Answered step by step

Verified Expert Solution

Question

1 Approved Answer

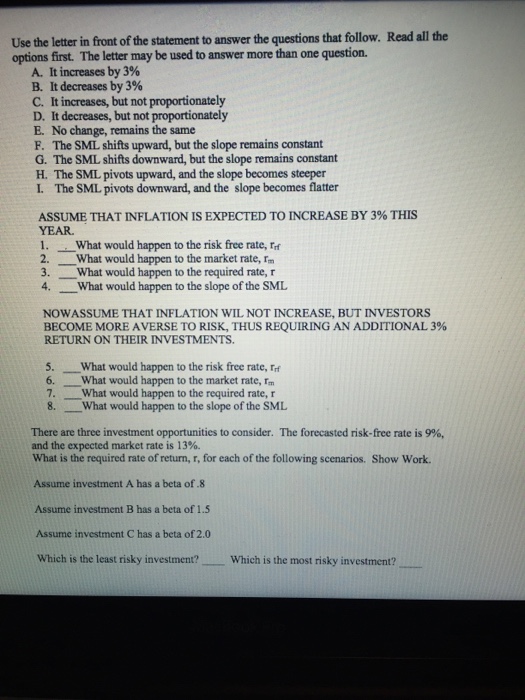

Please help me! :) Use the letter in front of the statement to answer the questions that follow. Read all the options first The letter

Please help me! :)

Use the letter in front of the statement to answer the questions that follow. Read all the options first The letter may be used to answer more than one question. It increases by 3% It decreases by 3% It increases, but not proportionately It decreases, but not proportionately No change, remains the same The SML shifts upward, but the slope remains constant The SML shifts downward, but the slope remains constant The SML pivots upward, and the slope becomes steeper The SML pivots downward, and the slope becomes flatter What would happen to the risk free rate, r_rf What would happen to the market rate, r_m What would happen to the required rate, r What would happen to the slope of the SML What would happen to the risk free rate, r_rf What would happen to the market rate, r_m What would happen to the required rate, r What would happen to the slope of the SML There are three investment opportunities to consider. The forecasted risk-free rate is 9%, and the expected market rate is 13%. What is the required rate of return, r. for each of the following scenarios. Assume investment A has a beta of.8 Assume investment B has a beta of 1.5 Assume investment C has a beta of 2.0 Which is the least risky investment? Which is the most risky investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started