Answered step by step

Verified Expert Solution

Question

1 Approved Answer

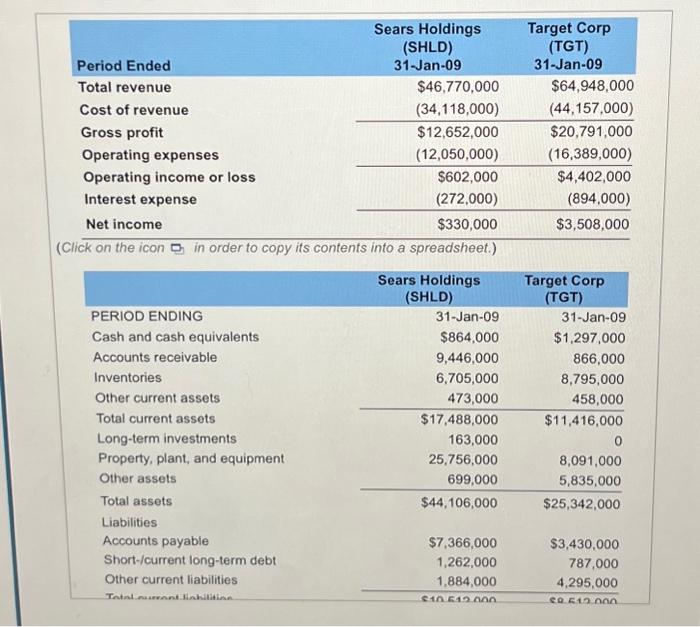

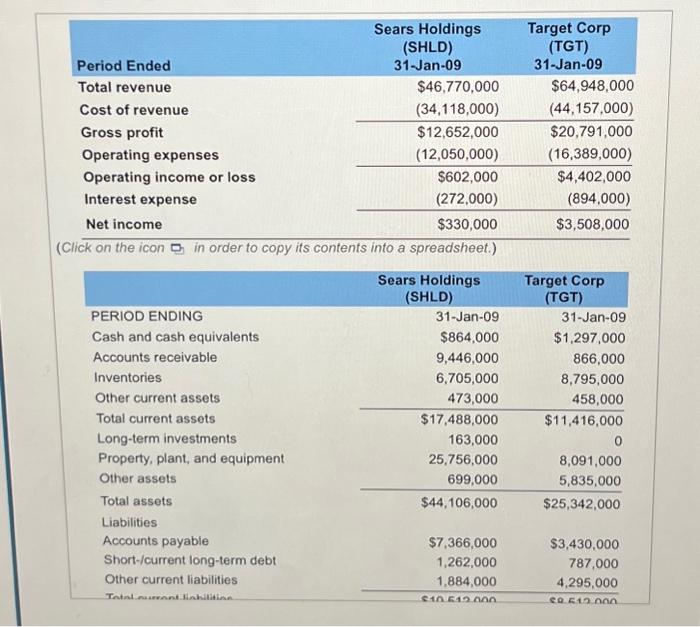

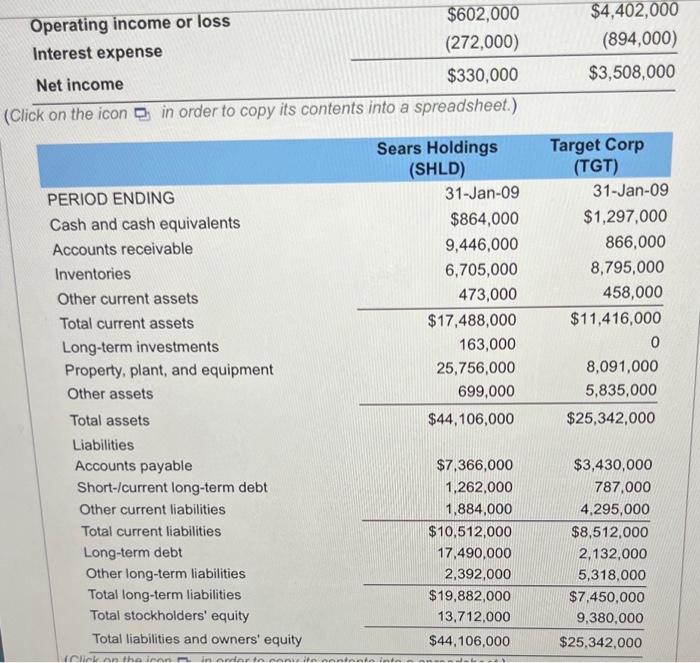

please help me understand how to make these calculations. liquidity ratios- capitail structure ratios - Asset Management Efficiency Ratios- profitability ratio- begin{tabular}{lrr|} hline Period Ended

please help me understand how to make these calculations.

