Answered step by step

Verified Expert Solution

Question

1 Approved Answer

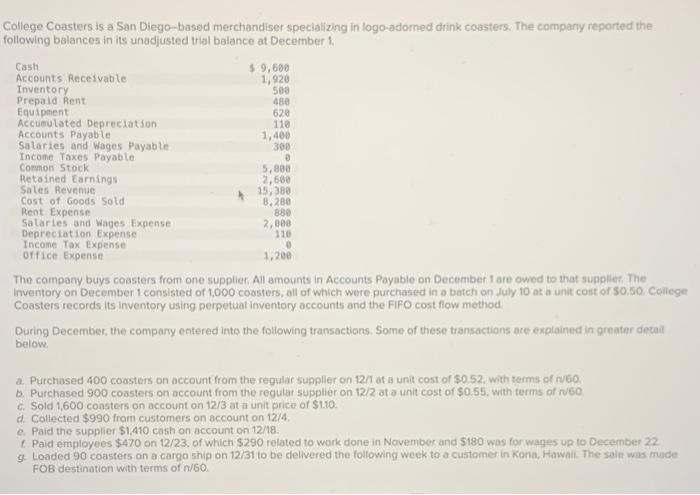

PLEASE HELP ME UNDERSTAND WHAT I GOT WRONG WITH EXPLANATION OF CORRECTED AMSWER 500 620 300 College Coasters is a San Diego-based merchandiser specializing in

