please help me with 5 6 7 8 questions

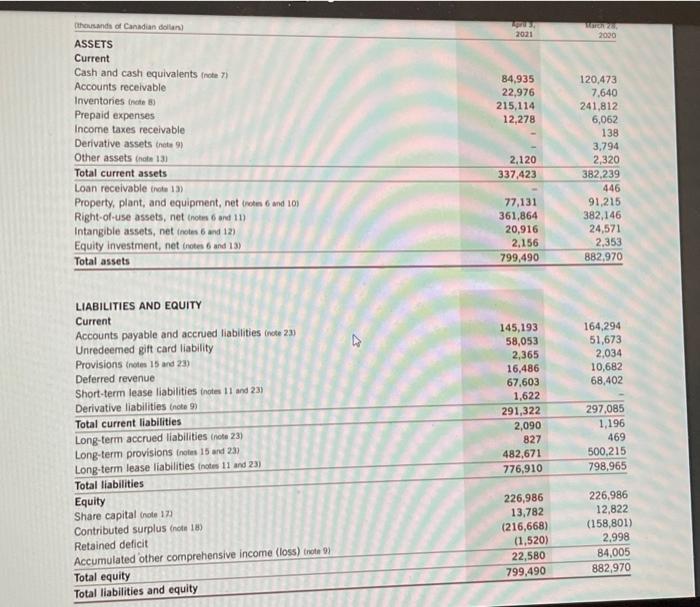

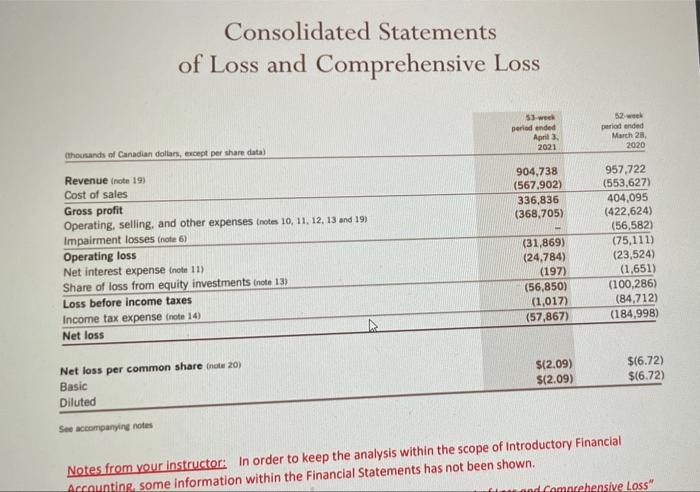

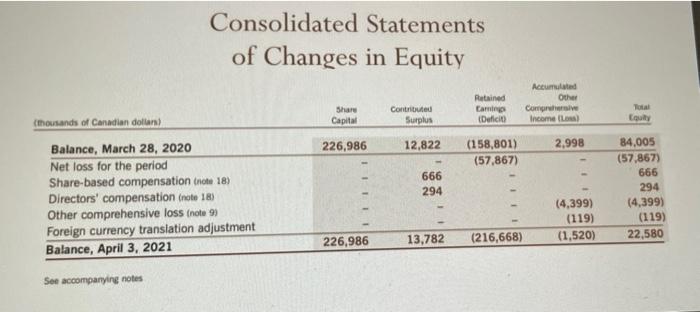

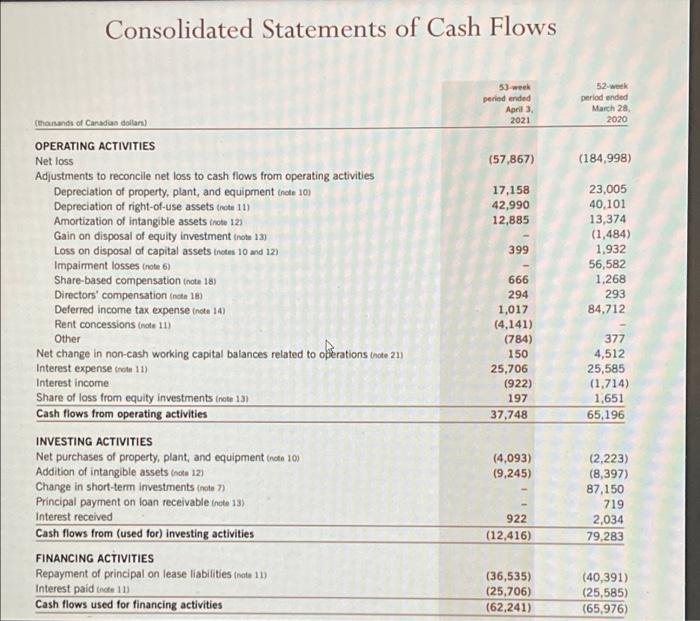

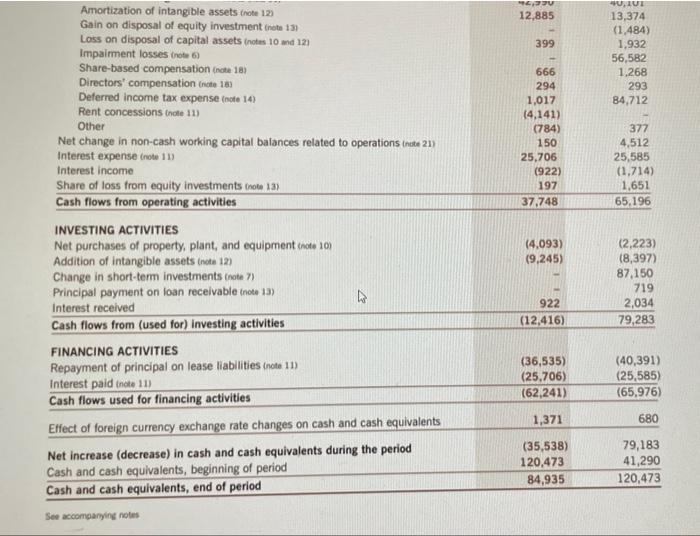

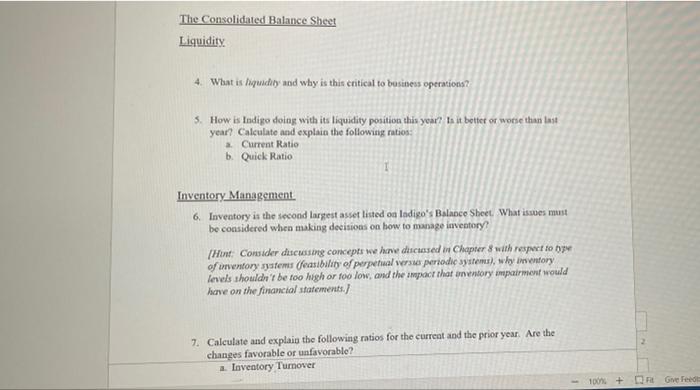

The Consolidated Balance Sheet Liquidity 4. What is liquidity and why is this critical to business operationa? 5. How is Indigo doing with its liquidity position this year? Is it better or worse than last year? Calculate and explain the following ratios: Current Ratio b. Quick Ratio Inventory Management 6. Inventory is the second largest asset listed on Indigo's Balance Sheet. What isses must be considered when making decisions on how to manage inventory? [Hunt: Consider discussing concepts we have discussed in Chapter 8 with respect to be of orventory systems (feasibility of perpetual versio periodic systems, why inwentory levels shouldn't be too high or too low, and the impace that inventory mpairment would have on the financial statements.) 7. Calculate and explain the following ratios for the current and the prior year. Are the changes favorable or unfavorable? a. Inventory Turnover - 100+ Give Feed u Ratio h. Quick Ratio Inventory Management 6. Lovestory is the second largest asset listed on ludio's Balance Sheet. What is it be considered when making decisions on how to manage inventory [Hint: Consider dessing concepts we have discussed in Chapter with respect to typu of onestory Systems (feasibility of perpetual versus periode system why Inventory level showch y be too high or too low, and the impact that infory impairment would have on the financial statements. 1 7. Calculate and explain the following ratios for the current and the prior year. Are the changes favorable or unfavorable? a. Inventory Tumover b. Average Days to Sell Inventory Now Sed ting balance for my wadefore we do not nem formance on wrap or balance for the 2020 false Capital Structure 8. What is meant by the term "capital structure"? thousands of Canadian dolla) 2021 2000 84,935 22,976 215,114 12,278 120.473 7,640 241,812 6,062 138 ASSETS Current Cash and cash equivalents frete 77 Accounts receivable Inventories tridte 8 Prepaid expenses Income taxes receivable Derivative assets tete Other assets trate 131 Total current assets Loan receivable thote 13) Property, plant, and equipment, net om 6 and 101 Right-of-use assets, net noms 6 and 11) Intangible assets, net nos 6 and 12) Equity Investment, net (rates 6 and 13) Total assets 2,120 337,423 77,131 361,864 20,916 2.156 799,490 3,794 2,320 382,239 446 91.215 382,146 24,571 2,353 882,970 164.294 51,673 2,034 10,682 68,402 