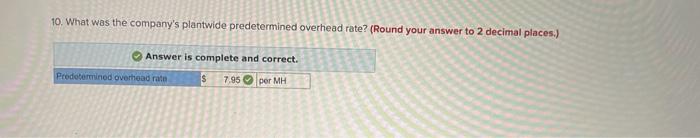

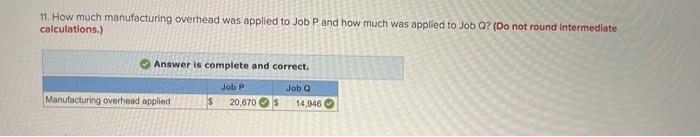

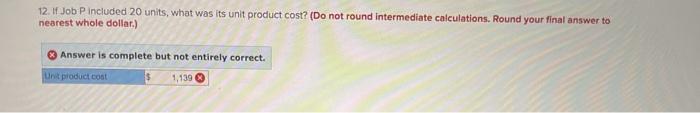

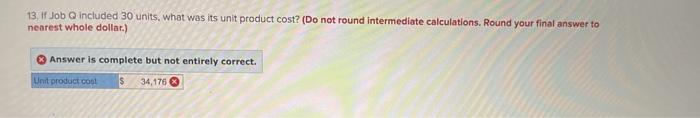

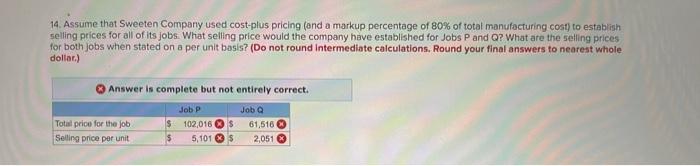

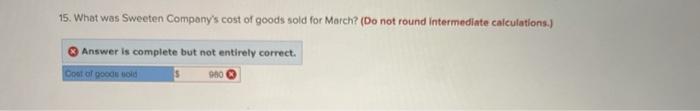

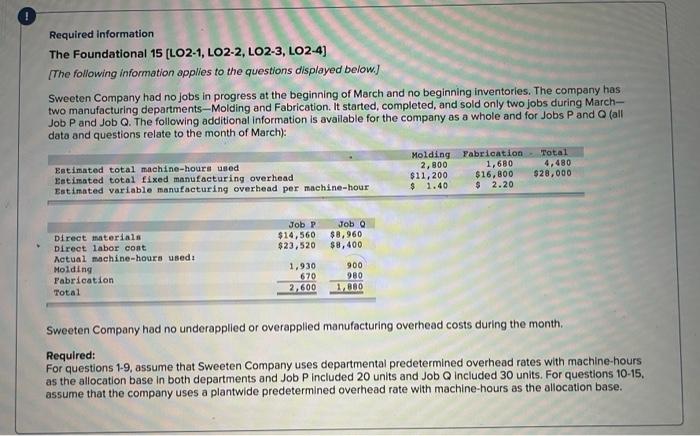

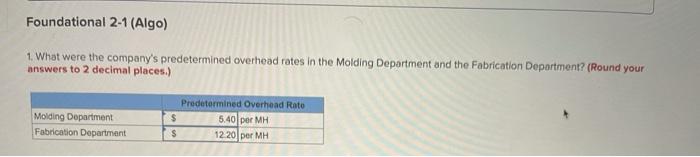

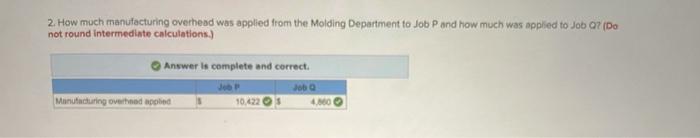

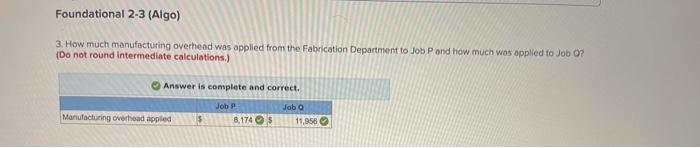

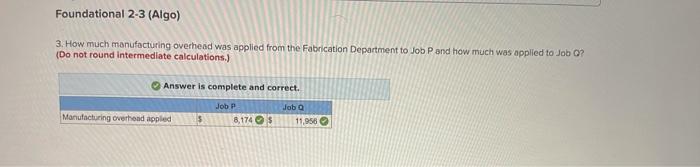

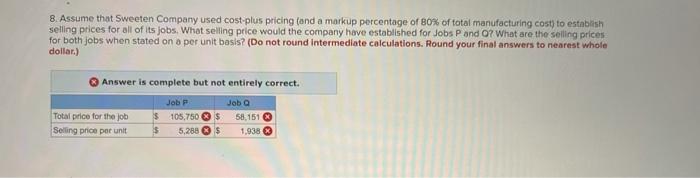

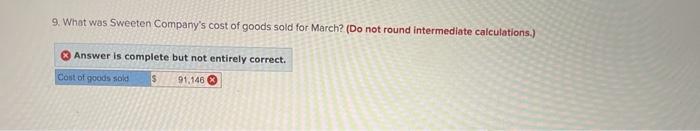

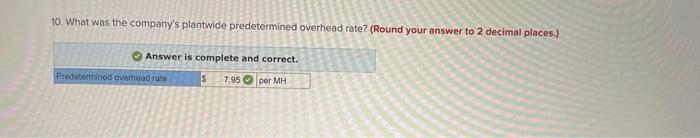

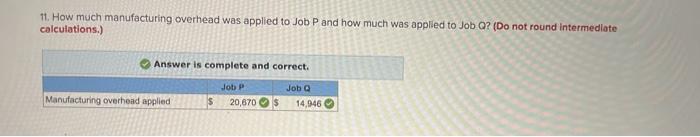

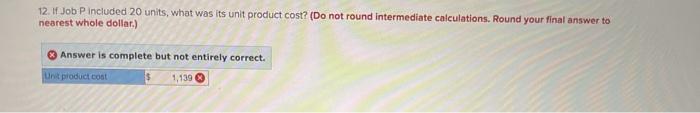

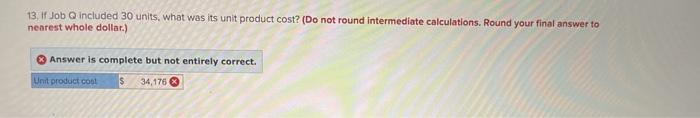

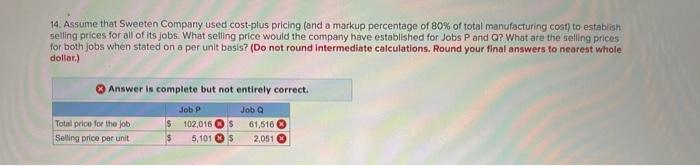

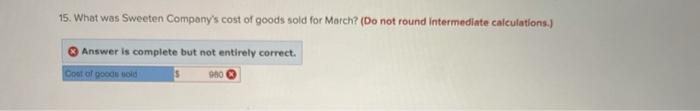

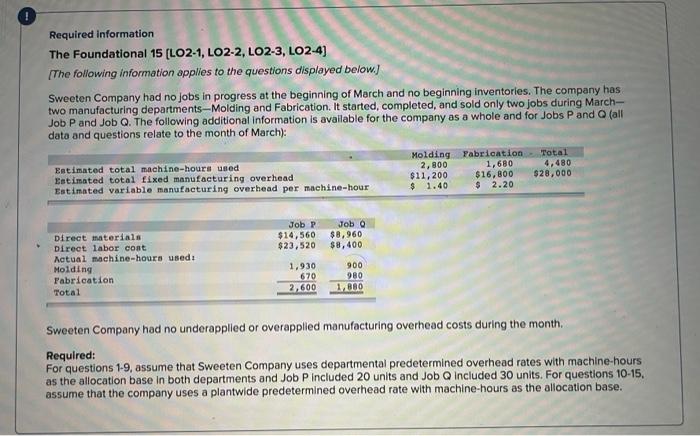

! Required information The Foundational 15 [LO2-1, LO2-2, LO2-3, LO2-4) [The following information applies to the questions displayed below.) Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during March- Job P and Job Q. The following additional Information is available for the company as a whole and for Jobs P and (all data and questions relate to the month of March): Molding Fabrication - Total Estimated total machine-hours used 2,800 1,680 4,480 Estimated total fixed manufacturing overhead $11,200 $16,800 $28,000 Estimated variable manufacturing overhead per machine-hour $ 1.40 $ 2.20 Job P $14,560 $23,520 Job O $8,960 $8,400 Direct materials Direct labor cont Actual machine-hours used: Molding Fabrication Total 1,930 670 2,600 900 980 1. BRO Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-9, assume that Sweeten Company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments and Job P Included 20 units and Job Q included 30 units. For questions 10-15 assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. Foundational 2-1 (Algo) 1. