please help me with a-j. i have no idea

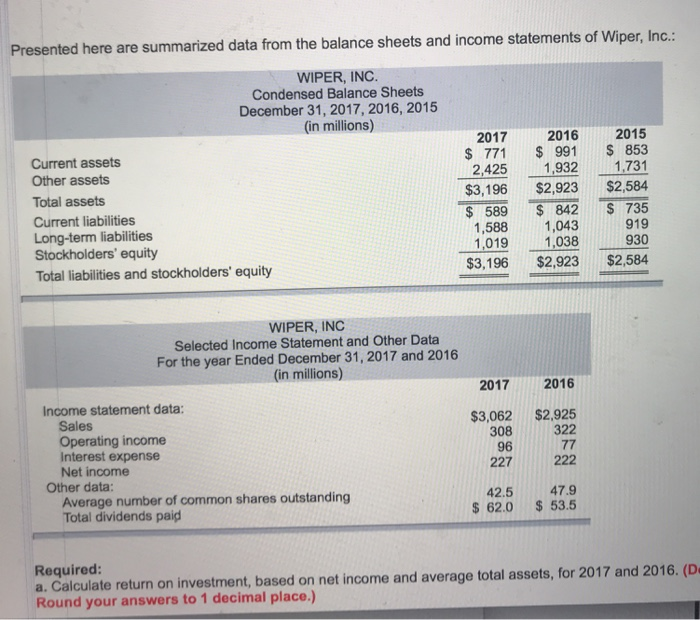

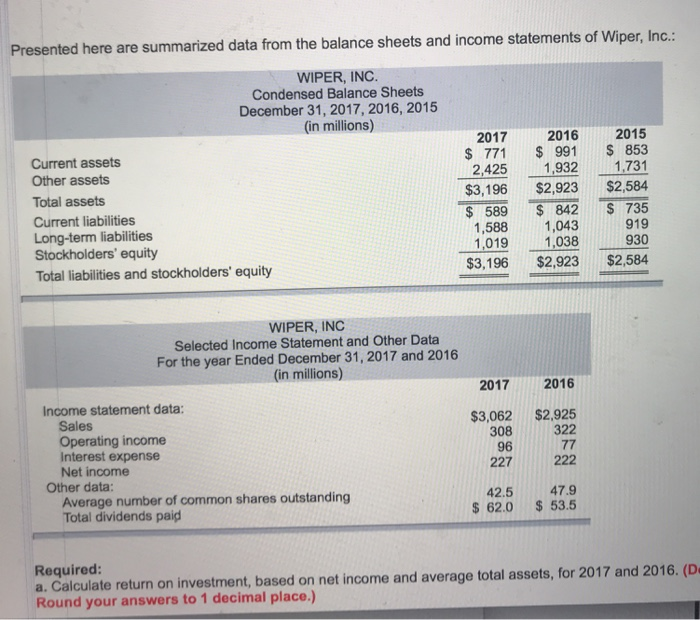

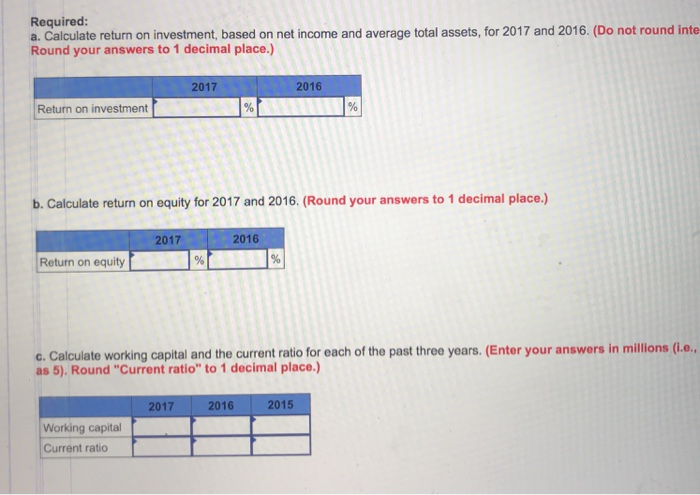

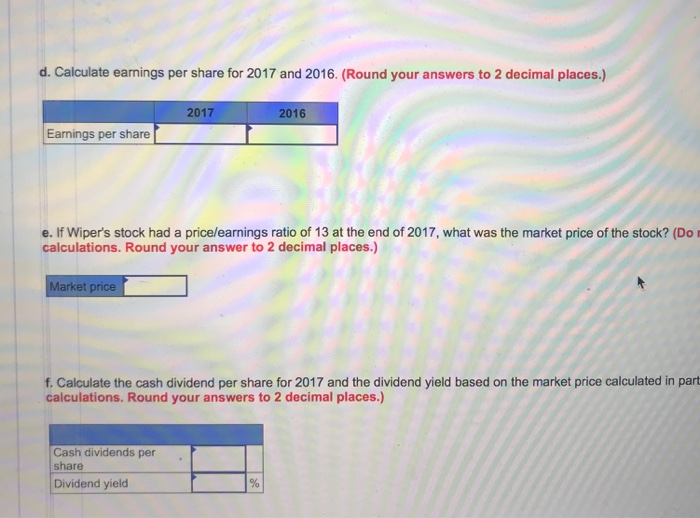

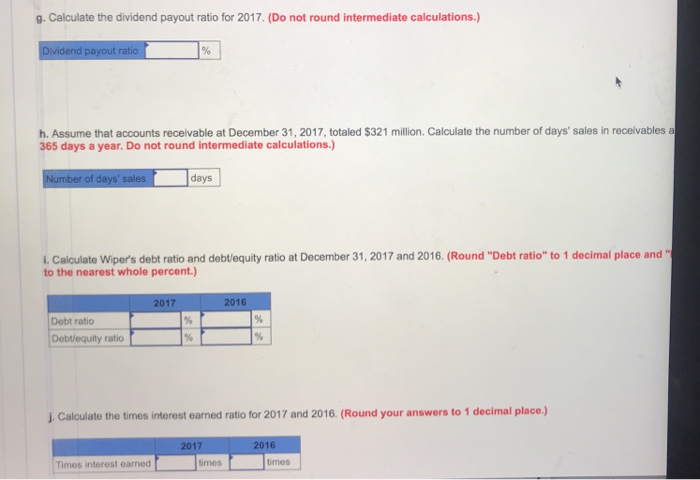

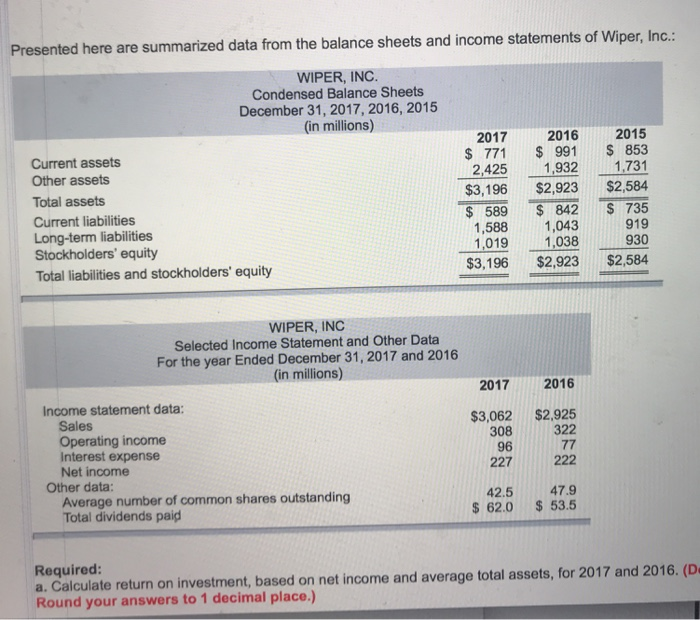

Presented here are summarized data from the balance sheets and income statements of Wiper, Inc. WIPER, INC. Condensed Balance Sheets December 31, 2017, 2016, 2015 (in millions) 2017 2016 2015 $ 771 991 S 853 2,425 1932 1731 Current assets Other assets Total assets Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity $3,196 $2,923 $2,584 589 S 842 S 735 1,588 1,043 1,0191,038 919 930 $3,196 $2,923 $2,584 WIPER, INC Selected Income Statement and Other Data For the year Ended December 31, 2017 and 2016 (in millions) 20172016 Income statement data: $3,062 $2,925 Sales Operating income Interest expense Net income 308 96 227 322 222 47.9 Other data: Average number of common shares outstanding Total dividends paid 42.5 62.0 $53.5 Required: a. Calculate return on investment, based on net income and average total assets, for 2017 and 2016. (D Round your answers to 1 decimal place.) Required: a. Calculate return on investment, based on net income and average total assets, for 2017 and 2016. (Do not round inte Round your answers to 1 decimal place.) 2017 2016 Return on investment b. Calculate return on equity for 2017 and 2016. (Round your answers to 1 decimal place.) 