LIABILITIES AND EQUITY Current Accounts payable and accrued liabilities (note 23) Unredeemed gift card liability Provisions notes 15 and 23) Deferred revenue Short-term lease liabilities notes 11 and 23) Derivative liabilities (note 93 Total current liabilities Long-term accrued liabilities (hola 23) Long-term provisions totes 15 and 23) Long-term lease liabilities notes 11 and 23) Total liabilities Equity Share capitalino 17 Contributed surplus (note 18) Retained deficit Accumulated other comprehensive income (loss) trote) Total equity Total liabilities and equity 145,193 58,053 2,365 16,486 67,603 1,622 291,322 2,090 827 482,671 776,910 297,085 1,196 469 500.215 798,965 226,986 13,782 (216,668) (1,520) 22,580 799,490 226,986 12,822 (158,801) 2,998 84,005 882,970 Consolidated Statements of Loss and Comprehensive Loss 53 we period ended April 2021 52 period ended March 28, 2020 thousands of Canadian dollars, except per share data) 904.738 (567.902) 336,836 (368,705) Revenue (note 19) Cost of sales Gross profit Operating, selling, and other expenses notes 10, 11, 12, 13 and 19) Impairment losses (note 6) Operating loss Net interest expense note 11) Share of loss from equity investments inote 133 Loss before income taxes Income tax expense note 14 Net loss (31,869) (24,784) (197) (56,850) (1,017) (57,867) 957.722 (553,627) 404,095 (422,624) (56,582) (75,111) (23,524) (1,651) (100,286) (84.712) (184,998) $(2.09) $(2.09) $16.72) $(6.72) Net loss per common share nate 20) Basic Diluted See accompanying notes Notes from your instructor: In order to keep the analysis within the scope of Introductory Financial Accounting, some information within the Financial Statements has not been shown. and Comnrehensive Loss" Consolidated Statements of Changes in Equity Accumulated Other Com Income Share Capital Retained Caming Deficit Contributed Surplus Total tout (thousands of Canadian dollar) 226,986 12,822 2,998 (158,801) (57,867) 666 294 Balance, March 28, 2020 Net loss for the period Share-based compensation note 18) Directors' compensation (note 18) Other comprehensive loss (note 93 Foreign currency translation adjustment Balance, April 3, 2021 84,005 (57,867) 666 294 (4.399) (119) 22,580 (4,399) (119) (1,520) 226,986 13,782 (216,668) See accompanying notes Consolidated Statements of Cash Flows 53 week period ended April 3, 2021 52 wock period ended March 28 2020 (thousands of Canadian dollars) (57,867) (184,998) 17.158 42,990 12,885 399 23,005 40.101 13,374 (1,484) 1.932 56,582 1,268 293 84,712 OPERATING ACTIVITIES Net loss Adjustments to reconcile net loss to cash flows from operating activities Depreciation of property, plant, and equipment (note 