PLEASE HELP ME UNDERSTAND WHAT I GOT WRONG WITH EXPLANATION OF CORRECTED AMSWER

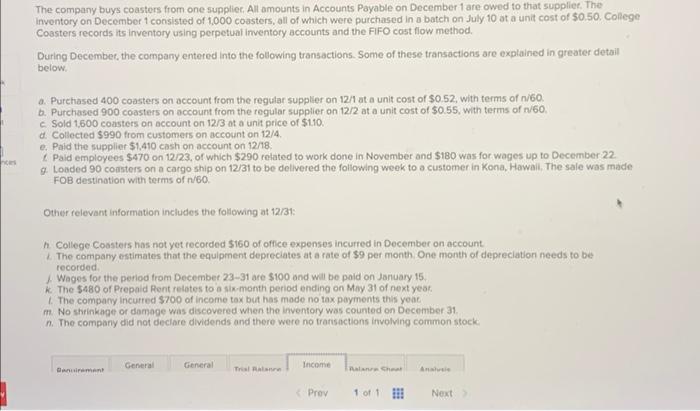

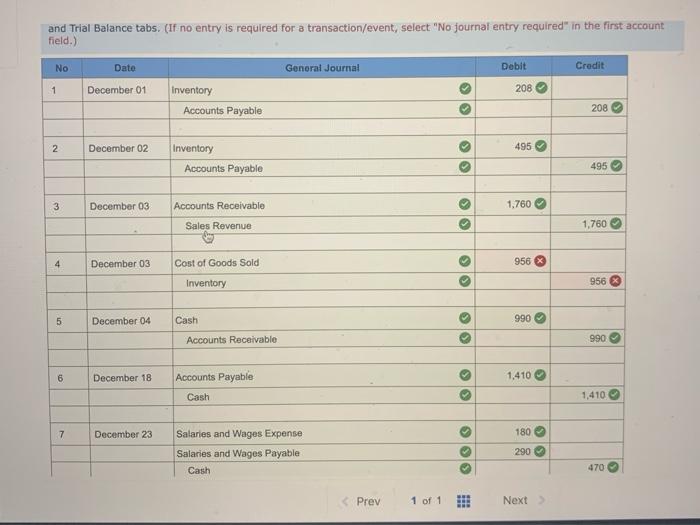

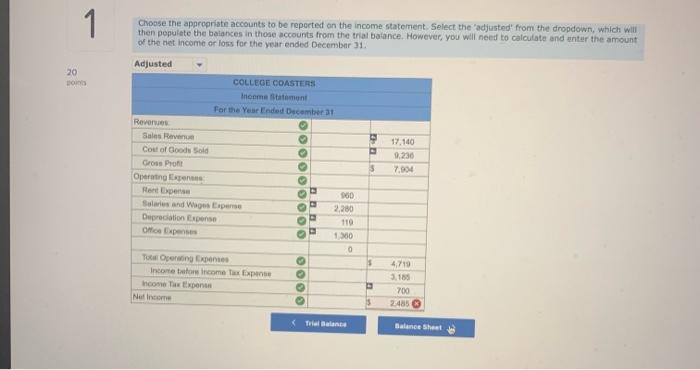

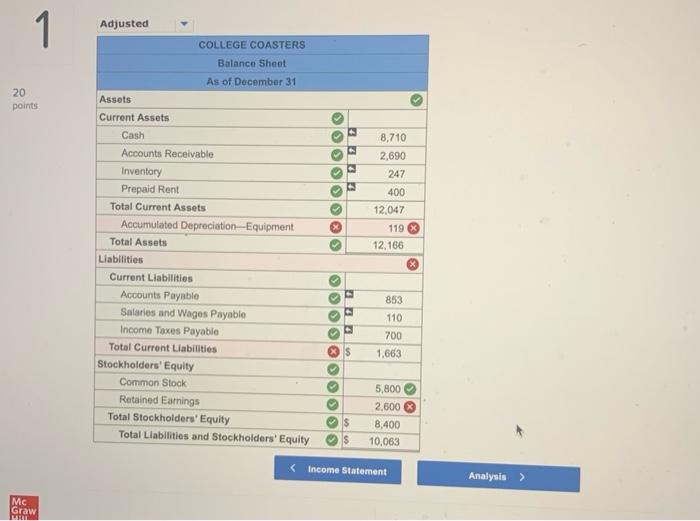

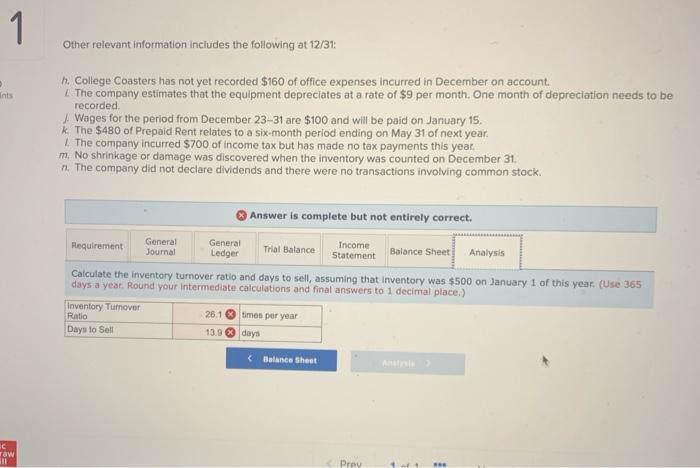

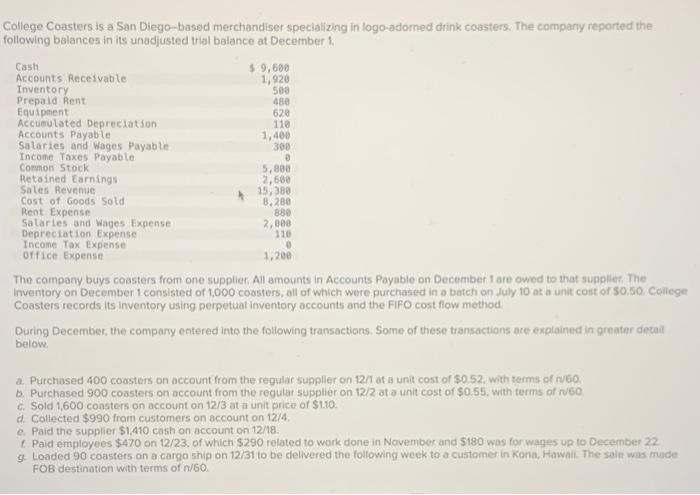

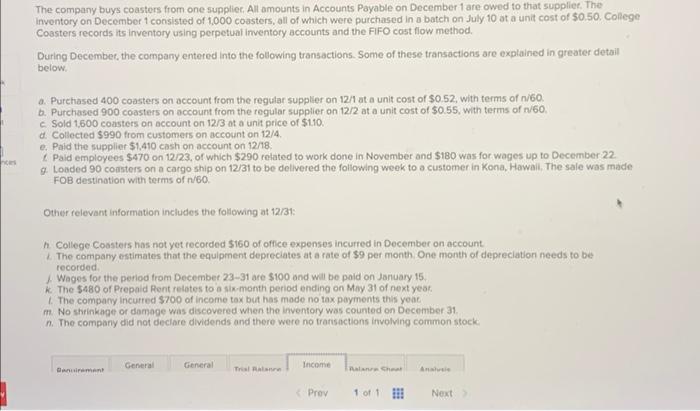

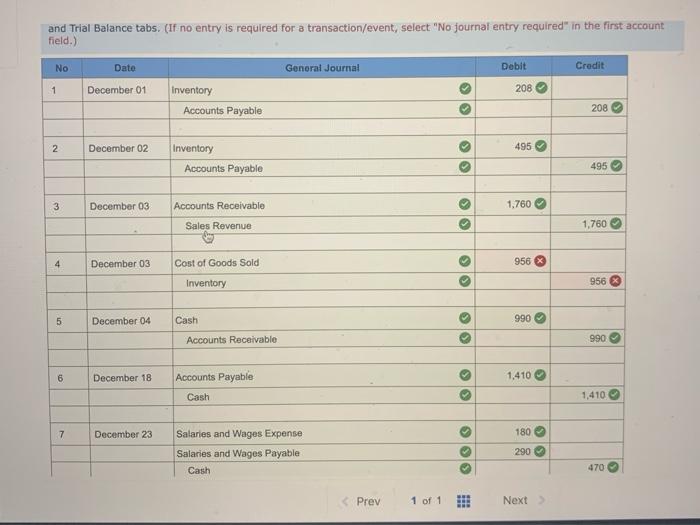

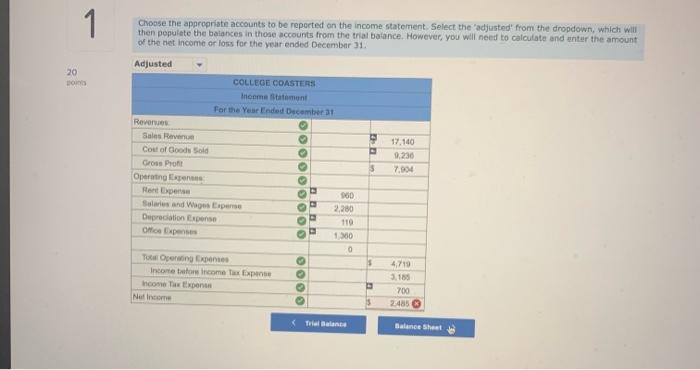

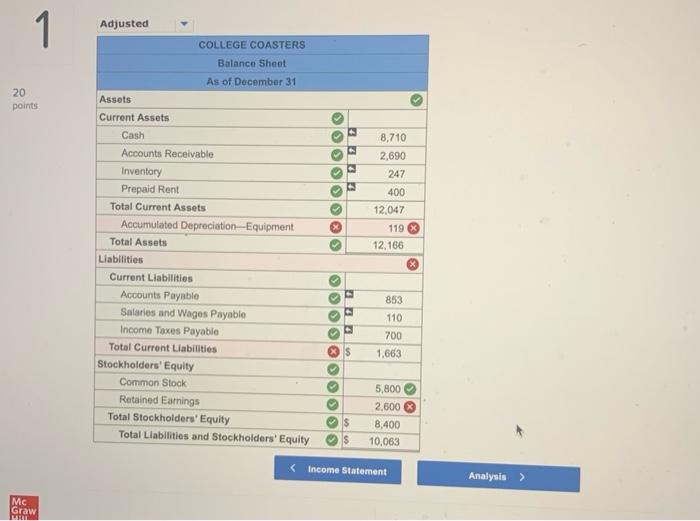

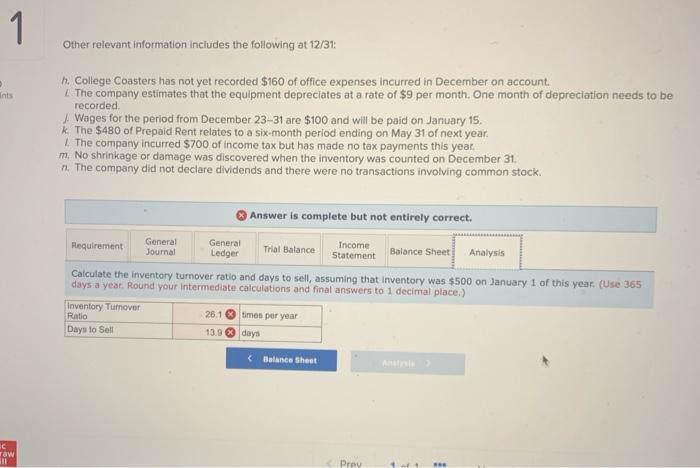

500 620 300 College Coasters is a San Diego-based merchandiser specializing in logo-adorned drink coasters. The company reported the following balances in its unadjusted trial balance at December 1, Cash $ 9,600 Accounts Receivable 1,920 Inventory Prepaid Rent 480 Equipment Accumulated Depreciation 110 Accounts Payable 1,400 Salaries and Wages Payable Income Taxes Payable Common Stock 5,800 Retained Earnings 2,600 Sales Revenue 15,380 Cost of Goods Sold 8.280 Rent Expense 880 Salaries and Wages Expense 2.000 Depreciation Expense Income Tax Expense Office Expense 1,200 The company buys coasters from one supplier. All amounts in Accounts Payable on December 1 are owed to that supplier. The Inventory on December 1 consisted of 1,000 coasters, all of which were purchased in a batch on July 10 at a unit cost of $0,50. College Coasters records its inventory using perpetual inventory accounts and the FIFO cost flow method During December, the company entered into the following transactions. Some of these transactions are explained in greator detail below 110 a. Purchased 400 coasters on account from the regular supplier on 12/1 at a unit cost of $0 52. with terms of 1/60 b. Purchased 900 coasters on account from the regular