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Department? (Round your answers to 2 decimal places.) Molding Department Fabrication Department Predetermined Overhead Rato $ 5.40 per MH $ 12 20 per MH 2. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job 07 (Do not round intermediate calculations.) Answer is complete and correct Job 10.622 Manufacturing overade Foundational 2-3 (Algo) 3. How much manufacturing overhead was applied from the Fabrication Department to Job Pond how much was applied to Job O? (Do not round Intermediate calculations.) Answer is complete and correct. Manufacturing overhead applied Job P 8,174 Job 11,958 Foundational 2-3 (Algo) 3. How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job ? (Do not round Intermediate calculations.) Answer is complete and correct. Job Manufacturing overhond applied 5 Job P 8,174 11,958 4. What was the total manufacturing cost assigned to Job ? (Do not round Intermediate calculations.) Answer is complete and correct Total manufacturing cost 56,076 5. If Job P included 20 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Answer is complete and correct. Unit product cont 2.834 6. What was the total manufacturing cost assigned to Job Q? (Do not round intermediate calculations.) Answer is complete and correct. Total manufacturing cost $ 34,176 6. What was the total manufacturing cost assigned to Job Q? (Do not round intermediate calculations.) Answer is complete and correct. Total manufacturing cost $ 34,176 8. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing costs to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and O? What are the selling prices for both jobs when stated on a per unit basis? (Do not round intermediate calculations. Round your final answers to nearest whole dollar) Answer is complete but not entirely correct. Job P Job Total price for the job $ 105,750 $ 58,151 Selling price per unit $ 5,288 * $ 1.9383 9. What was Sweeten Company's cost of goods sold for March? (Do not round intermediate calculations.) Answer is complete but not entirely correct. Cost of goods sold S 91,146 10. What was the company's plantwide predetermined overhead rate? (Round your answer to 2 decimal places.) Answer is complete and correct. Predetermined overhead rata S 7.95 per MH 11. How much manufacturing overhead was applied to Job P and how much was applied to Job Q? (Do not round Intermediate calculations.) Answer is complete and correct. Manufacturing overhead applied Job P 20,670 $ Job 14,946 $ 12. If Job Pincluded 20 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Answer is complete but not entirely correct. Unit ploduct cost 1,139 13. Job Q included 30 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Answer is complete but not entirely correct. Unit product cool S 34,176 14. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? (Do not round Intermediate calculations. Round your final answers to nearest whole dollar) Answer is complete but not entirely correct. Job P Job Total price for the job $ 102,016 $ 61,516 Selling price per unit $ 5,101 $ 2,051 15. What was Sweeten Company's cost of goods sold for March? (Do not round Intermediate calculations.) Answer is complete but not entirely correct. Coot of good old 980