Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with both questions A firm is trying to determine the cash flow from selling an old computer system to an interested buyer.

please help me with both questions

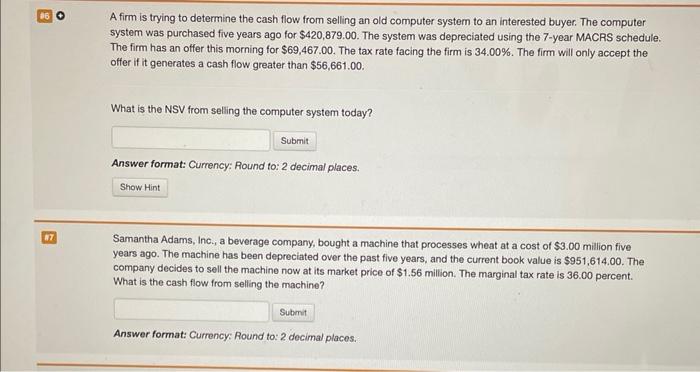

A firm is trying to determine the cash flow from selling an old computer system to an interested buyer. The computer system was purchased five years ago for $420,879.00. The system was depreciated using the 7 -year MACRS schedule. The firm has an offer this morning for $69,467.00. The tax rate facing the firm is 34.00%. The firm will only accept the offer if it generates a cash flow greater than $56,661.00. What is the NSV from selling the computer system today? Answer format: Currency: Round to: 2 decimal places. Samantha Adams, Inc, a beverage company, bought a machine that processes wheat at a cost of $3.00 million five years ago. The machine has been depreciated over the past five years, and the current book value is $951,614.00. The company decides to sell the machine now at its market price of $1.56 million. The marginal tax rate is 36.00 percent. What is the cash flow from selling the machine? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started