Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with all 3 questions below. thank you. Shaw Landscapes (SL) develops and sells plans for various types of gardens and outdoor spaces.

Please help me with all 3 questions below. thank you.

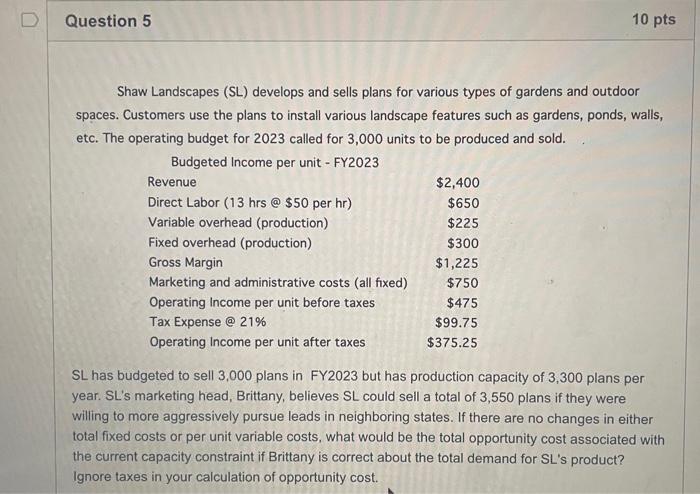

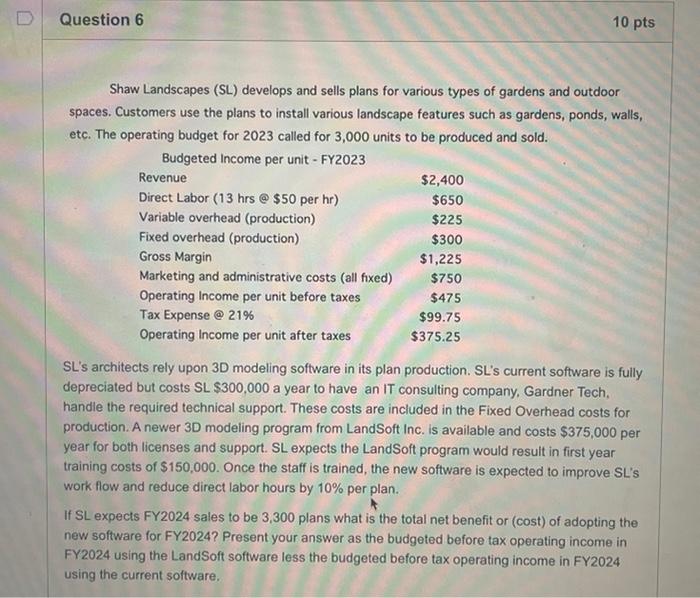

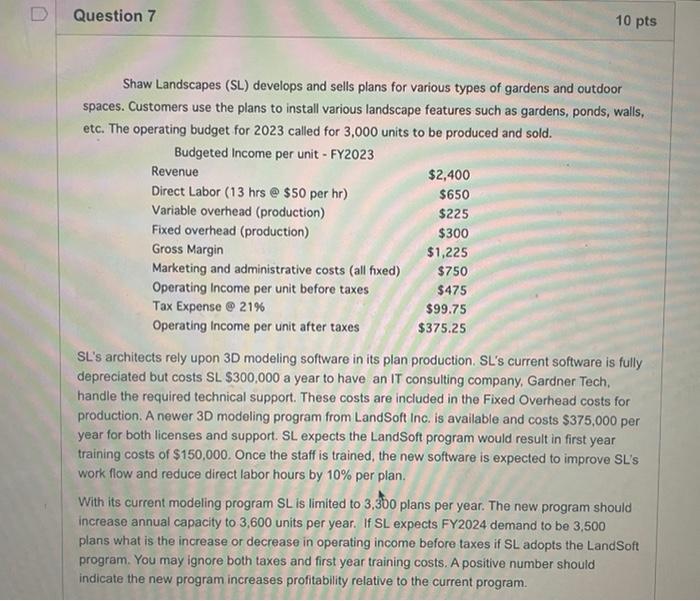

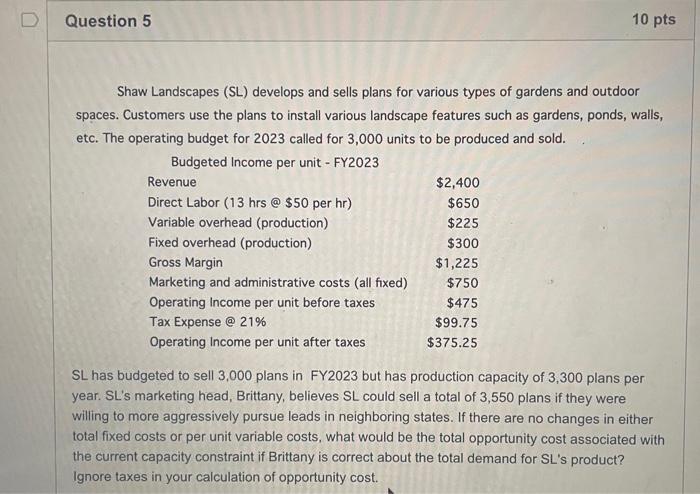

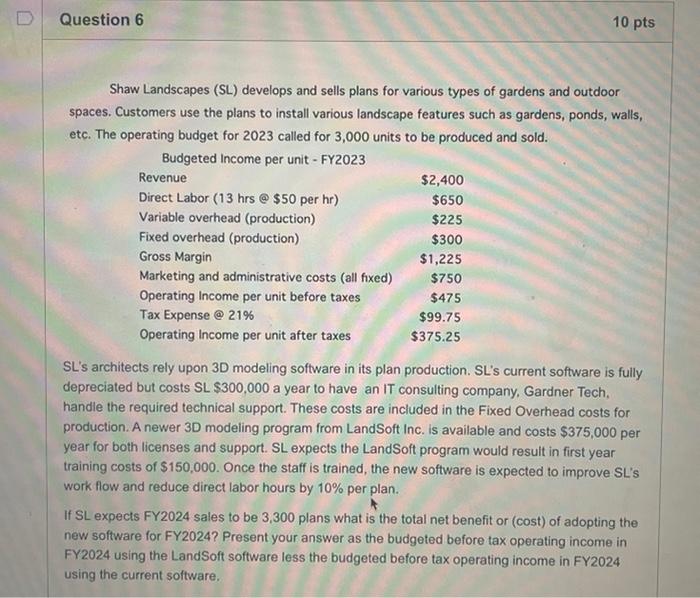

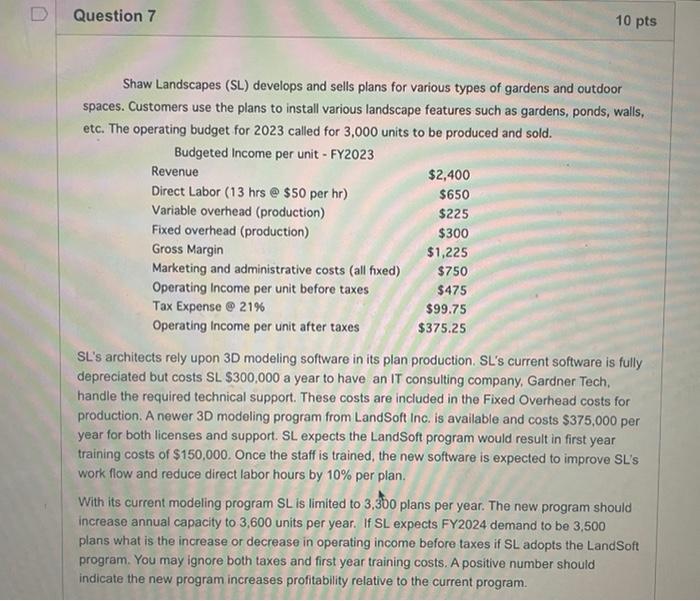

Shaw Landscapes (SL) develops and sells plans for various types of gardens and outdoor spaces. Customers use the plans to install various landscape features such as gardens, ponds, walls, etc. The operating budget for 2023 called for 3,000 units to be produced and sold. SL has budgeted to sell 3,000 plans in FY2023 but has production capacity of 3,300 plans per year. SL's marketing head, Brittany, believes SL could sell a total of 3,550 plans if they were willing to more aggressively pursue leads in neighboring states. If there are no changes in either total fixed costs or per unit variable costs, what would be the total opportunity cost associated with the current capacity constraint if Brittany is correct about the total demand for SL's product? Ignore taxes in your calculation of opportunity cost. Shaw Landscapes (SL) develops and sells plans for various types of gardens and outdoor spaces. Customers use the plans to install various landscape features such as gardens, ponds, walls, etc. The operating budget for 2023 called for 3,000 units to be produced and sold. SL's architects rely upon 3D modeling software in its plan production. SL's current software is fully depreciated but costs SL $300,000 a year to have an IT consulting company, Gardner Tech, handle the required technical support. These costs are included in the Fixed Overhead costs for production. A newer 3D modeling program from LandSoft Inc. is available and costs $375,000 per year for both