10) Depreciation of right-of-use assets (robe 11) Amortization of intangible assets (noto 121 Gain on disposal of equity investment (note 13) Loss on disposal of capital assets (notes 10 and 12) Impairment losses (note 6 Share-based compensation nata 18) Directors' compensation (note 16) Deferred income tax expense (note 14) Rent concessions (note 11 Other Net change in non-cash working capital balances related to operations (noto 21) Interest expense tro 11) Interest income Share of loss from equity investments (note 13) Cash flows from operating activities INVESTING ACTIVITIES Net purchases of property, plant, and equipment no 10) Addition of intangible assets (nota 12) Change in short-term investments (note 7) Principal payment on loan receivable free 13) Interest received Cash flows from (used for) investing activities FINANCING ACTIVITIES Repayment of principal on lease liabilities (note 11) Interest paid tee 113 Cash flows used for financing activities 666 294 1,017 (4,141) (784) 150 25,706 (922) 197 37,748 377 4,512 25,585 (1,714) 1.651 65,196 (4,093) (9,245) (2,223) (8,397) 87,150 719 2,034 79,283 922 (12,416) (36,535) (25,706) (62,241) (40,391) (25,585) (65,976) 16:27 12,885 399 0,11 13,374 (1.484) 1,932 56,582 1,268 293 84,712 666 294 1,017 (4,141) (784) 150 25,706 (922) 197 37,748 377 4,512 25,585 (1,714) 1,651 65.196 Amortization of intangible assets trote 123 Gain on disposal of equity investment (nota 13) Loss on disposal of capital assets trous 10 md 121 Impairment losses trote 6 Share-based compensation (note 18) Directors' compensation note 183 Deferred Income tax expense (note 14) Rent concessions inte 11) Other Net change in non-cash working capital balances related to operations inste 21) Interest expense (now 11) Interest income Share of loss from equity investments (nota 13) Cash flows from operating activities INVESTING ACTIVITIES Net purchases of property, plant, and equipment (note 101 Addition of intangible assets (no 13 Change in short-term investments not) Principal payment on loan receivable note 13) Interest received Cash flows from (used for) investing activities FINANCING ACTIVITIES Repayment of principal on lease liabilities (note 11) Interest paid enote 11) Cash flows used for financing activities Effect of foreign currency exchange rate changes on cash and cash equivalents Net increase (decrease) in cash and cash equivalents during the period Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period (4,093) (9,245) (2,223) (8,397) 87,150 719 2,034 79,283 922 (12,416) (36,535) (25,706) (62,241) (40,391) (25,585) (65,976) 1,371 680 (35,538) 120,473 84,935 79,183 41,290 120,473 See accompanying notes