Please help me undertstand and complete this project. Directions are in photos. Thank you for your time!

Financial Statement Analysis :

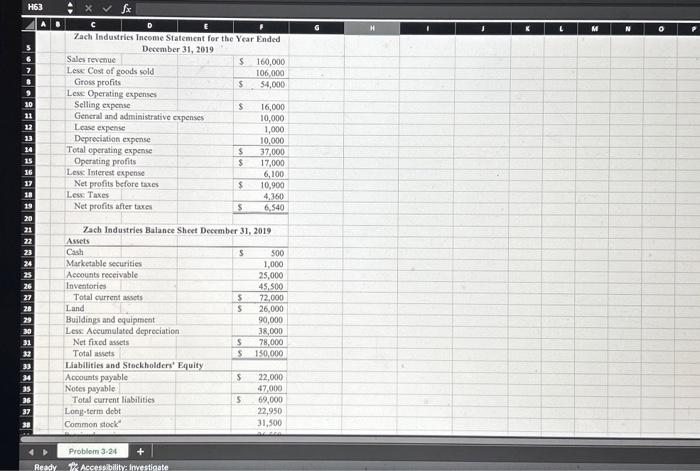

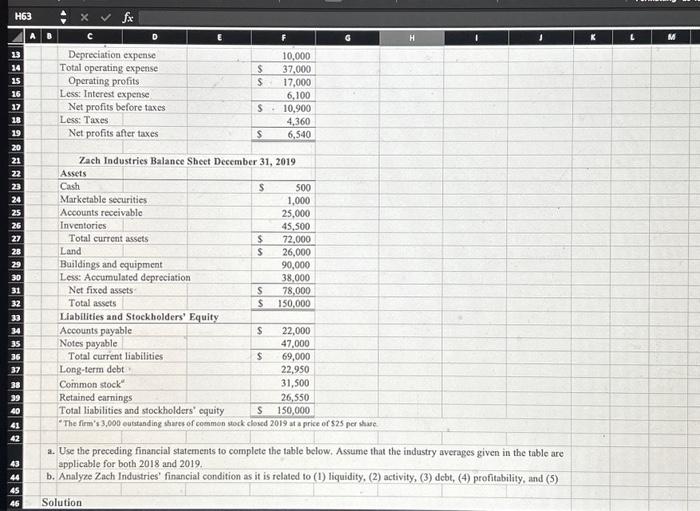

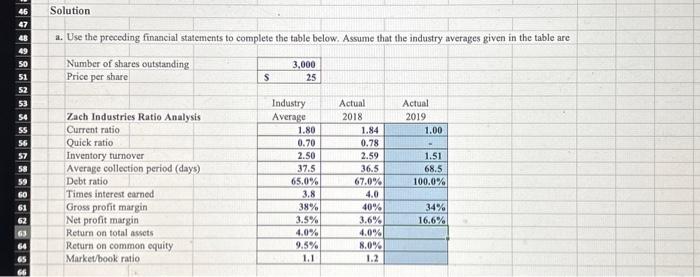

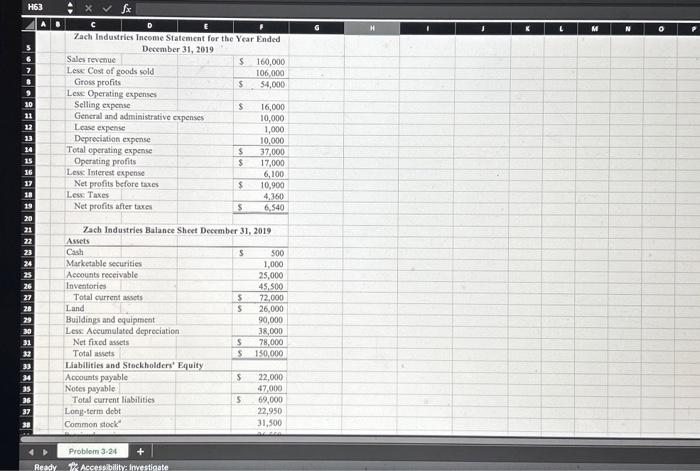

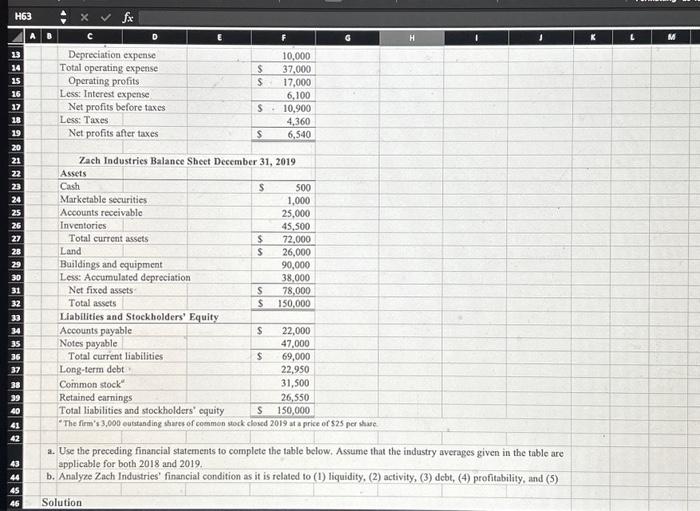

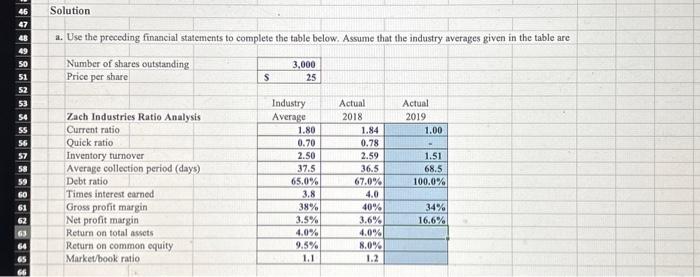

