please help me where it is red

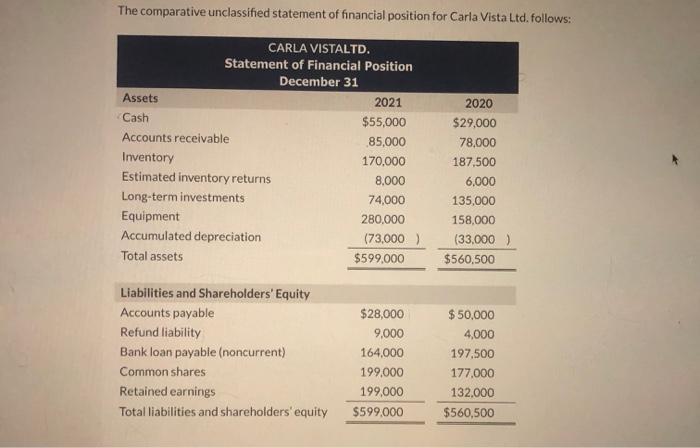

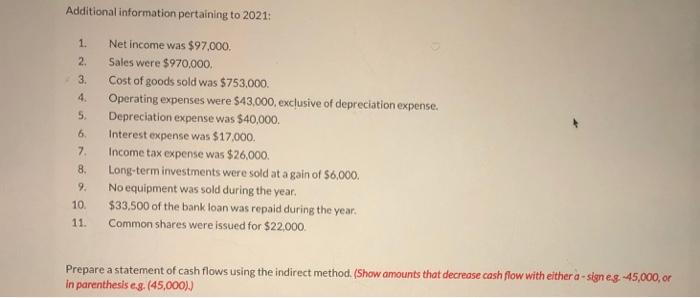

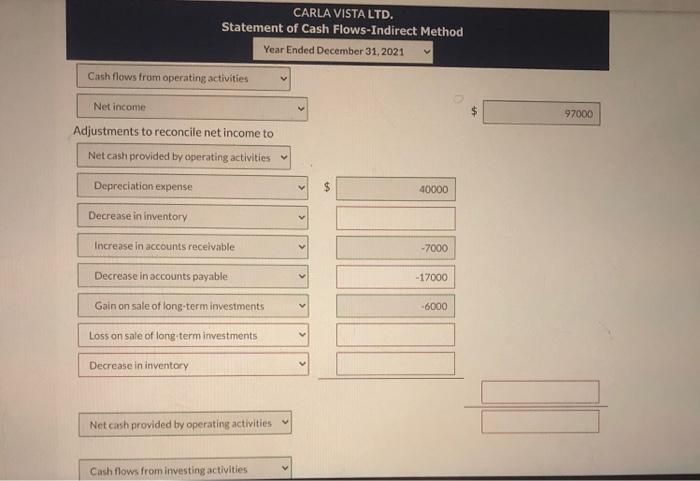

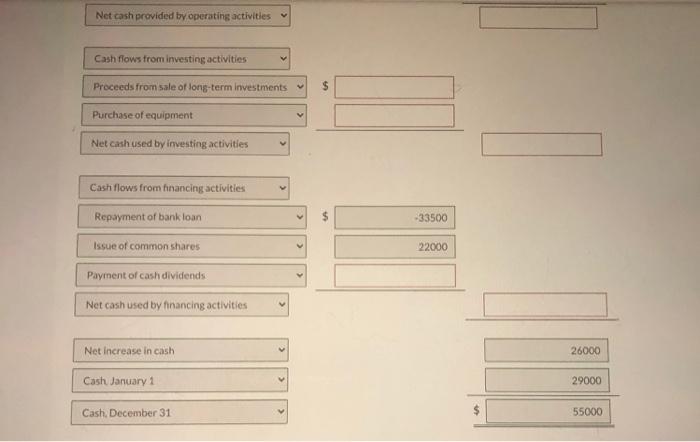

The comparative unclassified statement of financial position for Carla Vista Ltd. follows: CARLA VISTALTD. Statement of Financial Position December 31 Assets 2021 Cash $55,000 Accounts receivable 85,000 Inventory 170,000 Estimated inventory returns 8,000 Long-term investments 74,000 Equipment 280.000 Accumulated depreciation (73,000) Total assets $599,000 2020 $29,000 78,000 187,500 6.000 135,000 158,000 (33.000) $560,500 Liabilities and Shareholders' Equity Accounts payable Refund liability Bank loan payable (noncurrent) Common shares Retained earnings Total liabilities and shareholders' equity $28,000 9,000 164,000 199,000 199,000 $599,000 $ 50,000 4,000 197.500 177.000 132.000 $560,500 1. 2. Additional information pertaining to 2021: Net income was $97.000 Sales were $970,000 3. Cost of goods sold was $753,000 4. Operating expenses were $43,000, exclusive of depreciation expense. 5. Depreciation expense was $40,000 Interest expense was $17.000. Income tax expense was $26,000. 8. Long-term investments were sold at a gain of $6,000. 9. No equipment was sold during the year. 10. $33,500 of the bank loan was repaid during the year. 11. Common shares were issued for $22,000 6. 7 Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign eg 45,000, or in parenthesis eg. (45,000).) CARLA VISTA LTD. Statement of Cash Flows-Indirect Method Year Ended December 31, 2021 Cash flows from operating activities Net income 97000 Adjustments to reconcile net income to Net cash provided by operating activities Depreciation expense $ 40000 Decrease in inventory Increase in accounts receivable -7000 Decrease in accounts payable -17000 Gain on sale of long-term investments -6000 Loss on sale of long-term investments Decrease in inventory Net cash provided by operating activities Cash flows from investing activities Net cash provided by operating activities Cash flows from investing activities V Proceeds from sale of long-term investments $ Purchase of equipment Net cash used by investing activities Cash flows from financing activities Repayment of bank loan -33500 Issue of common shares 22000 Payment of cash dividends Net cash used by financing activities Net increase in cash 26000 Cash January 1 29000 Cash, December 31 55000