Please help me with all three need help ASAP. Thank you.

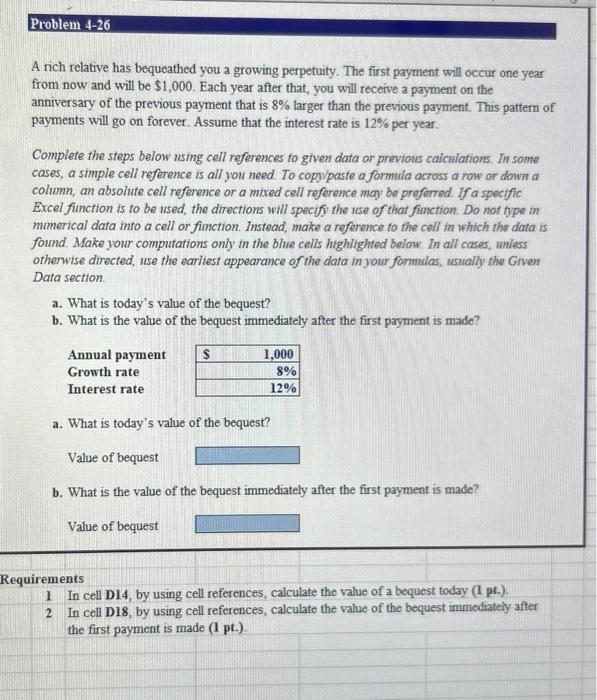

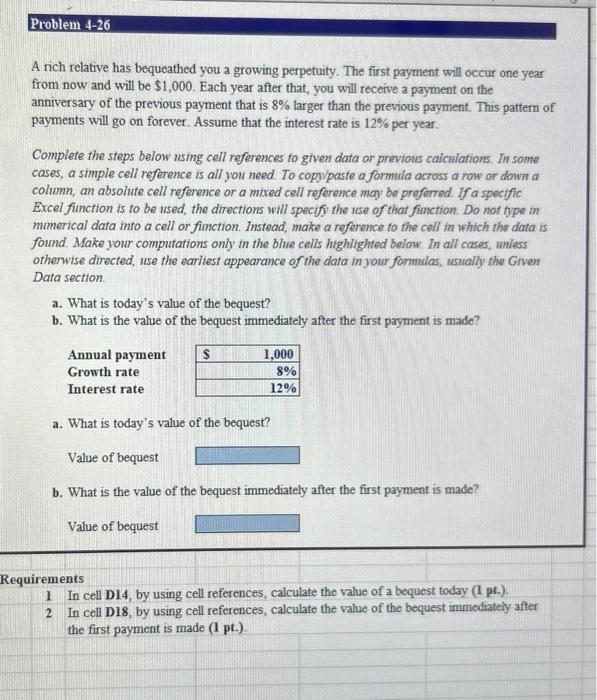

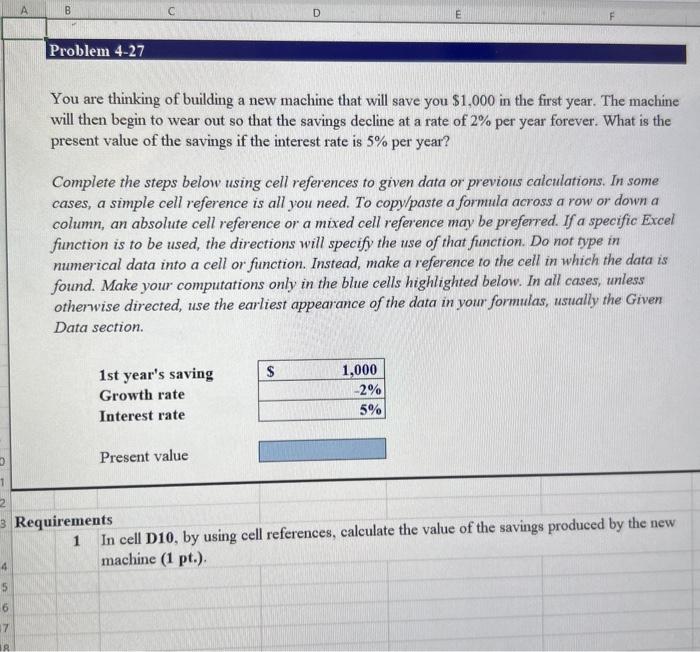

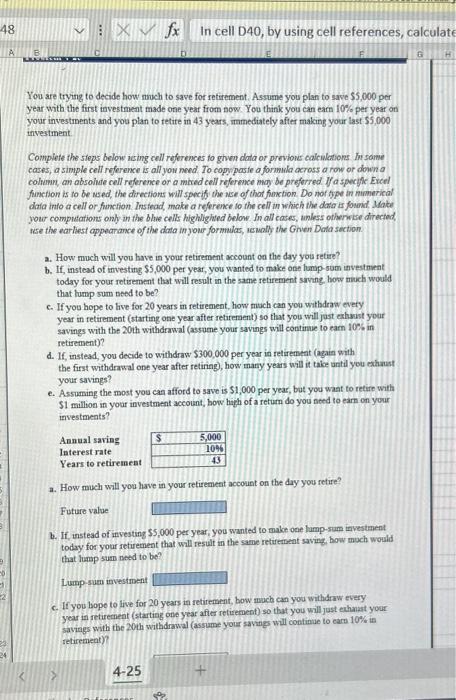

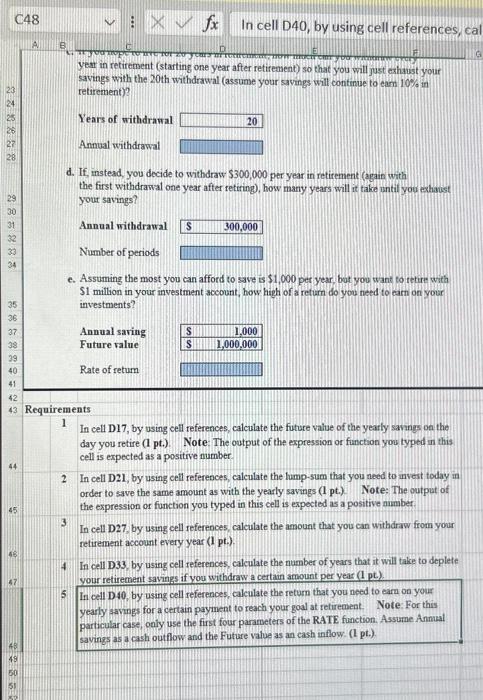

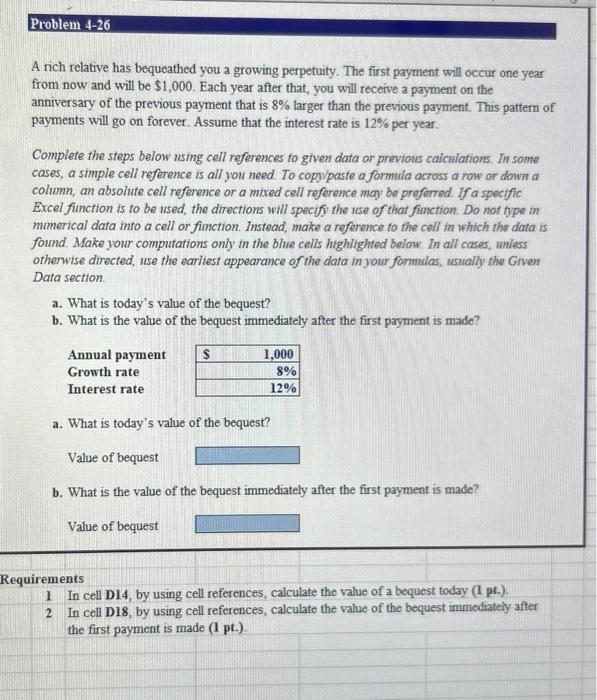

You are thinking of building a new machine that will save you $1,000 in the first year. The machine will then begin to wear out so that the savings decline at a rate of 2% per year forever. What is the present value of the savings if the interest rate is 5% per year? Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, ustally the Given Data section. Requirements 1 In cell D10, by using cell references, calculate the value of the savings produced by the new machine (1 pt.). Xou are trying to decide how much to save for refirement. Assume you plan to save $5,000 per ear with the first investmeat made one year from now. You think you can eam 10\% per year on your investanents and you plan to tetire in 43 years, mmediately after making your last $5,000 nvestment. Compiefe the steps below icing cell references to ghen data or previone calculations in same cases, a simple cell reference is all yow need. To copy paste a formula across a rove or down a function is to be used, the directions will specify the nse of thot fanction. Do nor fype in mimerical data into a cell or funcion. Insiead, make a reference to the cell in which the data is found, Mabe your computations only in the bhe cells highlighted below In all cases, unless othernise dinected, nese the earliest appearance of the data in your formulas, semally the Gnen Dafa saction. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $5,000 per year, you wanted to make one hump-sam investnient today for your retisement that will result in the same retirement siving, how mich would that homp sum need to be? c. If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one year after retarement) so that you will just exhsust your savings with the 20th withdrawal (assume your savings will continue to eam 10% in retirement)? d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the first withdrawal one year after retiring, how many years will it take until you exhaust your savings? e. Assuming the most you can afford to save is $1,000 per year, but you wat to retire with $1 million in your investment account, how high of a return do you seed to earn on your irvestmeats? Annual saring Interest rate Years to retiremeat a. How much will you have in your retirement account on the day you retire? Future value b. If, ustead of investing $,000 per year, you wanted to make one lamp-sum investment today for your icturement that will result in the same retiretneat saving, bow moch would that lump sum notd to be? Lump-sum investment c. If you bopo to five for 20 years in tetirement, bow mucb can you withdraw every year in ieturenent (starting one year after retisement) so that you will just echanat your savings with the 20h withdrawal (assume your saving will continue to card 10% in retirement)? A rich relative has bequeathed you a growing perpetuity. The first payment will occur one year from now and will be $1,000. Each year after that, you will receive a payment on the anniversary of the previous payment that is 8% larger than the previous payment. This pattern of payments will go on forever. Assume that the interest rate is 12% per year. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copyypaste a formula across a row or down a cohum, an absolute cell reference or a mixed cell reference may be preferred. If a spocific Excel finction is to be used, the directions will specify the use of that finction. Do not type in mumerical data into a cell or fimction. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below In all cases, unless otherwise directed, use the earliest appearance of the data in your formilas, uswally the Grven Data section. a. What is today's value of the bequest? b. What is the value of the bequest immediately after the first payment is made? Annual payment Growth rate Interest rate a. What is today's value of the bequest? Value of bequest b. What is the value of the bequest immediately after the first payment is made? Value of bequest Requirements 1 In cell D14, by using cell references, calculate the value of a bequest today ( 1pt.). 2 In cell D18, by using cell references, calculate the value of the bequest immediately after the first payment is made ( 1 pt.). year in retirement (starting one year after retirement) so that you will just cahisust your savings with the 20 th withdrawal (assume your savings will continue to eam 10% in retirementy? Years of withdrawal Annual withdrawal d. If, instead, you decide to withdraw $300,000 per year in reticenent (again with the first withdrawal one year after retiring), how many years will it take sntil you echaust your savings? Annual withdrawal Number of periods e. Assuming the most you can afford to save is $1,000 per year, bot you want to tetire with $1 mitlion in your investment account, how high of a return do you need to carn on your investments