Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with both please. Please!! I will be very grateful and will give thumbs up! A firm is considering replacing the existing industrial

Please help me with both please. Please!! I will be very grateful and will give thumbs up!

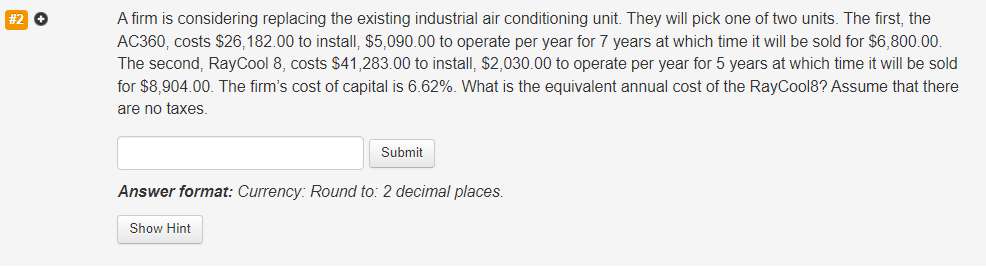

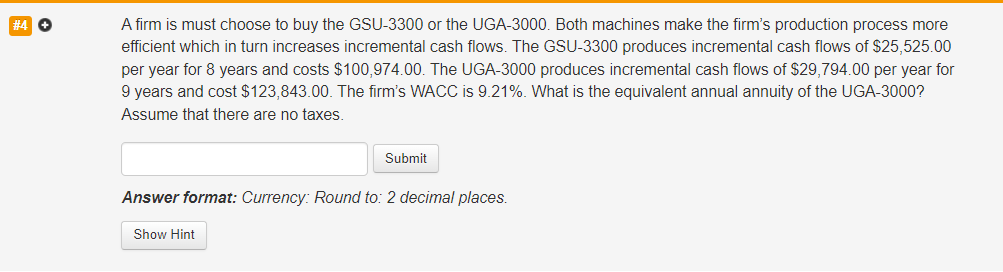

A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,182.00 to install, $5,090.00 to operate per year for 7 years at which time it will be sold for $6,800.00. The second, RayCool 8 , costs $41,283.00 to install, $2,030.00 to operate per year for 5 years at which time it will be sold for $8,904.00. The firm's cost of capital is 6.62%. What is the equivalent annual cost of the Raycool 8 ? Assume that there are no taxes. Answer format: Currency: Round to: 2 decimal places. A firm is must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $25,525.00 per year for 8 years and costs $100,974.00. The UGA- 3000 produces incremental cash flows of $29,794.00 per year for 9 years and cost $123,843.00. The firm's WACC is 9.21%. What is the equivalent annual annuity of the UGA-3000? Assume that there are no taxes. Answer format: Currency: Round to: 2 decimal places

A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,182.00 to install, $5,090.00 to operate per year for 7 years at which time it will be sold for $6,800.00. The second, RayCool 8 , costs $41,283.00 to install, $2,030.00 to operate per year for 5 years at which time it will be sold for $8,904.00. The firm's cost of capital is 6.62%. What is the equivalent annual cost of the Raycool 8 ? Assume that there are no taxes. Answer format: Currency: Round to: 2 decimal places. A firm is must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $25,525.00 per year for 8 years and costs $100,974.00. The UGA- 3000 produces incremental cash flows of $29,794.00 per year for 9 years and cost $123,843.00. The firm's WACC is 9.21%. What is the equivalent annual annuity of the UGA-3000? Assume that there are no taxes. Answer format: Currency: Round to: 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started