Please help me understand how to figure out this problem.

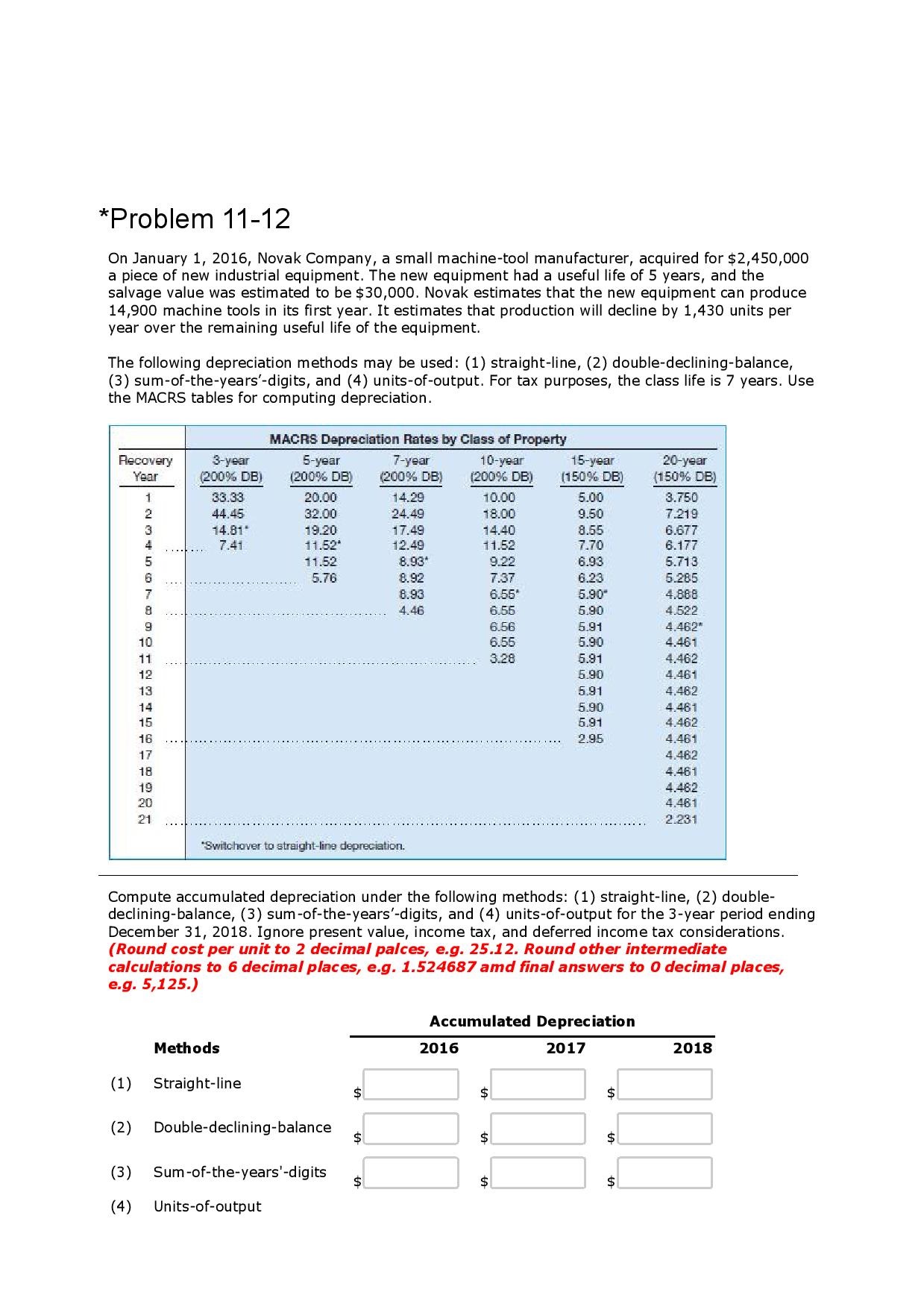

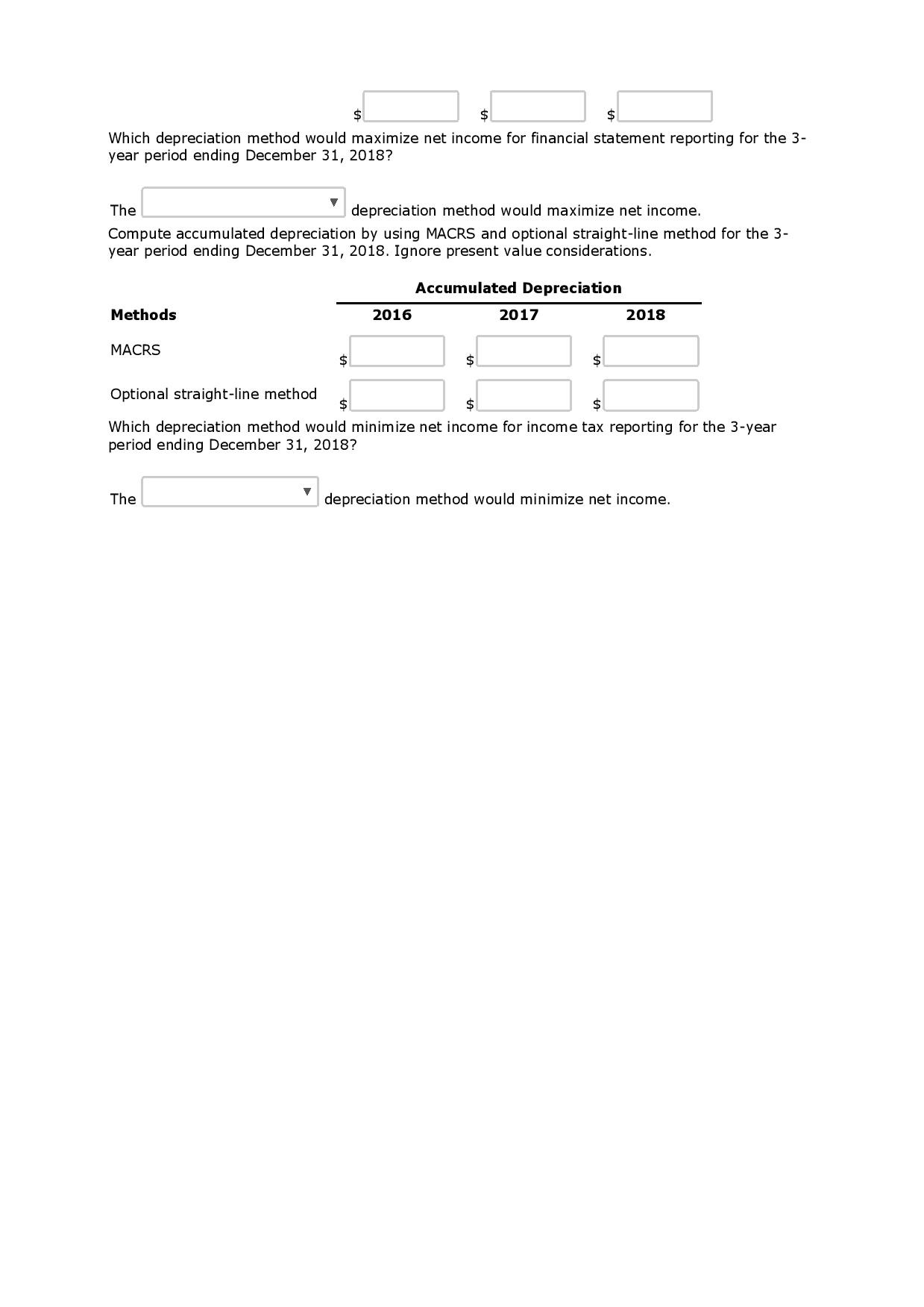

Problem 11 - 12 On January 1 , 2016 Novak Company , a small machine tool manufacturer , acquired for $ 2 450,000 a piece of new industrial equipment . The new equipment had a useful life of 5 years , is , and the salvage value was estimated to be $ 30 000 . Novak estim imates that the new equipment can produce 14 , 900 machine tools in its first year . It estimates that production will decline by 1 430 units be year over the remaining useful life of the equipment The following depreciation methods may be u ay be used : ( 1 ) straight - line , ( 2 ) double - declining - balance , ( 3 ) sum of the years - digits , 5 - digits , and ( 4 ) units - of - output . For tax pur tax purposes , the class life is 7 years . Use the MACRS tables for computing depreciation loss of Property Recovery ( 20 065 DE ) (2001 6 DB ) ( 20 09 6 DB1 12009 6 DB ) ( 150 2 6 DB ) my MOMS Depreciation rates By Class of Property 503 DBI Switchover to straight - line depreciation . Compute accumulated depreciation under the following me following methods : ( 1 ) straight - line , ( 2 ) double - declining - balance , ( 3 ) sum of the - years digits , igits , and ( 4 ) units - of - output for the 3 - year period ending December 31 , 2018 . Ignore present value , income tax , and deferred income tax considerations ( Round cost per unit to 2 decimal paices , e.g . 25 . 12 . Round other interm calculations to 6 decimal places , e . g 1 . 524687 aid final answers to decimal places , e . 9 5 , 125 . ) ccumulated Depreciation Methods ( 1 ) Straight - line ( 2 ) Double- declining - balance ( 3 ) Sum of the - years digits ( 4 ) Units of -output$ $ Which depreciation method would maximize net income for financial statement reporting for the 3- year period ending December 31, 2018? The depreciation method would maximize net income. Compute accumulated depreciation by using MACRS and optional straight-line method for the 3- year period ending December 31, 2018. Ignore present value considerations. Accumulated Depreciation Methods 2016 2017 2018 MACRS $ Optional straight-line method Which depreciation method would minimize net income for income tax reporting for the 3-year period ending December 31, 2018? The depreciation method would minimize net income