2017 2016 Return on equity ce. Calcuate working capital and the currhe past threo yoars. (Entor your answors in millions (l.o. as 5). Round "Current ratio to 1 decimal place.) 20172016 2015 Working capital Current ratio d. Calculate earnings per share for 2017 and 2016. (Round your answers to 2 decimal places.) 2017 2016 Earnings per share e. If Wiper's stock had a price/earnings ratio of 13 at the end of 2017, what was the market price of the stock? (Do calculations. Round your answer to 2 decimal places.) Market price f. Calculate the cash dividend per share for 2017 and the dividend yield based on the market price calculated in part calculations. Round your answers to 2 decimal places.) Cash dividends per . share Dividend yield g. Calculate the dividend payout ratio for 2017. (Do not round intermediate calculations.) h. Assume that accounts receivable at December 31, 2017, totaled $321 million. Calculate the number of days' sales in receivables a 365 days a year. Do not round intermediate calculations) days L Calculate Wipers debt ratio and debl/equity ratio at December 31, 2017 and 2016. (Round "Debt ratio" to 1 decimal place and to the nearest whole percent.) 2017 2016 Debt ratio Debtlequity ratio J. Calculate the times interest earned ratio for 2017 and 2016. (Round your answers to 1 decimal place.) 2017 2016 Times interest earned times times