a. use the preceding financial statementd to complete the table below. assume that thr industry averages given in the table are applicable for both 2018 and 2019.

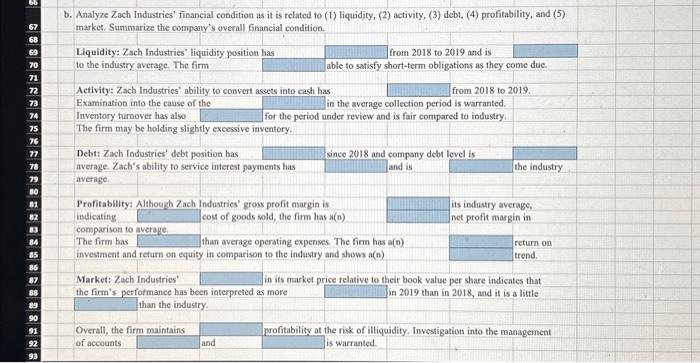

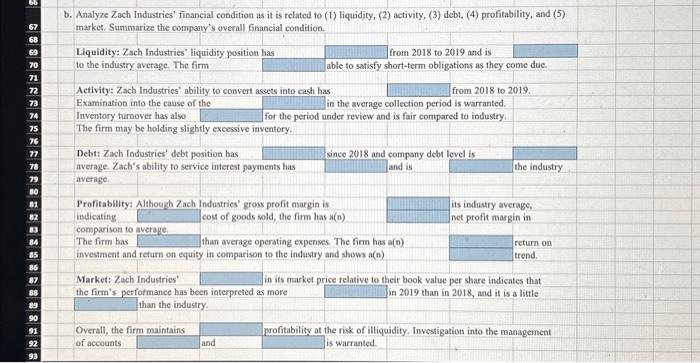

b. Analyze Zach Industries' financial condiyion ad it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5)