licenses and support. SL expects the LandSoft program would result in first year training costs of $150,000. Once the staff is trained, the new software is expected to improve SL's work flow and reduce direct labor hours by 10% per plan. If SL expects FY2024 sales to be 3,300 plans what is the total net benefit or (cost) of adopting the new software for FY2024? Present your answer as the budgeted before tax operating income in FY2024 using the LandSoft software less the budgeted before tax operating income in FY2024 using the current software. Shaw Landscapes (SL) develops and sells plans for various types of gardens and outdoor spaces. Customers use the plans to install various landscape features such as gardens, ponds, walls, etc. The operating budget for 2023 called for 3,000 units to be produced and sold. SL's architects rely upon 3D modeling software in its plan production. SL's current software is fully depreciated but costs SL $300,000 a year to have an IT consulting company, Gardner Tech, handle the required technical support. These costs are included in the Fixed Overhead costs for production. A newer 3D modeling program from LandSoft Inc. is available and costs $375,000 per year for both licenses and support. SL expects the LandSoft program would result in first year training costs of $150,000. Once the staff is trained, the new software is expected to improve SL's work flow and reduce direct labor hours by 10% per plan. With its current modeling program SL is limited to 3,300 plans per year. The new program should increase annual capacity to 3,600 units per year. If SL expects FY2024 demand to be 3,500 plans what is the increase or decrease in operating income before taxes if SL adopts the LandSoft program. You may ignore both taxes and first year training costs. A positive number should indicate the new program increases profitability relative to the current program

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started