Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with # 3 the adjusting entries Comprehensive Problem: Joan Miller Advertising Agency This comprehensive problem involving the Joan Miller Advertising Agency covers

please help me with # 3 the adjusting entries

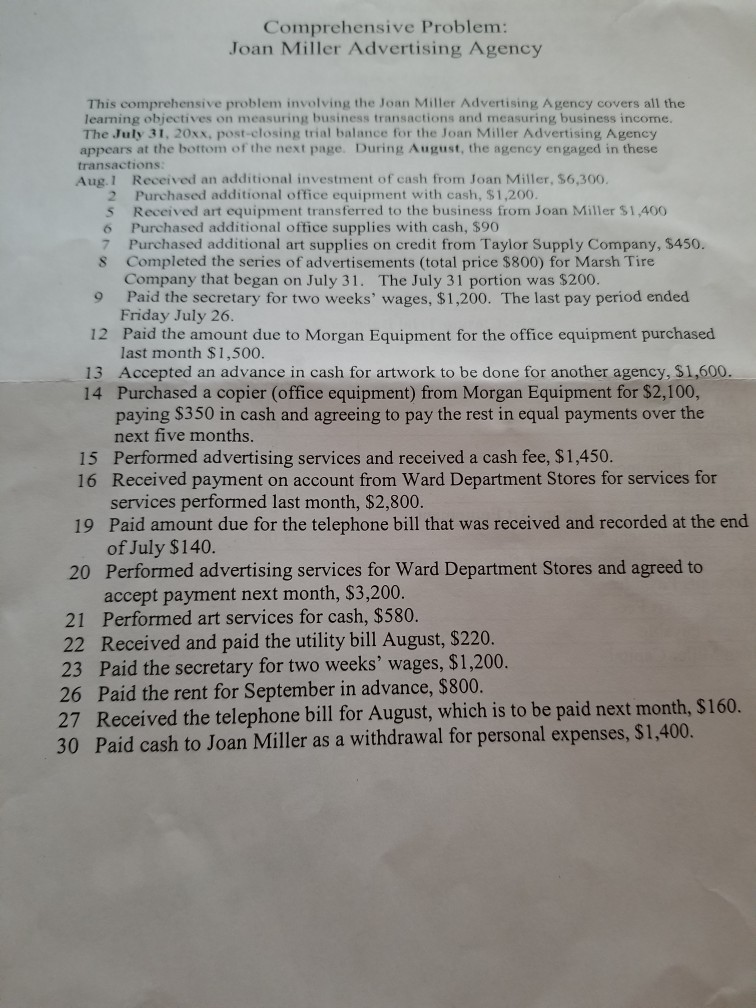

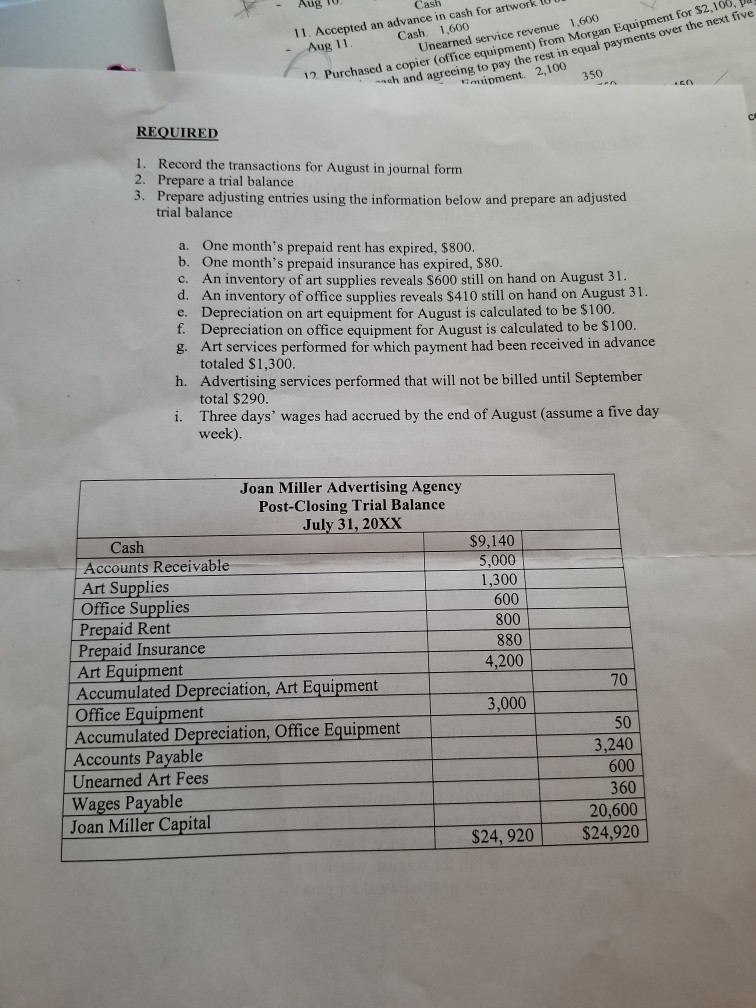

Comprehensive Problem: Joan Miller Advertising Agency This comprehensive problem involving the Joan Miller Advertising Agency covers all the learning objectives on measuring business transactions and measuring business income. The July 31, 20xx, post-closing trial balance for the Joan Miller Advertising Agency appears at the bottom of the next page. During August, the agency engaged in these transactions Aug.1 Received an additional investment of cash from Joan Miller, $6,300 Purchased additional office equipment with cash, $1,200 2 5 Received art equipment transferred to the business from Joan Miller $1,400 6 Purchased additional office supplies with cash, $90 7 Purchased additional art supplies on credit from Taylor Supply Company, $450. 8 Completed the series of advertisements (total price $800) for Marsh Tire Company that began on July 31. The July 31 portion was $200. o Paid the secretary for two weeks' wages, $1,200. The last pay period ended Friday July 26 12 Paid the amount due to Morgan Equipment for the office equipment purchased last month $1,500. 13 Accepted an advance in cash for artwork to be done for another agency, $1,600 14 Purchased a copier (office equipment) from Morgan Equipment for $2,100, paying $350 in cash and agreeing to pay the rest in equal payments over the next five months. 15 Performed advertising services and received a cash fee, $1,450. 16 Received payment on account from Ward Department Stores for services for services performed last month, $2,800. Paid amount due for the telephone bill that was received and recorded at the end 19 of July $140. 20 Performed advertising services for Ward Department Stores and agreed to accept payment next month, $3,200. 21 Performed art services for cash, $580. 22 Received and paid the utility bill August, S220. 23 Paid the secretary for two weeks' wages, $1,200 26 Paid the rent for September in advance, $800 27 Received the telephone bill for August, which is to be paid next month, S160. 30 Paid cash to Joan Miller as a withdrawal for personal expenses, $1,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started