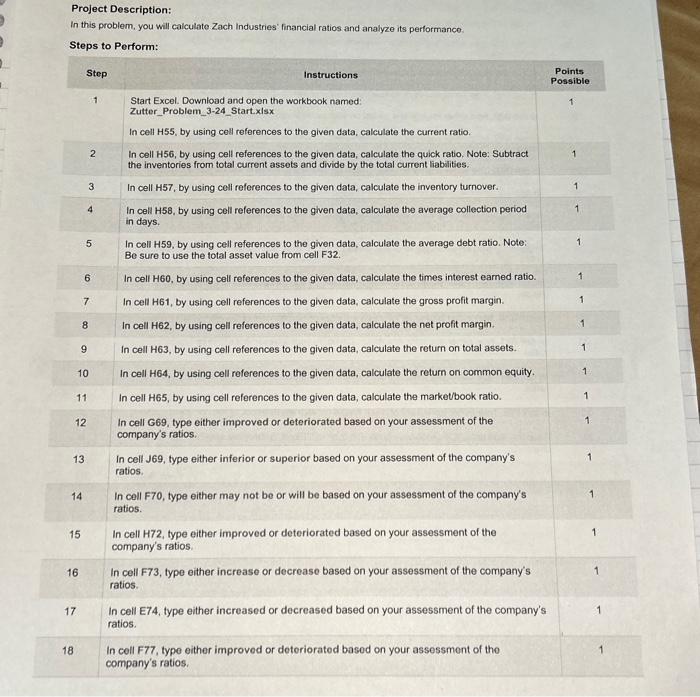

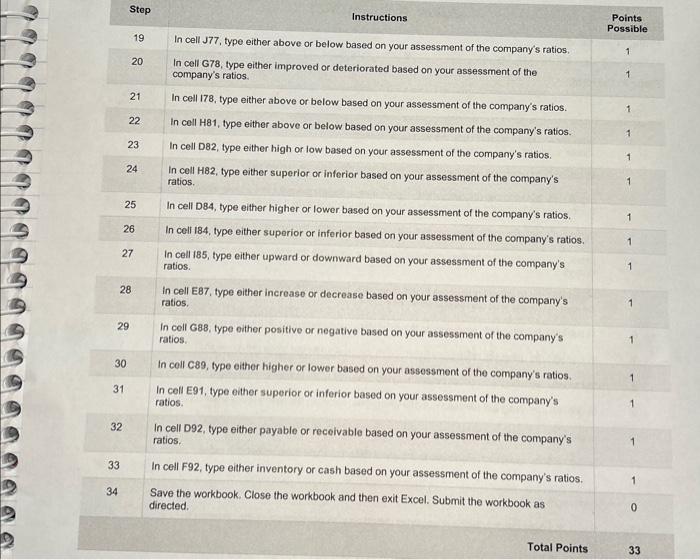

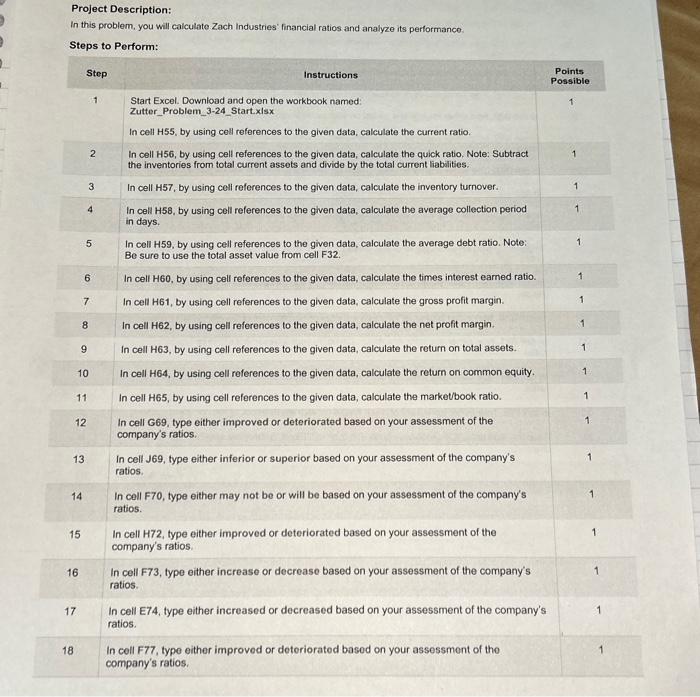

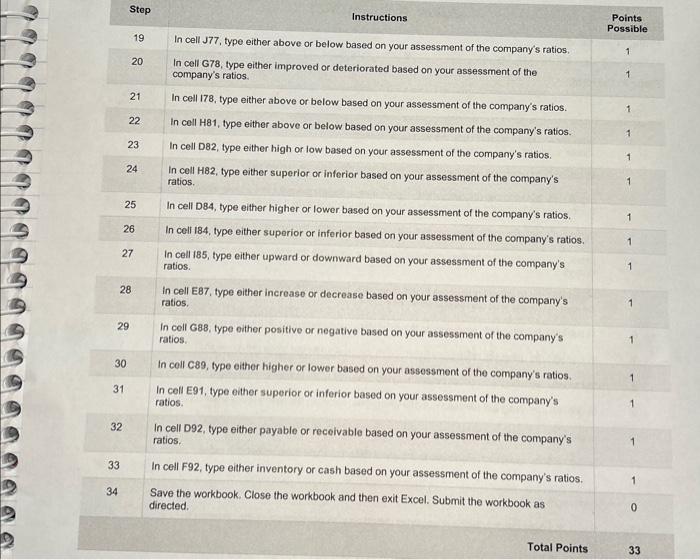

163 46 Solution a. Use the preceding financial statements to complete the table below. Assume that the industry averages given in the table are Number of shares outstanding Price per share \begin{tabular}{|lr|} \hline & 3,000 \\ \hline 5 & 25 \\ \hline \end{tabular} Zach Industries Ratio Analysis Industry Current ratio Quick ratio Inventory turnover Average collection period (days) Debt ratio Times interest earned Gross profit margin Net profit margin Return on total assets Return on common equity Marketbook ratio \begin{tabular}{|r|r|r|} \hline \multicolumn{1}{|c|}{ Industry } & \multicolumn{1}{|c|}{ Actual } & \multicolumn{1}{c|}{ Actual } \\ \hline \multicolumn{1}{|c|}{ Average } & \multicolumn{1}{|c|}{2018} & \multicolumn{1}{c|}{2019} \\ \hline 1.80 & 1.84 & 1.00 \\ \hline 0.70 & 0.78 & - \\ \hline 2.50 & 2.59 & 1.51 \\ \hline 37.5 & 36.5 & 68.5 \\ \hline 65.0% & 67.0% & 100.0% \\ \hline 3.8 & 4.0 & \\ \hline 38% & 40% & 34% \\ \hline 3.5% & 3.6% & 16.6% \\ \hline 4.0% & 4.0% & \\ \hline 9.5% & 8.0% & \\ \hline 1.1 & 1.2 & \\ \hline \end{tabular} b. Analyze Zach Industries' financial condition as it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition. Project Description: In this problem, you will calculate Zach Industries' financial ratios and analyze its performanco. 