please help me with a step by step

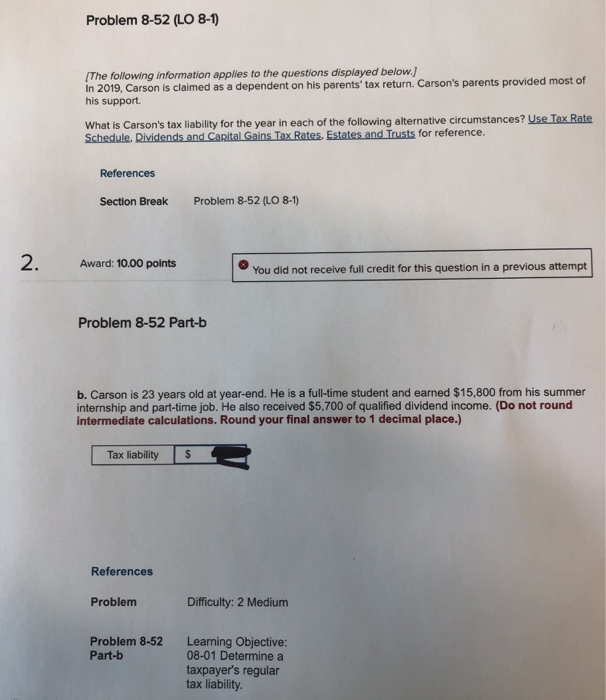

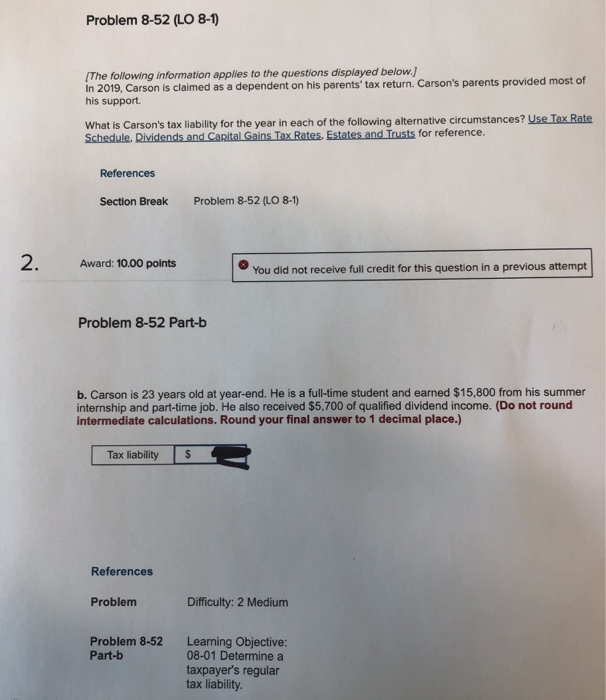

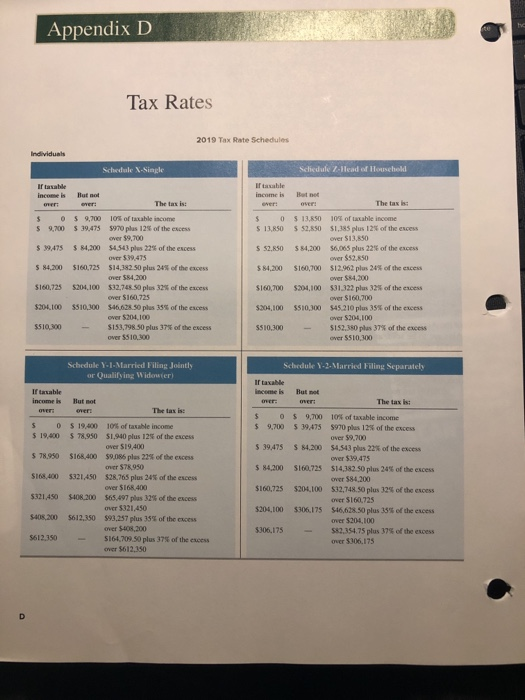

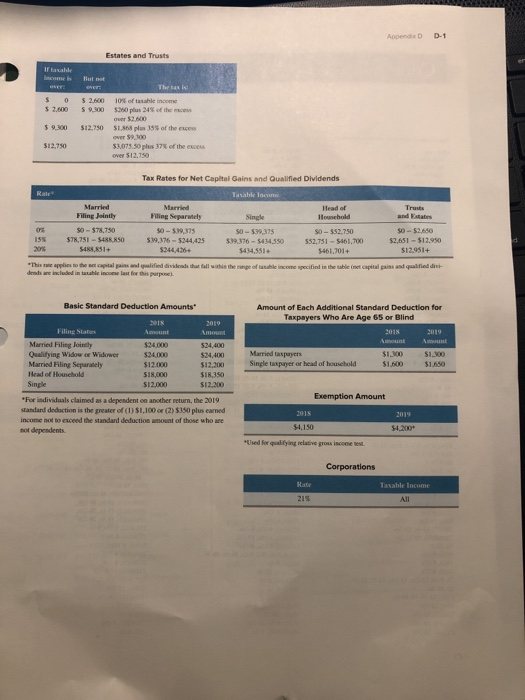

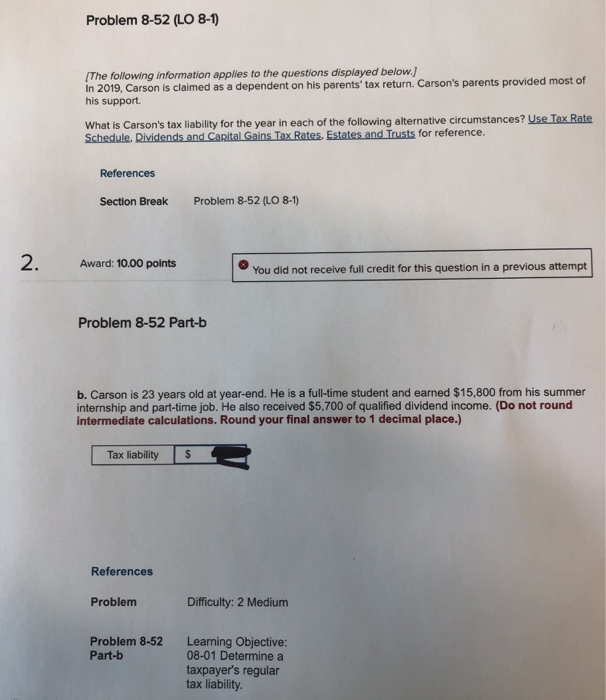

Problem 8-52 (LO 8-1) The following information applies to the questions displayed below.) In 2019, Carson is claimed as a dependent on his parents' tax return. Carson's parents provided most of his support What is Carson's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates. Estates and Trusts for reference. References Section Break Problem 8-52 (LO 8-1) Award: 10.00 points You did not receive full credit for this question in a previous attempt Problem 8-52 Part-b b. Carson is 23 years old at year-end. He is a full-time student and earned $15.800 from his summer internship and part-time job. He also received $5.700 of qualified dividend income. (Do not round intermediate calculations. Round your final answer to 1 decimal place.) Tax liability s References Problem Difficulty: 2 Medium Problem 8-52 Part-b Learning Objective: 08-01 Determine a taxpayer's regular tax liability Appendix D Tax Rates 2019 Tax Rate Schedules Individuals Schedule X-single Schedule leader n ell If the in Hut income is Bote The tax is The text $ 0 0 ,00 19475 0 5 13 RSD 5 13.50 $ 52.50 $ 39,475 $ 84,200 $ 52.50 $4,200 S $4,200 $160,725 $84.200 $100,700 of the income plus 125 of the excess over 59,700 $4563 plus 225 of the end $19,475 14,32 50 plus 34% of the excess over $84,200 $12.748 plus 32% of the excess over $160,725 $46.628 30 plus 35% of the excess over $204,100 $153,798 50 plus 37 of the excess OVER 510.000 105 of taxable income SI, Nus of the exces over SIO 56.05 us 2 of the E N over $250 $12.96 plus 20% of the excess over $4,200 31.322 plus 2 of the excess over 16,00 $45 210 plus 35% of the excess over 5204,100 5152,350 plus 37% of the excess over 5510,300 S160,725 204,100 $160,700 204,100 5204.100 S510,300 $204,100 $10,300 SS100 SS10,300 Schedule Y-1Married Filing Jointly or Qualifying Widenier Schedule Y-3. Married Filing Separately Ir taxe If taxable income is Hut not