Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me urgent answer all question (b) Beek Limited is a company that produce air filter. Beek's is currently gathering its financial information for

Please help me urgent answer all question

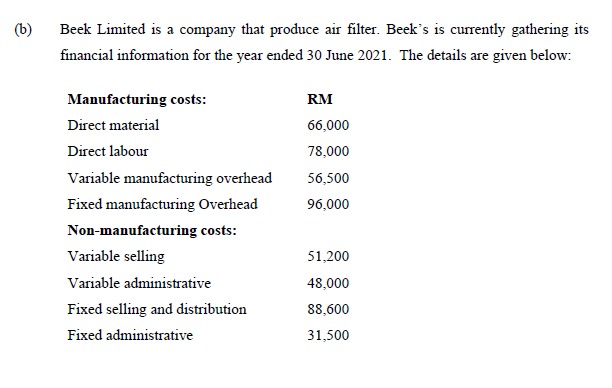

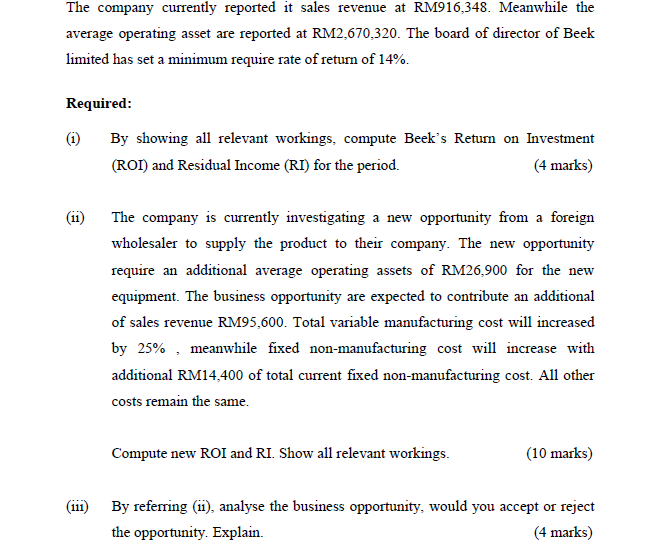

(b) Beek Limited is a company that produce air filter. Beek's is currently gathering its financial information for the year ended 30 June 2021. The details are given below: RM 66,000 78,000 56,500 96,000 Manufacturing costs: Direct material Direct labour Variable manufacturing overhead Fixed manufacturing Overhead Non-manufacturing costs: Variable selling Variable administrative Fixed selling and distribution Fixed administrative 51,200 48,000 88,600 31,500 The company currently reported it sales revenue at RM916,348. Meanwhile the average operating asset are reported at RM2,670,320. The board of director of Beek limited has set a minimum require rate of return of 14%. Required: (1) By showing all relevant workings, compute Beek's Return on Investment (ROI) and Residual Income (RI) for the period. (4 marks) (11) The company is currently investigating a new opportunity from a foreign wholesaler to supply the product to their company. The new opportunity require an additional average operating assets of RM26,900 for the new equipment. The business opportunity are expected to contribute an additional of sales revenue RM95,600. Total variable manufacturing cost will increased by 25% , meanwhile fixed non-manufacturing cost will increase with additional RM14,400 of total current fixed non-manufacturing cost. All other costs remain the same. Compute new ROI and RI. Show all relevant workings. (10 marks) (111) By referring (11), analyse the business opportunity, would you accept or reject the opportunity. Explain. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started