supplier on 12/2 at a unit cost of $0.55, with terms of r450, cSold 1600 coasters on account on 12/3 at a unit price of $110. d. Collected $990 from customers on account on 12/4 e Paid the supplier $1,410 cash on account on 12/18, Paid employees $470 on 12/23, of which $290 related to work done in November and $180 was for wages up to December 22 g Loaded 90 coasters on a cargo ship on 12/31 to be delivered the following week to a customer in Kona, Hawall. The sale was rude FOB destination with terms of n/60 The company buys coasters from one supplier All amounts in Accounts Payable on December 1 are owed to that supplier, The Inventory on December 1 consisted of 1,000 coasters, all of which were purchased in a batch on July 10 ot a unit cost of $0.50. College Coasters records its inventory using perpetual inventory accounts and the FIFO cost flow method. During December, the company entered into the following transactions. Some of these transactions are explained in greater detail below a. Purchased 400 coasters on account from the regular supplier on 12/1 at a unit cost of $0.52, with terms of n/60 b. Purchased 900 coasters on account from the regular supplier on 12/2 at a unit cost of $0.55. with terms of 1/60 Sold 1,500 coasters on account on 12/3 ot a unit price of $110. d: Collected $990 from customers on account on 12/4 e. Paid the supplier $1,410 cash on account on 12/18 Paid employees $470 on 12/23, of which $290 related to work done in November and $180 was for wages up to December 22 Loaded 90 comters on a cargo ship on 12/31 to be delivered the following week to a customer in Kona, Hawaii, The sale was made FOB destination with terms of n/60 Other relevant information includes the following at 12/31 n College Coasters has not yet recorded $160 of office expenses incurred in December on account The company estimates that the equipment depreciates at a rate of $9 per month One month of depreciation needs to be recorded Wages for the period from December 23-31 are $100 and will be paid on January 15, k The 5480 of Prepold Rent relates to a six-month period ending on May 31 of next year The company incurred $700 of income tax but has made no tax payments this year m. No shrinkage or damage was discovered when the inventory was counted on December 31 n. The company did not declare dividends and there were no transactions involving common stock General General Income Tala Chat & Prov 1 of 1 Next and Trial Balance tabs. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) . No Date General Journal Debit Credit > 1 December 01 208 Inventory Accounts Payable 208 2 December 02 495 Inventory Accounts Payable >S 495 3 December 03 Accounts Receivable 1.760 >S Sales Revenue 1,760 4 December 03 956 Cost of Goods Sold Inventory 956 5 December 04 Cash 990 Accounts Receivable 990 6 December 18 1,410 Accounts Payable Cash 3 1,410 7 December 23 180 Salaries and Wages Expense Salaries and Wages Payable Cash * 290 470 Prev 1 of 1 Next 1 20 Choose the appropriate accounts to be reported on the income statement. Select the 'adjusted from the dropdown, which will then populate the balances in those accounts from the trial balance. However, you will need to calculate and enter the amount of the net income or loss for the year ended December 31 Adjusted COLLEGE COASTERS Inome statement For the Year Ended December 31 Revenue Sales 17.140 Cost of Goods Sold 9.230 Gross Prote 7.904 Operating per Rent Experts 900 Salaries and Wages Expense 2,280 Depreciation Expense 110 Once Expense 10 0 Total Operating Expo 