Answered step by step

Verified Expert Solution

Question

1 Approved Answer

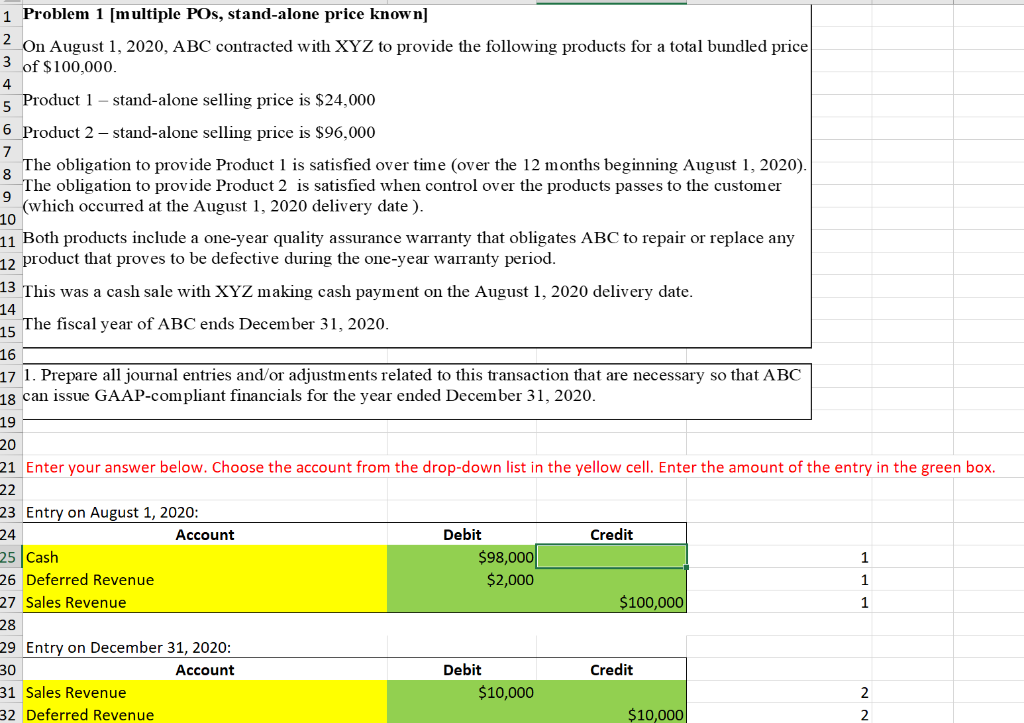

Please help me verify if my answers are correct, otherwise please explain what I did incorrectly and what the correct answer(s) should be. Thank you!

Please help me verify if my answers are correct, otherwise please explain what I did incorrectly and what the correct answer(s) should be. Thank you!

For cells A25, A26, and A27, as well as cells A31 and A32, the only possible journal accounts, are the following:

Cash, Sales Revenue, or Deferred Revenue

Other than verifying if my journey accounts are correct, I need to verify that the journal entry amounts are correct given the information in the problem.

1 Problem 1 [multiple POs, stand-alone price known) 2 On August 1, 2020, ABC contracted with XYZ to provide the following products for a total bundled price 3 of $100,000. 4 5 Product 1 - stand-alone selling price is $24,000 6 Product 2 - stand-alone selling price is $96,000 7 The obligation to provide Product 1 is satisfied over time (over the 12 months beginning August 1, 2020). 8 The obligation to provide Product 2 is satisfied when control over the products passes to the customer 9 (which occurred at the August 1, 2020 delivery date ). 10 11 Both products include a one-year quality assurance warranty that obligates ABC to repair or replace any 12 product that proves to be defective during the one-year warranty period. 13 This was a cash sale with XYZ making cash payment on the August 1, 2020 delivery date. 14 15 The fiscal year of ABC ends December 31, 2020. 16 17 1. Prepare all journal entries and/or adjustments related to this transaction that are necessary so that ABC 18 can issue GAAP-compliant financials for the year ended December 31, 2020. 19 20 21 Enter your answer below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. 22 23 Entry on August 1, 2020: 24 Account Debit Credit 25 Cash $98,000 26 Deferred Revenue $2,000 1 27 Sales Revenue $100,000 1 28 29 Entry on December 31, 2020: 30 Account Credit 31 Sales Revenue $10,000 2 32 Deferred Revenue $10,000 2 1 DebitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started