verver: The tax is: The tax is: 0 9,700 $ 9,700 S 19.475 $ $ 39,475 S 4200 $ 84,200 $160725 $ 0 19.00 107 of taxable income $ 19,00 S 78,950 $1,940 plus 12% of the excess Over $19,400 $ 7,950 $168.400 ples 234 of the excess 57.950 SIA 0 21,450 $28.765 plus 24% of the excess over SIA 400 5121450 SIO 2005.97 plus 32% of the excess V 5321,450 200612.150 993.357 plus of the excess 200 5612.150 5 164209 50 plus 37 of the 1612150 10 of taxable income 5970 plus 12 of the EXCESS over $9,700 54 543 plus 21 of the excess over $19,475 $1432 50 plus 3% of the excess V 200 $32,748 50 plus of the ress Wer S160725 $16.628 50 plus of the ces over $204,100 $82.154.75 of the N 106175 $160,725 5204,100 53041005106175 S 5306, 175 Appendix D-1 Estates and Trusts income is Bulut $ 0 $ 2,00 $ 2.0 S O 10% of taxable income SMO plus 24 of the con $ 9.300 $12.750 SL 3 5% of the excess over $9, 100 $3.075.50 plus 37 of the excess $12.750 Tax Rates for Net Capital Gains and Qualified Dividends Rate Taxable incum Married Filing Jointly Head of Household Single Filing separately SO - 5:19.375 19,376 - 5244 425 5244 90 - $78,730 $78,751 - S SO S1+ 155 50 - 539,375 99,376 - 444550 SO-55.750 5 52.51 - $461,700 461.2017 50 - 52.650 $2,651 - $12.950 $12951+ "This a pplies to the palais quified dividends that fall within the des are included in the income as for this purpose peftate income specified in the capital gains and qualified Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind 2019 Amount Amount Basic Standard Deduction Amounts 2018 Amount Married in Jointly $34.000 Qualifying Widow of Widower $24,000 Married Piling Separately $12.000 Head of Household SI8.000 Single 524.400 524400 $12,200 $18,350 $12.200 Married taxpayers Single taxpayer or head of household SI OD $1.600 $1.300 $1.650 Exemption Amount For individuals claimed as a dependent on another return, the 2019 standard deduction is the greater of (1) $1,100 (2) $350 plus earned income not to exceed the standard deduction amount of those who are no dependents 2013 2019 $4.150 $1.200+ *Used for qualifying relative gross income Corporations Rate Taxable income 215 All