4,719 Income before income Tax Expense 3.185 com per Notice 24853 an OOOOOOOO 000 700 (Tulal Balance Balance Sheet 1 20 $ points 8,710 2.690 247 > Adjusted COLLEGE COASTERS Balance Sheet As of December 31 Assets Current Assets Cash Accounts Receivable Inventory Prepaid Rent Total Current Assets Accumulated Depreciation Equipment Total Assets Liabilities Current Liabilities Accounts Payable Salaries and Wages Payable Income Taxes Payable Total Current Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 400 12,047 119 12.166 . 853 110 700 1.663 $ 000000 5,800 2,600 8,400 10,063 Mc Graw 1 Other relevant information Includes the following at 12/31 Ints h. College Coasters has not yet recorded $160 of office expenses incurred in December on account. The company estimates that the equipment depreciates at a rate of $9 per month. One month of depreciation needs to be Wages for the period from December 23-31 are $100 and will be paid on January 15, k The $480 of Prepaid Rent relates to a six-month period ending on May 31 of next year. 1. The company incurred $700 of income tax but has made no tax payments this year. m. No shrinkage or damage was discovered when the inventory was counted on December 31. 1. The company did not declare dividends and there were no transactions involving common stock Answer is complete but not entirely correct. General General Requirement Income Journal Ledger Trial Balance Balance Sheet Analysis Statement Calculate the inventory tumover ratio and days to sell, assuming that inventory was $500 on January 1 of this year. (Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place.) Inventory Turnover Ratio 26.1 times per year Days to Sell 13.9 days Balance Sheet Taw Prey

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started