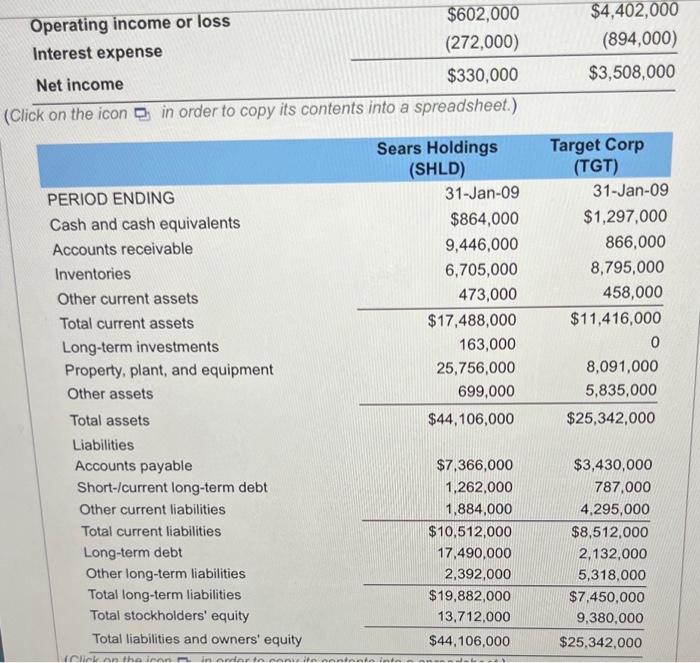

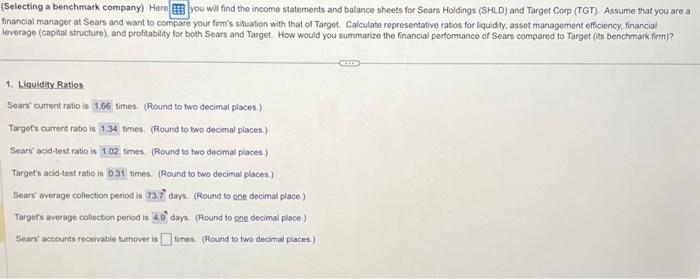

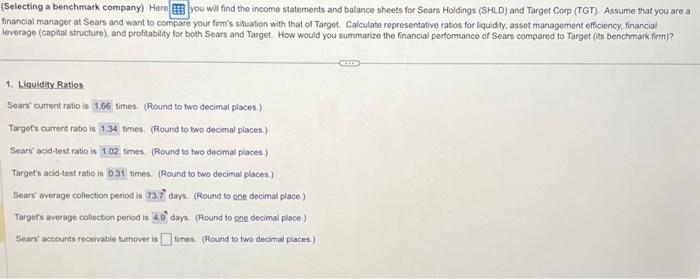

\begin{tabular}{lrr|} \hline Period Ended & SearsHoldings(SHLD)31-Jan-09 & \multicolumn{1}{c}{TargetCorp(TGT)} \\ 31-Jan-09 \end{tabular} (Click on the icon in order to copy its contents into a spreadsheet.) (Selecting a benchmark company) Here you wil find the income statements and balance sheets for Sears Holdings (SHL.D) and Targot Corp (TGT). Assume that you are a financial manager at Sears and want to compare your firm's situation with that of Target. Calculate representative ratios for liquidity, asset management efficioncy, financial leverage (capital structure), and profitability for both Sears and Target. How would you summarize the financial performance of Sears compared to Target (its benchmark firm)? 1. Liquidity Ratios Sears current ratio is limes. (Round to two decimal places.) Target's current ratio is times. (Round to two decimal places.) Sears' acid-test ratio is tmes. (Round to two decimal places) Targets acid-test ratio is times. (Round to two decimal places.) Sears' average collection period is days. (Round to ene decimal place.) Tarpers average collection period is days. (Round to ene decimal place.) Sears' acoounts receivable tumover is times. (Round to two decimal places.) liquidity ratios-

capitail structure ratios -

Asset Management Efficiency Ratios-

profitability ratio-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started