163 46 Solution a. Use the preceding financial statements to complete the table below. Assume that the industry averages given in the table are Number of shares outstanding Price per share \begin{tabular}{|lr|} \hline & 3,000 \\ \hline 5 & 25 \\ \hline \end{tabular} Zach Industries Ratio Analysis Industry Current ratio Quick ratio Inventory turnover Average collection period (days) Debt ratio Times interest earned Gross profit margin Net profit margin Return on total assets Return on common equity Marketbook ratio \begin{tabular}{|r|r|r|} \hline \multicolumn{1}{|c|}{ Industry } & \multicolumn{1}{|c|}{ Actual } & \multicolumn{1}{c|}{ Actual } \\ \hline \multicolumn{1}{|c|}{ Average } & \multicolumn{1}{|c|}{2018} & \multicolumn{1}{c|}{2019} \\ \hline 1.80 & 1.84 & 1.00 \\ \hline 0.70 & 0.78 & - \\ \hline 2.50 & 2.59 & 1.51 \\ \hline 37.5 & 36.5 & 68.5 \\ \hline 65.0% & 67.0% & 100.0% \\ \hline 3.8 & 4.0 & \\ \hline 38% & 40% & 34% \\ \hline 3.5% & 3.6% & 16.6% \\ \hline 4.0% & 4.0% & \\ \hline 9.5% & 8.0% & \\ \hline 1.1 & 1.2 & \\ \hline \end{tabular} b. Analyze Zach Industries' financial condition as it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition. Project Description: In this problem, you will calculate Zach Industries' financial ratios and analyze its performanco