Please help me with all of these questions!

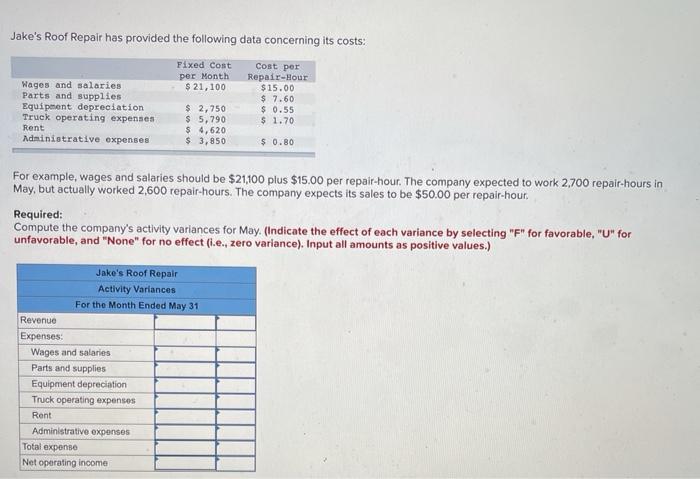

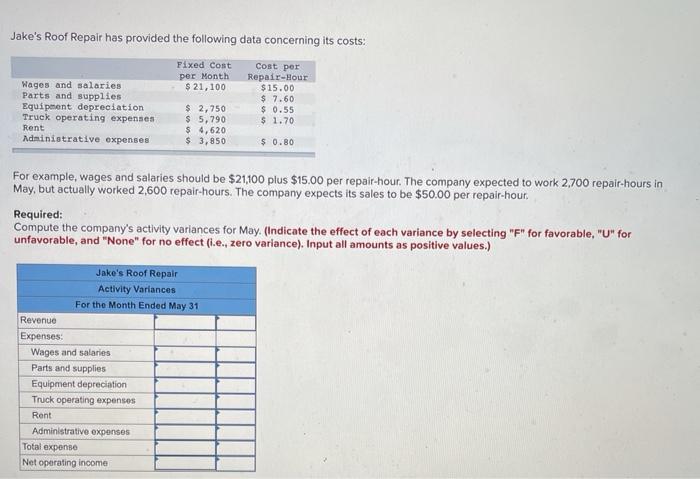

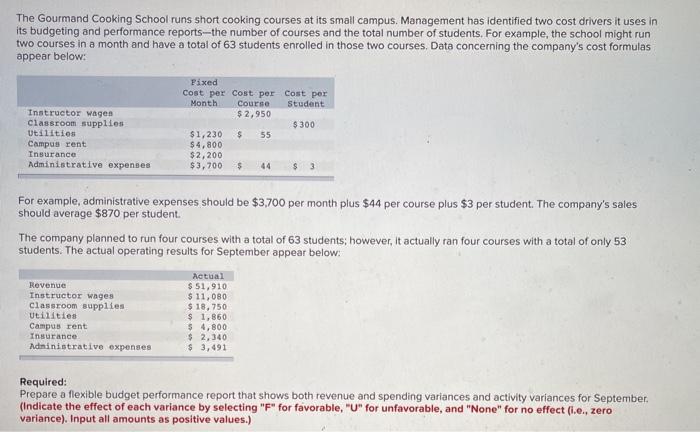

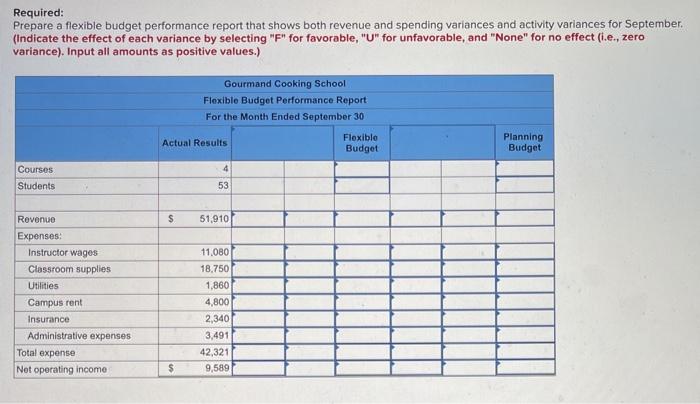

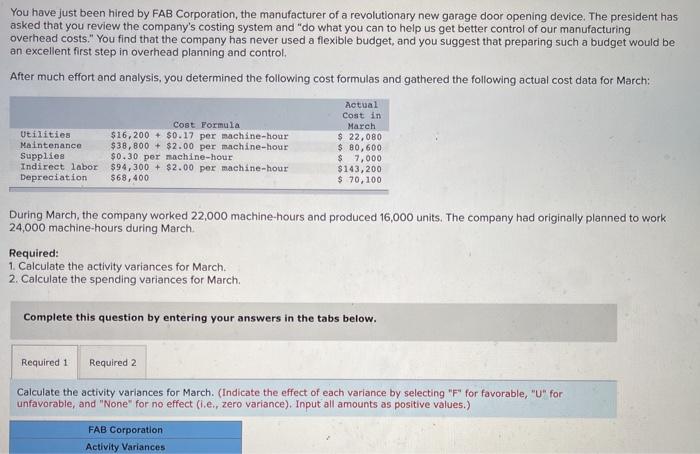

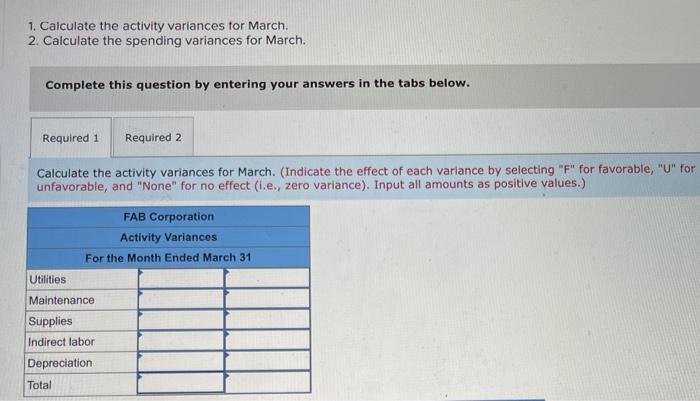

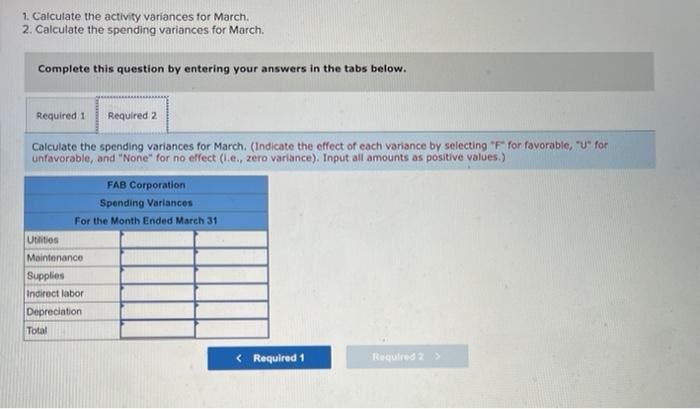

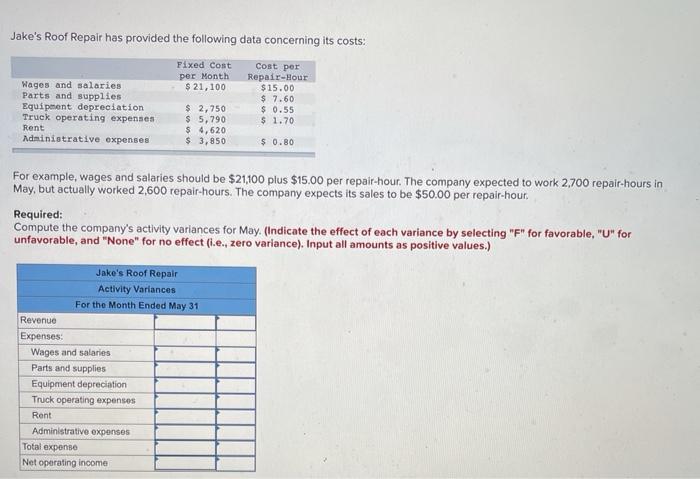

Jake's Roof Repair has provided the following data concerning its costs: Fixed Cost per Month $ 21,100 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Cost per Repair Hour $15.00 $ 7.60 $ 0.55 $ 1.70 $ 2,750 $ 5,790 $ 4,620 $ 3,850 $ 0.80 For example, wages and salaries should be $21,100 plus $15.00 per repair-hour. The company expected to work 2,700 repair-hours in May, but actually worked 2,600 repair-hours. The company expects its sales to be $50.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Jake's Roof Repair Activity Variances For the Month Ended May 31 Revenue Expenses: Wages and salarios Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net operating income The Gourmand Cooking School runs short cooking courses at its small campus. Management has identified two cost drivers it uses in its budgeting and performance reports-the number of courses and the total number of students. For example, the school might run two courses in a month and have a total of 63 students enrolled in those two courses, Data concerning the company's cost formulas appear below: Instructor wages classroom supplies Utilities Campus rent Insurance Administrative expenses Fixed Cost per cost per cost per Month Course Student $ 2,950 $300 $1,230 $ 55 $4,800 $2,200 $3,700 $ 44 $ 3 For example, administrative expenses should be $3,700 per month plus $44 per course plus $3 per student. The company's sales should average $870 per student. The company planned to run four courses with a total of 63 students; however, it actually ran four courses with a total of only 53 students. The actual operating results for September appear below: Revenue Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses Actual $51,910 $ 11,080 $ 18,750 $ 1,860 $ 4,800 $ 2,340 $ 3,491 Required: Prepare a flexible budget performance report that shows both revenue and spending variances and activity variances for September (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect i.e., zero variance). Input all amounts as positive values.) Required: Prepare a flexible budget performance report that shows both revenue and spending variances and activity variances for September (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Gourmand Cooking School Flexible Budget Performance Report For the Month Ended September 30 Actual Results Flexiblo Budget Planning Budget 4 Courses Students 53 $ 51.910 Revenue Expenses: Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses Total expense Not operating income 11.080 18.750 1,860 4,800 2,340 3,491 42,321 9,589 $ You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company's costing system and "do what you can to help us get better control of our manufacturing overhead costs." You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control, After much effort and analysis, you determined the following cost formulas and gathered the following actual cost data for March: Utilities Maintenance Supplies Indirect labor Depreciation Cost Formula $16,200 + $0.17 per machine-hour $38,800 + $ 2.00 per machine-hour $0.30 per machine-hour $94,300 + $2.00 per machine-hour $68,400 Actual Cost in March $ 22,080 $ 80,600 $ 7,000 $143,200 $ 70,100 During March, the company worked 22,000 machine-hours and produced 16,000 units. The company had originally planned to work 24,000 machine-hours during March Required: 1. Calculate the activity variances for March 2. Calculate the spending variances for March Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the activity variances for March. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values.) FAB Corporation Activity Variances 1. Calculate the activity variances for March. 2. Calculate the spending variances for March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the activity variances for March. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values.) FAB Corporation Activity Variances For the Month Ended March 31 Utilities Maintenance Supplies Indirect labor Depreciation Total 1. Calculate the activity variances for March. 2. Calculate the spending variances for March Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the spending variances for March. (Indicate the effect of each variance by selecting " for favorable, "U" for unfavorable, and "None" for no effect (le, zero variance). Input all amounts as positive values.) FAB Corporation Spending Variances For the Month Ended March 31 Utilities Maintenance Supplies Indirect labor Depreciation Total